How fast is Islamic finance growing and what’s driving it?

Explore how Islamic finance has grown, what’s driving it and the key opportunities for banks in ESG, Sukuk and emerging markets.

Islamic finance is one of the fastest-growing segments of the global financial ecosystem. Driven by rising demand, evolving regulations, and a stronger focus on ethical and responsible finance, Islamic finance has gained significant traction in recent years.

In this article, we explore how quickly the industry is expanding, the structural and market drivers behind this growth, and what it means for financial institutions. For deeper insights and actionable takeaways, download the full report at the end.

How big is the Islamic finance industry?

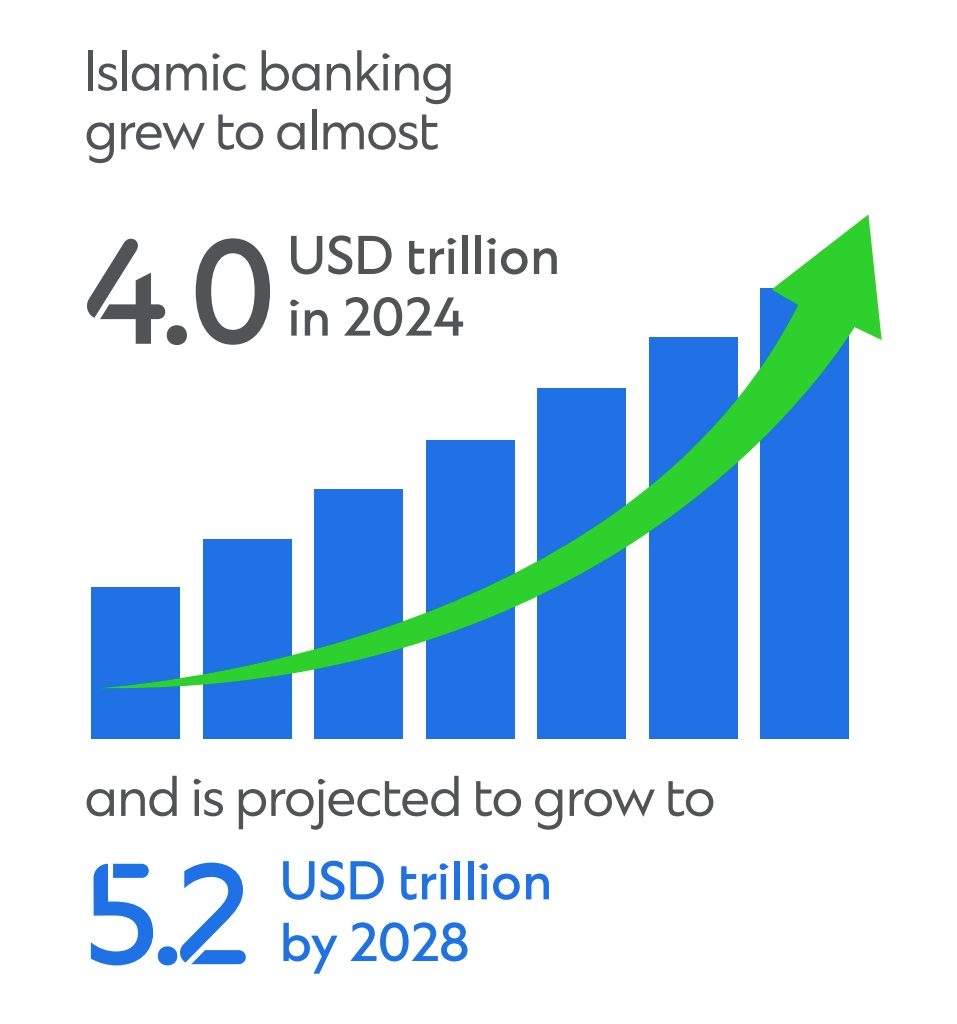

In 2024, global Islamic finance assets surpassed USD 5 trillion, and are projected to grow to USD 7.5 trillion by 2028.

What’s driving growth in Islamic finance?

1. Islamic banking leads the way

Islamic banking accounts for over 70% of total industry assets. In 2024, the sector grew by 12% year-on-year, mirroring the industry’s broader momentum.

2. Surge in Sukuk Issuance

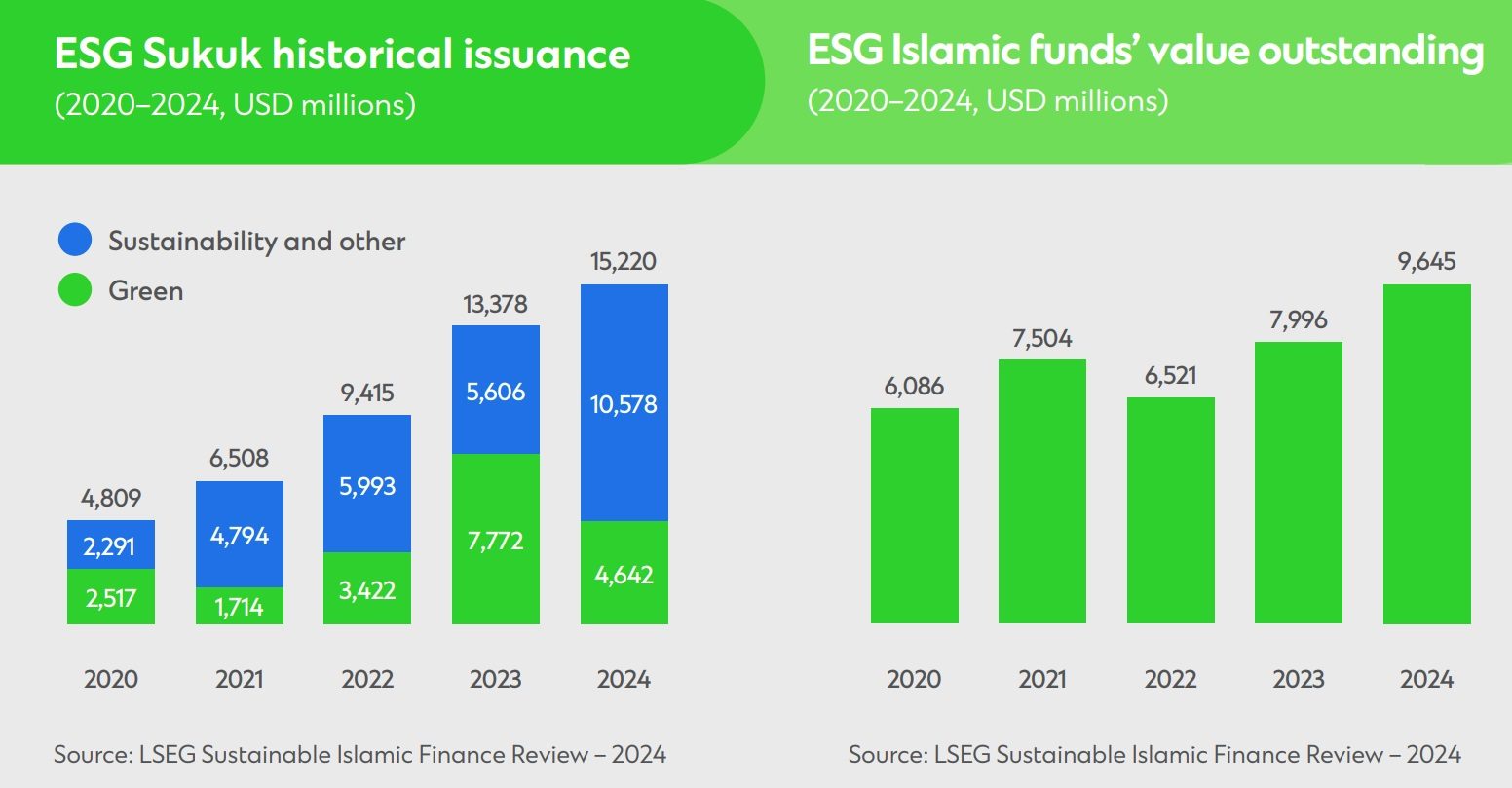

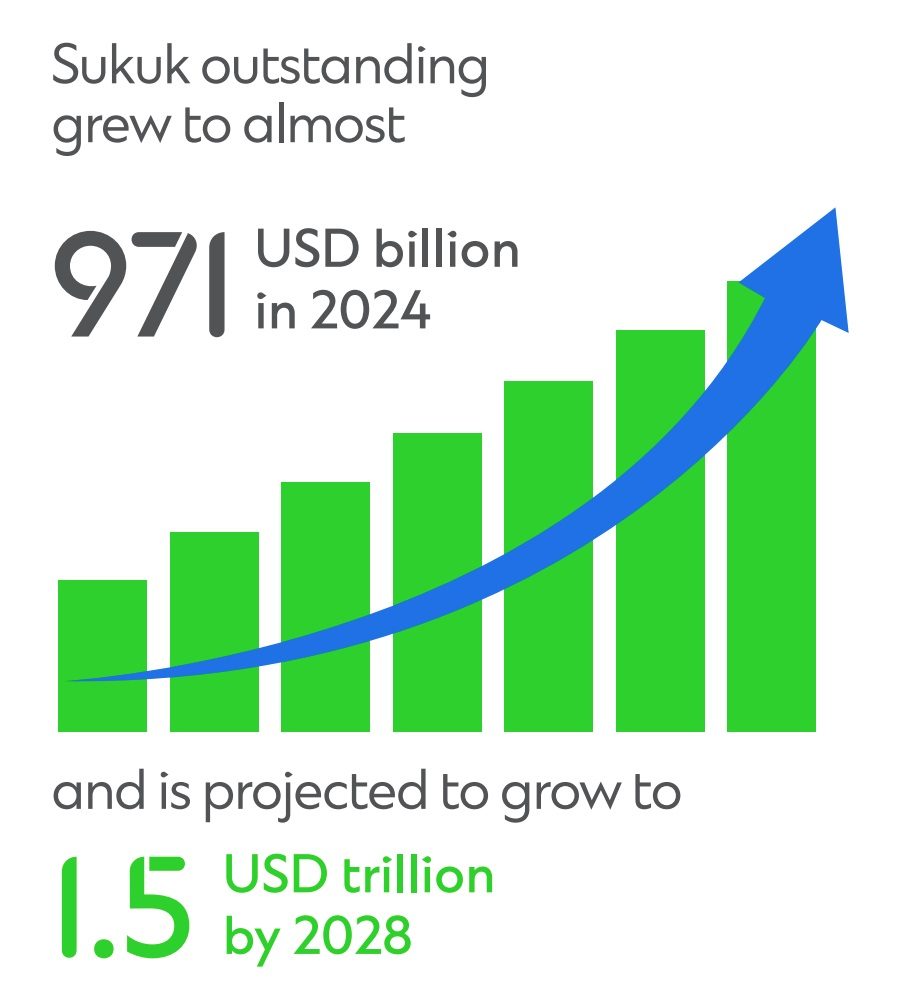

Sukuk remains the second-largest segment, with outstanding value reaching USD 971 billion in 2024, reflecting 13% growth from 2023.

Regulatory changes are accelerating market expansion

Governments and regulators are playing a key role in unlocking new markets:

Pakistan: In 2024, Parliament passed a constitutional amendment mandating the elimination of interest (Riba) by 2027, aligning the financial system with Islamic principles.

Indonesia: The Financial Services Authority (OJK) requires conventional banks’ Islamic units to spin off or merge if Islamic assets exceed 50%. Several regional banks have already converted to full Islamic banks.

What are Islamic banking leaders saying?

Standard Chartered’s Pulse of Islamic Banking survey captured insights from 26 global Islamic banking leaders. Below are the key findings:

- 87% are optimistic about industry growth over the next 5–10 years

- 50% have adopted or plan to adopt AI technologies

- Local demand is the strongest driver of adoption

- China, the Middle East, and Africa are expected to offer the greatest opportunities in the next 2–3 years

- Green Sukuk and Islamic ESG finance top the list of future product innovations

Explore the full survey results in the downloadable report.

Why this matters for financial institutions

The Islamic finance industry is at a turning point. While challenges remain, significant growth potential exists, especially for institutions that embrace innovation, digital transformation, and sustainability.

Opportunities include:

- Gaining first-mover advantage through new products and technologies

- Aligning with ESG and ethical finance principles

- Expanding in high-growth corridors and newly regulated markets

Islamic banking for financial institutions report

Explore in-depth insights, client case studies and future opportunities

Our latest insights

Corridors in focus: Our clients – Marubeni

In this client story, Marubeni Middle East & Africa Power Limited ("Marubeni") shares how Standard Chartered…