The buyback boom: Capital allocation under pressure

Explore the balance between buybacks and organic investment, and why dynamic capital allocation frameworks are key to sustaining long-term value creation.

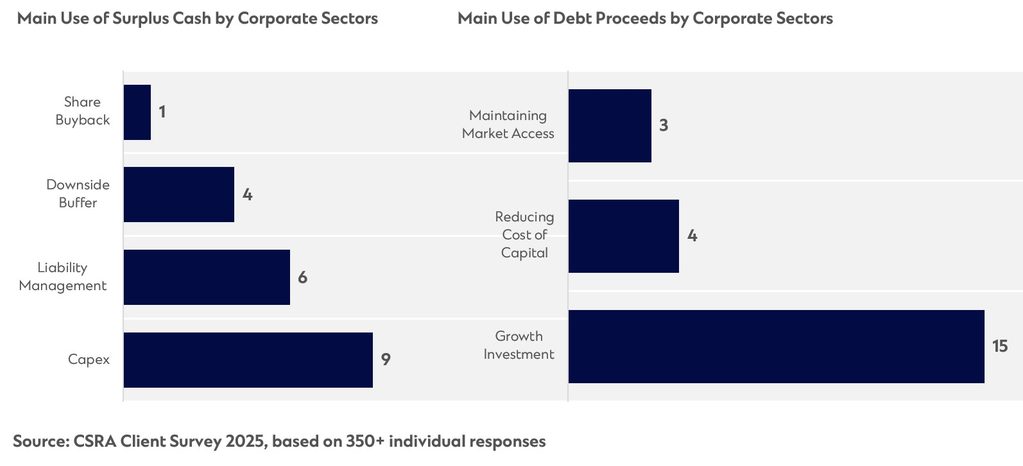

Capital allocation is once again at the centre of corporate and financial institution strategy, but the dynamics are shifting. Across sectors, but particularly in technology, banking and oil and gas, management teams face a growing challenge. Share buybacks deliver instant and visible value to shareholders, while organic investment often takes years to translate into returns. Yet earlier this year, our survey showed that most Chief Financial Officers (CFOs) would prefer to direct more capital towards growth and capital expenditure rather than buybacks.

This tension carries important consequences. Buybacks remain attractive in a high-cost capital environment. They provide flexibility compared with dividends, can be scaled depending on cash flow visibility, and are often more tax-efficient for investors. Energy and technology corporates, among others, have leaned heavily on this strategy in recent years.

However, sustained reliance on buybacks risks undermining structural resilience. Such projects often underpin the long-term equity story and drive strategic differentiation. Yet in the face of weak investor appetite for long-cycle projects, particularly in sectors with limited demand visibility or heightened policy risk, the value from reinvestment is harder to demonstrate upfront.

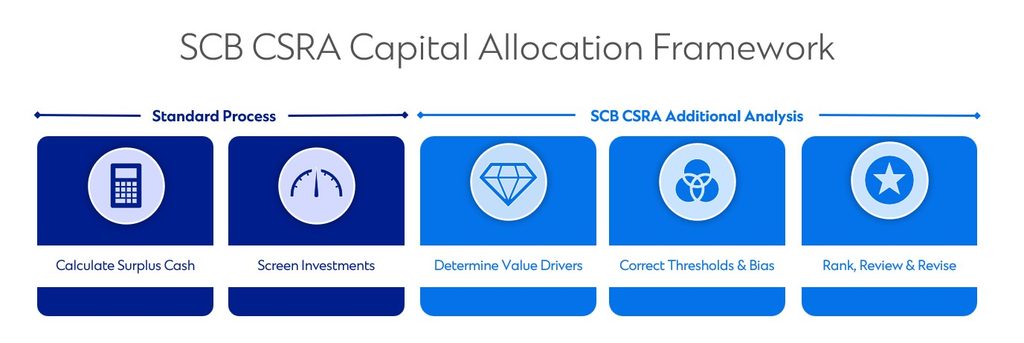

The implication is clear: CFOs and boards need more dynamic capital allocation frameworks. The most resilient corporates and banks treat buybacks and organic investments as complementary levers, returning cash when equity is undervalued while preserving optionality for reinvestment in projects that deliver structural advantage. Striking this balance will define which corporates sustain value creation in the decade ahead.

Traditional capital allocation approaches should be complemented with forward-looking analysis, linking decisions to value drivers, adjusting for management biases, and aligning return thresholds with long-term value. CFOs also need to apply this framework dynamically. As buyback-driven share price increases push up equity valuations, the economics of buybacks can quickly erode.

The Capital Structure & Rating Advisory team works with corporates and financial institutions to design capital allocation frameworks that are both dynamic and sector-specific. If you would like a deeper, company-level analysis of your capital allocation priorities, please contact us.

Explore new insights

bp transforms its regional cash management

Successful treasury transformation achieved enhanced treasury performance and yield optimisation.