The strategic impact of tariffs on the US renewables value chain

Explore how US tariffs and policy uncertainty are impacting the renewables value chain.

The United States renewable energy sector remains a compelling yet complex opportunity for global corporates. Driven by long-term energy transition goals and increasing electricity demand, the market continues to attract interest across the solar, wind, and utility value chains. However, with increasing policy and tariff uncertainty under Trump 2.0 and arguably the previous administrations, there is increased layers of complexities.

This uncertainty is particularly pronounced for the following segments and is covered in greater detail in our full report:

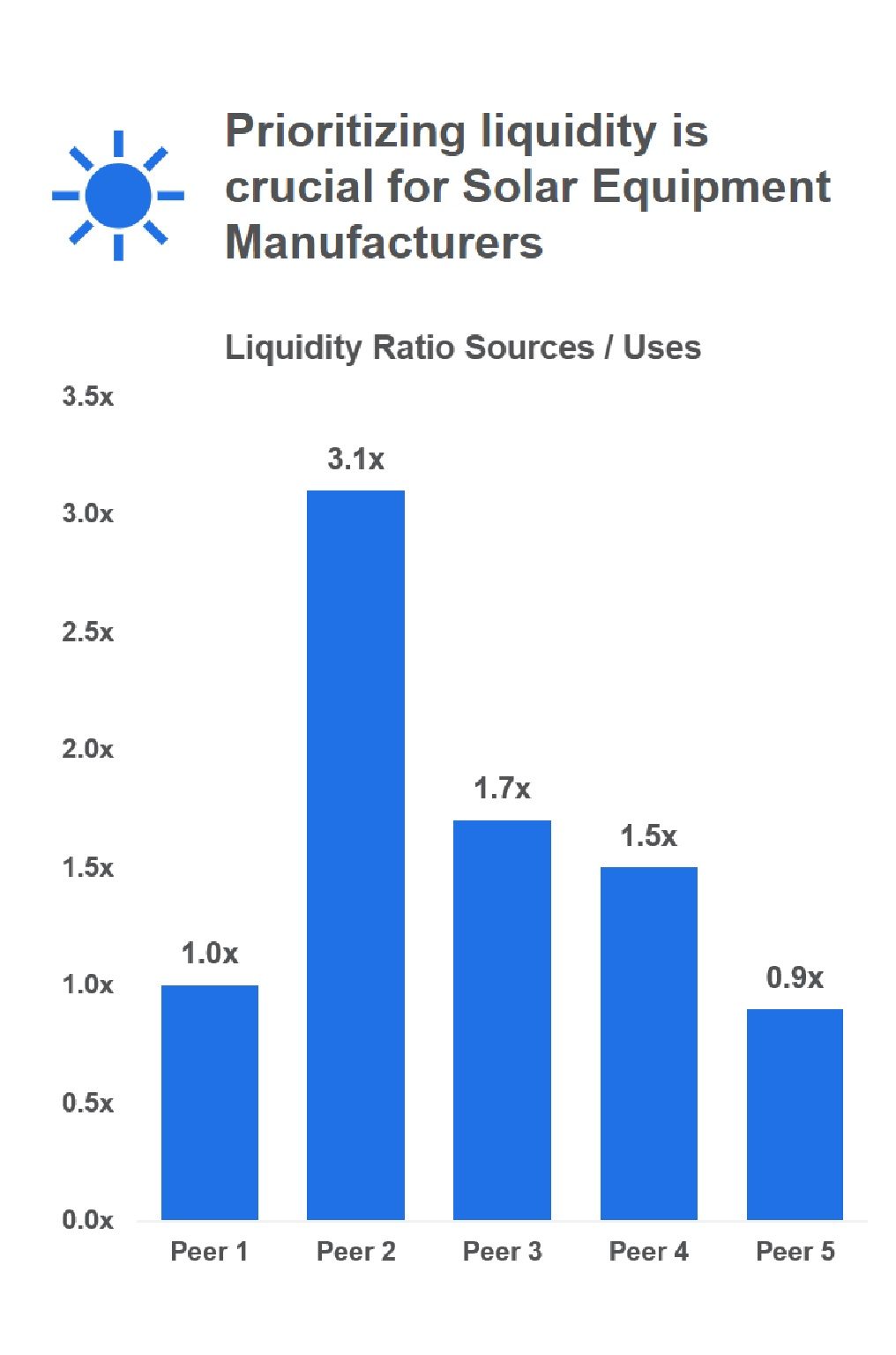

Chinese Solar Equipment Manufacturers: Overcapacity and Liquidity Pressures

Chinese manufacturers, which represent the majority of global solar module production, are currently managing significant overcapacity issues. The result has been six consecutive quarters of industry-wide losses, exacerbated by the introduction of targeted tariffs in key export markets including the US.

In this environment, these firms are prioritising liquidity management to navigate an increasingly challenging market environment.

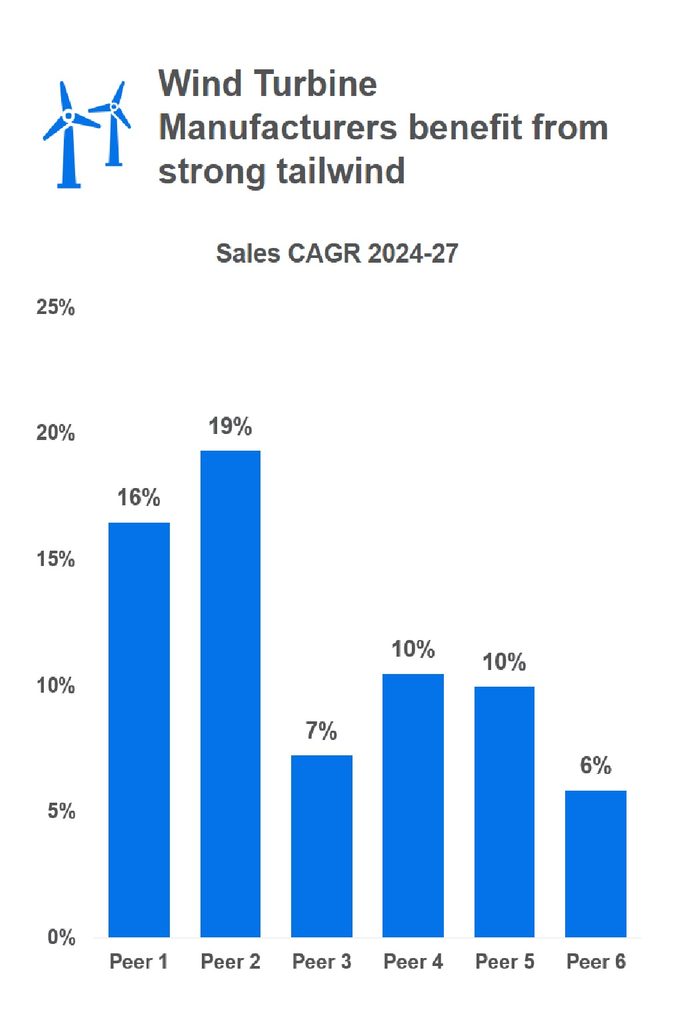

Wind Turbine Manufacturers: Challenging Offshore Segment but Strong Balance Sheets

Global wind turbine manufacturers, particularly those with offshore exposure, are also facing headwinds. Policy support for offshore wind has been inconsistent, leading to a slowdown in demand and reduced project pipelines.

Despite these challenges, many firms in this segment boast net cash positions and benefit from diversified revenue streams which provides a buffer against demand fluctuations. To further mitigate volatility, leveraging commodity hedging strategies and optimising working capital cycles can be advantageous.

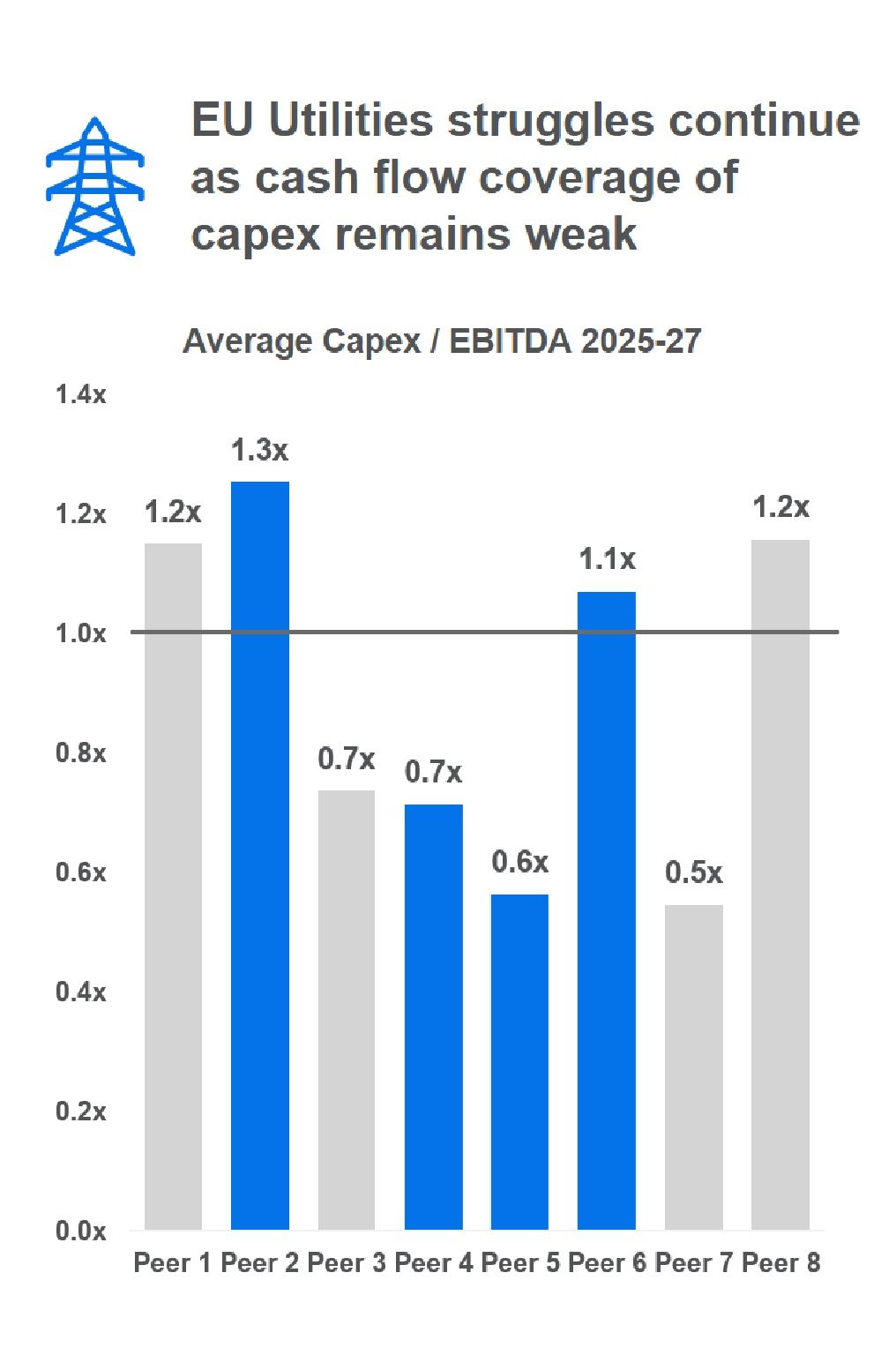

European Utilities: Impairments and Capital Discipline

Several European utilities have reported substantial impairment losses on their US offshore wind assets, resulting in significant setbacks on their balance sheet positions. As investment strategies become more selective and demand shifts toward solar, these firms are grappling with the growing gap between cash flow generation and capital expenditure requirements.

To address these challenges, utilities may consider a range of capital management strategies. These include pursuing asset rotation or issuing hybrid capital instruments to strengthen their balance sheets.

To read more about these themes, as well as what they mean for capital structure strategy for corporates in these sectors, contact us here.

Report

US Renewables Value-chain and Tariffs

Read more about these themes, as well as what they mean for capital structure strategy for corporates in these sectors.

Latest insights

Explore our archive of articles and insights.

CORSIA compliance: a strategic window for airlines

CORSIA has moved from future obligation to current cost. Easing supply constraints may offer airlines a window t…