Why airlines struggle to create value: it’s not entirely a cost of capital issue

Despite strong recovery, most airlines fail to beat WACC. Learn how capital discipline and cash cycle efficiency can unlock sustainable value creation.

The global airline industry has experienced a remarkable rebound from the depths of the COVID-19 pandemic. Yet, a persistent challenge remains: airlines struggle to create value.

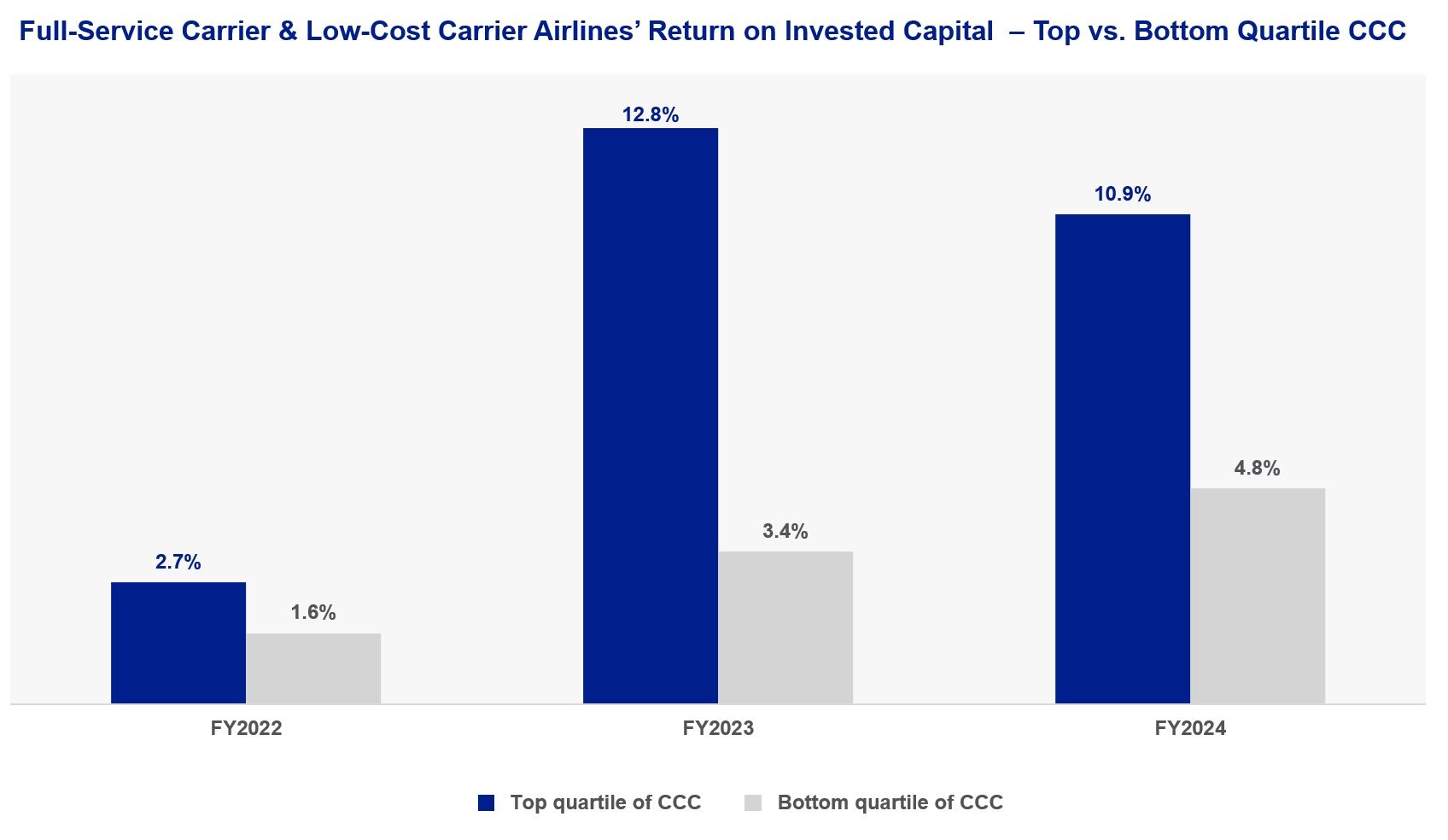

Despite the strong operating results, a majority of airlines – 19 out of 25 global airlines analysed – struggle to deliver returns on invested capital (ROIC) that exceed their weighted average cost of capital (WACC). This returns deficit is further exacerbated by an increasingly complex and challenging macroeconomic and geopolitical landscape – one that could exert downward pressure on returns while pushing cost of capital drivers higher.

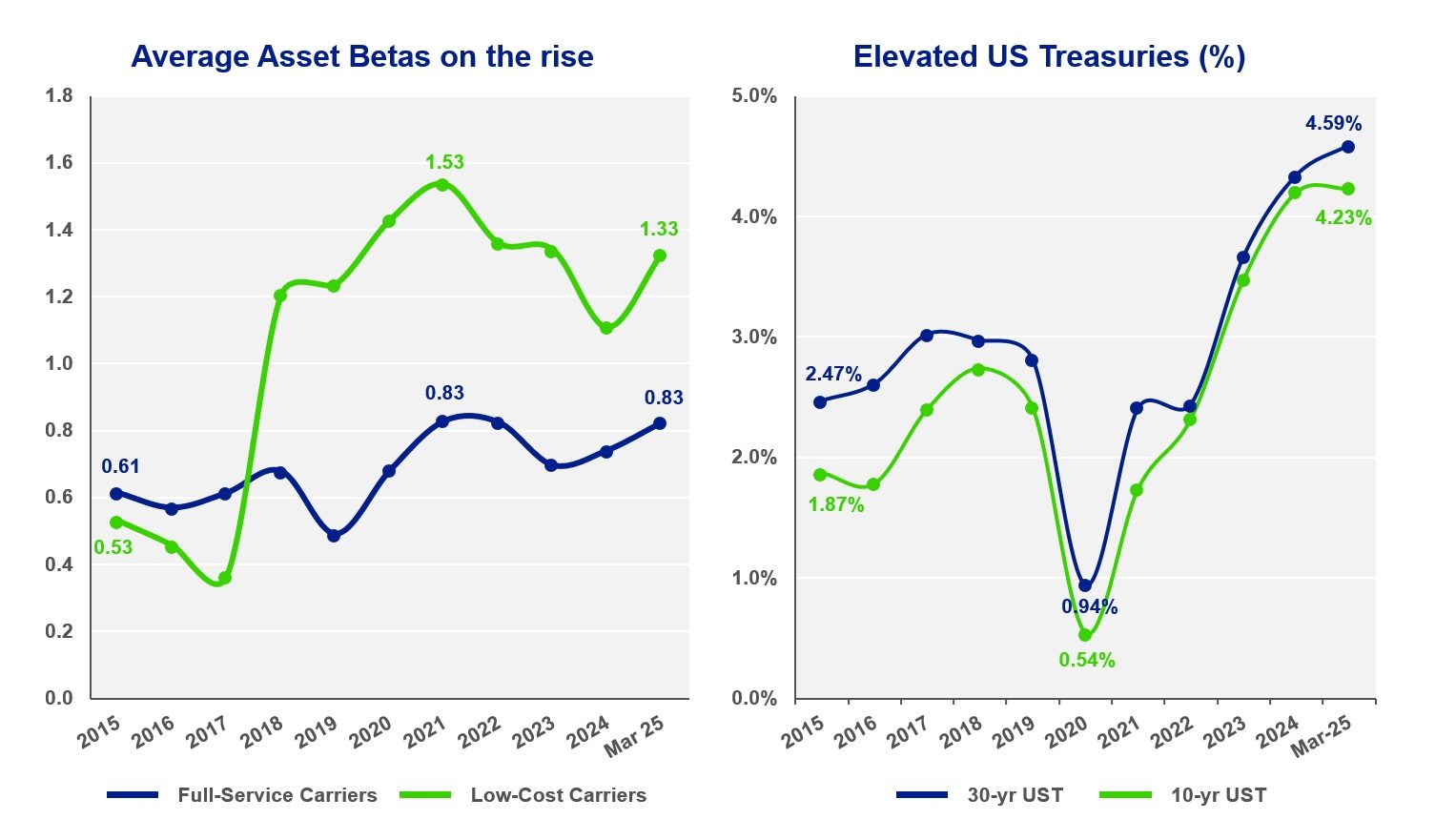

Indeed, cost of capital has grown recently. Tighter credit spreads offered little relief, as higher benchmark rates and sector betas approaching pandemic-era levels are driving WACC upward.

Many of these factors remain beyond the control of the sector and while recalibrating debt equity mix can help, inherent volatility of the sector means that this is not as simple.

Achieving sustainable value creation will be more about sharpening capital allocation discipline and optimising working capital. Per our analysis, airlines that excel in managing their cash conversion cycle achieved 2.3x higher returns than their bottom quartile peers last year.

In parallel, proactive fuel hedging strategies can alleviate earning volatility, enabling airlines to operate closer to minimum WACC.

Turbulence is an inevitable part of this sector, but revisiting the core principles of capital structure strategy and emphasising key value drivers can help navigate these challenges more effectively. While the journey towards value creation may be challenging, the right tools and a clear focus can make it attainable.

To read more about these themes, as well as what they mean for capital structure strategy for corporates in these sectors, contact us here.

Our latest insights

Corridors in focus: Our clients – Marubeni

In this client story, Marubeni Middle East & Africa Power Limited ("Marubeni") shares how Standard Chartered…