-

Straight2Bank PayDigitalising collections, your way

A one-stop global platform to provide customers with different digital payment options, online and offline.

Your challenge

The payment ecosystem today is dynamic – and there is a wide range, and ever-growing list of digital payment options available to consumers. Keeping up is a challenge and can even increase the cost of doing business.

If you’re thinking of how to offer customers more digital payment options without needing multiple integrations and managing different collection accounts with providers across markets, Straight2Bank Pay is for you.

Here to help

Meet your immediate challenges and long-term aspirations

One-stop

Scale and collect digitally across countries working with a single provider and integration point

Peace of mind

Our superior bank infrastructure meets the highest standards of security, integrity, and stability

Real-time information

Get real time payment notifications while automated reconciliation enhances your cash visibility

Be future-ready

Shorten speed to market while flexible integration options support omnichannel payment acceptance

Use cases

Straight2Bank Pay can be tailored to different business needs, providing you with a unified digital commerce solution across all your sales channels and business models. Plus, your customers can enjoy a seamless checkout and payment experience.

Collections via online store

Add payment methods to your online store easily so your customers can pay seamlessly. This improves the checkout experience and increases your conversion rates.

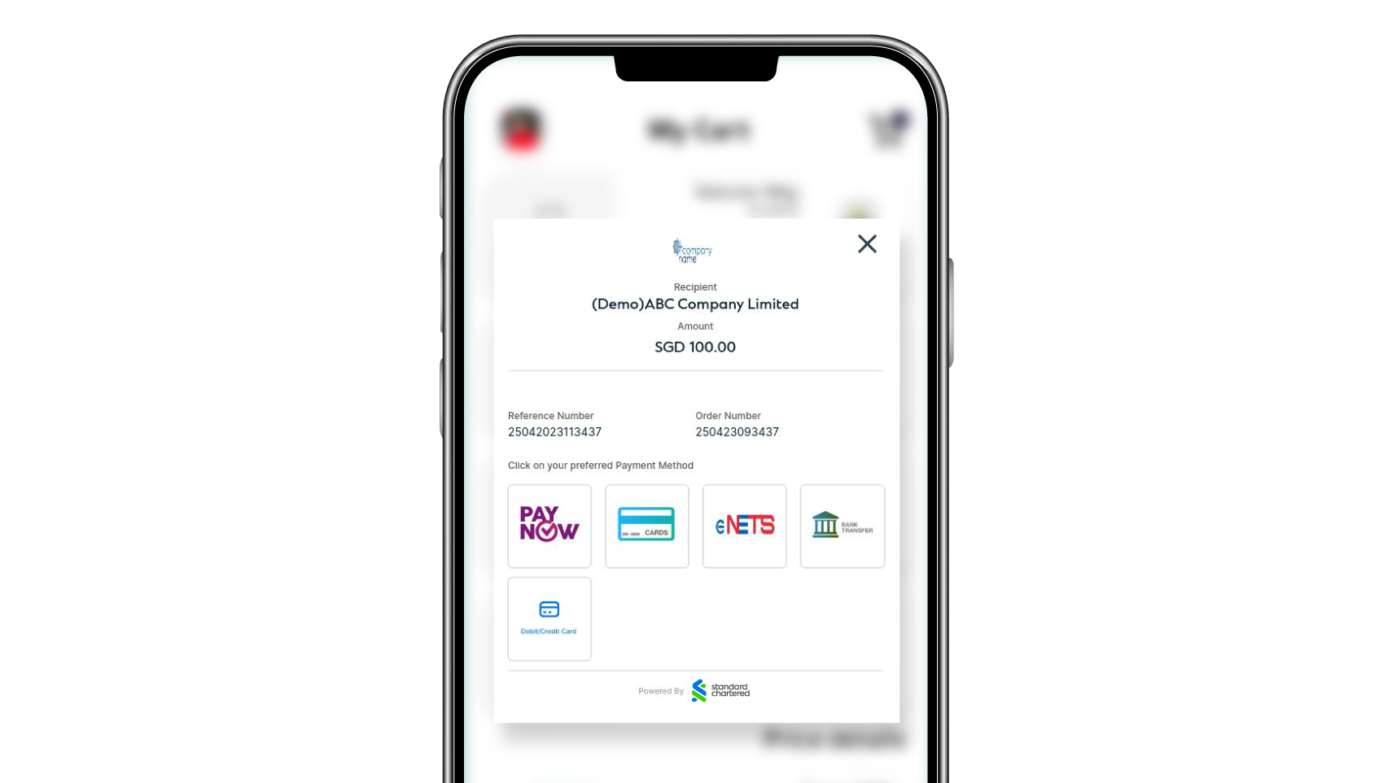

Collections via mobile app

Like collections via an online store, you can add payment methods to your mobile app easily for a seamless checkout experience.

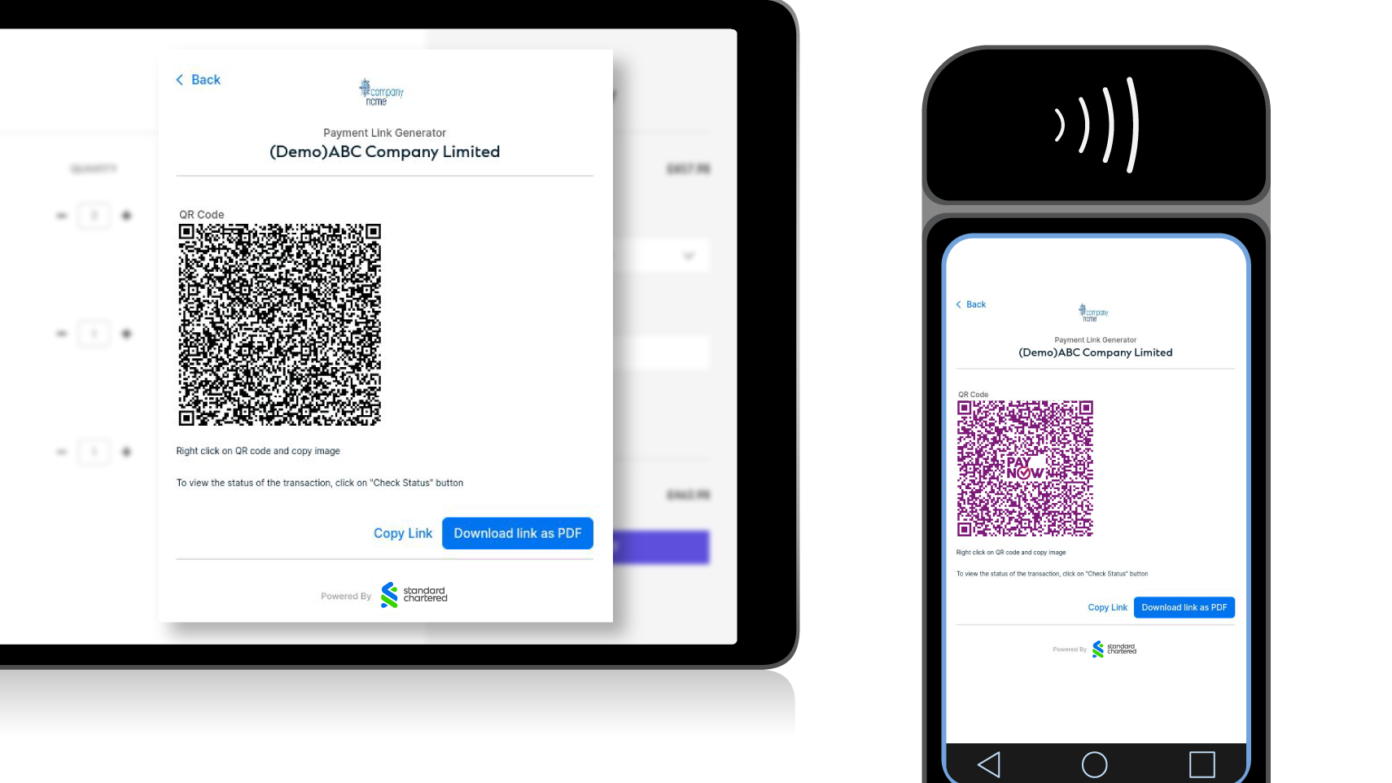

Collections in physical stores

Enhance the in-store experience for your customers by allowing them to scan and pay using a QR code generated on your POS device. Alternatively, they can also pay via payment link.

Remote collections

There is no need for your customers to visit your store – simply collect payments remotely by sharing a payment link via email, SMS or any other communication channel. Plus generate the link on your own or obtain it from us.

Payment on delivery

Replace your cash-on-delivery with digital payment modes enabled through the handheld device of your delivery agent or payment link generated, to collect payments on the go.

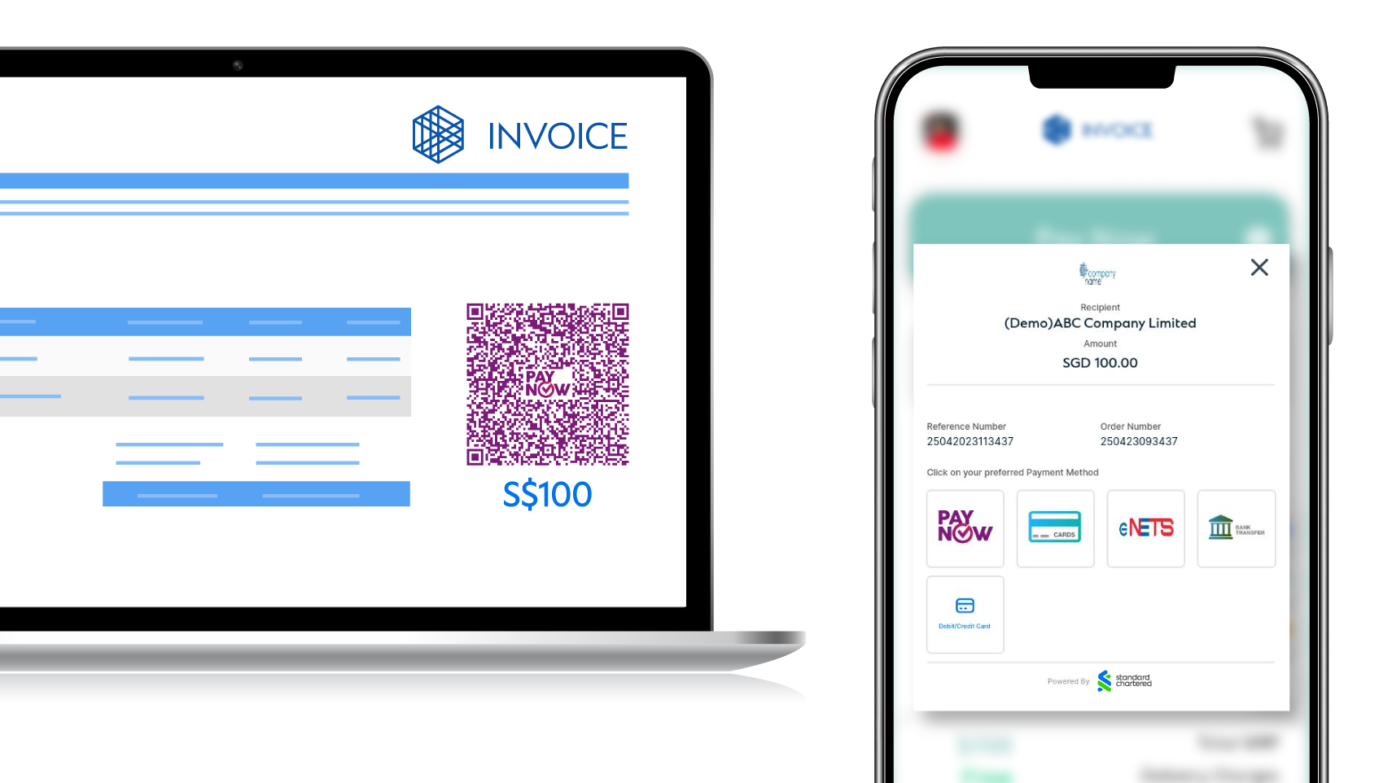

Collections via invoice

Get paid faster by embedding a QR code or a payment link on your invoices. Alternatively, allow your customers to self-service by obtaining and paying their invoices digitally with our Invoice Presentment and Payment solution.

Case studies

Offer your customers a wide variety of digital payment options while minimising the number of merchant accounts and contracts with payment service providers.

One of the world’s leading mail and logistics group uses Standard Chartered’s Straight2Bank Pay to:

- Allow customers across several markets to make online payments in local currencies– via various payment methods including QR codes and instant payments – for shipping charges, duties and taxes

- Digitise their in-store collections and payments on delivery

- Stay updated with real-time notification on transactions status in order to release goods

- Perform auto-reconciliation and access standardised, consolidated reports via their ERP system

Bring convenience and assurance to your customers while eliminating cumbersome processes.

An international insurance provider uses Standard Chartered’s Straight2Bank Pay to:

- Enable cards as a payment method for online collection of insurance premiums, with real-time transaction status notification

- Void transactions and initiate refunds via API

- Schedule settlements for every successful transaction, with automated reconciliation of transactions and settlement reports

- Ensure bank-grade security standards for communication between the payment gateway and internal system(s)

Our clients

Trusted by businesses and organisations of all sizes for digitalising their collections

International availability

We are available in 23 markets across Asia, Africa and the Middle East, and growing.

- Bangladesh

- China

- Cote d’Ivoire

- Ghana

- Hong Kong

- India

- Indonesia

- Kenya

- Malaysia

- Nepal

- Nigeria

- Pakistan

- Philippines

- Singapore

- South Africa

- Sri Lanka

- Taiwan

- Tanzania

- Thailand

- Uganda

- United Arab Emirates

- Vietnam

- Zambia

Discover more

Transforming B2B into B2B e-commerce

More and more companies are embracing B2B e-commerce, and there are two distinct trends driving this boom.

Solving the collections conundrum

How digitalisation of collections can help merchants improve customer experience and tap on more opportunities.

Reshaping treasury practices

New payment methods reshaping treasury practices

Asia’s B2B e-commerce surge

Asia may be leading the transformation in B2B e-commerce but there are still untapped opportunities.

Insights from YouTrip

Enhancing the payment experience for customers

In this podcast, you’ll hear from Lim Weijern, the Head of Finance and Corporate Development at YouTrip, the Singapore-based mobile payments start-up and Mahesh Narayan, Global Product Lead for Mobile Money and eCommerce at Standard Chartered, about how these customer expectations varies across countries and regions, the challenges they pose to multinationals operating across the globe, and ideas on how these challenges can be effectively managed.

Learn more about transaction banking at Standard Chartered

Powering businesses for a transformative and sustainable future

Whatever business challenges come your way, your need for smooth, successful transactions will be constant. Alongside continuing operational requirements, you’ll need to balance enduring targets with emerging ones – including sustainability and digitialisation aspirations.

By combining international-bank stability with local-market knowledge, we can support your transaction banking needs across the world. From cash management solutions to bolster your treasury to financing solutions to sustainably fund your supply chain, we have the solutions to help you prepare for future opportunities.