Flexible receivables purchasing to boost liquidity

With an increasingly global footprint, UAE-headquartered Ducab has improved its liquidity position through a flexible receivables purchasing solution.

With an increasingly global footprint, UAE-headquartered Ducab was looking to improve its liquidity position. However, it struggled to find an appropriate receivables purchase option, given the unique diversity of its buyer base.

By applying a flexible solution using multiple risk mitigants, Ducab can now monetise all its receivables – setting the stage for its next era of growth.

Results

- By not having to take on external debt to fund its receivables, leverage has remained stable.

- Ducab can now turn receivables into cash almost instantly after invoices are raised, boosting liquidity and its working capital position.

- Risk management is maintained at the forefront and optimised for all buyers. With the stronger risk coverage enhancing Ducab’s confidence, buyer relationships have strengthened.

- Removing the constraint of slow-moving receivables and strengthening buyer relationships have both enabled sales growth.

Background

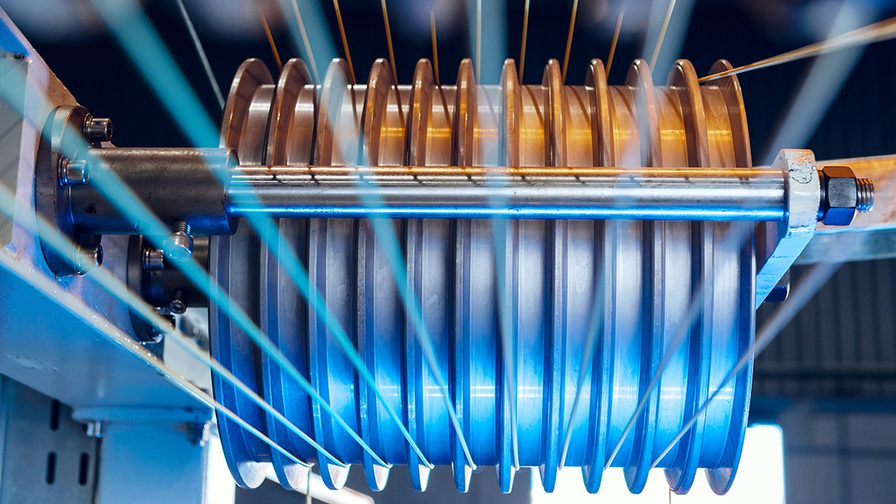

Founded in 1979, Dubai Cable Company (Ducab) is one of the largest cable manufacturers in the Middle East. From its regional beginnings, Ducab now has a footprint of 45 countries across the Middle East, Africa, Asia, Australasia, Europe, and the Americas.

Ducab operates six high-tech manufacturing facilities, producing copper and aluminium wire and cable products, with an increasing focus on renewable energy. Its buyer base is diverse, covering sectors such as construction, oil and gas, renewables, defence, mining, autos, and more.

Challenges and objectives

With such a wide buyer base in terms of both sectors and geography, Ducab was struggling to convert its receivables into cash. Given the scale of its global supply chain, this was a wasted opportunity to unlock liquidity.

Ducab wanted to implement a solution that quickly converts receivables into cash while maintaining steadfast credit-risk management. However, Ducab found the standard receivables solutions available to be too limiting. Such solutions typically only use one risk-mitigating approach, meaning they lack the flexibility Ducab needed to cover such a mixed portfolio of buyers.

In addition to solution flexibility, Ducab wanted to ensure buyer relationships were unaffected by changes in collections processes. Plus, the liquidity-boosting solution had to balance the need for financial prudence with a structure that enables ongoing business growth.

Solution

With its unique buyer base in mind, Standard Chartered structured a limited recourse receivables purchase solution for Ducab. In an innovative setup, the solution is structured around buyers’ payment behaviours, rather than applying one rigid structure for all.

The key enabler supporting this flexible approach is Standard Chartered’s use of a variety of risk-mitigating tools, tailored to the needs of each buyer. The main approaches used are as follows.

For government/public-sector buyers, Standard Chartered uses its existing relationships and/

established credit limits with such groups across Ducab’s key regions to underwrite the risk.

In instances where the Bank doesn’t have existing relationships, it instead leverages:

- Risk-coverage instruments such as standby letters of credit (SBLCs) issued by other banks.

- Its own credit insurance to mitigate credit risk, particularly for buyers with weaker financials (largely in Asia).

For buyers deemed sensitive by Ducab, the Bank takes a balanced approach, whereby Ducab

continues to manage such collections directly.

With these various approaches in place, Ducab can monetise its receivables from all types of buyers, adapted to specific payment cycles.

Moreover, the solution continues to evolve, with Standard Chartered now established as Ducab’s key receivables partner for its future growth plans.

“Ducab appreciates the service offerings from Standard Chartered Bank mainly in enhancing the technology standards; both organisations benefit from this partnership and user experiences are enriching throughout multiple business dimensions. The teams at Standard Chartered are dedicated and manage to deliver innovative financing solutions despite challenges and complexity in business transactions, The ability to drive solutions and meeting our business requirements is commendable. The bank has offered dynamic solutions in multiple areas which improves our group liquidity, fosters partnerships with suppliers and assists in maintaining healthier balance sheet.”

Aliasgar Rangwala, Group Treasurer, Ducab

This solution has been awarded Best Trade/Supply Chain Finance Solution (Highly Commended) in the 2025 TMI Awards for Innovation & Excellence.

Explore more insights

Orchestration takes centre stage: Six forces shaping Treasur…

Explore the six forces shaping transaction banking's transition from digital adoption to digital orchestration.