-

Sustainability

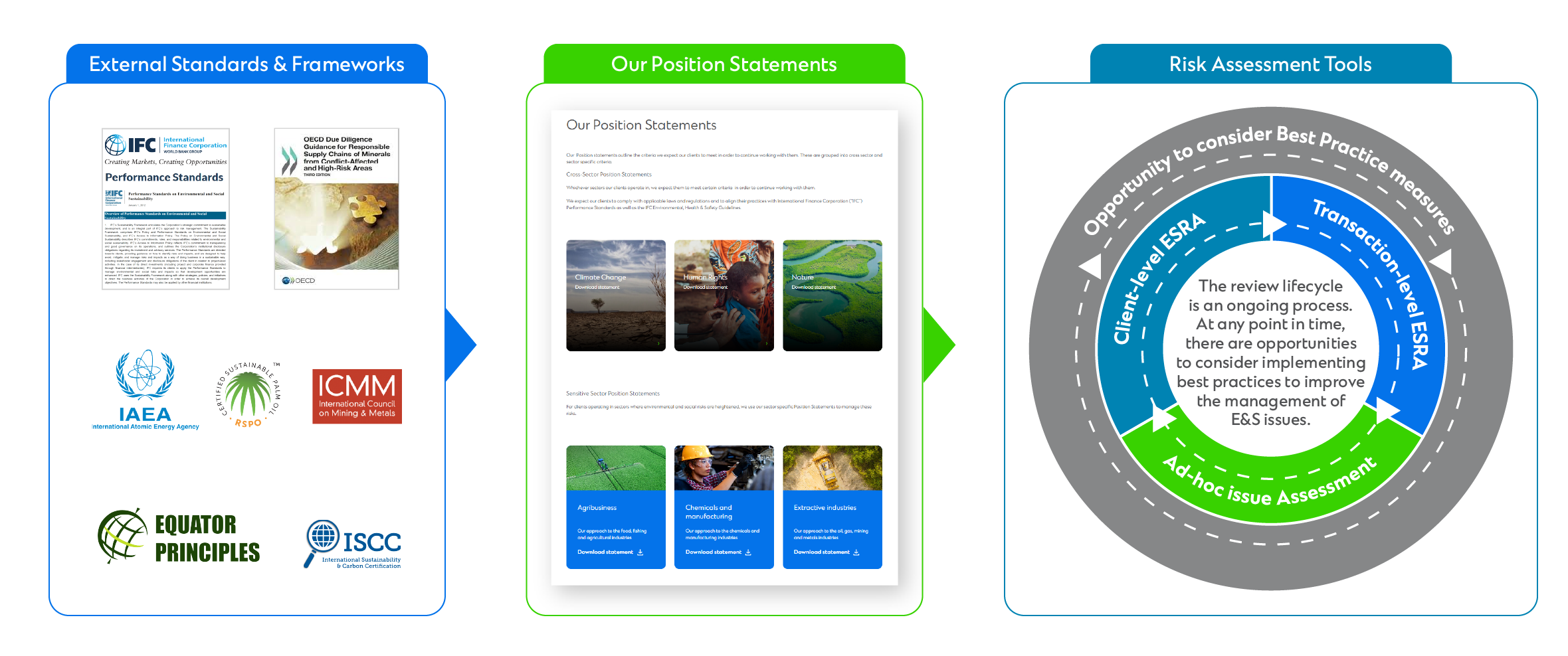

Our environmental and social risk framework

Our cross-sector framework helps us manage environmental and social risk while supporting sustainable growth.

Our approach to environmental and social risk management

Our approach to managing environment and social (E&S) risk is informed by international conventions, national laws and regulations and industry standards and best practices. These requirements are translated into cross sector and sector specific criteria, which we articulate in our position statements that we assess our clients and transactions against.

Aligning with external standards and industry best practice

Our position statements are informed by international best practice and appropriate industry wide benchmarks.

Our position statements

Our position statements outline the criteria we expect our clients to meet in order to continue working with them. These are grouped into cross sector and sector specific criteria.

Cross sector position statements

Whichever sectors our clients operate in, we expect them to meet certain criteria in order to continue working with them.

We expect our clients to comply with applicable laws and regulations and to align their practices with International Finance Corporation (“IFC”) Performance Standards as well as the IFC Environmental, Health & Safety Guidelines.

Climate Change

Download Statement

Human Rights

Download Statement

Nature

Download Statement

Sensitive sector position statements

For clients operating in sectors where environmental and social risks are heightened, we use our sector specific position statements to manage these risks.

Agribusiness

Our approach to the agricultural and fishing industries

Chemicals and manufacturing

Our approach to the chemicals and manufacturing industries

Extractive industries

Our approach to the oil, gas, mining and metals industries

Infrastructure and transport

Our approach to the infrastructure and transport industries

Power generation

Our approach to the power generation industry

Thermal coal

Our approach to the thermal coal industry

Prohibited activities

We will not provide financial services for activities which breach certain restrictions.

Grievance Mechanisms and Remediation

We track and monitor complaints through official industry channels (e.g. IFC’s Complaints Ombudsman or RSPO’s complaints panel). If we discover any issues or have these brought to our attention we will investigate these and engage with the client via our relationship managers.

Due to client confidentiality, or an ongoing complaints process, we may not be able to publicly comment on ongoing investigations.