-

Working capital management

Tailored for maximum balance sheet value

Discover our analytical approach and find your optimal strategy for your unique working capital needs

Solving your working capital challenges

Your working capital needs are unique – so how you manage them should be too. Discover our analytical approach, and find your optimal strategy.

Efficient working capital management underlines the health of any organisation. Without the right balance of payments, receivables, inventory and cash, liquidity can quickly become trapped – undermining the value of your balance sheet and hampering growth opportunities.

With the complexity of supply chains today, more and more businesses are facing liquidity challenges. We recognise increased layers of complexity around capital requirements across our footprint in Asia, Africa and the Middle East. Yet the investment opportunities in these markets are abundant – if the liquidity can be accessed.

To find the optimal plan for your business, we apply a consultative and data-led approach, supported by our benchmarking tool. Following an initial analysis, we can subsequently provide solutions across payments, receivables, and supply chain finance that can optimise the value of your balance sheet.

Discover your optimal strategy

With our bespoke approach, we can determine a working capital plan to match your business’ needs

Plan ahead with precision

Leaning on industry data, we facilitate accurate forecasting to maximise future balance sheet value

Local expertise on a global scale

We combine global-solutioning capabilities with local-market knowledge, for the best of both worlds

Reach your working capital goals

Benchmark and improve your ratios

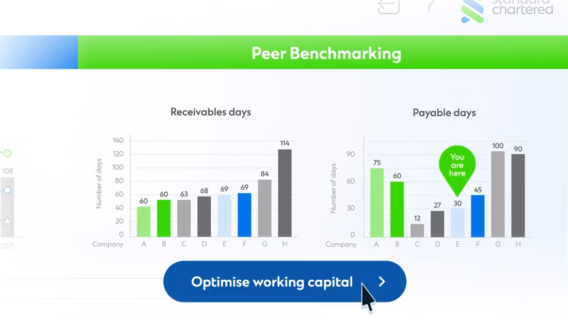

Rely on our benchmarking tool to uncover opportunities to improve your ratios. Knowing your position amongst your peers and your industry will be fundamental to help you progress to the next quartile.

Evaluate your progress

Whether working on your days sales outstanding (DSO), days inventory outstanding (DIO), or other critical metric, fast feedback on changes made is important. We provide immediate access to your data, including the impact of adjustments.

Be future-ready

Our consultative, data-led approach enables us to recommend solutions for your unique requirements. We also provide working capital scenario analysis, to help you strategise and allocate capital for future growth.

Make better-informed decisions

Straight2Bank (S2B) Loans, accessed via our Straight2Bank online banking platform, allows you to initiate and approve drawdown and rollover requests anytime, anywhere. With a real-time view of facility limits and utilisation you can also track the maturities of your outstanding transactions and repayment dates – transforming your working capital experience.

Thrive in emerging markets

As a leading cash and trade solutions provider across Asia, Africa and the Middle East, we can guide you through the parameters and capital requirements in these regions.

Discover more

Business resilience

Putting treasurers in the driver’s seat for business resilience

The USD80 billion opportunity

Why working capital management is vital to future-proofing FMCG

Beyond the pandemic

Why the pharma sector needs to focus on working capital

Proof of our expertise

We continue to be recognised in working capital management – and for our underlying cash and trade solutions

The Asset: A record breaking year

We received 59 awards under the publication’s 2021 Triple A programme – breaking our previous record. These include Best Working Capital and Trade Finance and Best in Treasury and Working Capital for LLCs

GTR: Leaders in innovation

We were named the leading bank for innovation under Global Trade Review (GTR)’s 2021 Leaders in Trade awards, in acknowledgement of our bespoke approach to financing cross-border trade.

Learn more about transaction banking at Standard Chartered

Powering businesses for a transformative and sustainable future

Whatever business challenges come your way, your need for smooth, successful transactions will be constant. Alongside continuing operational requirements, you’ll need to balance enduring targets with emerging ones – including sustainability and digitialisation aspirations.

By combining international-bank stability with local-market knowledge, we can support your transaction banking needs across the world. From cash management solutions to bolster your treasury to financing solutions to sustainably fund your supply chain, we have the solutions to help you prepare for future opportunities.