The Transition Finance Imperative: A Conversation with Simon Cooper

On 13 May 2021, Standard Chartered launched the Transition Finance Imperative as part of its drive to become The World’s Most Sustainable Bank. In this conversation, Simon Cooper, Chief Executive, Corporate, Commercial & Institutional Banking and Chief Executive, Europe & Americas, answers some of the most pressing questions about this initiative and our sustainability ambitions.

The global transition to net zero carbon emissions is the biggest challenge that we face today. According to our Zeronomics report, 55 per cent of executives told us their companies are not transitioning fast enough to net zero, while 78 per cent of investors said most business leaders are failing to take the action needed. With more than half of the CAPEX required to finance the net zero transition expected before 2030, we must act now.

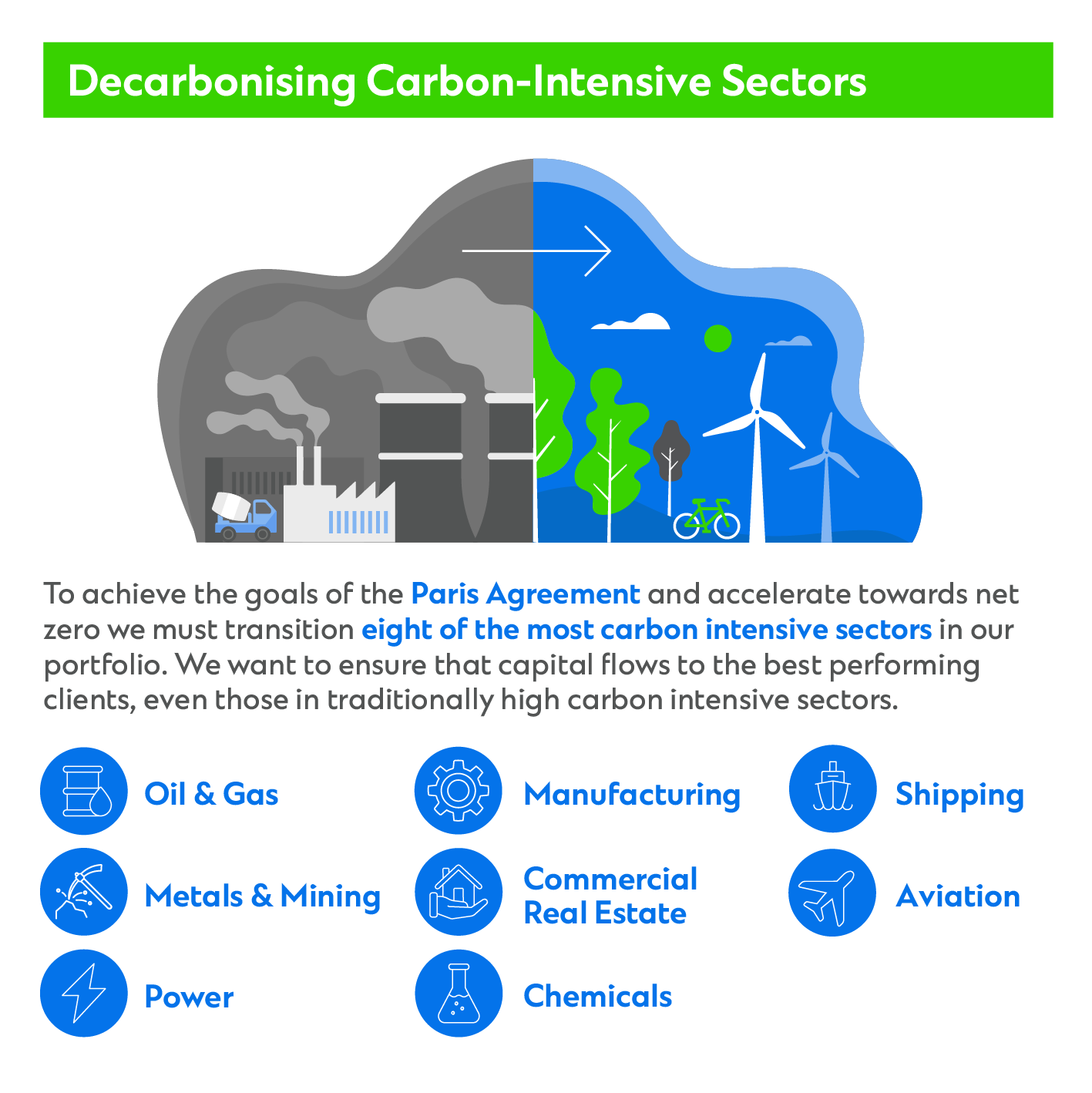

The Transition Finance Imperative is our commitment to facilitating the net zero transition. Our objectives are to reduce our financed emissions and help clients transition, with extra focus on eight of the most carbon-intensive sectors in our portfolio, in the regions of the world that need this most. We want to ensure capital flows to clients who are the best performers in the climate transition, even those in carbon-intensive sectors.

The net zero transition is most challenging in emerging markets across Africa, Asia and the Middle East. These are our footprint markets. Around 95 per cent of the cities most affected by climate change are in Africa and Asia.1 In turn, these markets have suffered nearly twice as much climate-change-related economic damage as developed markets.2 Without sturdy plans backed by ample investment, achieving net zero in these markets will not be possible.

Facilitating the investment required will be challenging. According to Zeronomics, 78 per cent of senior executives and 71 per cent of investors expect the most significant net zero transition capital shortfall to occur in carbon-intensive sectors in emerging markets. That means the countries and sectors that require the most financing to adopt low-carbon business models are often the least likely to get it. Changing that is central to our Transition Finance Initiative.

In part, the lack of funding in emerging markets is due to concerns around policy uncertainty, political insecurity and currency fluctuations. In fact, 84 per cent of investors state that the high level of investment risk posed by emerging markets is a barrier, according to Zeronomics.

Commercial viability is another challenge. More than three-quarters of companies around the world struggle to justify sacrificing reliable revenue from a proven business model today for uncertain revenue tomorrow, according to Zeronomics. That challenge is greatest for emerging-market-headquartered companies, where 64 per cent of executives tip a lack of internal net zero transition support as a hurdle.

The world needs corporate leaders to be climate leaders. Our presence in the markets that face the biggest capital shortfall for the net zero transition gives us a unique opportunity to ensure that economic development continues at pace while climate impact is reduced. This is our chance to catalyse, standardise and democratise access to sustainable finance where it is needed most.

We quantified part of that in Opportunity 2030: The Standard Chartered SDG Investment Map. Our report found an almost USD10 trillion private-sector investment opportunity across 15 high-growth markets in Africa and Asia aligned to three of the most tangible, infrastructure-focused Sustainable Development Goals. Many of those investment opportunities have strong links to the net zero transition. We are committed to realizing them.

In 2020, we committed USD75 billion in financing through 2024 to support our clients as they transition to a low-carbon economy. For clients who are in the early stages of their net zero journeys, we provide guidance on what they must do to prepare for a low-carbon future. And for those who have not yet started that journey, we help to identify the most relevant transition levers. When it comes to clients in our highest-emitting sectors, we made it a condition of our financing that they must have a transition plan by the end of 2022.

We are working on our transition strategy in close collaboration with the Boston Consulting Group, and we also recently joined 39 other banks in the Net Zero Banking Alliance to help the world transition to net zero emissions by 2050, and just last week we also announced the launch of Climate Impact X (CIX), a carbon credit exchange, in collaboration with DBS Bank, Temasek and the Singapore Stock Exchange.

We hope that these types of collective action will bring about real change.

The net zero transition cannot happen overnight. It will be a long process. We don’t have all of the answers, but we balance the urgency in our actions with a focus on making sure that we work with our clients to make this a just transition.

One of the biggest challenges is where we operate. Eighty per cent of our business is in emerging markets where energy from fossil fuels plays a critical role in supporting living standards. Yet, they must transition. Three of our net zero transition pillars focus exclusively on making that happen. By providing these markets with the capital, connections and business support required, we can help them achieve the goals outlined in the Paris Agreement.

Our commitment to facilitating the transition in emissions-intensive industries is equally important. Every company is at a different point in their transition journey, but we should all be heading for the same outcome. We will continue to support those who acknowledge the need to transition and make progress at the appropriate pace. Last year, we ceased providing financial services to four clients who did not transition away from purely thermal coal revenue.

When I joined Standard Chartered in 2016, one of the things that struck me was the line ‘Here for Good.’ The more time that I spent with the bank and interacting with people across our markets, the clearer it became that that rallying cry is the reason why people work for us. Our employees see the value that we bring to the markets in which we operate and the benefits that we can deliver to their communities.

At Standard Chartered, we are constantly looking at what we stand for and finding better ways to work towards that. One of the things that is very important to us right now is helping our clients in their journey to net zero. As parents, consumers and members of society, we all have something at stake. Thus, we are all committed to making the net zero transition successful.

While the world has woken up to net zero being an imperative, sometimes we find that businesses are uncertain about where to begin and what to do. That’s where we come in. We can provide the support and advice that clients need to accelerate their net zero journey.

Our effort to make that happen is built on five pillars:

We are innovating the way we help finance our clients. Aside from bond issuances like the first Blue Bond with the Republic of Seychelles, the first Women’s Livelihood Bond with impact Exchange, the first transition sukuk with Etihad Airways, we have also financed infrastructure deals like our USD1.46 billion project financing of a Tanzanian railway, and we have created the first Sustainability Deposit. Funds raised from the Sustainable Deposits have then been used to finance SDG aligned activities such as the upgrading of a wastewater treatment plant in Bahrain, set up of a solar plant in Bangladesh and the build of a wind power plant in Rajasthan.

Standard Chartered is here to support our clients and to enable them as they transition to net zero. However, that is not without conditions. For clients in our highest-emitting sectors, we have made it a condition of our financing that they must have a credible transition plan by the end of 2022. We are confident that those who do not yet have a plan, will because people are starting to realise that the need to decarbonise is a reality. Some companies simply need a roadmap. We’re here to help.

Produced by Bloomberg Media Studios in partnership with Standard Chartered.

With topics around urban transformation, energy transition, the future of transport and critical infrastructure across Asia, Africa and the Middle East, this content series will unearth fresh trends and showcase how we are supporting clients in the transition towards a more sustainable and inclusive future.