Asia’s mid-sized companies: confident, dynamic and growing

Standard Chartered survey of CEOs and CFOs of

mid-sized companies in China, India, Indonesia and Malaysia

KUALA LUMPUR, 21 January 2015

Asia’s mid-sized companies: confident, dynamic and growing

Standard Chartered survey of CEOs and CFOs of

mid-sized companies in China, India, Indonesia and Malaysia

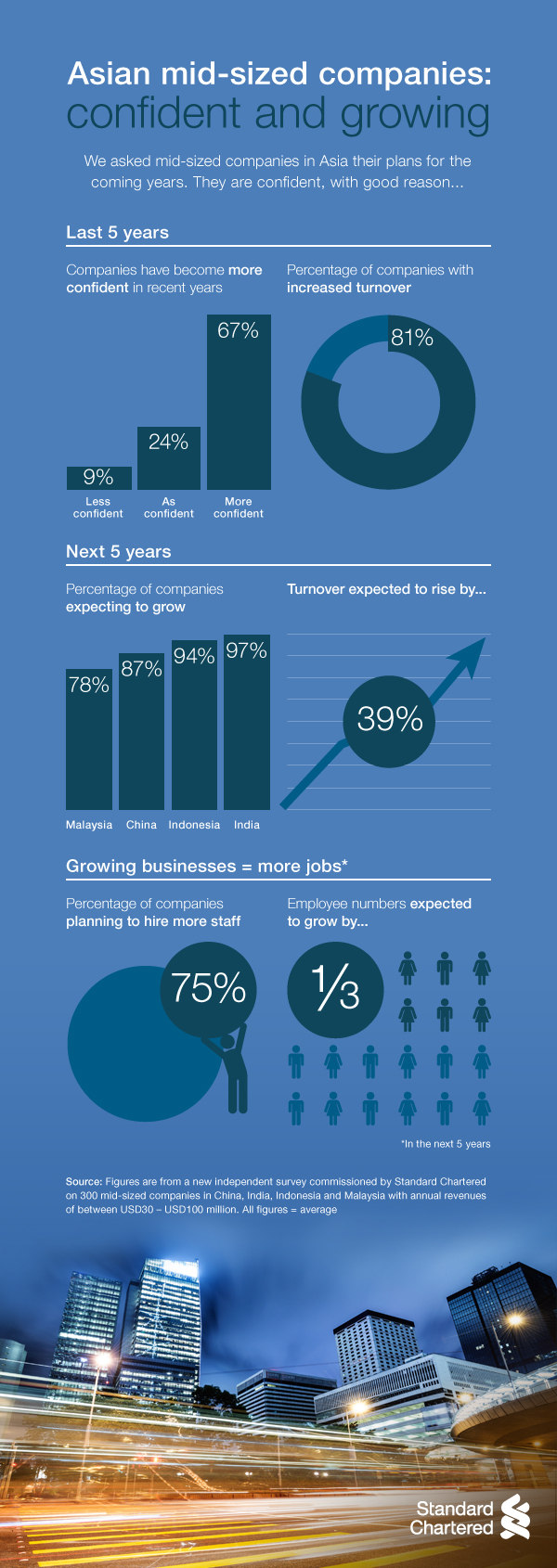

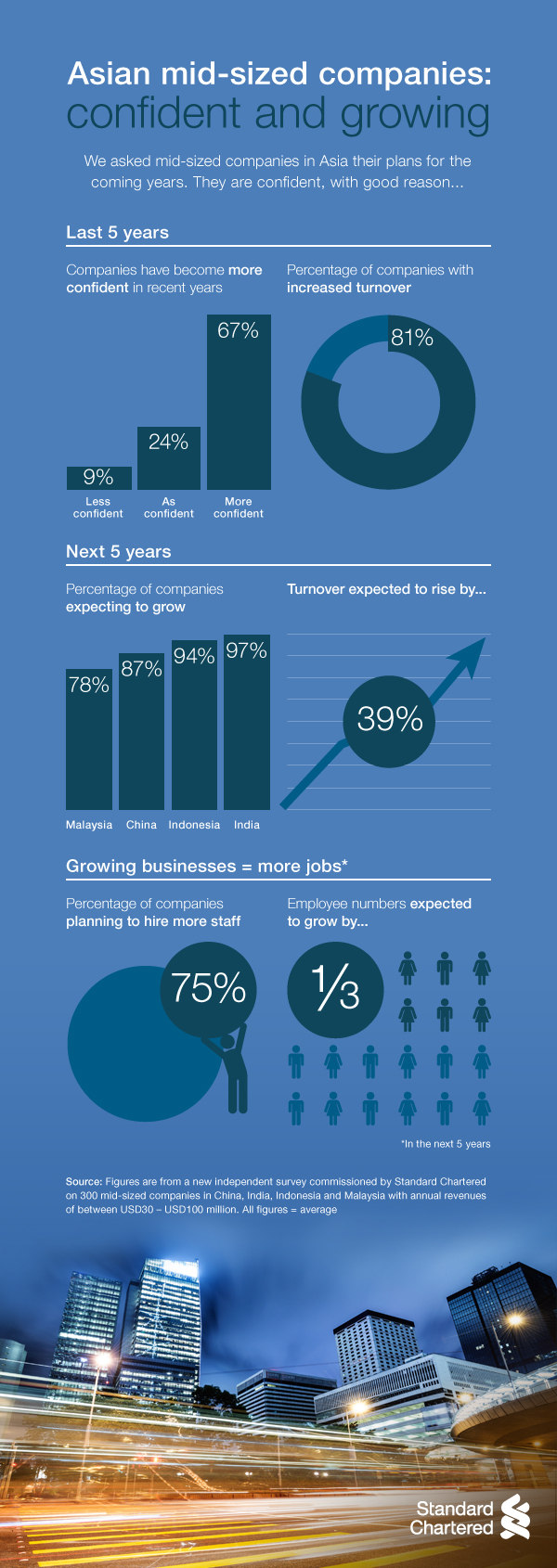

KUALA LUMPUR, 21 January 2015 – Mid-sized companies in Asia are highly confident in their ability to grow, and alongside domestic expansion are increasingly looking to international markets to build further momentum, finds a new independent study commissioned by Standard Chartered.

The survey of 300 CEOs and CFOs of companies with an annual turnover of between USD30-USD100 million across four of Standard Chartered’s Asian markets � China, India, Indonesia and Malaysia � points to considerable optimism, despite slowing economies across the region.

78 per cent of the CEOs and CFOs of Malaysian businesses are confident in the potential to grow their business in the next five years, with an average anticipated rise in turnover of 26 per cent. Confidence comes from increasing demand for products and services, much of this driven by a growing middle class.

While overwhelmingly high, levels of optimism vary. Indian business leaders are the most optimistic, with 97 per cent confident that their company will grow in the next five years, while Malaysian respondents have slightly more mixed views, with 78 per cent confident in their growth prospects.

Job creation

Job creation

The findings are good news for these four Asian economies, as the companies here look to expand their workforce to meet increased demand for the products and services they provide. Three-quarters of the businesses who plan to grow also expect to take on more workers in the next five years, with headcount expected to increase by an average of one-third.

International appetite

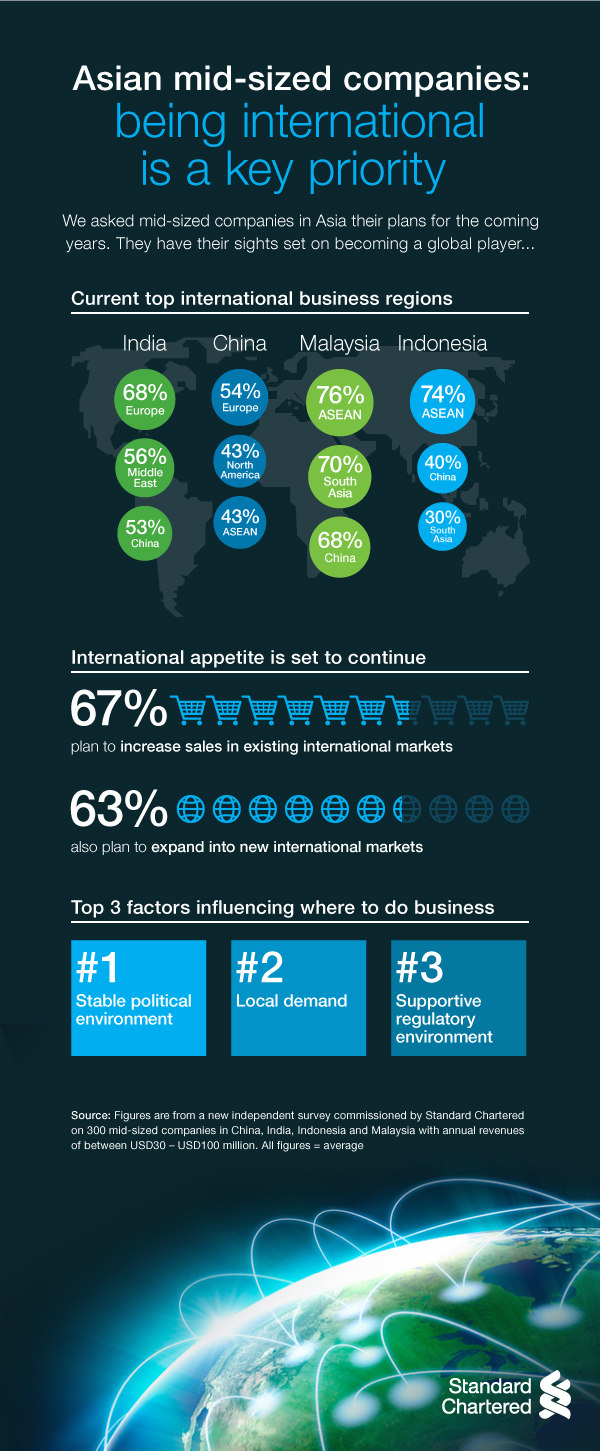

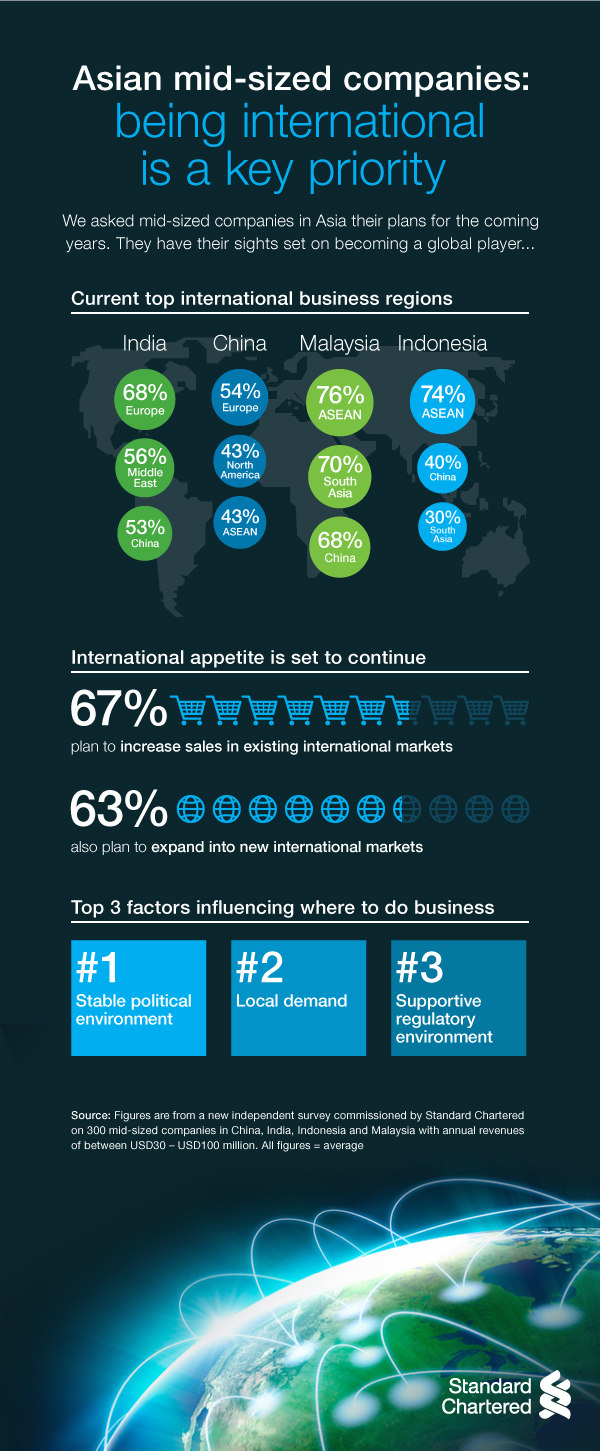

Nine in ten of the Malaysian companies are international, typically doing business with other companies in the region, including ASEAN, China and South Asia.

Expanding internationally is a priority for most of the Malaysian mid-sized companies in the study, with 70 per cent planning to increase their sales in existing foreign markets, and 64 per cent expecting to expand the number of international markets in which they operate.

Future ambition

The CEOs and CFOs cite becoming leaders in their respective industries as their top priority. Quality and consistency are also front of mind, as the companies plan to increase the scale of their operations while continuing to provide the quality of their products and services.

Eddie Hu, Executive Director and Head of Commercial Clients at Standard Chartered Bank Malaysia, commented: �Mid-sized companies are crucial engines of economic growth and job creation across Malaysia, and increasingly active in global trade. They are the Tatas and Alibabas of tomorrow, and this study shows that slowing growth in the region has not dented their confidence in the future. Far from it, these dynamic companies are looking to take on more workers and expand into new markets, growing their turnover in the next five years.�

-ENDS-

For further information please contact:

Elissa Foo

Manager, Business Communications

Corporate Affairs Malaysia

Standard Chartered Bank

Tel: +603 2117 7948

Mobile: +6012 326 5889

Email: Elissa.Foo@sc.com

Geraldine Tan

Head, Business Corporate Affairs

Corporate Affairs Malaysia

Standard Chartered Bank

Tel: +603 2117 7821

Mobile: +6012 907 1740

Email: Geraldine.Tan@sc.com

Note to Editors

The study surveyed 300 CEOs and CFOs of mid-sized businesses with annual turnover of between USD30 � USD100 million across four Asian markets: China, India, Indonesia and Malaysia.

Standard Chartered partnered with GlobeScan to conduct this study. GlobeScan is an independent specialist consultancy and has been offering stakeholder intelligence and engagement advisory services to global companies, multilateral organizations and NGOs since 1987, including in emerging markets.

Standard Chartered

We are a leading international banking group, with more than 86,000 employees and a 150-year history in some of the world’s most dynamic markets. We bank the people and companies driving investment, trade and the creation of wealth across Asia, Africa and the Middle East, where we earn around 90 per cent of our income and profits. Our heritage and values are expressed in our brand promise, Here for good.

Standard Chartered PLC is listed on the London and Hong Kong Stock Exchanges as well as the Bombay and National Stock Exchanges in India.

Standard Chartered in Malaysia

Standard Chartered Bank, a member of the Standard Chartered Group was established in Malaysia in 1875 and incorporated as Standard Chartered Bank Malaysia Berhad in 1984. As Malaysia’s first bank, Standard Chartered leads the way through product innovation, consistent and strong growth performance and sustainability initiatives. The Bank provides a comprehensive range of financial products and services to corporates, institutions, small and medium-sized enterprises and individuals through its network of 43 branches across Malaysia.

In 2001, Standard Chartered UK established its third global technology & operations centre, Scope International, in Malaysia � the first international bank to do so in the country. Scope International provides software development, banking operations, IT support services and customer service capabilities to the Bank in up to 70 countries. It now houses the biggest software development company in the country, International Software Centre Malaysia (ISCM) and has a total workforce of more than 3,200 people.

Price Solutions Sdn Bhd, a wholly owned subsidiary of Standard Chartered Bank UK is also located in Malaysia. The company promotes and markets Standard Chartered’s financial products in Malaysia through a network of direct sales agents.

Standard Chartered Saadiq Berhad (Saadiq), Standard Chartered Bank Malaysia’s Islamic Banking subsidiary was established in November 2008. It offers a full suite of Syariah-compliant products and services to individuals and corporates through its dedicated branches. In 2012, Saadiq established Kuala Lumpur as its global hub for Islamic consumer banking.

Standard Chartered employs close to 7,000 employees in all its Malaysian operations.