4 Factors Affecting Gold Rates: An Investor’s Guide

From young, we’ve been taught the value of gold from childhood stories of pirates, princesses, and leprechauns. We have grown to know its distinct yellow shade, and its perceived value as something to covet. As such, gold is one of the best-known assets or commodities in the world.

But if you’re thinking of jumping into the precious metals game, you must realise that gold’s monetary value is actually derived by several, often contrasting, market forces. So, before you go out digging for gold, here’s what you should know.

Why do gold prices rise and fall?

The price movements of gold arise from a combination of many different factors, rather than a single cause. Here are some of the main causes affecting gold prices:

1. Demand

Gold is a highly coveted commodity with many uses. Apart from being a precious metal, gold is also commonly used in the manufacturing sector – as an electricity conductor, a material in life-support devices , amongst many others.

Gold is also traded as an investment. Owned in many different forms, investors may choose to own physical gold, such as in the form of gold bullion, coins, or jewellery, while others may find it more convenient to own “paper” gold, such as Gold Exchange Traded Funds (ETFs), unit trusts that specialise in gold, trading in gold currency, or even buying into gold miners.

Instinctively, an increase demand for gold typically translates to a surge in the yellow metal’s price. In the past decade, China and India’s economic growth has fuelled demand in gold and thus increased prices. This demand has softened in recent years, in line with their stabilising economic growth.

2. Gold and fiat currencies: an inverse relation

Many countries used to adopt the gold standard i.e. the value of the country’s currency or paper money was pegged to the price of gold. For example, if an ounce of gold was US$1,000, then one US dollar would be 1/1000th of an ounce.

Today, this is no longer the case. Most governments have migrated to fiat currencies, where the value of the currency is based on factors such as monetary supply or trust in the government to repay the country’s loans. While this comes with added risk, it gives governments freedom to increase or decrease monetary supply based on their economic goals, and not based on how much gold they can hold in their treasury.

This also means that when trust in the government or economy falls, the value of their respective currency often falls with it. In such scenarios, many investors turn to gold, to prevent their wealth from eroding on the back of currency devaluation.

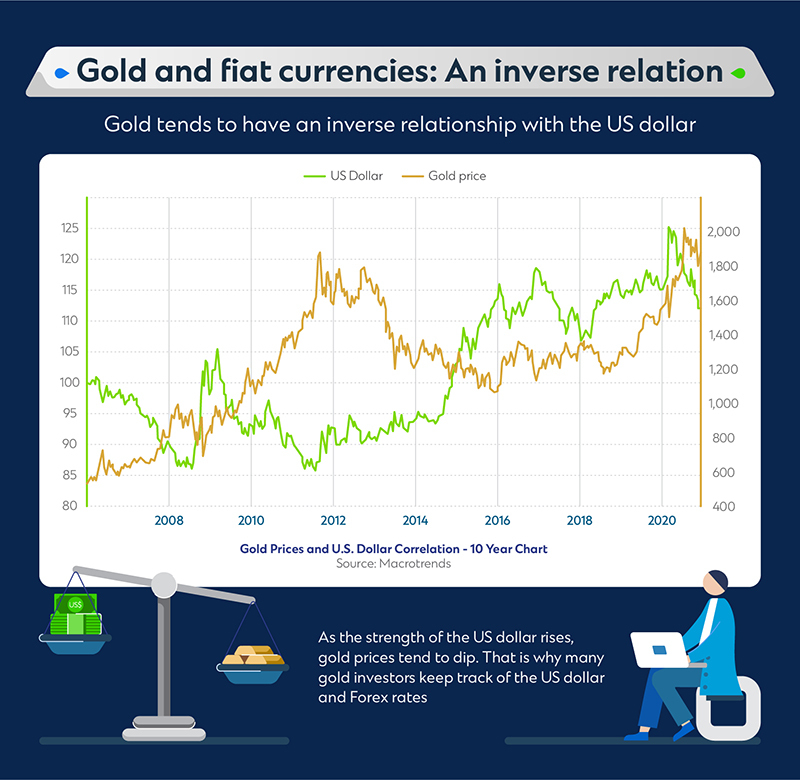

Furthermore, when the greenback’s value increases against other currencies, this will lead to a depreciation of gold prices. This is because investors ex-US would need to look at the price of the commodity in their local currency (which will be more expensive), and hence, the demand for gold would decrease – and vice versa.

As such, gold tends to have an inverse relationship with the US dollar. As the strength of the US dollar rises, gold prices tend to dip. This is why many gold investors keep track of the US dollar and Foreign Exchange (Forex) rates

Surprisingly, over the past 5 years, gold and the US dollar have been rising in tandem. Surges in the price of gold this year have been explained by a few macroeconomic factors including rising global debt levels and the effects from the China-US trade war.

3. Gold as a safe haven asset

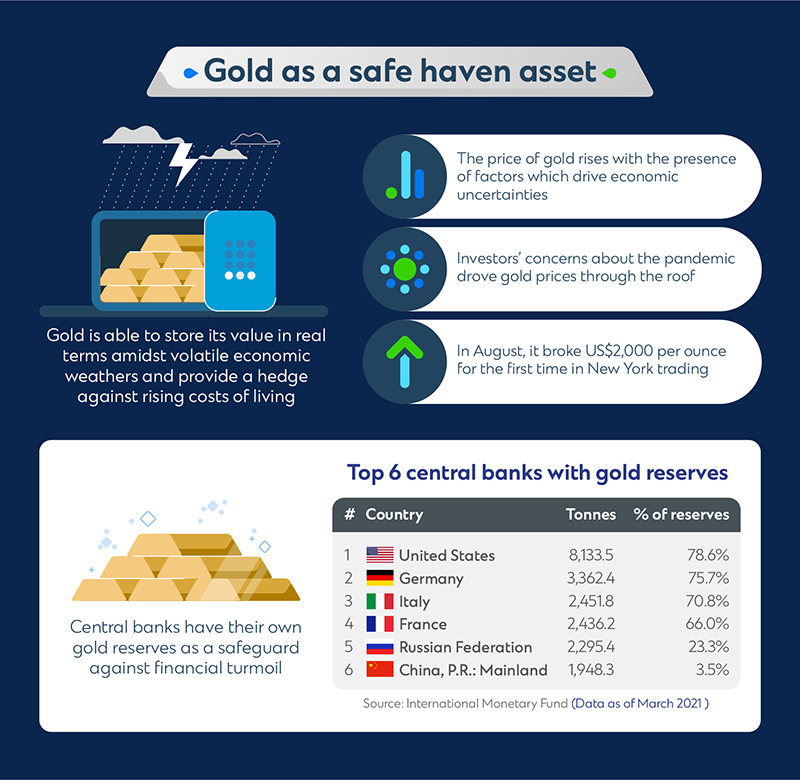

Coined Wall Street’s safe haven asset, gold is able to store its value in real terms amidst volatile economic weather and provide a hedge against rising costs of living, unlike cash. Central banks have their own gold reserves as a safeguard against financial turmoil.

According to the 2020 Central Bank Gold Reserves Survey, central banks have cited one of the top reasons they are holding on to their gold is because of the precious metal’s “performance during times of crisis”, and 20 per cent of them are looking to increase their gold reserves over the next 12 months.

As a safe haven asset, the price of gold rises with the presence of factors which drive economic uncertainties, such as the COVID-19 pandemic and its subsequent waves. Gold prices fluctuate upwards during periods of volatility due to growing investor demands – investors are able to minimise portfolio risks by investing in gold as opposed to equities or bonds.

In fact, throughout 2020, investor concerns about the pandemic drove gold prices through the roof, hitting an all-time high in August, when it broke US$2,000 per ounce for the first time in New York trading. Similarly, when the news about a coronavirus vaccine was announced in early November, gold prices fell, albeit still maintaining its price of under US$1,900 per ounce.

4. Supply of available gold

The total weight of all the gold mined throughout human history is estimated at almost 198,000,000 kilograms. This means, if we were to gather all the gold mined, it would fit into a single cube that’s about 21 metres in length and depth!

Each year, we add approximately 2,500,000 to 3,000,000 kilograms from gold mining to the overall stock of gold above the ground. This amount is usually not enough to meet global demands. Unexpectedly low supplies such as miners finding less gold than expected, can push up gold prices further.

At present, it is estimated that there is only about 20 per cent of gold left to be mined, albeit this figure is not set in “stone”. With new technologies, miners may be able to extract gold at sites which were originally overlooked because they were not economical to access.

Investing in different forms of gold

As gold prices are affected by multiple factors, aspiring gold investors shouldn’t be too quick to buy; it is not a simple matter of just “buying more gold when times are bad”. Investors need to work out how much gold is the right amount to buy, and how long they should be holding on to it. They should also consider what form their gold investment should take.

Note that the type of gold investment products you hold also carry different types and levels of risks which often can differ significantly. For example, owning physical gold in the form of coins or bullion, is the most direct form of gold investment. However, this requires investors to have proper insurance and means of storage. There is also the need to buy from trustworthy sources to prevent the risk of fraud, such as when other metals are mixed into a gold bar to reduce the gold content. Gold in its purest form consists of 99.9% of the precious metal.

Some investors prefer investing in Gold Exchange Traded Funds (ETF); they are able to invest in gold without owning the physical commodity. Gold ETFs allow investors to track the performance of the gold market and trade them like stocks. However, as Gold ETFs may include shares in different gold-backed derivatives, how well they do would depend on the performance of their underlying assets.

There are several ways for you to invest in gold. Check out the article on How to Start Investing in Gold: A Beginner’s Guide for more information. You can also reach out to us at Standard Chartered to start your gold investment journey.