Recovering from COVID-19 – Three options for accessing additional capital

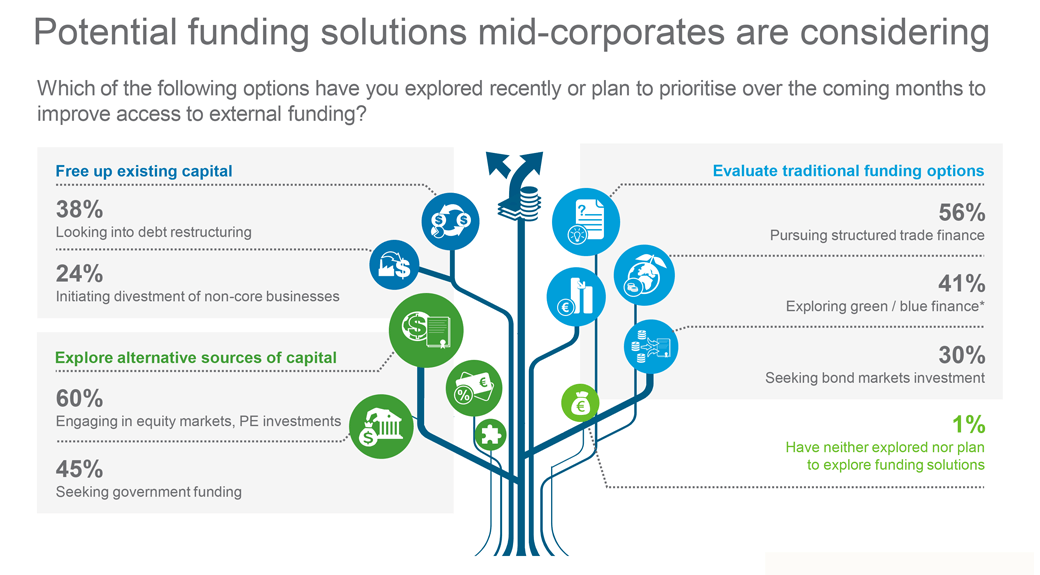

Access to capital and limited liquidity is an immediate challenge for mid-corporates, especially in the current stage of the COVID-19 crisis, where the priority is ‘Preservation and Stability’. Our survey1 of 205 mid-corporates showed that as mid-corporates seek to stabilise their business and recover from the impact of the pandemic, they are exploring a combination of equity and debt solutions:

The interest that mid-corporates have shown in exploring alternative sources of capital is unsurprising, since over half of those surveyed had reported receiving ‘limited financing support from traditional channels’, and faced ‘challenges in meeting existing debt obligations, as detailed in the second point-of-view in our ‘Road to Resilient Growth’ series, ‘Recovering from COVID-19: Three focus areas for improving liquidity’.

Getting access to funds in order to resume (and grow) business operations is high on their agenda, along with enhancing working capital and meeting debt obligations in the near term. As mid-corporates progress on their road to resilient growth, they need to find additional capital via funding solutions that are also consistent with their long-term strategic objectives, to support them in navigating uncertainty and disruption going forward. Given this situation, it is critical for mid-corporates to consider and evaluate both traditional and alternative sources of capital as they look to recover from the impact of COVID-19 and achieve stability.

With the increased uncertainty and volatility brought about by COVID-19, mid-corporates now need to look inward to reassess their core competencies2 and optimise their business and funding models accordingly. Corporate finance and treasury teams will play a pivotal role in reshaping the organisation’s capital structure, to help them recover from the impact of COVID-19 and rebuild towards long-term resilient growth.

Our survey indicates that both private equity and debt are being considered as potential financial solutions, and the right balance will also position mid-corporates well to weather future disruption. In order to attain this balanced capital structure, mid-corporates can make internal changes to existing operations or capital sources to free up funds, as well as seek external sources of finance. The three options for mid-corporates to access additional capital are:

*Note: Green and blue finance involves engaging traditional capital markets in creating and distributing a range of financial products and services that deliver both investable returns and environmentally positive outcomes (Development Asia, 2018)

In order to unlock capital and improve their long-term liquidity, mid-corporates should first look at their existing capital position and consider internal changes or actions. In the current situation, it is critical that companies identify their core competenciesii and strategic priorities before allocating capital and streamlining non-core activities. The organisation’s balance sheet would then need to be restructured, with a view towards unlocking existing capital by:

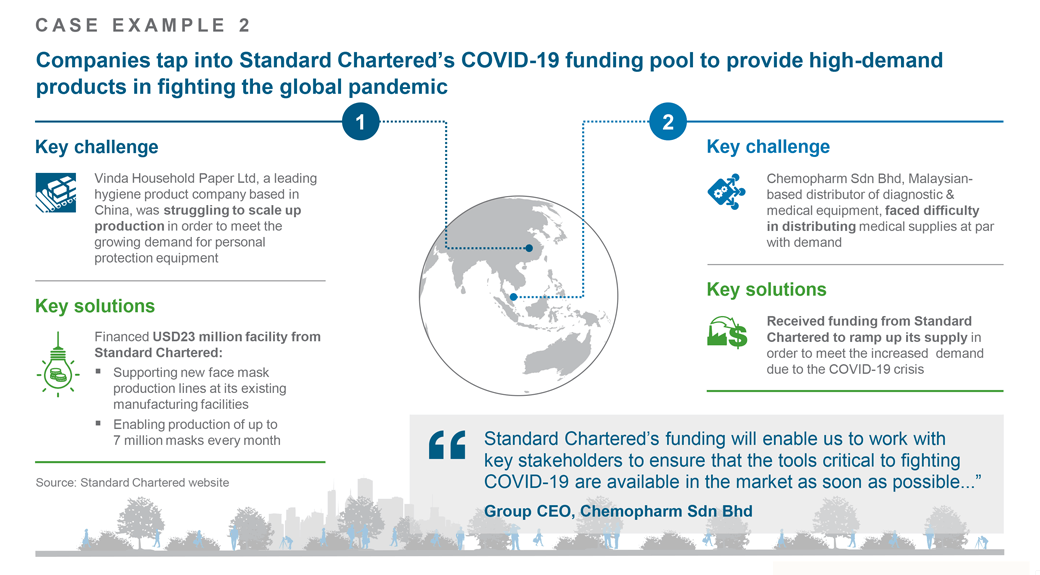

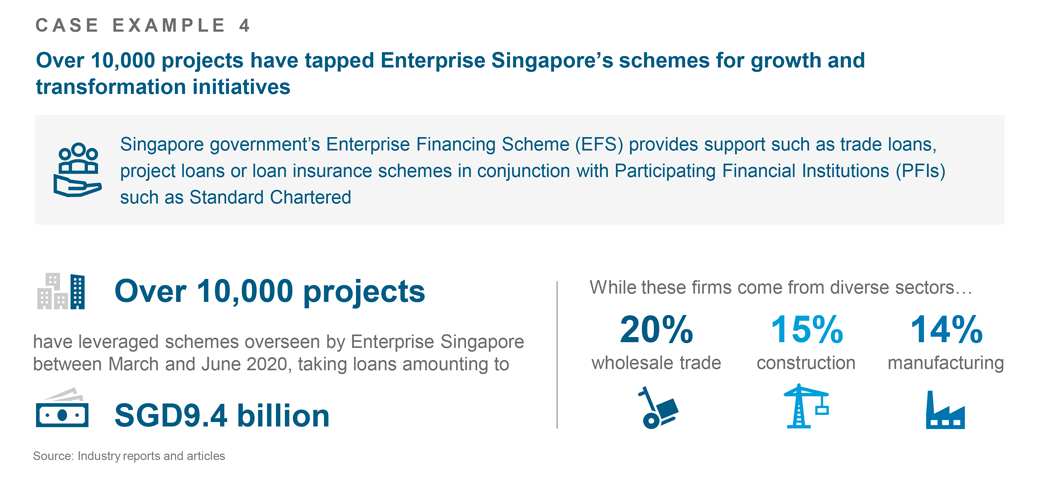

Despite ongoing disruption, traditional funding sources such as capital markets and commercial banks still remain viable options for mid-corporates to approach for raising capital. Mid-corporates ought to work with their banking partners to critically evaluate the suitability and attractiveness of the various capital-raising solutions that may be available. These include:

To access new capital, mid-corporates can also explore a range of non-traditional or alternative sources, provided that they carefully evaluate their options from a strategic and longer-term perspective. Having the right partner in place will not only help mid-corporates with their immediate capital requirements but also in driving resilient growth in a post COVID-19 world. Some of these potential avenues are:

Mid-corporates need to focus on accumulating capital to navigate Stage 2 (‘Preservation and Stability’) as well as for investing into strategic initiatives as they look towards entering Stage 3 (‘Preparing for Growth’) of the ‘Road to Resilient Growth’. Concentrating on the organisation’s core competenciesii – and being supported by the right strategic and financial partner – will be critical for success.

The next point-of-view in our series will cover manufacturing and supply chain capabilities, and how mid-corporates can better manage disruptions to operations and the broader supply chain in order to continue delivering value to customers.

1 Survey commissioned by Standard Chartered in June 2020 and completed by 205 mid-corporates (annual revenue USD100m-500m) based in Mainland China, Hong Kong, Singapore, Malaysia and India.

2 Core competencies differentiate an organization from its competition and create a company’s competitive advantage in the marketplace. Typically, a core competency refers to a company’s set of skills or experience in some activity

Watch now

[iframe title=”Video” width=”800″ height=”450″ scrolling=”no” marginheight=”0″ marginwidth=”0″ src=”https://www.youtube.com/embed/https://www.youtube.com/watch?v=6p1gduMaGwM?showinfo=0&rel=0″]

PwC, ‘Looking beyond the short term: funding the future’

PwC, ‘Funding for the future: Preparing scenarios and disclosures’

Standard Chartered, ‘We’re committing USD1 billion to finance companies helping to tackle COVID-19, March 2020

Standard Chartered, ‘Moving Past COVID-19: Best practices for Treasurers’, July 2020

EuroFinance, ‘Managing treasury through the Covid-19 crisis’, April 2020

EuroFinance, ‘Before and after Covid-19: What can Treasurers expect?’, March 2020

Euromoney, ‘Private equity bets on post-Covid survivors with hybrid capital’, May 2020

This material has been prepared by PricewaterhouseCoopers Consulting (Singapore) Pte Ltd. (“PwC”) at the request of Standard Chartered PLC and its affiliates (“SC Group”) in accordance with the agreement between PwC and SC Group. Other than to SC Group, PwC will not assume any duty of care to any third party for any consequence of acting or refraining to act, in reliance on the information contained in this report or for any decision based on it. PwC accepts no responsibility or liability for any use of this report by any third party, including any partial reproduction or extraction of this content.