Securing the Future: The crucial link between crypto custody and counterparty risk

2022 was a tumultuous year for the cryptocurrency market, exemplified by the shocking collapse of a major crypto exchange and the resulting fallout on the surrounding ecosystems. Nevertheless, the asset class has demonstrated its resilience. Many institutions are still keen to invest in cryptocurrency related activities and digital assets more broadly – albeit with caution. Consequently, they are prioritising service providers that are well-capitalised, subject to prudential regulations, and take risk management seriously.

In the face of challenging fixed income and equity markets and recent upheavals in the banking world, institutions have been motivated to seek yield elsewhere. Digital assets evidently remain an appealing choice for diversification. Even as the events of 2022 unfolded, research by Fidelity Digital Assets found that 81% of institutions believed that digital assets should be included in an investment portfolio.1

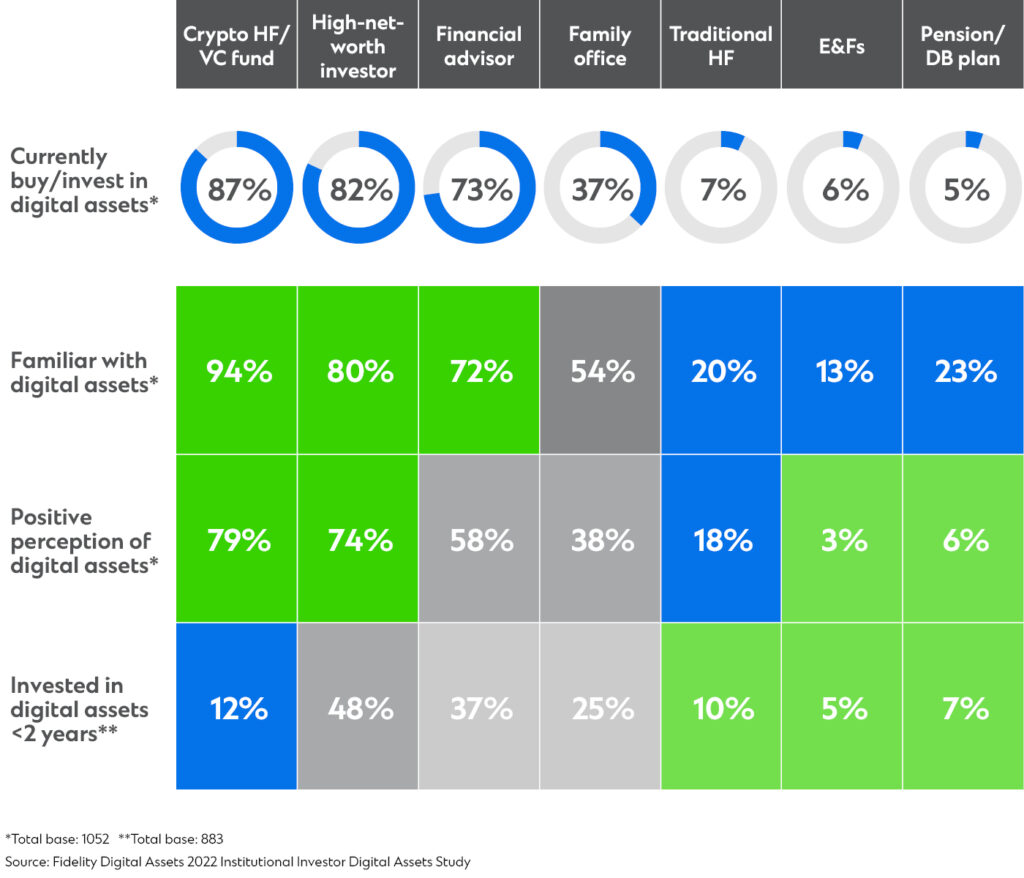

The appeal of these assets isn’t universal, though. The same study cited crypto-focused hedge funds, venture capital firms, HNWIs (high-net-worth investors) and financial advisers as among the most enthusiastic backers of digital assets. By contrast, family offices, traditional hedge funds, pension funds and endowments and foundations were largely sceptical (Figure 1).2

Figure 1: Openness to digital assets by investor type

Source: Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study

Within the vast world of digital assets, what are investors buying? A good number will opt for digital asset and crypto ETFs, with one study showing that half of the surveyed institutional investors plan to add them to their portfolios in 2023.3

For those wanting to invest directly in digital assets rather than through ETFs, the most accessible option are cryptocurrencies. While there are a number of hedging instruments available today, cryptocurrencies are still prone to price volatility: the market capitalisation declined dramatically from a high of USD3 trillion in 2021 to just USD800 billion at the beginning of 2023, followed by a jump to USD1.19 trillion in April 2023.4

This volatility is enough to put off traditional investors – including some of the major institutional investors, asset and fund managers – who also remain concerned about safety of assets and regulatory uncertainty.

Nevertheless, cryptocurrencies remain popular among smaller institutions, and some larger asset managers are taking measured steps into the digital asset world. For example, Blackrock5 and Fidelity6 are giving access to cryptocurrencies to certain classes of traders, while Schroders7 has invested a minority stake in a digital asset-focused investment manager, as part of a broader strategy towards tokenisation.

Schroders’ investment is just one example of a number of larger institutions turning to tokenisation, which enables real-world liquid and illiquid assets to be digitalised and traded on a distributed ledger or a blockchain. As security tokens can be fractionalised, they can be cheaper to buy than existing assets, presenting the potential for greater financial inclusion among a wider range of investors. Another draw is that security tokens – unlike cryptocurrencies – are subject to existing securities laws, making them more attractive for institutional investors.

A temporary downside is that most security tokens and fractionalised funds are still in the proof-of-concept stages of development and operate in a highly restrictive closed loop, making them largely illiquid, in contrast to cryptocurrencies, which are actively traded. Despite this, major financial institutions remain bullish that asset tokenisation will take off eventually, with some anticipating that their market volume in Europe alone could reach €918 billion by 2026.8 A report earlier this year suggests that tokenisation in private markets could grow 80-fold by 2030, reaching almost USD4 trillion in value.9

These are strong enough reasons for institutions to closely monitor the asset class. One interested institution is SWIFT, which has demonstrated that existing market infrastructure can support both issuances and secondary market transfers of tokenised assets.10 And last year, the Depository Trust and Clearing Corporation (DTCC), launched an alternative settlement platform using distributed ledger technology (DLT). The platform, Project Ion, was developed by a number of banks and fintech firms and processes transactions in parallel with traditional settlement systems.11

As the digital asset market continues to expand its range of use cases and becomes more relevant to larger investors, institutions will need to ensure their service providers are credible, reliable and secure. The events of 2022 revealed just how many crypto service providers had weak or non-existent internal controls, unclear business models that created potential conflicts of interest and more importantly compromised security controls that could not prevent serious losses for the service provider and, ultimately, the end clients.

“At a time where a lack of controls has seen high-profile institutions fail, it’s more important than ever for clients to look for a reliable partner that they can trust for the long term” says Waqar Chaudry, Executive Director, Innovation and Digital Assets Product, Financing & Securities Services at Standard Chartered.

This means that the market players must carefully consider how they select digital asset custodians. Firstly, the provider should be licensed and domiciled in a jurisdiction with a robust regulatory framework backed by experienced regulatory oversight and recognition across major prudential regulators. A number of the crypto service providers that eventually failed had not been subject to appropriate regulation and oversight, meaning that investors had limited recourse when recovering trapped or misappropriated funds.

Secondly, institutions must also ensure that the service provider takes risk management seriously, and that there is no conflict of interest. At the most rudimentary level, investors’ due diligence processes should include a deep dive into crypto-custodians’ balance sheets, knowledge of the assets they actually hold, and an understanding of how they legally, technologically and structurally ensure asset segregation.

Thirdly, investors should also assess potential contagion risk at crypto-custodians from other arms of their businesses.

Going forward, crypto service providers that offer custody will need to demonstrate true segregation and client asset protection measures from affiliated activities such as an exchange, brokerage and lending businesses.

Until the emergent crypto industry has sufficient safeguards to prevent a repeat occurrence of the events of 2022, there will be impediments to its growth for true institutional adoption. From an asset safeguarding perspective, with institutions that are already regulated, such as traditional bank custodians, there is a reliable track record that spans decades in providing safekeeping for trillions of dollars of assets.

“As regulated institutions, banks are in a strong position to play an important role in the ecosystem” says Chaudry. Indeed, many global bank custodians have already started to reposition their custody propositions to support clients who are starting to trade digital assets. This means that traditional custodians are in an especially strong position, as they can provide a bridge between traditional markets and the emerging cryptocurrency and wider digital assets markets.

This is good news for institutions that still see the potential of digital assets and are in need of strong partners to ensure that their assets will be protected. As custodians in both the traditional and crypto world take the lessons of 2022 forward, investors will benefit from a more secure and robust digital asset space.

1 Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study

2 Fidelity Digital Assets 2022 Institutional Investor Digital Assets Study

3 https://cointelegraph.com/news/institutions-extremely-interested-in-crypto-etfs-but-buying-has-cooled-survey

4 Coin Desk (April 4, 2023) Bitcoin’s huge surge pushes crypto market cap to USD1.19 T, the highest since June

5 https://www.ft.com/content/0948f1a9-ad0b-4126-9ae8-5ce4e212c07e

6 https://www.forbes.com/sites/digital-assets/2023/03/16/amid-crypto-bank-crisis-fidelity-opens-bitcoin-ether-trading-for-retail–accounts/

7 https://www.ft.com/content/fd5d2d6a-3c31-44f2-bec0-7c52262aa3fa

8 Coin Desk – September 14, 2021- Security tokens could see rapid growth in Europe, outpacing cryptocurrencies

9 The Tokenizer (March 31, 2023) – Citi expects $4 trillion in value of tokenized assets by 2030

10 SWIFT – October 5, 2022 – Ground breaking SWIFT innovation paves way for global use of CBDCs and tokenised assets

11 https://www.fintechfutures.com/2022/08/dtcc-launches-dlt-powered-settlement-platform-project-ion/

The best is yet to come in emerging and frontier securities services markets. We’re ready to help.

Turning expertise into actionable insights. Explore our views on what to watch out for.