-

CSDR

CSDR Settlement Discipline Regime

Preparing for implementation of the Settlement Discipline Regime, a landmark change in the securities market regulatory framework.

Overview

The European Central Securities Depositories Regulation (CSDR) is an EU/EEA regulation that came into effect on 17 September 2014 and aims to increase the safety and efficiency of securities settlement and settlement infrastructures in the EU. The CSD Regulation complements and completes the regulatory framework for securities market infrastructures, alongside European Markets Infrastructure Regulation (EMIR – regulating CCPs) and the Markets in Financial Instruments Directive (MiFID – regulating Trading Venues). It creates, for the first time at European level, a common authorisation, supervision and regulatory framework for CSDs.

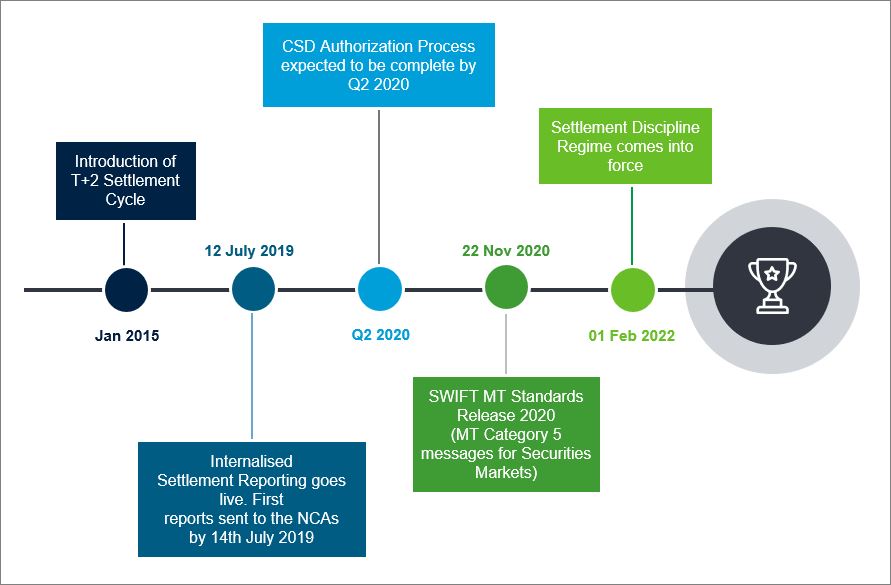

Key milestones and timelines

CSDR has been implemented in a phased manner since 2015 and the Settlement Discipline Regime, going live on 1 February 2022 as the final step of the implementation process.

Csdr

The Settlement Discipline Regime (SDR)

The focus of this regulation now shifts to its most critical phase, the implementation of the Settlement Discipline Regime (SDR).

The intent of the settlement discipline regime is to improve the efficiency of the EU/EEA securities settlement process by incentivizing the trading parties to meet their obligations under a trade on intended settlement date (ISD). However, the complex nature of the way the markets operate necessitate all parties in the trade and settlement chain to review internal policies and procedures, assess the financial impact of SDR on day-to-day operations and implement a suitable control framework to achieve regulatory compliance.

How will settlement discipline be achieved?

To achieve the objective of improving the safety and efficiency of securities settlement, in particular for cross-border transactions, the regulation harmonises the timing and framework for securities settlement in the EU. This section will elaborate on the set of measures to PREVENT and ADDRESS failures in the settlement of securities transactions, commonly referred to as settlement discipline measures.

How is Standard Chartered preparing for CSDR?

Standard Chartered recognises the importance of this regulation to harmonise securities settlement processes in the EU (including cross border transactions) and the impact it will have on our clients and industry in general if not implemented in a streamlined manner.

Key Focus Areas

- Reviewing end-to-end trade execution, booking and settlement process to identify inefficiencies and remediate ahead of implementation date

- Reviewing and enhancing current processes to monitor, report and mitigate settlement fails

- Reviewing our technology infrastructure to pro-actively identify trades at risk of cash penalties and buy-ins

- Upgrading our technology infrastructure to consume and process cash penalties against each failing securities transaction

- Completing internal work required to process new MT Category 5 messages due to be released by SWIFT in November 2020

- Identifying and appointing a buy-in agent and building a front-to-back buy-in management workflow

- Seeking legal advice on amendments required to trading, broker or custody agreements to ensure contractual arrangements incorporate the buy-in process requirements and are enforceable in all relevant jurisdictions

- Targeted client outreach to review current settlement efficiency levels and remedy root cause issues causing settlement failures.

Market Advocacy

Standard Chartered actively participates at all major trade associations and industry working groups focusing on CSDR and is keen to collaborate with other market participants to prevent unintended consequences of the regulation. We have been actively contributing to industry guidelines developed by trade associations such as AFME, ICMA, ISLA and AGC. There are still several clarifications that are needed ahead of implementation and Standard Chartered looks forward to playing its part in ensuring a streamlined implementation of this pivotal securities markets’ regulation.

What can our clients do?

While there remain a number of uncertainties, Standard Chartered strongly recommends that clients commence performing their own assessment of the impact this regulation might have on their current business strategies and evaluate the efficiency of their trade booking, pre-matching and settlement operating models. We also recommend that clients stay tuned into industry developments on the implementation of the settlement discipline regime and periodic updates from ESMA on clarifications pertaining to the regulatory technical standards.

Clients can contact Standard Chartered to discuss CSDR at any time. Please contact your Relationship Manager for any CSDR related queries.