-

Who we work with

Power and Diversified Industries

Corporate banking solutions tailored for Power and Diversified organisations.

Your global cross-border network partner

As a super connector bank, we bring strong cross-border capabilities linking Asia, the Middle East and Africa, Europe and the Americas. Our Power and Diversified Industries network and deep local knowledge across 54 markets help our clients navigate complex markets and drive growth.

With the rising demand of this industry, let us support and enable your global trade ambitions, project financing and decarbonisation journey.

Powering and building for the future

The world’s appetite for power is accelerating sharply, from the explosive growth of AI to cloud computing, digital content streaming and data centres.

As countries and companies pursue net-zero goals, the shift to clean power, resilient energy systems and more sustainable infrastructure create significant new opportunities across power utilities, industrial manufacturing, engineering, procurement and construction (EPC) contractors and the construction ecosystem.

Cross-border is in our DNA

We don’t just support your business. We connect your business across borders.

Whether it’s transitioning to renewables, building new manufacturing plants, managing your inventory, or providing construction services, we have a range of sustainable, tailored solutions to meet many financing needs. We can help facilitate your cross-border needs, unlock liquidity, optimise capital structures and accelerate decarbonisation. With our deep sector expertise and cross-border connectivity, we help you move faster, go further and make long-lasting impact that matters.

Financing and Advisory to help accelerate your energy transition

- Payments and liquidity: Determine the best payment and liquidity approach for you.

- Trade and working capital: Let us find the optimal strategy for your trade and working capital needs.

- Lending and financing: We help to find you the right balance with tailored lending and financing solutions.

- Infrastructure and development financing: We can help finance critical infrastructure through our understanding of risk and the cash flow generated by these assets.

- Debt capital markets: Our solutions meet your financing needs and could help to support your sustainability goals.

- Macro trading: Our team offers on-ground research, market intelligence, and trade execution to manage risk.

Learn more about the Clean Tech & Environment (CT&E) deals our M&A advisory team supported our clients on in 2025.

Real insights backed by extensive industry experience

Discover case studies and ideas for the Power and Diversified Industries sector.

Supporting ACEREZ in NSW, Australia

Helping connect solar and wind projects and battery energy storage systems in New South Wales.

Green senior USD bond for EDF

Standard Chartered strengthens its leading position in the Formosa market with green senior USD bond for EDF.

Adviser for sale of hydropower assets

Standard Chartered acts as sole financial adviser to Scatec for the sale of its African hydropower assets to TotalEnergies.

Poland’s largest energy project

Standard Chartered’s role as Mandated Lead Arranger and Hedge Provider for the financing of two new offshore wind farms in Poland – Bałtyk 2 and Bałtyk 3.

Powering Portugal: Chint

Learn more about how we supported our client, Chint, a leading Chinese cleantech company to secure a bank guarantee facility to power Portugal’s renewable energy ambitions.

How clean energy is transforming the power industry

A global perspective on how solar, wind, nuclear and hydrogen are drivin…

How can the power industry accelerate its transition?

Charting the power sector’s different transition pathways – and how we s…

Industries in Transition podcast

Power and utilities: clean energy trajectories

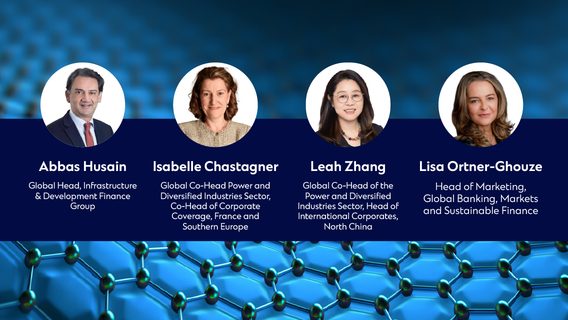

As the demand for energy continues to grow, the power and utilities sector is transforming and the experience of renewable energy projects around the world is varied. In this episode of Industries in Transition, Standard Chartered’s Isabelle Chastagner, Leah Li Zhang and Abbas Husain discuss how innovation, policy shifts and investment in low-carbon technologies are driving progress.

“Whether it’s moving to clean tech, helping create security, maintaining resilient supply chains or changing carbon economics, we are here to support and finance your journey. Because driving the future takes more that financing. It takes a trusted partnership.”

Isabelle Chastagner

Managing Director, Global Co-Head of Power and Diversified Industries, Corporate Coverage France and Southern Europe

“Our clients face the pressure to modernise fast, while navigating rising demand, policy shifts and ageing infrastructure. We work as one to bring sharp sector insights, flexible cross-border capital and solutions to help turn friction into forward momentum.”

Leah- Li Zhang

Managing Director, Global Co-Head of Power and Diversified Industries, Corporate Coverage North China

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We currently provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to net zero in our own operations by 2025 and in our financed emissions by 2050.