Watch: Diego De Giorgi on our Q3’25 results

Hear from our Group CFO about a strong quarter of performance and growth in service of our clients.

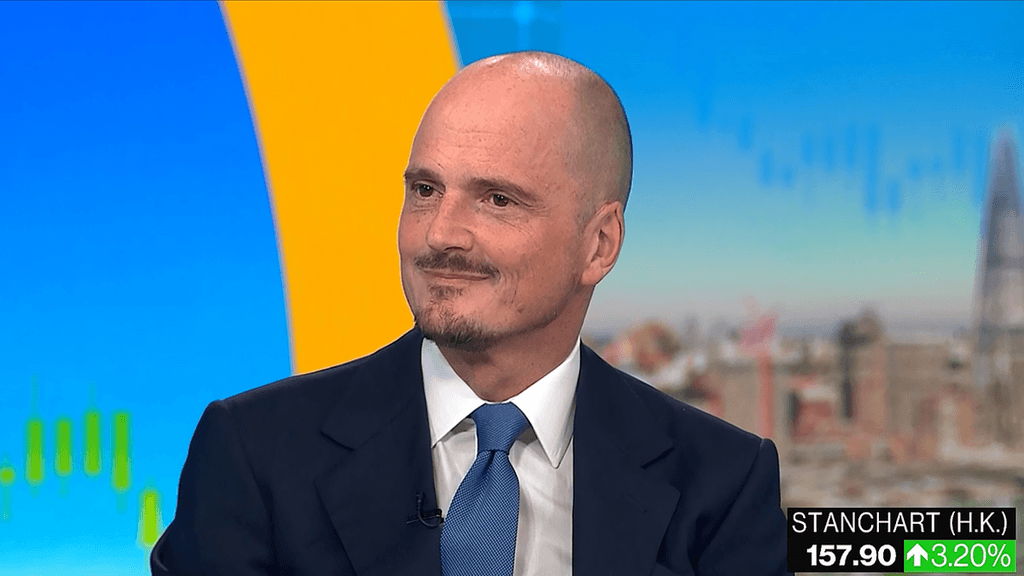

Group Chief Financial Officer Diego De Giorgi joined Bloomberg’s Tom Mackenzie shortly after our third-quarter results were published on 30 October 2025.

Watch the video to hear more about:

- The fastest-growing wealth hubs and how our network enables strong organic growth.

- The tailwinds in our affluent business – and the renewed confidence we observe in our wealth management clients.

- How treating transformation as a long-term strategy enables us to innovate as technology evolves.

Read the transcript

Tom Mackenzie (Bloomberg Reporter): Does this momentum from the bank continue in the quarters ahead – both the current quarter and those to come?

Diego: It’s been a very strong quarter, and we’re confident the momentum will continue. We can now say that we’re going to reach the equity target we had set for 2026 a full year ahead of schedule.

As you mentioned, it’s been a period of solid growth – about 30 billion in new business and 6,000 new clients – all propelled by major structural trends.

What’s particularly interesting, given recent market discussions, is that our clients are once again taking strategic decisions after a period of reflection earlier this year. You can see that reflected in our banking results – strong, sustainable, and on target, delivered one year early.

Tom Mackenzie: That’s interesting – 67,000 clients and 13 billion in inflows. How does that story evolve from here? Hong Kong is projected to become the biggest cross-border wealth destination by the end of the decade, surpassing Switzerland. Do you share that view?

Diego: Hong Kong is indeed the largest and fastest-growing wealth hub in the world right now, with Singapore a close second. We’re performing strongly in both markets, particularly across the fastest-growing regions of Asia, the Middle East, and Africa.

Our wealth management clients are showing renewed confidence – after a period of caution, they’re putting money back to work, especially in investment products. This shift is reflected in our results. As policy uncertainty continues to ease, we expect that confidence to grow further. These are powerful tailwinds for our business.

Tom Mackenzie: You’re well into your growth phase, but you’ve also been focusing on efficiency and reducing costs. Where are you on that journey? Are you on track, ahead, or behind?

Diego: We remain on track and will deliver by the end of this year what we guided the market to expect.

The bulk of our spending adjustments will take place through 2026. As always, for a bank like ours, transformation is a long-term journey. With new technologies, we’ll continue evolving in the years ahead.

Tom Mackenzie: Let’s talk about credit. Concerns are rising amid recent bankruptcies. You reported a USD295 million increase – how concerned are you?

Diego: Our credit charge is around 24 basis points, annualized – comfortably within our through-the-cycle range of 30–35 basis points. It’s been subdued over the past few quarters, and the environment remains conducive overall.

There’s been increased scrutiny around private credit recently, so we added more disclosure in our latest results. Less than half a percentage point of our total exposures relate to private credit. It remains an important area of growth, but we treat it with the same rigor as public credit. At Standard Chartered, we are cautious and disciplined – with strong credit concentration limits and continuous client reviews.

We’re constantly evaluating and adjusting our risk assessments, not just reacting to current conditions but trying to anticipate where the next signs of stress might emerge.

Tom Mackenzie: Where do you see potential stress today?

Diego: At this stage, we don’t see significant signs of stress, though we remain highly vigilant. We benefit from a very strong balance sheet built over the past decade. About 75 per cent of our corporate exposures are investment grade, and our wealth management clients are primarily affluent – the most resilient segment.

We’ve been reducing our exposure to credit cards and personal loans while increasing our focus on wealth management.

Tom Mackenzie: So no “cockroaches” in the portfolio, so to speak – nothing alarming under the surface?

Diego: No, nothing of that sort. We’re vigilant on multiple fronts, but we sleep well at night. Our balance sheet is healthy, and the stock is up 63 per cent year to date.

Tom Mackenzie: What about M&A? HSBC recently announced a USD14 billion deal in Hong Kong to take Hang Seng private. Does that make you think about pursuing something similar?

Diego: Seeing that deal actually makes me happy to be in Hong Kong. It’s a great market where we’re doing extremely well – revenues are up 16 per cent year-to-date, and we have the number one client satisfaction rating in wealth management.

Confidence returning to Hong Kong is good news for us. As for M&A, it’s one route to growth, but we’re fortunate to be operating in some of the world’s fastest-growing regions. Given our strong organic growth, we don’t currently feel the need for large acquisitions.

Tom Mackenzie: Diego, thank you very much for your time – always appreciate your insights following another strong set of results.

Diego: Thank you, Tom. Always a pleasure.