-

ISO 20022

Preparing you for the future of payments

ISO 20022 brings faster, more transparent transactions. We can help you understand the implications & benefits

Migrating to ISO 20022

The global payments sector is entering a new era. The adoption of ISO 20022 – a global and open messaging language for payments – will bring richer data and more detailed information to the financial services industry.

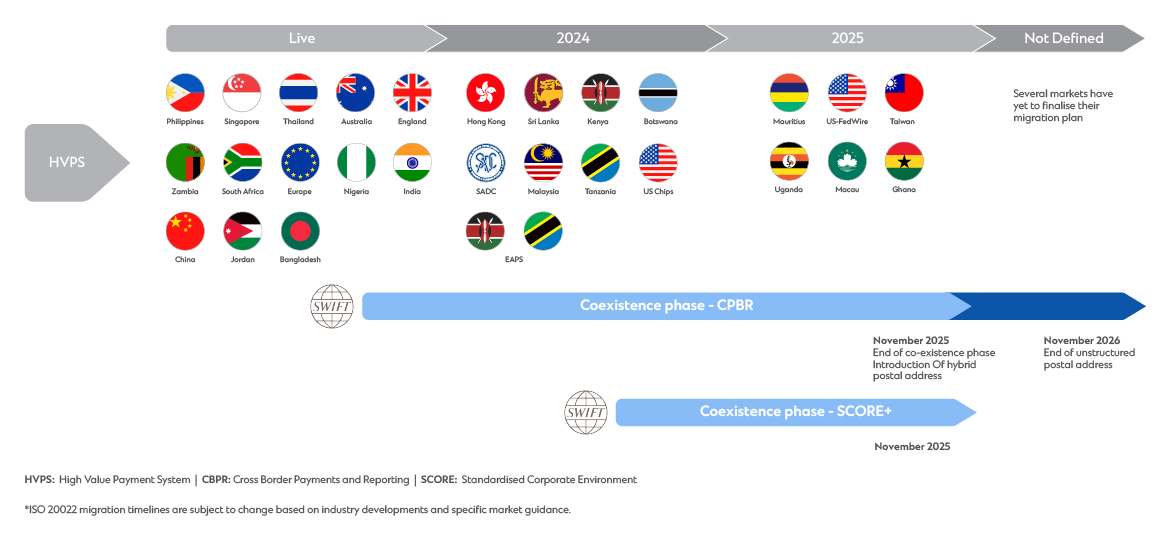

The move to ISO 20022 is being championed by SWIFT and adopted by major payment market infrastructures for high-value payments systems and cross-border payments across the world. And with ISO 20022 set to dominate high-value payments (supporting approximately 80% of volumes and 90% of transaction values worldwide over the next few years), this shift will have a wider impact across financial services than any other current initiative.

The global HVPS+ taskforce has published a roadmap towards ISO 20022 harmonisation, setting a common standard for payment data. SWIFT’s cross-border payments and reporting (CBPR+) working group has also published usage guidelines for adopting ISO 20022. Nonetheless, implementation will have differing implications for corporates and financial institutions – and we’re here to help with your transition.

Why transit to ISO 20022

Rely on a resilient payment system

Payment systems across the world are fragmented, with different formats and standards used across different domestic markets. The resulting inefficiencies makes the movement of payments between systems unnecessarily expensive and complicated. A uniform standard will bring global consistency, and remove these inefficiencies. To reach this point, industry-wide adoption will be paramount.

Speed and transparency

ISO 20022 payments’ data sets ensure higher straight-through processing (STP) rates than legacy standards, with the probability of payment errors reduced thanks to the uniformity. With reduced fragmentation, there will no longer be a need to build customised matching systems, nor devote time to manual processing. Plus, data richness and automation ensure greater visibility over your transactions.

Fortify your payments – and business

ISO 20022 will also help strengthen your business against shocks or disturbances. Uniform data formats and structures help to ensure payments are redirected between systems if operational disruptions occur. And crucially, more structured data in payments leads to more efficient screening against money laundering, terrorist financing and other criminal activities.

Standard Chartered’s ISO 20022 adoption journey

Useful resources

Watch our explainer videos to learn more

For more videos on ISO 20022 Migration for Financial Institutions, please visit here.

We’re here to help

Contact us for support with your business’ ISO 20022 migration

Learn more about transaction banking at Standard Chartered

Powering businesses for a transformative and sustainable future

Whatever business challenges come your way, your need for smooth, successful transactions will be constant. Alongside continuing operational requirements, you’ll need to balance enduring targets with emerging ones – including sustainability and digitialisation aspirations.

By combining international-bank stability with local-market knowledge, we can support your transaction banking needs across the world. From cash management solutions to bolster your treasury to financing solutions to sustainably fund your supply chain, we have the solutions to help you prepare for future opportunities.