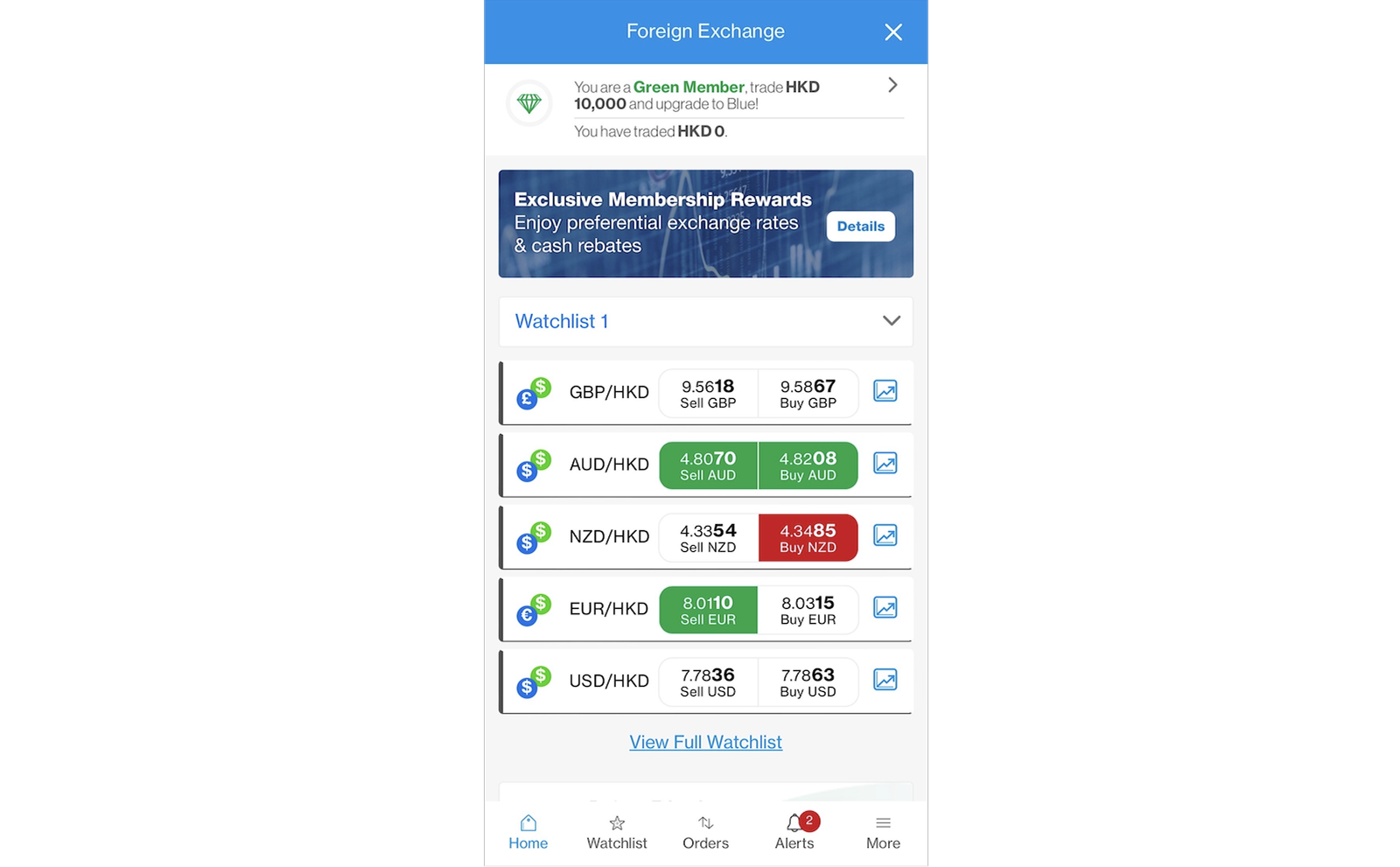

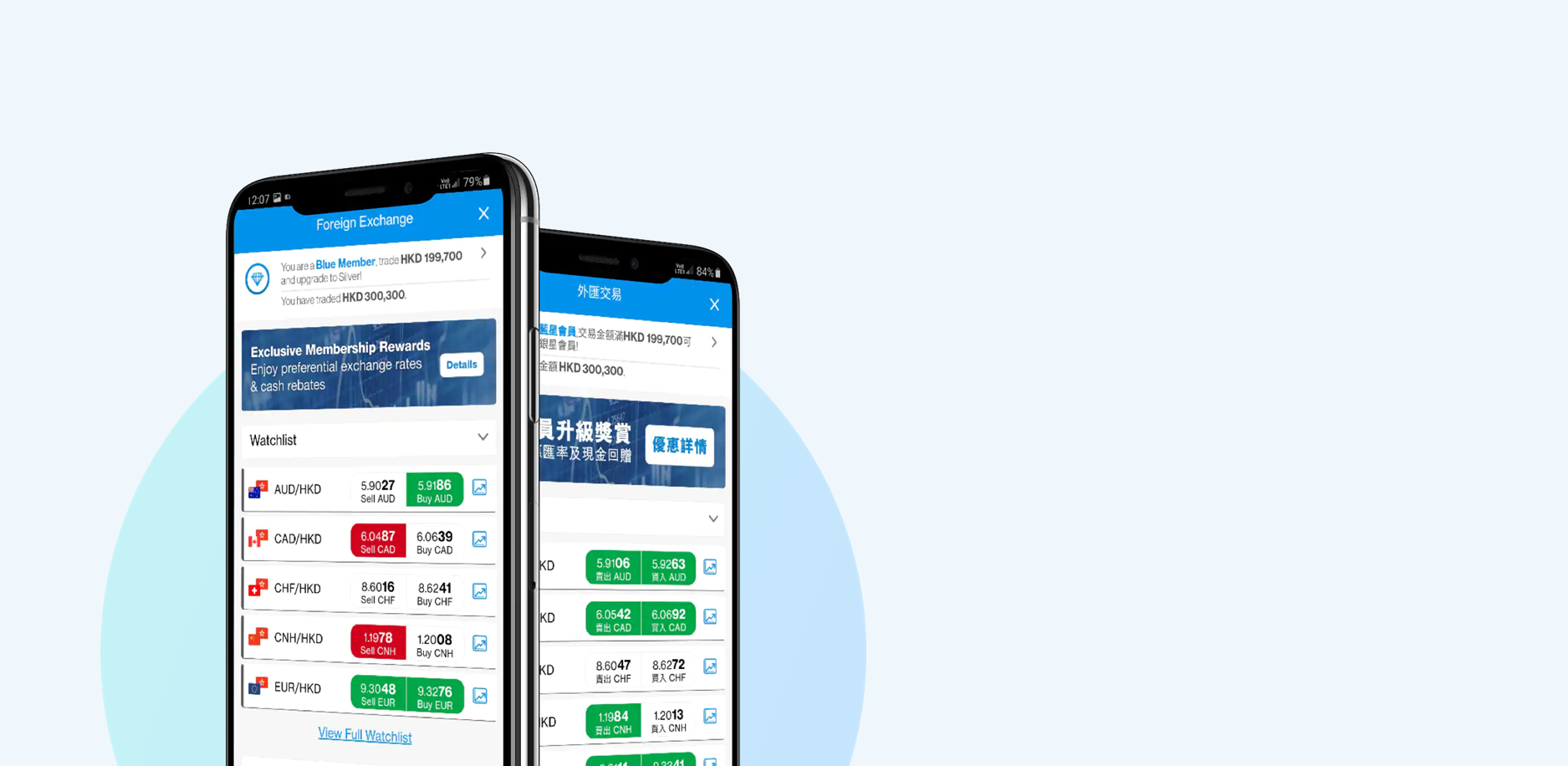

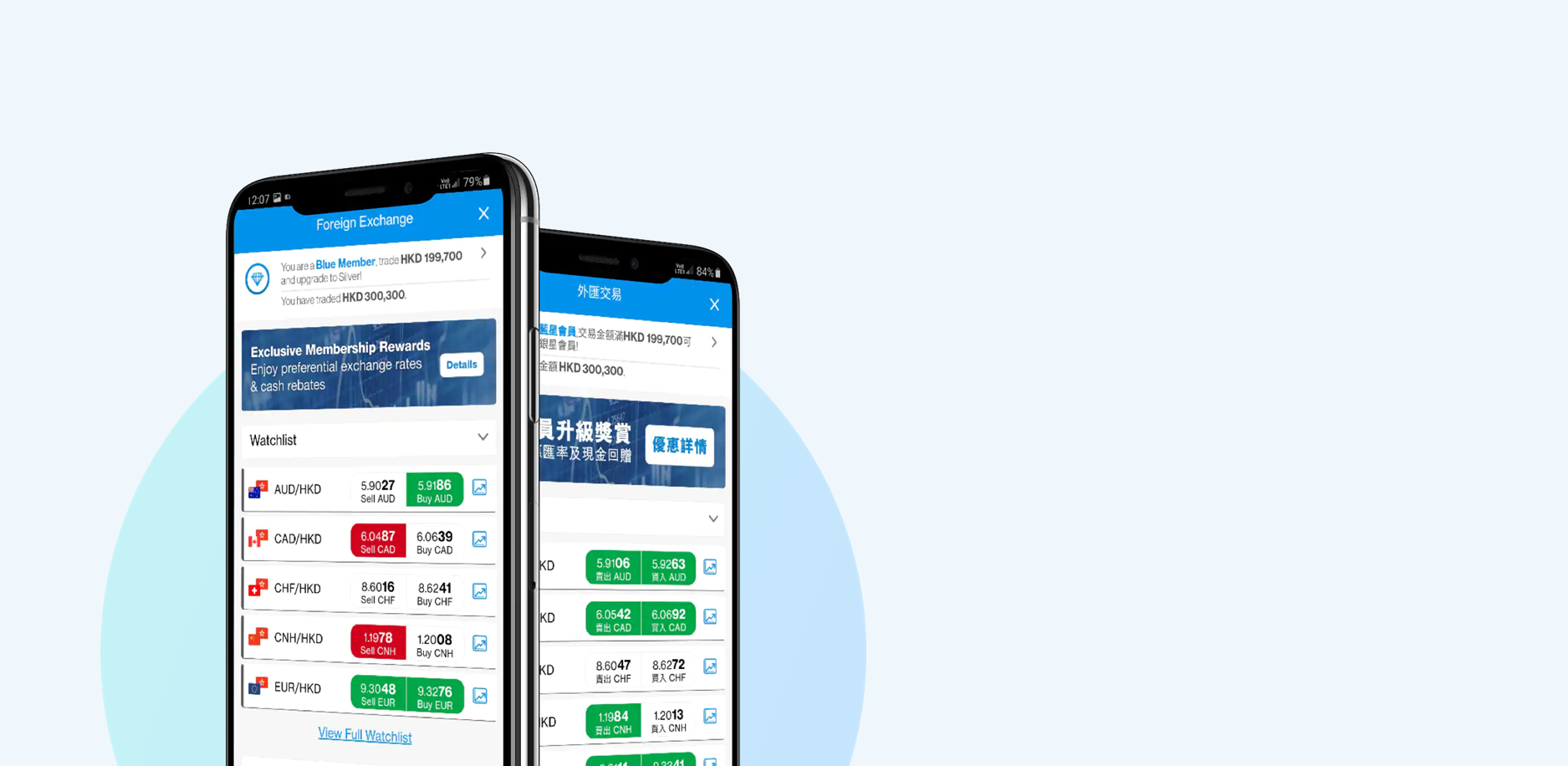

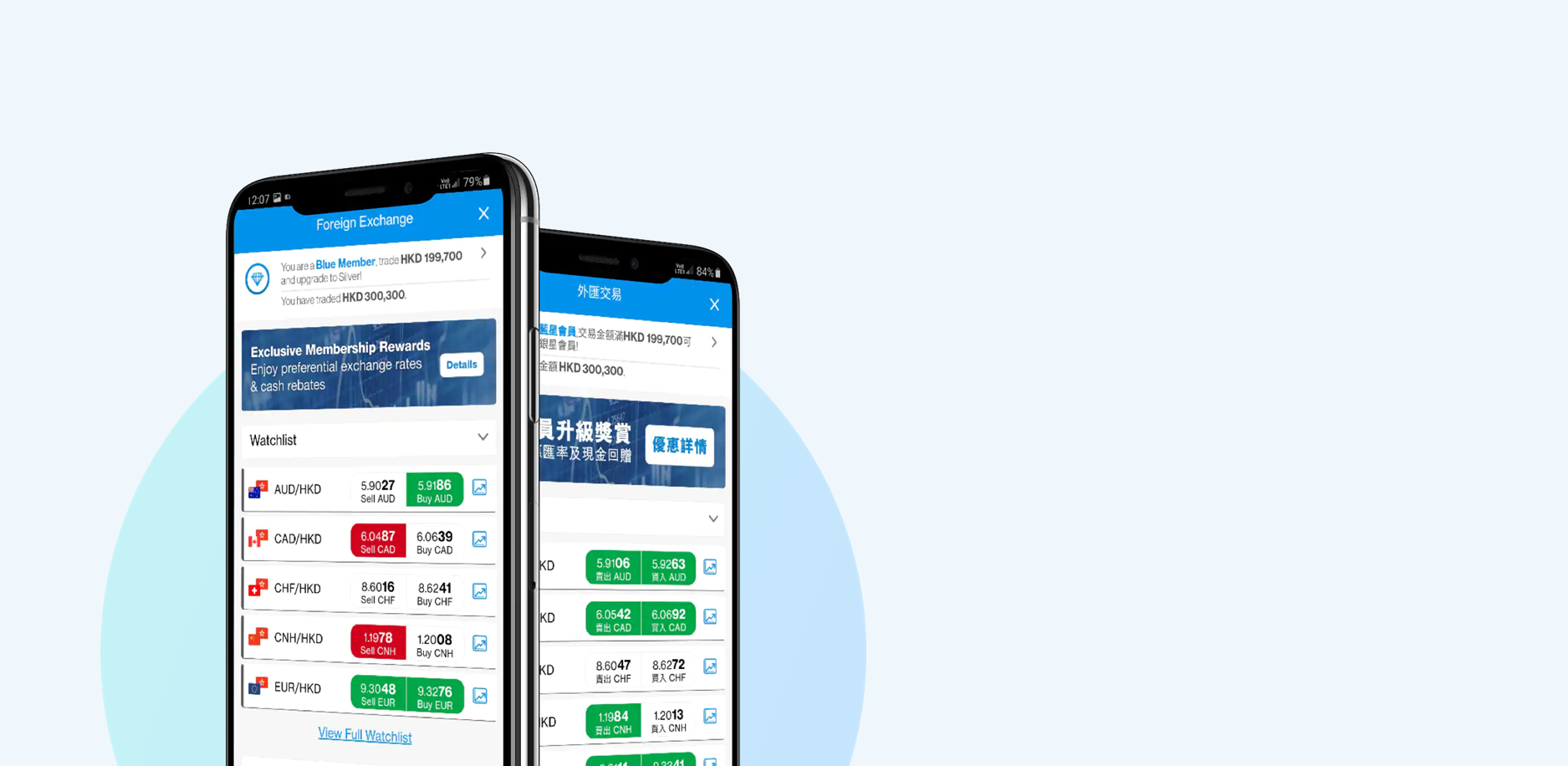

Discover your one-stop Forex trading platform. Trade in 11 major currencies anytime, anywhere

Join the first-in-market FX Membership Program to enjoy exclusive rates and up to HKD18,888 cash rewards.

-

Trade Now

Trade Now

How to start trading? Log onto Foreign Exchange Platform now

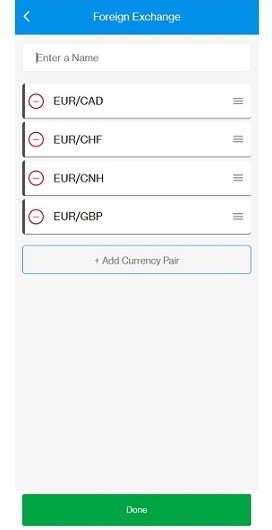

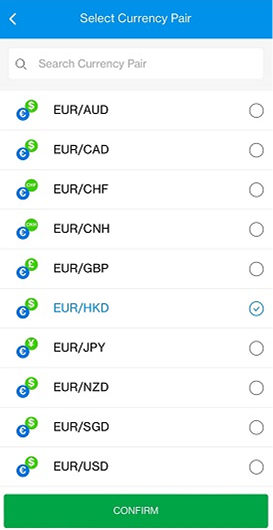

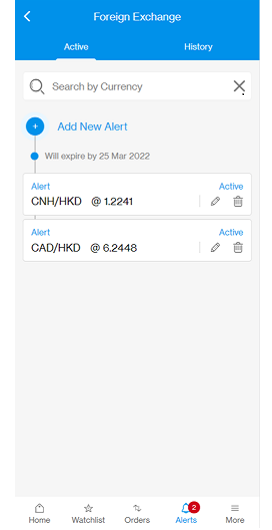

Via SC Mobile App

Use mobile device (iOS App or Android App) to click the following button. Simply click “FX” on Invest tab.

Via Online Banking

Login Online Banking and select “Foreign Exchange” from the menu

HKD100 Foreign Exchange Welcome Offer

Enjoy HKD100 welcome offer with an accumulated foreign exchange transaction of HKD10,000

-

Exchange Now

Exchange Now

How to start trading? Log onto Foreign Exchange Platform now

Via SC Mobile App

Use mobile device (iOS App or Android App) to click the following button. Simply click “FX” on Invest tab.

Via Online Banking

Login Online Banking and select “Foreign Exchange” from the menu

Up to HKD4,000 Referral Cash Rewards

Refer your family and friends for FX transactions to enjoy cash rewards.

-

Exchange Now

Exchange Now

How to start trading? Log onto Foreign Exchange Platform now

Via SC Mobile App

Use mobile device (iOS App or Android App) to click the following button. Simply click “FX” on Invest tab.

Via Online Banking

Login Online Banking and select “Foreign Exchange” from the menu

Membership Rewards

FX Membership

Swipe right to view the next tier

Membership eligibility1

Spread discount2 (USD/HKD)

Spread discount2 (Other non-USD currencies/ HKD)

Cash Rewards

Blue

Membership eligibility1

HKD 10,000*

Spread discount2 (USD/HKD)

11%

6%

HKD 88 cash rewards for transaction amount* HKD 200,000 – 499,999

Silver

Membership eligibility1

HKD 500,000*

Spread discount2 (USD/HKD)

22%

13%

HKD 488 cash rewards for transaction amount* HKD 1 million to < 2 million

HKD 188 cash rewards for transaction amount* HKD 0.5 to < 1 million

Gold

Membership eligibility1

HKD 2,000,000*

Spread discount2 (USD/HKD)

28%

16%

HKD 3,888 cash rewards for transaction amount* HKD 10 million to < 30 million

HKD 888 cash rewards for transaction amount* HKD 2 million to < 10 million

Platinum

Membership eligibility1

HKD 30,000,000*

Spread discount2 (USD/HKD)

33%

19%

HKD 18,888 cash rewards for transaction amount* HKD 50 million or above

HKD 12,888 cash rewards for transaction amount* HKD 30 million to < 50 million

- Blue

- Silver

- Gold

- Platinum

Green

Enjoy HKD100 cash reward with accumulated transaction amount HKD 10,000 or above for any new member who have not traded from 1/1/2025 to 30/6/2025.

Foreign Exchange Membership Details

* Accumulated FX transaction amount from 1 July – 31 December 2025

1 The membership tiers are determined by reference to the total Accumulated Transaction Amount of all Eligible Foreign Exchange Transactions in every half year (i.e. from 1 January – 30 June or from 1 July – 31 December every year)

2 More savings in spread for Priority Banking clients

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Membership Rewards

FX Membership

Swipe right to view the next tier

Membership eligibility1

Spread discount2 (USD/HKD)

Spread discount2 (Other non-USD currencies/ HKD)

Cash Rewards

Blue

Membership eligibility1

HKD 10,000*

Spread discount2 (USD/HKD)

11%

6%

HKD 88 cash rewards for transaction amount* HKD 200,000 – 499,999

Silver

Membership eligibility1

HKD 500,000*

Spread discount2 (USD/HKD)

22%

13%

HKD 488 cash rewards for transaction amount* HKD 1 million to < 2 million

HKD 188 cash rewards for transaction amount* HKD 0.5 to < 1 million

Gold

Membership eligibility1

HKD 2,000,000*

Spread discount2 (USD/HKD)

28%

16%

HKD 3,888 cash rewards for transaction amount* HKD 10 million to < 30 million

HKD 888 cash rewards for transaction amount* HKD 2 million to < 10 million

Platinum

Membership eligibility1

HKD 30,000,000*

Spread discount2 (USD/HKD)

33%

19%

HKD 18,888 cash rewards for transaction amount* HKD 50 million or above

HKD 12,888 cash rewards for transaction amount* HKD 30 million to < 50 million

- Blue

- Silver

- Gold

- Platinum

Green

Enjoy HKD100 cash reward with accumulated transaction amount HKD 10,000 or above for any new member who have not traded from 1/1/2025 to 30/6/2025.

Foreign Exchange Membership Details

* Accumulated FX transaction amount from 1 July – 31 December 2025

1 The membership tiers are determined by reference to the total Accumulated Transaction Amount of all Eligible Foreign Exchange Transactions in every half year (i.e. from 1 January – 30 June or from 1 July – 31 December every year)

2 More savings in spread for Priority Banking clients

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Membership Rewards

FX Membership

Swipe right to view the next tier

Membership eligibility1

Spread discount2 (USD/HKD)

Spread discount2 (Other non-USD currencies/ HKD)

Cash Rewards

Blue

Membership eligibility1

HKD 10,000*

Spread discount2 (USD/HKD)

11%

6%

HKD 88 cash rewards for transaction amount* HKD 200,000 – 499,999

Silver

Membership eligibility1

HKD 500,000*

Spread discount2 (USD/HKD)

22%

13%

HKD 488 cash rewards for transaction amount* HKD 1 million to < 2 million

HKD 188 cash rewards for transaction amount* HKD 0.5 to < 1 million

Gold

Membership eligibility1

HKD 2,000,000*

Spread discount2 (USD/HKD)

28%

16%

HKD 3,888 cash rewards for transaction amount* HKD 10 million to < 30 million

HKD 888 cash rewards for transaction amount* HKD 2 million to < 10 million

Platinum

Membership eligibility1

HKD 30,000,000*

Spread discount2 (USD/HKD)

33%

19%

HKD 18,888 cash rewards for transaction amount* HKD 50 million or above

HKD 12,888 cash rewards for transaction amount* HKD 30 million to < 50 million

- Blue

- Silver

- Gold

- Platinum

Green

Enjoy HKD100 cash reward with accumulated transaction amount HKD 10,000 or above for any new member who have not traded from 1/1/2025 to 30/6/2025.

Foreign Exchange Membership Details

* Accumulated FX transaction amount from 1 July – 31 December 2025

1 The membership tiers are determined by reference to the total Accumulated Transaction Amount of all Eligible Foreign Exchange Transactions in every half year (i.e. from 1 January – 30 June or from 1 July – 31 December every year)

2 More savings in spread for Priority Banking clients

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)

Example 1:

Tony is in blue tier as he has accumulated HKD10,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now he wants to exchange HKD to 2,000,000 JPY for his travelling.

- Spread discount: 6%

- JPY/HKD exchange rate before discount: 0.054432

- JPY/HKD exchange rate after discount: 0.054405

- Savings after exchange: HKD54

- Accumulated Transaction Amount after exchange: HKD118,810

- Membership Tier after exchange: Blue (remain)

Example 2:

Jenny is in silver tier as she has accumulated HKD1,500,000 within the half year period (1st Jan – 30th June OR 1st July – 31st December). Now she wants to exchange HKD to AUD100,000 for her children’s education.

- Spread discount: 13%

- AUD/HKD exchange rate before discount: 5.04

- AUD/HKD exchange rate after discount: 5.035

- Savings after exchange: HKD500

- Accumulated Transaction Amount after exchange: HKD2,003,500

- Membership Tier after exchange: Gold (upgraded)