-

Sustainability

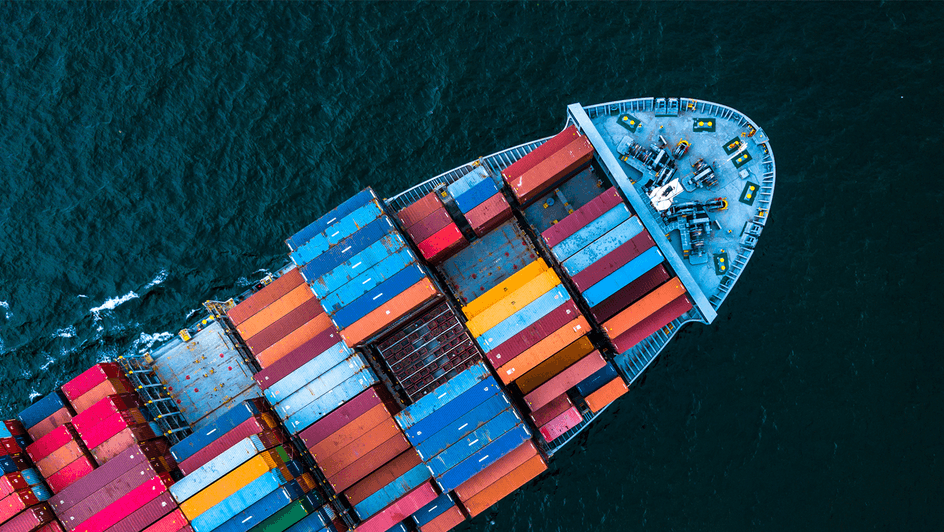

We’re mobilising capital to help deliver sustainable and inclusive growth for the places we call home.

Our market footprint shapes our unique perspective on the opportunities and challenges our clients and communities face as the world shifts to a more sustainable path. This means we are strategically positioned to connect capital to where it’s needed.

28-42%

of global emissions must be cut by 2030¹

$376.6bn

potential estimated damages and lost growth in just ten markets by 2030²

$4tn

annual new investment needed to meet the UN Sustainable Development Goals³

The three pillars of our approach

Responsible business practices

We strive to be a responsible business by operationalising our net zero targets, managing our environmental and social risk, acting transparently, and investing in our people.

Bespoke sustainable finance solutions

We leverage our deep expertise and innovative product suite to offer bespoke sustainable finance solutions designed to help our clients address challenges and achieve sustainable growth.

Innovation in service of our markets

We advocate in service of our markets, applying our innovative mindset to unlock the areas where capital is not flowing at scale or not at all and to drive economic inclusion.

Working on real-world solutions

We don’t have all the answers, but we are on the ground in our markets, developing real-world solutions to help our clients navigate complexity and unlock opportunity. See how we apply our expertise and innovative mindset to meet our clients’ and communities’ evolving needs.

Case study

Let’s talk about energy in Angola

Rural electrification is an important part of Angola’s strategy to diversify its energy mix. New solar infrastructure in Angola will help provide electricity from 100 per cent renewable energy sources to a million people who were previously not connected to the national grid.

Case study

Let’s talk about aluminium in the UAE

Aluminium plays a key role in decarbonisation as an input for everything from solar panels to electric vehicles. As the world’s biggest ‘premium aluminium’ producer, Emirates Global Aluminium extended their sustainability practices by opening a Sustainable Account with us – allowing the company to retain intraday liquidity for business needs while contributing to sustainable development.

Case study

Let’s talk about battery storage capacity in Australia

Demand for renewable energy is rapidly rising across different sectors in Australia. In turn, this is also stepping up demand for renewable energy storage technologies. A new energy storage system will increase battery storage capacity, support the electricity grid, and power up to 80,000 homes for up to an hour during peak times.

Latest sustainability news and insights

We’re taking a stand

The execution of our sustainability strategy helps us deliver against our Stands. These give us a framework for positive action across our footprint.

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We currently provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to net zero in our own operations by 2025 and in our financed emissions by 2050.