-

Sustainability

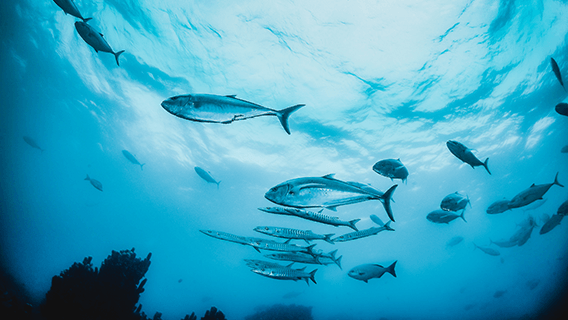

Channelling capital towards the ocean

We’re working to help transition the real blue economy to more sustainable practices.

Protecting and facilitating the sustainable use of the ocean is essential to mitigating the effects of climate change, supporting livelihoods across our markets, and fostering inclusive and enduring economic growth.

3bn

people rely on the ocean for their livelihoods¹

80%

of the world’s biodiversity is estimated to be in the ocean²

90%

of our markets are coastal, approximately

Despite our global dependence on the ocean, marine health continues to decline, and its protection remains severely underfunded, presenting potential risks to inclusive economic development through impacts to livelihoods and biodiversity.

We aim to mobilise finance towards the ocean and a sustainable blue economy, and support the advancement of the blue finance ecosystem.

As a member of #BackBlue, an Ocean Finance Commitment, we are looking at how we can seek to ensure that a sustainable ocean is an important consideration in our financing decisions. We build our knowledge and understanding of key issues and share best practice through our membership of other industry and sector organisations, adoption of global commitments, and implementation of guiding frameworks. Discover these here.

We’re guided by our position statements, which are informed by international conventions, national laws and regulations, and industry standards and best practices.

Driving awareness of promising solutions

Our reports showcase investible, innovative solutions to catalyse the transition of the blue economy to more sustainable practices.

Valuing nature: The ROA of an MPA

Explore the potential Return on Assets (ROA) of a Marine Protected Area (MPA) to understand the importance of mainstreaming nature considerations into financial decision-making.

Harnessing Africa’s blue economy

Learn about the opportunity a sustainable blue economy represents in Africa.

Towards a sustainable ocean

Discover the range of solutions available to support the transition of the blue economy, with sector deep dives and financing solutions.

Seaweed: Kelp is on the way

Dive deeper to explore how seaweed can act as a sustainable disruptor, yielding value for businesses and investors.

Supporting our markets

A debt conversion for nature

We acted as the sole lender and deal manager in a debt conversion for nature with The Government of The Bahamas, which is expected to unlock USD124 million for marine conservation over the next 15 years.

Supporting multiple award-winning shipping finance transactions

We have supported multiple sustainable shipping finance transactions, including a USD 615 million SLL facility for HMM Co. Ltd., Korea’s largest container shipping company, which won the Marine Money East Structured Finance Deal of the Year in 2025. We also led MISC’s first USD 527 million SLL which supported MISC’s long-term business strategy and sustainability aspirations, and also won the Marine Money Sustainability-Linked Deal of the Year for Asia in 2023.

Project finance for two new offshore wind farms in Poland

We closed over EUR 6 billion in project financing for the Bałtyk 2 and Bałtyk 3 offshore wind farms in Poland, marking the deal as the largest project finance transaction in the history of the Polish sector.

A Sustainability-Linked Loan for Thai Union

We closed a Sustainability-Linked Short Term Loan for Thai Union, the world’s largest producer of shelf-stable tuna products, to support working capital needs in alignment with their overall arc of reshaping sustainable seafood practices.

Sustainability Structuring Bank for Seatrium

We helped Seatrium develop a Sustainable Financing Framework, which enabled Seatrium to access capital in the form of sustainable finance, including a USD 500 million sustainability-linked facility for Seatrium’s subsidiary, Estaleiro Jurong Aracruz.

Unlocking the value of nature in the Palk Bay Dugong Conservation Reserve

We’re supporting a new feasibility study, led by The Zoological Society of London (ZSL), the Wildlife Institute of India, the International Union for Conservation of Nature (IUCN) and the Tamil Nadu Forest Department, aiming to scope the potential blue carbon value which could be derived from Palk Bay’s very own seagrass.

Historically, investment into a sustainable blue economy has been a ripple when what we need is a wave. Marisa DrewChief Sustainability Officer

Marisa DrewChief Sustainability Officer

Hear more from our Chief Sustainability Officer:

The tide is now turning

Read Marisa’s reflection on how mechanisms which drive ocean conservation and protection are maturing.

Why 2025 is the year of progress

Discover the 4 reasons why 2025 can be a breakthrough year for the regenerative blue economy.

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We currently provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to net zero in our own operations by 2025 and in our financed emissions by 2050.