Business Banking

FOR INDIVIDUAL

For Companies

Business Banking

Business Banking

Cash flow, skilled staff and time are precious commodities for any business. Our business banking solutions help you make the most of these. We provide a comprehensive yet simple suite of business accounts, payments and collection solutions to help manage your cash flow efficiently.

i) Conventional:

ii) Saadiq:

Basic Current Account for Sole Proprietors, Partnerships, Clubs, Societies, and Ltd. Companies

Basic Savings Account for Sole Proprietors, Partnerships, Clubs, Societies, and Ltd. Companies

A Shariah compliant Current Account for all your transactional and business needs

A Shariah compliant Savings Account that offers transactional convenience along with returns on your savings

We also understand that you need unrestricted access to your bank at all times and that’s what you get with our market-leading online and mobile banking, available 24/7

With a comprehensive range of deposits in multiple currencies and investment solutions, you can maximize returns on idle cash, while maintaining the flexibility to deploy the funds at short notice for your business needs

If you are planning to borrow against an existing property to expand your business, our business property solutions are a simple, efficient way to arrange funding

Letters of credit (LCs) – A Standard Chartered letter of credit gives you the assurance from a world-class bank, when dealing with unfamiliar suppliers; you can be confident that payment will not be made until the documents are received and verified, to be in order

Import bills for collection – By asking your supplier to send their shipping documents to us, you will enjoy prompt advice upon our receipt of documents and fast payment according to your instructions

Shipping guarantee – To operate your business efficiently, it is vital that your goods are cleared expeditiously. By issuing a shipping guarantee in the shipper’s favour, we facilitate prompt clearance of goods until bills of lading are received

Import financing – We will be able to provide financing solutions topay for the supplier’s documents under letter of credit or import collections

Export letter of credit advising – Benefit from prompt advising of export letter of credit from a wide international network through us

Export letter of credit confirmation – By asking us to confirm your export LCs, you obtain our guarantee of payment for documents presented in compliance with the credit

Letter of credit checking and negotiation – Strict service standards are applied to ensure that your documents are negotiated and dispatched quickly

Export bills for collection – Simplify dispatch tracking of payment and reconciliation of your export collections when you choose our documents against acceptance, documents against payment or clean collections. Discounting of export collections is also available

Performance bonds and other guarantees – We offer tailored solutions to meet all your performance bond and guarantee needs

We value our relationship with you and we’re here to help you, with whatever you need to make your business grow. We are committed to providing you the highest level of service and getting things done when it counts for you.

Your relationship manager, a certified professional with comprehensive training, is your single point of contact with the bank, helping you plan as your business evolves in a fast-changing world. An experienced team of client service managers and a team of qualified trade, FX and investment experts support our relationship managers. With this team approach, you will also get the right level of service, expertise and attention.

Please contact your Relationship Manager

Whatever your business priorities and however complex your business goals, you can count on us as your trusted international partner to provide high-quality solutions that best serve your needs.

+92 21 111 722 724

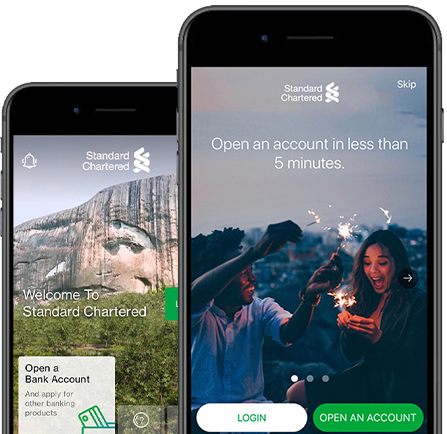

Experience SC Mobile Banking

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/pk and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/pk