-

Market profile

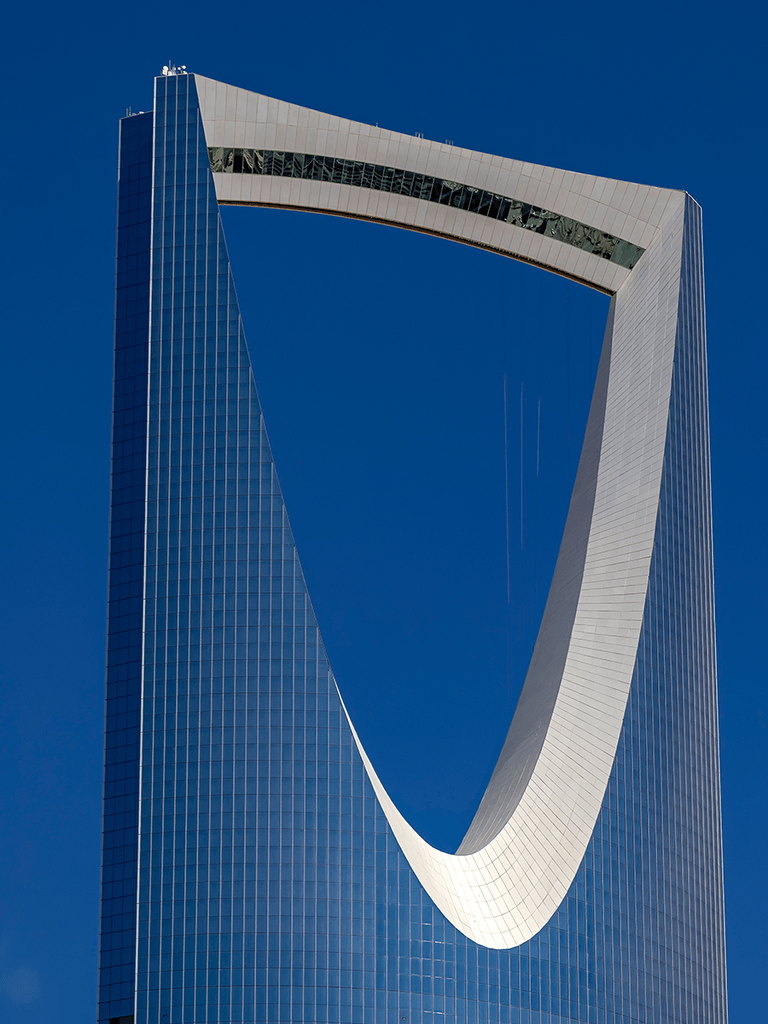

Saudi Arabia

Explore strategic opportunities and how we can support cross-border investment at scale.

Deep local expertise, global reach

Corridor expertise that drives growth

Proven leadership across China – Middle East, India – Saudi Arabia, and Africa – Gulf corridors.

A unique network

We have the broadest branch network of any international bank in the Middle East.

A superconnector bank

Cross-border business capabilities across Africa, Asia, the UK, the US and the Middle East.

A comprehensive regional footprint

Our Saudi Arabia presence is supported by a comprehensive regional footprint.

Solutions for your business

Our product range

We offer both conventional and Islamic Banking.

Domestic and cross-border funding

Regional interest optimisation coupled with true end-of-day liquidity management capabilities.

Comprehensive ecosystem support

We empower large family groups, government-related enterprises, local corporates and financial institutions.

Advanced digital and trade finance

Enhance operations with our digital platforms and structured trade finance solutions.

Sustainability champions

We were early pioneers in green sukuk, ESG-linked loans and carbon finance for emerging markets.

Vision 2030: Unlocking a new era of business opportunities

Saudi Arabia’s blueprint for economic transformation into a global hub for innovation,

renewable energy, and tourism seeks to unlock a new era of business opportunities.

Shipping network enhancements

Leveraging its strategic location at the centre of Asia, Africa and Europe, Saudi Arabia is enhancing its shipping networks to connect these regions and is continuously liberalising international trade of goods and services.

Broadening capital base

In line with Vision 2030’s landmark National Investment Strategy, Saudi Arabia is actively broadening its capital base by attracting foreign investment and deepening market access.

Diversification of funding channels

Policymakers are diversifying funding channels through increased foreign direct investment, greater foreign participation in domestic debt markets, and strategic issuances such as a China Eurobond in Saudi Arabia – marking a milestone in cross-border capital integration. For corporates and investors, this signals a maturing financial landscape with expanding opportunities for engagement and growth.

Progressive policy and regulatory reform

- 100% foreign ownership in most sectors.

- CMA and SAMA enabling capital market growth, fintech, and digital banking.

- Strong sovereign fiscal position supporting long-term economic planning.

Saudi Arabia today combines economic ambition with regulatory stability — making it a magnet for strategic capital.

Sector opportunities

- With flagship initiatives that include the National Strategy for Data & AI and the rapid 5G rollout, the Kingdom is cementing its position as a tech powerhouse.

- Focusing on advancing technology and digital transformation, Tonomus plays a crucial role in implementing cutting-edge technologies such as artificial intelligence, IoT, and smart city solutions, which are essential for the development of NEOM, a model of sustainable living with minimal environmental impact.

- From Tonomus’s cognitive cities to Riyadh’s digital overhaul, demand is rising sharply for fintech, cybersecurity, cloud solutions and e-commerce platforms, presenting vast opportunities for enterprises to drive the next wave of innovation.

- Global investor interest is rising, reflected in growing international participation on the Saudi Stock Exchange (Tadawul).

- Meanwhile, forward-looking fintech regulation is enabling the rapid growth of digital banking, payment innovation and blockchain integration.

- Saudi Arabia is embedding sustainability into its economic transformation, anchored by the Saudi Green Initiative.

- With a target to generate 50 per cent of its energy from renewables by 2030, the Kingdom is shaping a robust clean energy ecosystem.

- We are optimistic about the Kingdom’s non-hydrocarbon growth, propelled by robust domestic consumption and investment momentum.

- This creates compelling opportunities in solar, wind, hydrogen, and energy efficiency.

Saudi Arabia aims to boost tourism’s contribution to GDP to 10 per cent and welcome 100 million visitors annually by 2030, underpinned by world-class giga- projects such as project NEOM, the Red Sea Project, and Qiddiya.

- The launch of Riyadh Air, the Kingdom’s new world-class national carrier, signals a bold leap in connectivity and global access.

- Priority areas include freight forwarding, warehousing, distribution, maritime logistics, customs brokerage, and the development and operation of digital logistics platforms.

- The sector is expected to reach a value of $18 billion by 2030, supported by a strong compound annual growth rate (CAGR) of 12 per cent.

Demand across hospitality, travel and event management is rising sharply, presenting a window for businesses to shape one of the world’s fastest- growing tourism frontiers.

Corridor opportunities

We offer end-to-end treasury and liquidity solutions across more than fifty markets backed by local FX, regulatory and compliance expertise, with on-the-ground corridor bankers to accelerate cross-border growth.

Korea – Saudi Arabia

Economic and technological collaboration including in the energy sector benefits both economies.

China – Saudi Arabia

Deepening trade and investment links in energy, infrastructure, logistics, renewables, and tech.

India – Saudi Arabia Corridor

Presents strategic geopolitical importance, linking South Asia and the Middle East.

Our corridor capabilities

Standard Chartered is uniquely positioned to facilitate inward and outward investments from Saudi Arabia into overseas markets, particularly Asia, South Asia, the AME, and vice versa.

A full suite of solutions

End-to-end treasury and liquidity solutions across more than 50 markets.

Local expertise

Local FX, regulatory and compliance expertise.

Dedicated service

On-the-ground corridor bankers to accelerate cross-border growth.

Get the full report

Discover cross-border growth opportunities

Unlock actionable insights on sectors such as technology, transport and logistics, and cross-border corridors with India, Korea and China in our full market profile.

Related insights

Explore related insights on Saudi Arabia – including expert guides and thought leadership on key market trends.

Corridors in focus

Your guide to the new industries driving China-Middle East trade.

Guide to payment regulations

The latest edition covers 17 dynamic markets including Saudi Arabia.

Liquidity management

Determine the best approach to make the most of your cash.