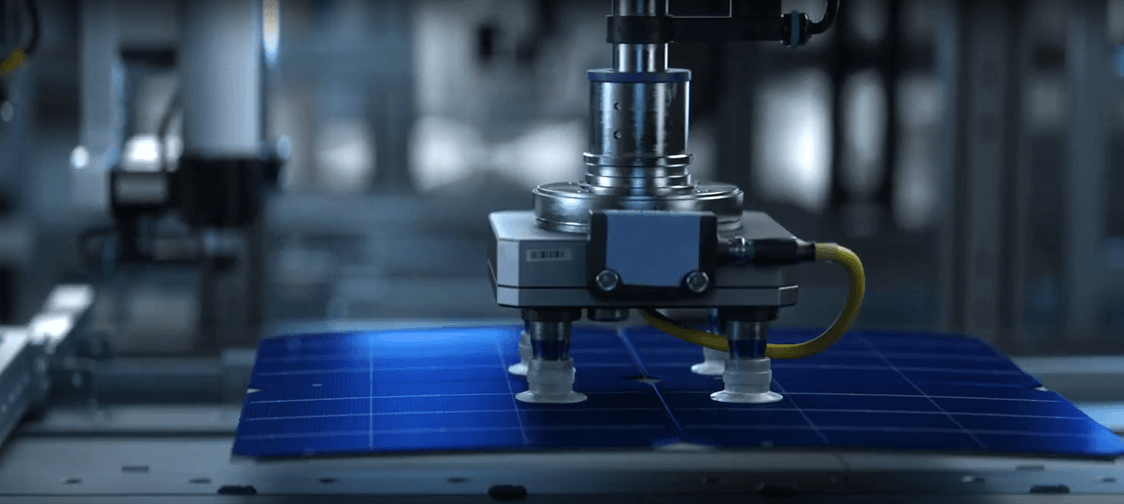

Case study: Catalysing cleantech with private capital

To achieve net zero emissions by 2050, Asia needs USD37 trillion worth of investment in its energy sector. Private capital can close this gap.

Background

To achieve net zero emissions by 2050, Asia needs up to USD 37 trillion worth of investment in its energy sector. Nearly half of the CO2 reductions required for net zero come from technologies that are currently in the prototype phase. Scaling those technologies requires large up-front capital expenditure based on anticipated revenue.

It’s here that Private Equity firms can play an outsized role in closing Asia’s funding gap. While public impact funds seek highly scaled mature platforms, Private Equity firms are well-placed to invest in earlier stage innovative companies. Their appetite for investment in cutting-edge innovation could shape the energy transition.

Watch the video case study to learn more

To achieve net zero emissions by 2050, Asia needs USD37 trillion worth of investment in its energy sector. Private capital can close this gap.

How can banks connect private capital to early-stage innovations to accelerate the clean energy transition?

Our latest insights

What will accelerate SAF scale-up?

Sustainable aviation fuel (SAF) is key to decarbonising aviation but faces economic and policy hurdles. Explore …