-

Sustainable Banking Report 2022

Retail investor capital is a USD8.2 trillion opportunity

Retail investors could help finance ESG priorities in 10 growth markets if their barriers are addressed.

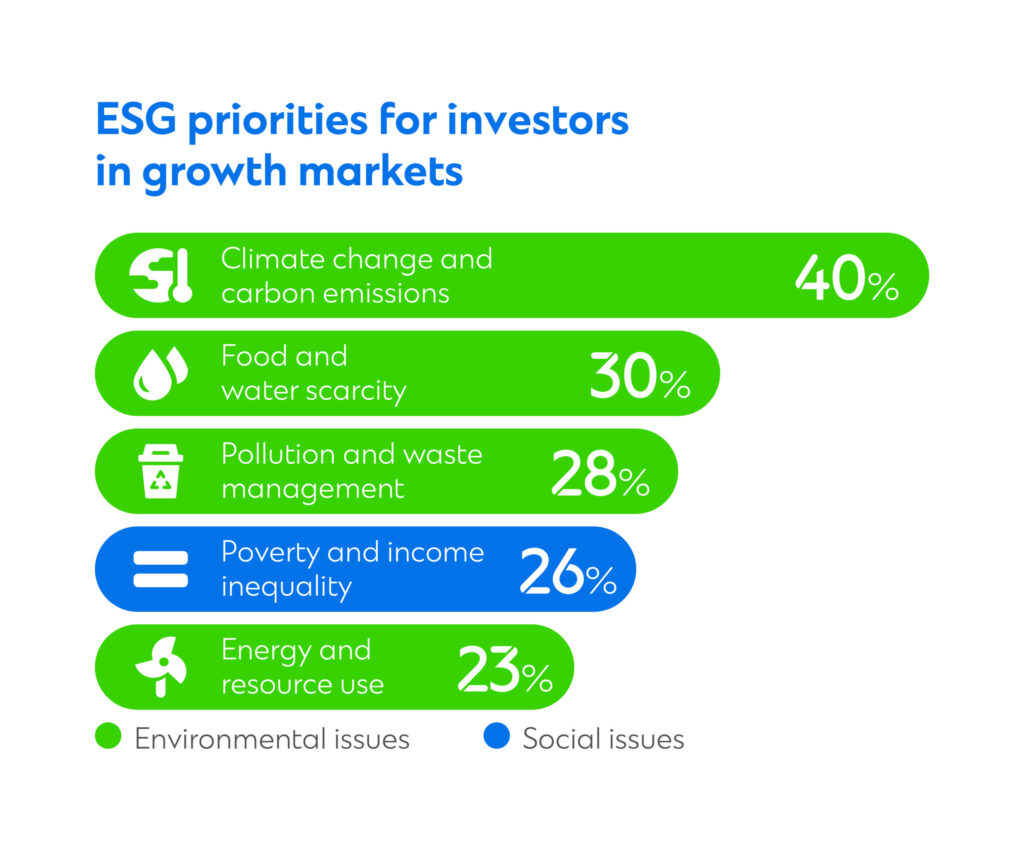

Investors in growth regions are becoming more conscious about the sustainability issues facing their home markets and beyond.

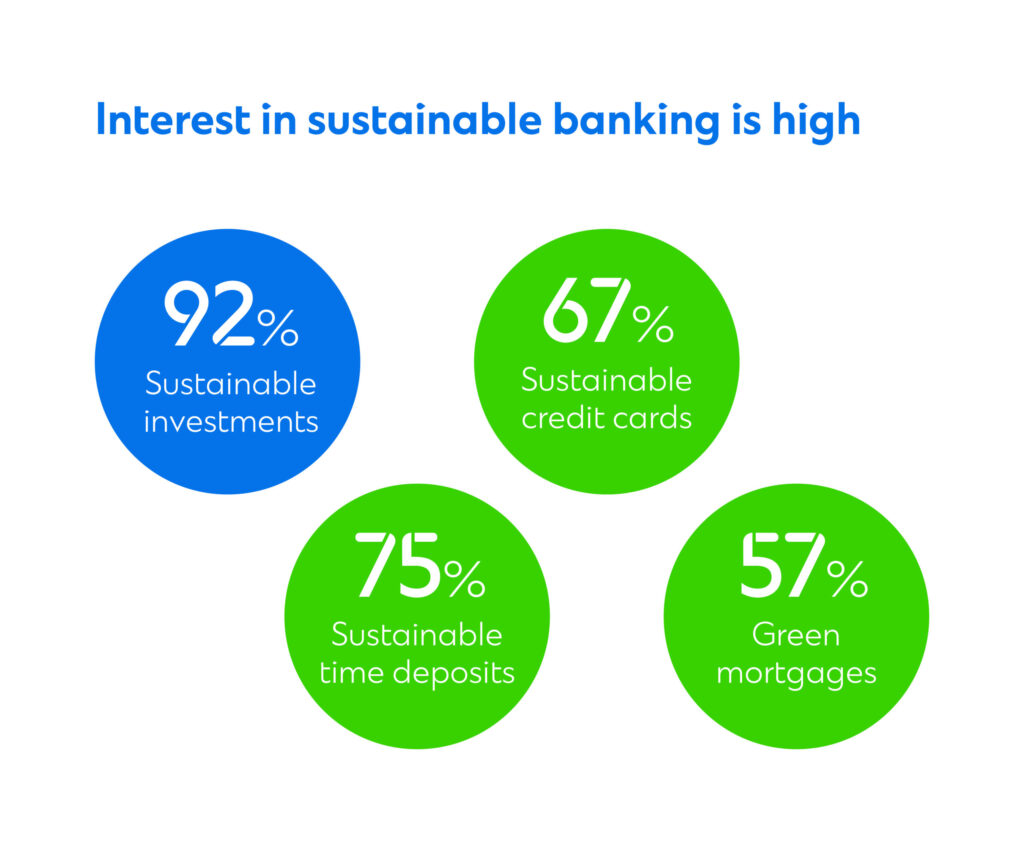

Products such as green mortgages, sustainable time deposits, sustainable credit cards and sustainable investments offer individuals a chance to make a positive difference in ESG-related areas.

Investors can make the highest impact through sustainable investments, which is fast becoming a mainstream asset class.

We commissioned a survey of over 3,000 individuals across 10 markets to understand their interests and apprehensions when it comes to sustainable investing.

Our research reveals the ESG issues that concern them most.

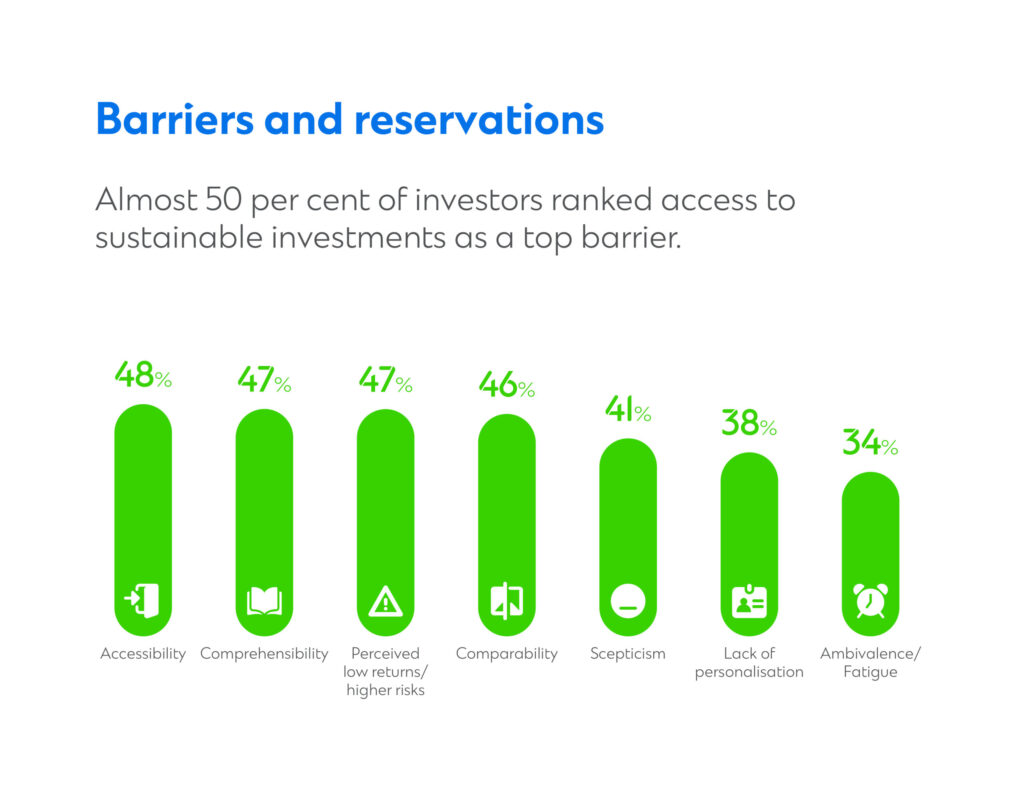

We also looked at the barriers holding them back from channelling their wealth into sustainable investments.

By addressing these barriers, we can facilitate the flow of USD8.2 trillion of retail investor capital into sustainable investments in 10 growth markets across Asia, Africa and the Middle East.

We identify three areas financial advisors should focus on to help investors overcome their barriers and unlock the full potential of their wealth.