Global construction: diverging credit and valuation path

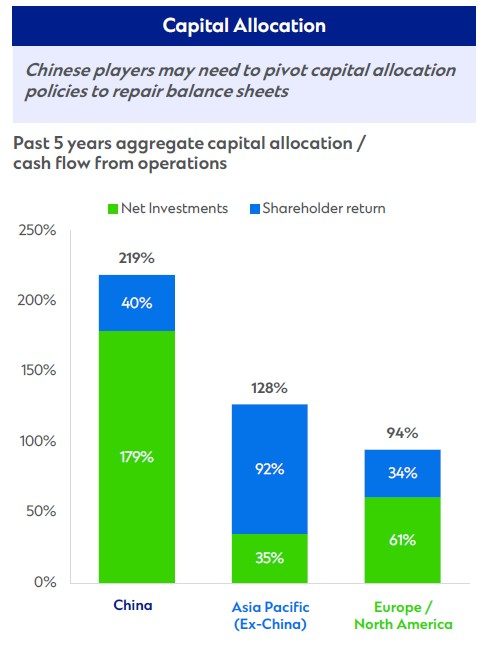

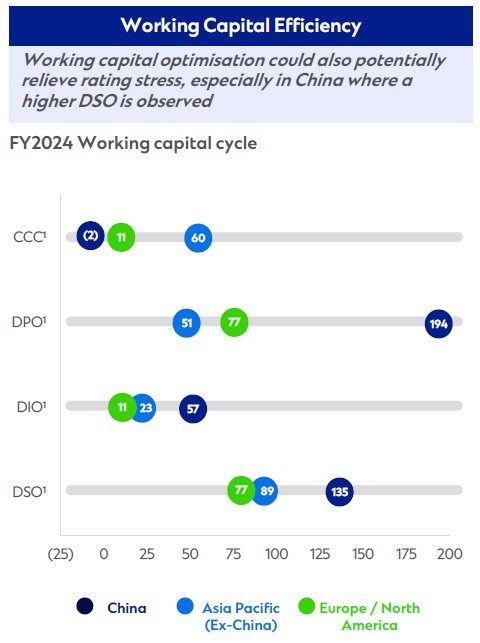

Our analysis outlines how capital discipline, working capital optimisation and targeted hybrids can reinforce resilience and support value.

Global construction spending is expected to maintain steady single-digit growth, underpinned by infrastructure stimulus, digitalisation and the energy transition. Beneath this headline, regional funding and profitability pressures are becoming more differentiated.

From a credit perspective, China-based construction players face tighter balance sheet headroom after years of expansion, though their state-owned enterprises (SOE) background continues to enable superior access to funding.

In Europe and North America, input-cost inflation, labour market tightness as well as recent trade policy measures risk weaker balance sheets and credit ratings.

Lastly, Asia Pacific (ex-China) players generally exhibit stronger balance sheets, but have room to enhance efficiency.

From an equity perspective, earnings growth and sustainable ROE are key valuation drivers. Discounted multiples for selected Chinese names highlight this need to improve profitability and capital discipline. Initial data also suggests that ESG underperformance may contribute negatively to valuations.

With this backdrop, we believe key levers to navigate this environment are:

- A shift in capital allocation strategy,

- Strategic use of working capital optimisation, and

- Tactical use of hybrid instruments or structured capital to support credit metrics.

To find out more, including tailored insights and solutions, please read our report.

Explore more insights

CORSIA compliance: a strategic window for airlines

CORSIA has moved from future obligation to current cost. Easing supply constraints may offer airlines a window t…