A just recovery: leaving no emerging economy behind

More than 18 months into the COVID-19 pandemic, the global economy is set for its strongest recovery from a recession in 80 years. This is according to the World Bank, which expects global growth to reach 5.6 per cent in 2021.1

But the recovery is also forecast to be driven mainly by the world’s strongest economies, including the US and China. The International Monetary Fund (IMF) expects Sub-Saharan Africa to grow by 3.4 percent,2 while much of the developing world continues to struggle with the pandemic.

As the World Bank and the IMF prepare for their annual meetings in October, here Karby Leggett, Global Head of Public Sector and Development Organisations, shares his thoughts on this divergence, and how governments and investors can help shape a more just recovery.

The IMF’s view is that global recovery will to be split into two blocs: those that are looking forward to further normalisation of activity later this year and into next year – almost all advanced economies- and those that still face resurgent infections, stress on medical infrastructure and rising death tolls from COVID-19, mostly emerging markets. (taken from SC research report)

Divergence is a serious problem that is probably going to deteriorate as many developing nations’ vaccination rates remain low. In some countries, economic output may not reach pre-pandemic levels until 2022 or 2023.3 Banks such as Standard Chartered and multilateral institutions are really focusing on this to see what can be done to narrow the gap and help further accelerate growth in the developing world.

In the US, Europe and Singapore, economies are opening up again, stimulating domestic consumption and tax revenues. Economic activity has really bounced back. In contrast, some African economies have been set back by years in terms of GDP per capita

In a lot of these countries, particularly those with large and young populations, domestic consumption is really important. I was talking recently with a member of our Vietnam team who described their latest lockdown – and it seems the tightened conditions could last for some time. The Philippines, Thailand and others face similar challenges.

An economic contraction of this magnitude means less money to put children into schools, or to provide medical care or other important government services. Governments have smaller pots from which to provide social benefits. And there is a disproportionate impact on gender equality and social initiatives that aim to lift participation among the economic or socially marginalised. The key defining limitation is low vaccination rates and high infection rates. In that context, vaccine affordability also becomes crucial.

Other factors include the strength of neighbouring economic blocs and the ability or lack thereof to get pan-regional trade, investment and even people flows moving again. China’s economic revival for instance is helping out most if not all of Asia. Africa on the other is benefiting less from the recovery in Europe and the US given its infrastructure deficit and reduced global connectivity.

Meanwhile, the rebound in global commodity prices presents a double-edged sword for developing countries. For resource exporter, higher prices are boosting government revenues, though some of that is offset by higher prices for commodities they don’t produce. For other countries – those in the South Asia region are prime examples – higher oil prices are having a fairly significant negative impact given the high import bill.

A final key factor is the depth of the fiscal and monetary stimulus that advanced economies are able provide compared to developing countries and particularly the smaller economies. In Sub-Saharan Africa, many countries have already reached the upper bounds of they can tolerate in terms of fiscal deficits – the highest for 20 years.4 Debt sustainability is a real issue.

This brings particular problems. Raising taxes would be the easiest way to address elevated fiscal deficits but that would have the practical effect of hurting already sub-optimal economic growth. In any case, tax nets in many parts of the developing world are not comprehensive. At the same time, smaller developing countries have under-developed financial systems and small local banks, which constrains their ability to raise local currency financing. For those that are able to, the size of the financial requirement is such that they run the risk of crowding out private enterprise that also need capital to grow. It’s a real conundrum.

Very important. If countries are able to defend their credit ratings and prevent downgrades, it will prevent funding costs from rising and in some cases the confidence inspired by stable ratings can actually help bring costs down. Because the sovereign ratings provides the cap for all other corporate and institutional ratings in any country, it has consequences for the entire country.

Stable credit ratings also supports the broader neighbourhood of investor confidence, avoiding the kind of negative downward spiral that can put pressure on exchange rates. By being on the ground, and having sustained engagement with investors and governments alike, banks like Standard Chartered can make a difference in terms of understanding and factoring key sovereign credit nuances.

Supporting vaccination projects is relatively simple and can have a real impact. Extending credit where it’s needed most and doing it in a way that allows additional monies to be crowded in creates a multiplier effect. For example, we provided USD 200 million of not-for-profit funding towards the African Export-Import Bank’s (Afreximbank) structured framework to help finance COVID-19 vaccines for more than 50 countries in Africa.5

In Sri Lanka, we helped to finance banks who then financed the vaccine import program. If booster shots are going to be required, which seems to be the case, the financing envelope needs to continue to grow.

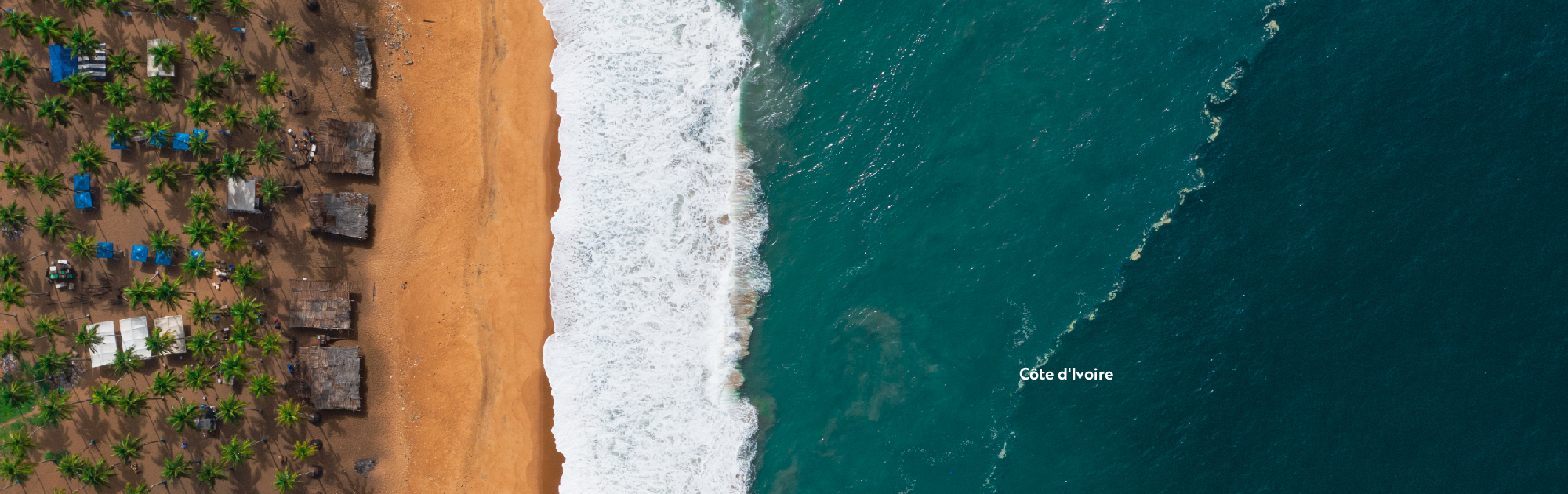

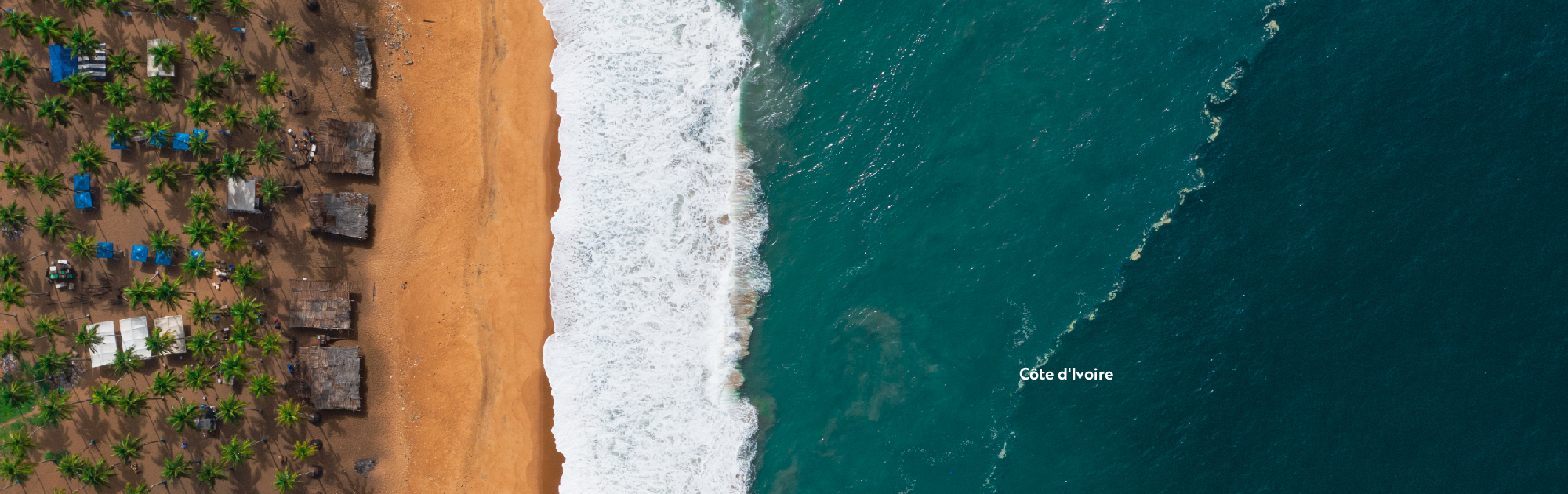

Supporting public sector medical projects in vulnerable communities – as we have done in Côte d’Ivoire – can also have an outsized positive impact. It doesn’t just support governments’ needs. It also helps mobile cross-border trade and financial flows. Standard Chartered plays a critical role in linking up and enabling these flows.

Another great example is social infrastructure investment such as Angola’s Luanda Bita Water Supply Project and Tanzania’s Standard Gauge Railway – both large-scale undertakings that unlocked with USD 1.1 billion and USD 1.46bn of financing respectively. These projects are just providing clean water and more efficient transportation. Both are great examples of how we can help ramp up economic activity in a way that has significant positive spill-over effects including new job creation, increase consumer demand and enhanced productivity to the broader economy.

Capital raising is another interesting area right now. Instruments like zero coupon bonds allow governments to raise capital at more affordable rates. Or contingent instruments where coupons rise as GDP growth rates rise – or potentially decline as growth rates fall – can also support a more even and just recovery.

We’re also seeing positive developments in insurance and hedging programs to mitigate natural disasters. Innovations in blended finance – bringing together private and public investors and different forms of capital – is also critically important. And of course, issuance that’s linked to the Sustainable Development Goals or specific ESG targets are also growing at an incredibly fast pace. Collectively these instruments can play a highly positive role.

Multilaterals have a huge role to play. Alongside their expertise and influence, they can use their superior credit quality reflected in AAA credit ratings t to crowd in private sector capital.

For instance, the USD 1.1bn facility we arranged for the Luanda Bita project in Angola included a World Bank partial credit guarantee. This guarantee enabled us to go out and bring in other private sector lenders. In order for this recovery to truly gain momentum, investment is going to have to pick up again. But investors also need to feel secure.

By working closely with both governments and markets, commercial banks and multilateral institutions like the IMF and the World Bank can both create new opportunities for investors and ensure that fewer people will be left behind by this divergence.

1 https://www.worldbank.org/en/news/feature/2021/06/08/the-global-economy-on-track-for-strong-but-uneven-growth-as-covid-19-still-weighs

2 https://www.imf.org/en/News/Articles/2021/04/14/pr21108-sub-saharan-africa-navigating-a-long-pandemic

3 https://news.un.org/en/story/2021/05/1091732

4 https://www.brookings.edu/blog/africa-in-focus/2021/04/28/figure-of-the-week-covid-19s-impact-on-debt-risks-in-sub-saharan-africa/

5 https://www.afreximbank.com/standard-chartered-commits-usd-200m-facility-with-afreximbank-for-african-union-covid-19-vaccination-acquisition-programme/