AI supply chains: Keeping pace with the infrastructure boom

As AI infrastructure accelerates, supply chain players must rethink financing, resilience and cross-border strategies to stay competitive.

The global AI race is accelerating—and for the technology sector, it’s no longer just a question of capability, but one of capacity, capital, and control. AI is fast becoming the engine of digital economies, and the real battleground lies not only in algorithms, but in supply chains, infrastructure, and finance.

With reports suggesting USD2T projected AI-infrastructure spend by 2028 (versus USD50B in 2023) and with hyperscale campuses targeting multi-GW footprints, the implications for tech supply chain participants – across the AI value chain – are clear: this is a once-in-a-generation infrastructure play that demands bold investment, cross-border collaboration, and financial foresight.

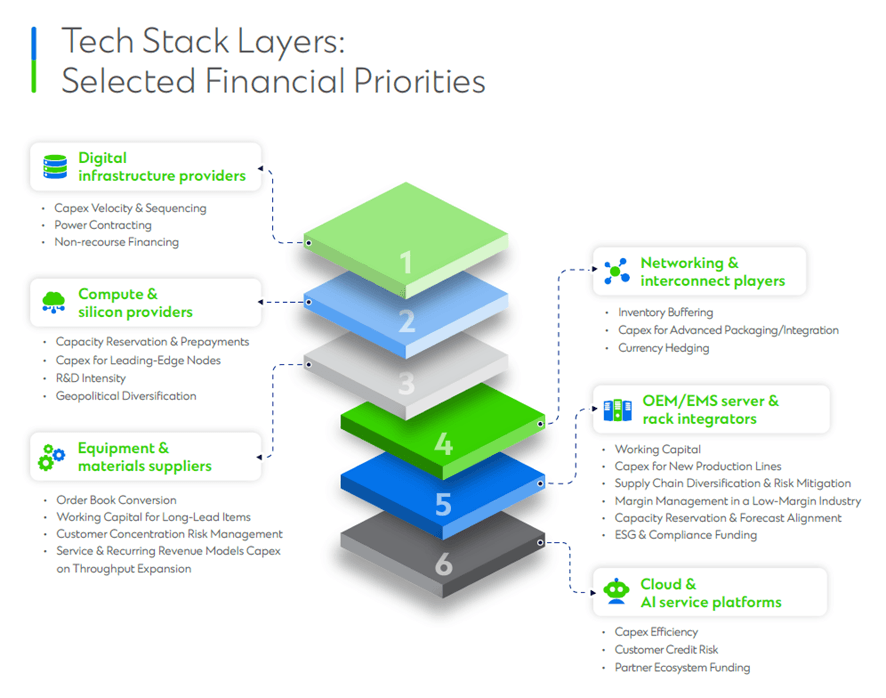

AI is reshaping the tech value chain

AI is fundamentally altering how Tech companies design, deliver, and scale services. Each of the components of the AI infrastructure value chain are critical for navigating growth and risk:

Capital is pouring into AI — but it’s geographically uneven

While the AI economy is global, investment patterns are shifting fast:

- US and Europe remain leading AI R&D, semiconductor design and equipment, and capital markets powerhouses. However, there are growing activities in other regions as well.

- China AI investment is growing, fuelled by state strategy, including a USD47.5B government semiconductor fund, and private-sector execution. Government and Private VC funds are investing at scale in AI-related firms across China.

- India is gaining momentum becoming a key services and data engineering hub, with a massive user base.

- Japan continues to lead in the semiconductor equipment and tools market, and Taiwan continues to drive global semiconductor production and hardware manufacturing.

- South Korea holds critical IP and semiconductor strength, particularly in memory chips, and the country’s AI market is expected to grow.

- Companies are diversifying chip and server production hubs to mitigate trade risks. The changing tariff landscape is moving supply chains to India, Vietnam, Malaysia, etc.

- UAE, Saudi Arabia, Singapore, India and Indonesia are driving infrastructure build-outs with national investment plans and putting in place local data privacy and sovereignty regulations.

- Data center energy consumption is set to double globally from 536 TWh in 2025 to 1,063 TWh by 2030 (source: Deloitte). Not only is there abundant energy for data centers in markets like China, several other markets are issuing sustainability guidelines for green data centers, managing energy, and land use.

Tech leaders must manage this complexity—balancing innovation ecosystems, geopolitical risk, and supply chain resilience

Cross-border financing and risk management now matters more than ever

For tech players, capital allocation will define winners and laggards. AI scale-ups are infrastructure-intensive, front-loaded, and margin-sensitive. Whether building out data centers, securing semiconductor supply, or acquiring AI startups, financial agility is crucial to scale operations.

Our cross-border expertise brings tech supply chain participants unique insights and a strategic competitive edge. As a major international bank with deep history in Asia, Africa and the Middle East, we help corporates navigate emerging markets with complex local regulations. We are the largest and oldest international bank in many of the markets where we operate, and we have longstanding relationships with local governments, regulators, sovereign funds, conglomerates, and tech giants. Our unparalleled access to private and public markets in these regions coupled with a granular understanding of the technology ecosystem and AI infrastructure value chain from semiconductors to digital infrastructure makes us exceptionally positioned to support growing investments in this space via:

- Structured trade and supply chain finance to improve working capital and balance sheet management across the infrastructure value chain scaling production and moving supply chains.

- Project, real estate and infrastructure financing to developers and operators for data center builds and renewable power sourcing, including ESG-linked financing structures.

- Foreign currency and commodity hedging solutions for risk management.

- Treasury and liquidity management solutions to enhance investment yields and reduce transaction costs.

- Cross-border strategic advisory and local market connections to navigate regulation, IP and capital controls.

In the AI boom, code is just one part of the equation. A key edge lies in how well tech companies build and fund the infrastructure behind it.

At Standard Chartered, we understand the AI infrastructure value chain end-to-end. We combine deep sector expertise, on-the-ground strength in local markets, risk management and cross-border solutions so that you can scale with confidence. If you are navigating the complexities of AI growth and global expansion, let’s start a conversation. AI winners will be those who see the full chessboard—and act decisively across product, platform, and portfolio. We are here to help you power it.

Was this article helpful?

We’d love to hear your thoughts. By voting below you’ll be taken to a quick anonymous survey to give us your opinion.

Explore more insights

The multi-currency imperative: RMB strategy for financial in…

A guide to RMB’s increasing internationalisation and the significant opportunities it presents for banks, centra…