-

Support Centre

Terms and Conditions

A. NOTICE TO USERS

The use of:

- this web site; or

- any services which Standard Chartered Bank, for itself and on behalf of each of its Affiliates (“SCB”, the “Bank” or “We”, which includes our successors and assigns) may offer from time to time via any electronic means (including, without limitation, (a) any Straight2Bank services or (b) any other services accessible via our web site or any mobile banking services) (together, the “Online Services”),

is subject to the terms and conditions stipulated in the agreements entered into between SCB and you or, if you are an individual using the Online Services on behalf of, or as agent for, a company, that company.

You are advised to always check with your company administrators, information security department, and/or any other relevant department, on all security matters in relation to the use of the Online Services including the agreements that govern the terms of the Online Services.

If you are an individual using the Online Services on behalf of, or as agent for, a company, you confirm and warrant that you have obtained all appropriate authorisations required and are permitted to access the service on behalf of, or as agent for, the company.

Before using, please read the following (in each case, as may be updated from time to time on our website or any other Online Service and together, the “Terms, Conditions and Policies”):

- the following Legal Notices:

- the terms and conditions set out below;

- Regulatory Compliance Statement; and

- Privacy Policy;

- Service Guides;

- Security Centre Articles; and

- System Requirements.

In this agreement, “you,” “your” and other similar terms refer to you, the individual (i) accessing this website and/or (ii) using an Online Service.

B. BINDING AGREEMENT

This is a legally binding agreement between (1) you and (2) the Bank establishing the Terms, Conditions and Policies under which this web site and the Online Services may be used by you.

For the purposes of these Terms, Conditions and Policies, “Affiliate” means, in relation to a body corporate, any other body corporate that controls, is controlled by or under common control with it. For the purpose of this definition, a body corporate “controls” another body corporate if the first body corporate, directly or indirectly, owns more than half of the issued equity share capital or has the power to appoint more than half of the members of the governing body, of that other body corporate.

By (a) logging in to any Online Services or (b) using or continuing to use the Online Services or this website, you confirm that you have read, understand and agree to each of the Terms, Conditions and Policies. If you do not accept the Terms, Conditions and Policies, do not access this web site and do not use the Online Services.

If you are accessing other SCB offices or other SCB group web sites outside the United Kingdom from this web site, you should read the appropriate terms and conditions, if applicable, for that site.

C. BANK DETAILS

Standard Chartered Bank is incorporated in England and Wales with limited liability by Royal Charter 1853, under reference ZC18 and the Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD, United Kingdom.

SCB is authorised by the Prudential Regulation Authority and regulated in the United Kingdom by the Financial Conduct Authority and the Prudential Regulation Authority. SCB’s VAT No. in the United Kingdom is GB244106593.

D. JURISDICTION

These Terms, Conditions and Policies are governed by English Law and any dispute shall be subject to the non-exclusive jurisdiction of the English Courts. SCB makes no representation that the material contained herein is appropriate or available for use in other jurisdictions.

E. USE AND DISCLOSURE OF PERSONAL INFORMATION

Unless restricted by applicable law, you agree that any and all personal information/data relating to you collected by SCB through the Online Services or from this web site from time to time may be used and disclosed for such purposes and to such persons as may be in accordance with SCB’s current Privacy Policy.

A copy of SCB’s current Privacy Policy may be accessed by clicking here.

F. TERMS AND CONDITIONS FOR THE USE OF THE STANDARD CHARTERED BIOMETRIC LOGIN SERVICE

The following terms and conditions in this Section F (“Biometric Terms”) apply to and regulate your use of the Standard Chartered biometric login service provided by the Bank.

By (a) undergoing the registration process to use the Standard Chartered biometric login service, or (b) using the Standard Chartered biometric login service, you accept and agree to these Biometric Terms. If you do not accept these Biometric Terms, please stop accessing or using the Standard Chartered biometric login service.

The Standard Chartered biometric login service is a service where you may use your fingerprint or face identification registered on a permitted mobile device in lieu of your Standard Chartered online/mobile banking username and password as a security code to confirm your identity to access the Bank’s Online Services.

The Standard Chartered biometric login service is provided as part of the Bank’s Online Services, and accordingly:

- these Biometric Terms are in addition to and shall be read in conjunction with the Bank’s Standard Terms and any other documents forming part of our banking agreement (and any reference to the terms and conditions of the Standard Terms shall include reference to these Biometric Terms);

- the meaning of key words printed like this and other words used in our banking agreement is explained in our Standard Terms. Some additional key words which apply to the services referred to in these Biometric Terms are explained at the end of these Terms; and

- in the event of any conflict or inconsistency, these Biometric Terms shall prevail over the Standard Terms and to the extent of such conflict or inconsistency.

You acknowledge and agree that in order to use the Standard Chartered biometric login service:

- You must be a valid user of the Online Services;

- You must install our mobile app using a permitted mobile device;

- You will need to activate the fingerprint / face recognition function on your permitted mobile device and register your face identification or at least one of your fingerprints to control access to the permitted mobile device;

- You will be required to undergo a registration process using your Standard Chartered online/mobile banking username and password to choose to use the face / fingerprint identification you store on your permitted mobile device for accessing our mobile banking services; upon the successful registration process, the face / fingerprint identification stored on your permitted mobile device will be a security code;

- You must ensure that only your face / fingerprint identification are stored on your permitted mobile device to access the device and you understand that upon the successful registration of your permitted mobile device, any face / fingerprint identification that is stored on your permitted mobile device can be used to access mobile banking including access to your accounts; and

- You should ensure the security of the security codes as well as the password or code that you can use to register your face / fingerprint identification on the permitted mobile device.

- You may still choose to access the mobile app using your Standard Chartered online/mobile banking username and password.

- Each time the mobile app detects the use of a face / fingerprint identification registered on a permitted mobile device on which you have registered for the Standard Chartered biometric login service to access our mobile banking services or authorise transactions, you are deemed to have accessed the mobile banking services and/or instructed us to perform such transactions as the case may be.

- You acknowledge that the authentication is performed by the mobile app by interfacing with the face / fingerprint identification authentication module on the permitted mobile device and that you agree to the authentication process.

- You can deactivate the Standard Chartered biometric login service at any time using the left navigation menu of the mobile app once you are signed in.

- If you inform us that the security of your face / fingerprint identification or other security code has been compromised, we may require you to change the security code, re-register your face / fingerprint identification or cease the use of the Standard Chartered biometric login service.

- You acknowledge and agree that, for the purposes of the Standard Chartered biometric login service, the mobile app will be accessing the face / fingerprint identification registered in your permitted mobile device, and you hereby consent to the Bank accessing and using such information for the provision of the Standard Chartered biometric login service.

- You understand the need to protect your permitted mobile device and shall be responsible for all use of your permitted mobile device (whether authorised by you or otherwise) to access the Standard Chartered biometric login service.

- In addition to and without subtracting the disclaimers and exclusions of liability in the Standard Terms:

- You understand that the face / fingerprint authentication module of the permitted mobile device is not provided by the Bank, and we make no representation or warranty as to the security of the face / fingerprint authentication function of any permitted mobile device and whether it works in the way that the manufacturer of the device represents.

- We do not represent or warrant that the Standard Chartered biometric login service will be accessible at all times, or function with any electronic equipment, software, infrastructure or other electronic banking services that we may offer from time to time

- Unless a law prohibits us from excluding or limiting our liability, we are not liable for any loss you incur in connection with the use or attempted use of the Standard Chartered biometric login service, or your instructions, or any unauthorised transactions through or in connection with the Standard Chartered biometric login service.

- You shall indemnify us from all loss and damage which we may incur in connection with any improper use of the Standard Chartered biometric login service.

- In these Biometric Terms, permitted mobile device means Apple iPhone 5s or higher / Samsung Galaxy S6 / Samsung Galaxy S6 Edge Plus / Samsung Galaxy Note 5 and such other electronic equipment that we may enable for use with the Standard Chartered biometric login service from time to time and includes the operating system or software that the device operates on. Please contact us for the current list of such electronic equipment.

G. ADDITIONAL TERMS & CONDITIONS FOR THE S2B ASSISTANT

The following terms and conditions in this Section G (“S2B Assistant Terms”) govern your use of the S2B Assistant provided by the Bank. The S2B Assistant comprises certain virtual assistance services and is provided as part of the Bank’s electronic banking services. Accordingly, these S2B Assistant Terms are in addition to and shall be read in conjunction with, where applicable, the other Terms, Conditions and Policies, Standard Terms and all other terms and conditions of particular products and services provided by the Bank to you (“Relevant Terms”).

- Definitions. In these S2B Assistant Terms:

- “Chatbot” refers to the automated virtual assistant available on the Straight2Bank portal, which provides responses upon receipt of queries entered by you.

- “Live Chat” refers to the messaging function on the Straight2Bank portal, through which you send and receive messages from Bank personnel in real time.

- “Loss” means any loss, damage, demand, claim, liability, cost or expense (including any direct, indirect or consequential loss, loss of profit, loss of goodwill or loss of reputation) whether or not it was foreseeable or likely to occur.

- “S2B Assistant” refers to the Chatbot and the Live Chat.

- By accessing or using the services offered by the S2B Assistant, you accept and agree to be bound by these S2B Assistant Terms. We may amend these S2B Assistant Terms from time to time at our sole discretion. By continuing to use the services offered by the S2B Assistant following any new amendment, you will be deemed as accepting the amended S2B Assistant Terms.

- By uploading, submitting, posting or transmitting data material or information (including any pictures, video, voice, graphics, text, files, software where applicable) (“Content”), you agree to grant the Bank a worldwide perpetual irrevocable non-exclusive transferable royalty free and sub-licensable license to use, copy, reproduce, process, adapt, publish, create derivative works, translate, transmit, host and disseminate such Content in any media, technology, or form (as per all applicable laws and regulations). We reserve the right, but not obligation, to remove, pre-screen, review, flag, filter, modify or refuse any of your Content at our sole discretion. Notwithstanding the foregoing, you agree that you are solely responsible for the Content uploaded, submitted, posted or transmitted by you on the S2B Assistant. You hereby represent and warrant that (i) you have all necessary rights in such Content; (ii) the storage, use or transmission of such Content does not violate any law, these S2B Assistant Terms or the rights of any third parties; and (iii) there are no virus, Trojan Horse, worms, logic bomb or other malicious program or code in such Content.

- You acknowledge and agree that the Bank has no responsibility or liability for any Content uploaded, posted or submitted by or sourced from a third party and has no obligation to actively monitor them. The Bank does not verify or make any warranties or representation in relation to any of such Content. You use or rely on such Content at your own risk. You may be required to provide information in order to register for and/or use the S2B Assistant. You represent, warrant and undertake to ensure that any such information provided by you shall be complete, accurate, true and correct.

- The ‘Chatbot’ is an automated service. Response from the ‘Chatbot’ is for general reference only and is not intended to be construed in any way as offering any products or services or providing any advice, professional or otherwise. The ‘Chatbot’ is not a channel for financial transactions or order taking, complaint lodging or direct marketing preference updating, etc. Please refer to other bank channels if you wish to take specific actions in relation to any account.

- When you use the Live Chat, you may share the screen of your electronic equipment with Bank personnel. During this sharing, the content of the screen may be visible to Bank personnel assisting you and may be recorded by the Bank. You should ensure that you not display your sensitive or confidential information (including your personal information), or the sensitive or confidential information of any company on whose behalf you are using the Live Chat, on the screen of your electronic equipment during the screen-sharing process of the Service, except where such information is required for the purposes for which you access the Live Chat.

- You acknowledge and consent to the recording of all your communications and Content via the ‘S2B Assistant, including video and/ or voice recordings and recordings of screen displays shared you. We will also keep records of such communications and Content in line with applicable legal and regulatory obligations and our internal policies. We may use the recorded communications and Content in any dispute and you agree not to challenge their validity, admissibility or enforceability on the basis that they are in electronic form. You agree that the recorded communications and Content remain our property, and may be used for training, quality control and dispute handling purposes (as per all applicable laws and regulations). The Bank may, subject to applicable law, also be entitled to use, reproduce, display, disclose, distribute and store such recorded communications and Content for the purposes of (i) providing the S2B Assistant to you or the company on whose behalf you are using S2B Assistant; (ii) meeting the Bank’s internal audit or compliance requirements including without limitation for audit, compliance, training, operational purposes; and (iii) meeting the Bank’s legal, regulatory, supervisory, judicial or governmental requirements.

- To the fullest extent permitted by applicable law, the S2B Assistant or any Content of it is provided “AS IS” and the Bank disclaims any representations, conditions or warranties, whether express or implied, in relation to the S2B Assistant or any Content of it. Without prejudice to the foregoing, the Bank makes no representations, conditions or warranties as to the accuracy, quality, completeness, timeliness, adequacy, security, reliability, validity, non-infringement of third party intellectual property rights or non-interruption of the S2B Assistant or any Content of it, and that any error or defects in the S2B Assistant or any Content of it will be timely corrected or at all. Content transmitted on the S2B Assistant may not be encrypted.

- If you are not happy with the S2B Assistant or any Content of it, your sole remedy is to stop use of the S2B Assistant.

- You agree and shall be solely responsible for any breach of your obligations under these S2B Assistant Terms or for your actions or omissions, and the Bank has no responsibility to you or any other persons because of your breach, actions or omissions. You also agree to use the S2B Assistant or any Content of it in accordance with these S2B Assistant Terms and not in any way that is unlawful or in breach of any applicable laws or promotes illegal activities, or that contravenes or infringes any rights of the Bank or any other persons.

- You must promptly indemnify the Bank on demand against any Loss arising from or incurred by the Bank in connection with:

- (a) the Bank providing the S2B Assistant for your use;

- (b) you breaching any obligation or representation as set out in these S2B Assistant Terms or the Relevant Terms, except where such Loss is caused by the Bank’s fraud, wilful misconduct or gross negligence.

- All aforementioned information is transmitted to and stored with the Bank and/or authorized third parties, which may include processing overseas. Any Content exchanged between you and the Bank through the S2B Assistant will be collected and used by the Bank in accordance with the Bank’s privacy policy. The Content will be analysed by the Bank and/or authorised third parties and used for the S2B Assistant’s accuracy and quality enhancement and the purpose of providing banking services. You are deemed to have reviewed and agreed to our Privacy Policy when you submit your Content to, or engage in any messages exchange with, the S2B Assistant.

- You are responsible for the security of your electronic equipment, mobile device, security code, and the confidentiality of your Content. You acknowledge that anyone who has access to the electronic equipment, devices, login credentials of you may be able to see all messages and Content that you have exchanged with the Bank via the S2B Assistant and your Content, including conversation history.

- We use technology like cookies to monitor, analyse, promote and improve the chatting experience and service. The S2B Assistant may send push notifications to you. If you do not wish to receive push notifications from the S2B Assistant, you can use your system privacy settings to adjust your preference.

- You agree to the regulatory compliance statement (also available at www.sc.com/en/rcs) (the “RCS”) setting out legal and regulatory requirements that apply to your relationship with the Bank. By your continued use of the S2B Assistant, you agree that all Content may be used and/or disclosed by the Bank in accordance with the RCS.

- You acknowledge that the S2B Assistant or any Content of it may be subject to the export control laws of the United States. You will not export, re-export, divert, transfer or disclose any portion of the S2B Assistant or any Content of it or any related technical information or materials, directly or indirectly, in violation of any applicable export law or regulation.

- No delay or omission by the Bank to exercise or avail itself of any right, power or privilege that it has or may have under these S2B Assistant Terms shall operate as a waiver of any breach or default by you. Any waiver of the Bank to any breach or default by you of these S2B Assistant Terms must be in writing and that it shall not be construed as a waiver of any succeeding breach of the same or any other provisions.

- You shall not engage in any activity or use the S2B Assistant in any manner that could damage, disable, overburden, impair or otherwise interfere with or disrupt the S2B Assistant, or any servers or networks connected to the S2B Assistant or the Bank’s security systems.

H. RESTRICTIONS – PRODUCTS AND SERVICES

Use of this web site or any Online Services and the distribution of this web site’s material or any materials from any Online Services may not be permitted by local laws or regulations in some countries. It is your responsibility to find out what those laws and regulations are and observe them. If in doubt, you should check with your local regulator or authority before requesting further information. This web site and the Online Services do not constitute an offer on the part of SCB to provide such non-permitted web site, Online Services or materials.

This web site and the Online Services are subject to the contractual terms and conditions on which they are offered and may be withdrawn or amended in accordance with those contractual terms and conditions. The full range of services on this website and Online Services may not be available in all locations.

I. DISCLAIMERS

- Transactions outside the UK

Please note transactions with any office of SCB outside the United Kingdom, or with any other SCB Group company outside the United Kingdom, are not protected by the United Kingdom’s regulatory regime for the conduct of investment business.

Transactions with offices of non-Group companies referred to in this site will not normally be so protected unless otherwise indicated. Individuals may obtain on request a quotation in writing about the terms on which a company named in this site is prepared to do business.

The conduct of investment business with any SCB office or with any other SCB Group company outside the United Kingdom is regulated by the appropriate authority and applicable securities legislation for the relevant jurisdiction as specified on the web site and in the terms and conditions for that particular office or company.

It is your responsibility to identify the appropriate regulatory authority for such investment business on a particular SCB Web Site and to ensure that such investment business qualifies for protection in your jurisdiction/country, as such securities legislation will vary from jurisdiction to jurisdiction.

2. Securities-related disclaimers

The information and material on this web site and the Online Services should not be regarded as an offer, solicitation, invitation, advice or recommendation to buy or sell investments, securities or any other instrument or banking product of SCB Group or any other issuer.

We do not offer or sell securities to U.S. persons unless either (a) those securities are registered for sale with the U.S. securities and exchange commission and with all appropriate U.S. state authorities; or (b) the securities or the specific transaction qualify for an exemption under the U.S. federal and state securities laws nor do we offer or sell securities to U.S. persons unless (i) we, our affiliated company and the appropriate personnel are properly registered or licensed to conduct business; or (ii) we, our affiliated company and the appropriate personnel qualify for exemptions under applicable U.S. federal and state laws.

3. No representation or warranty

- SCB makes no representation or warranty of any kind, express, implied or statutory regarding the Online Services or this web site or the materials and information contained or referred to on each page associated with the Online Services or this web site.

- Unless otherwise agreed in any other agreement between You and the Bank:

- The material and information contained on the Online Services and this web site is provided for general information only and should not be used as a basis for making business decisions. Any advice or information received via the Online Services or this web site should not be relied upon without consulting primary or more accurate or more up-to-date sources of information or specific professional advice. You are recommended to obtain such professional advice where appropriate.

- Geographic, political, economic, statistical, financial and exchange rate data is presented in certain cases in approximate or summary or simplified form and may change over time. Reliance has been placed by the editors on certain external statistical data which, though believed to be correct, may not in fact be accurate. SCB accepts no liability for any loss or damage arising directly or indirectly from action taken, or not taken, in reliance on material or information contained in any Online Services or on this web site.

- In particular, no warranty is given that economic reporting information material or data is accurate reliable or up to date.

- Any hyperlinks from any Online Services or this web site exist for information purposes and are for your convenience only and SCB accepts no liability for any loss or damage arising directly or indirectly (including consequential loss) from the accuracy or otherwise of materials or information contained on the pages of such sites or loss arising directly or indirectly from defects with such sites. SCB’s inclusion of hyperlinks does not imply any endorsement of the material on such sites.

4. Limitation of liability

- (a) Subject to paragraph (b) below:

- SCB accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of the Online Services or this web site, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with the Online Services or this web site, its contents or associated services, or due to any unavailability of the Online Services or the web site or any part thereof or any contents or associated services;

- Any software downloaded from the Online Services or this web site is at your own risk and SCB neither assumes nor accepts liability for any loss or damage, (whether direct or indirect), howsoever caused, as a result of any computer viruses, trojan horses, worms, software bombs or similar items or processes arising from your use of the Online Services or this web site;

- Materials or information (including files and documents) transmitted on this web site or as part of the Online Services provided may not be encrypted. You acknowledge and confirm that you are aware of and accept the risks associated with using the web site and the Online Services, including the risks of delay, loss, interception, corruption, misuse or disclosure to an incorrect third party of such materials or information (including files and documents), and that SCB accepts no liability for any loss or damage arising directly or indirectly from such risks; and

- SCB does not guarantee that any e-mails from the web site or any Online Services will be sent to you or received by SCB nor does SCB warrant the privacy and/or security of e-mails during internet transmission.

- (b) SCB remains liable for your direct loss caused by the Bank’s fraud, wilful misconduct or gross negligence. Notwithstanding the foregoing, the Bank excludes any liability for indirect or consequential losses or loss of profit whether or not they were foreseeable or likely to occur.

J. INDEMNITY

You hereby agree to indemnify and to keep SCB fully and effectively indemnified against any action, liability, cost, claim, loss, damage, proceeding or expense (including legal fees, costs and expenses on a full indemnity basis) (“Loss”) suffered or incurred by SCB arising from or which is directly or indirectly related to:

- your access to and/or use of the Online Services or SCB’s Web Site and/or any other person or entity’s use of the Online Services or SCB’s Web Site where such person or entity was able to access the Online Services or SCB’s Web Site using your user id and/or password; or

- any breach or non-observance of any of these terms and conditions by you or by any other person or entity where such person or entity was able to access and/or use the Online Services or this web site by using your user id and login password,

except where such Loss is caused by the Bank’s fraud, wilful misconduct or gross negligence.

K. TERMINATION AND MODIFICATION

Unless otherwise agreed in writing between you and SCB:

- SCB may terminate this Agreement, your access to this web site and use of any Online Services at any time, with or without cause or notice; and

- SCB reserves the right in its discretion to change without prior warning or notice any information or material contained in any Online Services or on this web site and the terms and conditions under which this web site or any Online Services is used.

L. INTELLECTUAL PROPERTY RIGHTS

All contents of this web site and any Online Services including, but not limited to the text, graphics, links and sounds are the copyright of Standard Chartered PLC and may not be copied, downloaded, distributed or published in any way without the prior written consent of SCB.

“Standard Chartered”, “Standard Chartered Bank”, are registered trade marks and service marks of Standard Chartered PLC and no permission or licence is granted to use any such trade marks or service marks without the prior written consent of Standard Chartered PLC. All other marks names and logos used on this web site or any Online Services (unless otherwise stated) are the intellectual property rights held by companies within the Standard Chartered Group.

In relation to any information or materials which you submit to SCB using this web site or any Online Services, you hereby grant to SCB a worldwide royalty-free perpetual licence (with a right to sub-license) of the copyright and intellectual property rights in such information or materials for any purpose it deems including, without limitation, the copying, transmission, distribution and publication thereof, unless restricted by applicable law.

You agree that SCB shall not be under any obligation of confidentiality to you regarding any such information or materials submitted to it using this web site or any Online Services unless agreed otherwise in a separate direct contract between you and SCB or required by law.

You acknowledge that the contents of the foregoing provisions shall not limit any specific provisions set out in the individual terms and conditions of any Online Services or any other products and services offered on or through this web site.

SCB may be contacted via email through any of the “CONTACT US” icons on any SCB web site.

M. SEVERABILITY

If any of these Terms, Conditions and Policies is held to be illegal, invalid or unenforceable in whole or in part, it shall be severed and the remaining Terms, Conditions and Policies will continue to be in full force and effect, and as if they have been varied without the invalid, illegal or unenforceable Terms, Conditions and Policies.

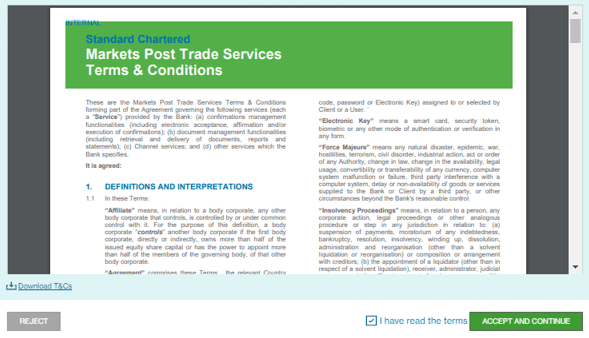

Markets Post Trade Services Terms & Conditions

The Markets Post Trade Services Terms & Conditions document is an agreement that includes the terms, responsibilities, country supplements and guidelines that must be agreed in order for a user to access and use the Markets Post Trade features. Users will be prompted to accept these terms digitally within the Straight2Bank platform.

This document will appear in the below two scenarios:

- When a user logs into Markets Post Trade for the first time.

- When an updated version of the Markets Post Trade Services Terms and Conditions is released.

User must read through the Markets Post Trade Services Terms & Conditions, select the “I have read the terms” checkbox and click on the “ACCEPT AND CONTINUE” button to access the Markets Post Trade modules.

Note:

- Users who have previously accepted the FM Post Trade Services Terms and Conditions digitally or have signed either the Straight2Bank Standard Terms or the FM Post Trade Services Terms in wet-ink already are still required to accept the latest version of the Markets Post Trade Services Terms and Conditions upon logging into the platform.

- Users will be allowed to access Markets Post Trade modules only after accepting the Markets Post Trade Services Terms & Conditions.

- An audit trail of the acceptance or rejection of the Markets Post Trade Services Terms & Conditions by each user will be maintained in our records for future reference.

- Clients located in countries who have regulatory requirements to sign Terms & Conditions in wet-ink will be sent a PDF copy of the Terms & Conditions to sign during onboarding. The digital versions shown above will not appear for these users when they log into Markets Post Trade.

Please click below to download the Markets Post Trade Services Terms & Conditions according to your country:

| Country | Signing Method |

|---|---|

| China | Digital Acceptance |

| Germany | Digital Acceptance |

| India | Digital Acceptance |

| Indonesia | Wet-Ink Sign |

| Taiwan | Wet-Ink Sign |

| Vietnam | Wet-Ink Sign |

| All other countries | Digital Acceptance |

网银助理服务条款

以下条款和条件将规范您使用银行提供的网银助理。网银助理包含特定的虚拟助手服务,构成银行电子银行服务的一部分。相应地,本网银助理服务条款应附加于并与银行向您提供的其它服务条款,条件和政策、标准条款,以及所有其它银行向你方提供的特定的产品和服务的条件条款 (以下称为“相关条款”),在可适用的前提下,一并阅读。

- 定义。在本网银助理服务条款中

- “聊天机器人”是指网银门户上可用的自动虚拟助手,它会在收到您输入的询问事项后提供回复。

- “实时聊天”是指网银门户上的即时通信功能,通过该功能您可以与银行人员实时发送和接收消息。

- “损失”指任何损失、损害、主张、索赔、责任、成本、或费用(包括任何直接、间接或后果性损失、利润损失、商誉损失或声誉损失),无论其是否可预见或可能发生。

- “网银助理”包括聊天机器人和实时聊天功能。

- 通过访问或使用网银助理,您接受并同意受本网银助理服务条款的约束。本行可自行 决定不 时对本网银助理服务条款进行修改。你在任何新修订后继续使用网银助理,即 视为您接受修订后的网银助理服务条款

- 通过上传、提交、发布或传输数据材料或信息(在可适用的情况下包括任何图片、视频、语音、图形、文本、文件、软件等内容)(“内容”),您同意授予本行一项全球范围的、永久性的、不可撤销的、非排他的、可转让的、免版税的、而且可转许可的授权许可,允许本行以任何媒体、技术或形式(根据所有适用的法律和法规)使用、复印、复制、处理、改编、发布、创作衍生作品、翻译、传输、主持、和传播此类内容。我行保留权利自行决定但无义务移除、预审、审查、标记、过滤、修改、或拒绝您提交的任何内容。尽管有上述规定,您同意您对通过网银助理上传、提交、发布或传输的内容负全部责任。您在此声明并保证:(i)您拥有该内容的所有必要权利;(ii)该内容的存储、使用或传输不违反任何法律、本网银助理服务条款、或任何第三方的权利;以及(iii)该内容中不存在病毒、木马、蠕虫、逻辑炸弹或其他恶意程序或代码。

- 您确认并同意,对于任何由第三方上传、发布、提交或源自第三方的内容,银行不承担任何责任或义务,也没有义务主动监控这些内容。银行不对这些内容进行验证,也不作任何相关的保证或陈述。您自行承担使用或依赖这些内容的风险。您可能需要提供相关信息以注册和/或使用网银助理。您陈述,保证并承诺将确保您提供的任何此类信息应是完整、准确、真实和正确的。

- “聊天机器人”是一款自动化服务。来自“聊天机器人”的回复仅供一般性参考,不应以任何方式被解释为提供任何产品或服务或提供任何建议(无论专业与否)。该“聊天机器人”不用于金融交易、订单接受、投诉提交或直销偏好更新等。如您希望对任何账户进行具体操作,请参考本行其他渠道。

- 在您使用实时聊天功能时,您可能需要与银行人员共享电子设备的屏幕。在此共享过程中,屏幕内容可能对协助您的银行人员可见,并会被银行录屏。您应确保在服务的屏幕共享过程中,不要在电子设备的屏幕上显示您的敏感或机密信息(包括您的个人信息),或您使用实时聊天功能时所代表的任何公司的敏感或机密信息,除非此类信息是您访问实时聊天功能所必需的。

- 您确认并同意网银助理可记录您所有的沟通信息和内容,包括视频和/或语音记录以及您共享的屏幕显示的录屏。我行将根据适用的法律和监管义务以及我行内部政策保留这些沟通和内容的记录。我行可能在任何争议中使用所记录的沟通和内容,您同意不会以它们是电子形式为理由,对它们的有效性、可采性或可执行性提出质疑。您同意所记录的沟通和内容仍属我行所有,并可用于培训、质量控制和争议处理之目的(根据所有适用的法律法规)。从属于适用法律的要求,银行还有权出于以下目的使用、复制、展示、披露、分发和存储这些记录的沟通和内容:(i)向您或该服务中您代表的公司提供网银助理;(ii)满足银行的内部审计或合规要求,包括但不限于审计、合规、培训和运营目的;以及(iii)满足银行的法律、监管、监督、司法或政府要求。

- 在适用法律允许的最大范围内,网银助理及其任何内容均按“现状”提供,银行对网银助理及其任何内容不作任何明示或暗示的陈述、条件或保证。在不影响前述内容的前提下,银行不对网银助理及其任何内容的准确性、质量、完整性、及时性、充分性、安全性、可靠性、有效性、不侵犯第三方知识产权或其不中断性、或其任何错误或缺陷将被及时修正与否,作出任何陈述、条件或保证。通过网银助理传输的内容不可加密。

- 如果您对网银助理或其任何内容不满意,您唯一的补救措施是停用该服务。

- 您同意并应独自承担因违反本网银助理服务条款项下的任何义务,或因您的行为或不作为而产生的全部责任,因您的违约、行为或不作为,银行对您或任何其他人员不承担任何责任。您还同意应按照本网银助理服务条款的规定使用网银助理或其任何内容,也不得以任何非法或违反任何适用法律、促进非法活动、或违反或侵犯银行或任何第三方的任何权利的方式使用网银助理或其任何内容。

- 你必须在银行要求时立即对银行因以下情况而产生的或与之相关的任何损失进行赔偿:

- (a)银行提供网银助理供您使用;

- (b)您违反了本网银助理服务条款或相关条款中的任何义务或声明,除非该等损失是由银行的欺诈、故意不当行为或重大过失所致。

- 前述所有信息将传输并存储在银行和/或授权的第三方处,可能包括在海外进行处理。您与银行之间通过网银助理交互的任何内容,银行将按照其隐私政策进行收集和使用。该内容将由银行和/或授权的第三方进行分析,并用于提升网银助理的准确性与服务质量,以及提供银行服务的目的。在您将内容提交网银助理或与之进行任何信息交互之时,即视为您已阅读并同意我们的隐私政策(在新窗口中打开)。

- 您有责任确保您的电子设备、移动终端、安全码以及您的内容的保密性。您确认,任何可以访问您的电子设备、设备或登录凭据的人员,都可查看您通过网银助理与银行交互的所有消息和内容,包括聊天记录。

- 我们使用类似 Cookie 的技术来监控、分析、推广和改进聊天体验及服务。网银助理可能会向您发送推送通知。如果您不希望接收来自网银助理的推送通知,可以通过系统隐私设置调整您的偏好。

- 您同意遵守监管合规声明(也可通过 www.sc.com/en/rcs 查阅)(“RCS”),该声明列出了适用于您与本行关系的法律和监管要求。通过继续使用网银助理,您同意本行可根据RCS的规定使用和/或披露所有内容。

- 您承认网银助理或任何内容可能受美国出口管制法律的约束。您不得直接或间接违反任何适用的出口法律或法规,将网银助理或其任何内容或任何相关技术信息或材料进行出口、再出口、转移、转让或披露。

- 银行未及时或未行使或使用其在本网银助理服务条款项下所享有的任何权利、权力或特权,不应构成对您违反本条款行为或过错行为的弃权。银行对您违反本网银助理服务条款的行为或过错的弃权,必须以书面形式作出,并且不应解释为对后续相同情况或其它条款的违约的弃权

- 您不得从事任何可能对于网银助理、与网银助理连接的任何服务器或银行的安全系统照成损害、失灵、超载、毁坏、或任何其它干扰或者破坏的活动,或以前述方式使用网银助理。