Powering up: How EVs are driving the China-Europe corridor

Chinese EV companies are moving manufacturing to Europe and forming joint ventures.

Key takeaways

- Flows of trade between China and Europe are being strengthened by investment from electric vehicle (EV) manufacturers

- Chinese firms are investing in local manufacturing and R&D facilities to develop new supply chains that are deeply integrated into the EU’s automotive industry

- EU policies on sustainability and carbon reduction are shaping investment strategies and positioning Europe as a strategic EV hub.

European consumers’ appetite for affordable electric vehicles (EVs) is transforming trade flows and deepening the critical China-Europe trade corridor, even as the geopolitical landscape becomes more complex.

Bilateral trade in goods between China and the European Union (EU) was worth more than USD800 billion in 2024, centred on machinery, vehicles, goods and chemicals. China is the EU’s largest source of imports and third-largest export partner.

The trading relationship has shown resilience, with a 2.9 per cent year-on-year increase in bilateral trade during January–May this year. Crucially, the corridor has grown in importance in the long term. Between 2014 and 2024, EU imports from China grew by over 102 per cent and exports grew by almost 47 per cent.

Despite the introduction of EU tariffs on Chinese EV manufacturers in 2024, the sector is increasingly important to the China-Europe corridor, aided in recent years by a flourishing EV ecosystem across Europe spanning vehicles, the battery supply chain, component manufacturing and research and development (R&D) hubs.

EVs at the fore

Drivers across Europe are switching to EVs in ever-greater numbers, supporting investment and attracting the attention of Chinese manufacturers. Battery electric car sales rose more than 20 per cent across the EU and more than 30 per cent in the UK in the first half of 2025, compared to the same period last year.

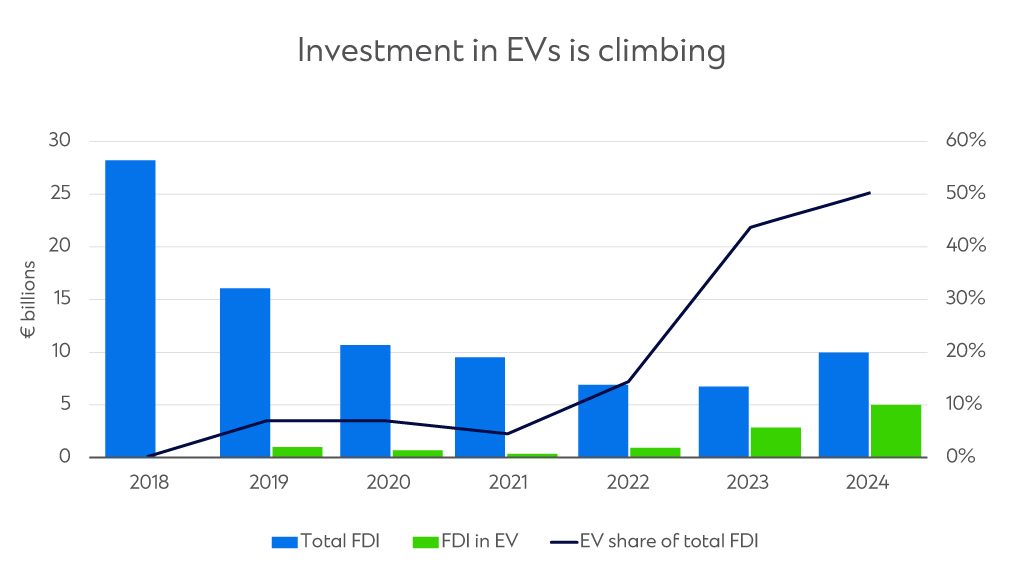

This demand has encouraged Chinese firms to increase greenfield investment in the EV sector across the EU and UK, committing close to EUR5 billion in 2024, a jump of more than 50 per cent compared to 2022.

Companies including BYD, Nio, XPeng, MG (SAIC) and Great Wall Motor have expanded rapidly, launching models tailored to European consumers, opening showrooms and investing in research, development and sales infrastructure.

BYD sold three times more EVs in the EU in August 2025 compared to the same month in 2024, while market share of Chinese EVs in the EU hit more than 5 per cent for the first half of 2025, double compared to the same period of 2024.

Source: Breugel

Chinese firms have also built significant partnerships with local businesses and European automotive companies even in the face of tariffs and fierce competition. Differentiation through affordability, battery innovation, advanced technology and local integration has been central to this strategy.

And it’s not limited to vehicles. Chinese companies are investing heavily across the battery supply chain, component manufacturing and R&D hubs throughout Europe, establishing localised manufacturing plants in Hungary, Spain and Türkiye.

BYD is growing its European EV supply chain in Hungary, investing around EUR4 billion, including in supplier partnerships. A new plant on the border of Hungary and Slovakia, which opened in 2017, initially sourced around 20 per cent of its components from European suppliers, but over time that proportion has risen to between 30 per cent and 50 per cent.

Hungary has positioned itself as an EV investment hub and, in 2024, accounted for 31 per cent of all Chinese investment in Europe, from firms such as BYD, CATL and EVE Power.

Other joint ventures, such as the collaboration between Chinese battery manufacturer CATL and automaker Stellantis in Zaragoza, Spain, facilitates production in European countries, embedding Chinese firms within the automotive landscape and strengthening cross-corridor ties.

China-Europe corridor growth will drive rapid replication in the EV supply chain, merging Chinese industrial capability and European market potential. Jerry ZhangGlobal Co-Head, Financial Institutions Coverage

Jerry ZhangGlobal Co-Head, Financial Institutions Coverage

Policy, tariffs and market dynamics

Tariffs and broader EU–China tensions, including concerns over market access and industrial competition, are shaping the competitive landscape.

Chinese firms have faced tariffs in the EU on top of standard car duty but discussion is now ongoing over a minimum pricing agreement. In October, China and the EU began talks over Chinese export controls over rare earth minerals, following increasing tensions due to supply chain and manufacturing concerns.

Yet, despite these headwinds, rising sales, increasing supplier partnerships and expanding production capacity reflect the way policy and market dynamics have shaped the EV ecosystem, turning the EU into a key hub for Chinese investment and innovation.

As Chinese players refine the way they approach EV manufacturing, Europe’s role could become more significant in the future, supported by carbon taxation.

The EU’s introduction of carbon taxes and green carbon certificates aims to incentivise decarbonisation, encouraging manufacturers to establish local production to reduce exposure to import tariffs and carbon levies.

As a result, the outlook for Chinese EV manufacturers in the EU remains positive, supported by strong consumer demand and an ambition among Chinese firms to integrate even more deeply into the continent’s automotive industry in the future.

The role of finance

Our unique footprint across the China–Europe corridor positions us as a solid partner for Chinese companies expanding in the EU and the UK.

This capability is already delivering results. We recently completed a structured sustainable trade financing facility for Lynk & Co International the high-end EV brand, which is a joint venture between Geely Auto Group and Volvo Car Group. In addition, we led a EUR350 million sustainable trade finance facility for Polestar, another EV manufacturer backed by Volvo and Geely.

As the China-Europe corridor continues to mature, we are likely to see this playbook replicated at an increasing pace across the EV supply chain, where Chinese industrial capability and European market potential will create the next wave of opportunity.

Explore Corporate & Investment Banking

What we offer

We act as a global superconnector for flows from corporates and financial institutions.

Tailored solutions

Learn how we can support your business to grow across markets with our wide range if tailored products.

Our strategy

We serve a diversified client base with a broad product suite and differentiated cross-border capabilities.