-

Ready-made, diversified foundation portfolios

Signature CIO Funds

Built with our Chief Investment Office expertise, designed to help you achieve your wealth goals

Developed in partnership between Standard Chartered and Amundi, the funds are designed to provide investors access to our Chief Investment Office (CIO) strategies via a globally diversified multi-asset fund of funds and ETFs portfolio, which includes global equities, global bonds, commodities, liquid alternatives, and cash.

Designed to stand the test of time

A quick foundation portfolio

Get a diversified foundation portfolio with one investment in a globally diversified multi-asset fund of funds and ETFs portfolio, dynamically rebalanced based on the latest CIO views.

Fund & ETF selection

Our Fund Select team uses a time-tested methodology – strong performance, quality people and repeatable process – to select best in class funds for the portfolios.

Funds to suit different needs

A range of 4 different fund types to choose from based on different risk profiles and investment objectives like regular income generation to long-term capital growth.

Range of funds with mid to long-term horizon

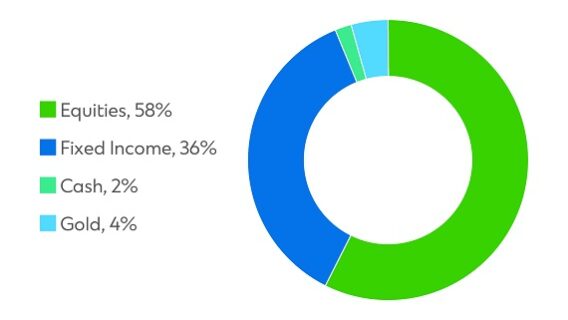

Signature CIO Balanced Fund

- For moderate returns

- Similar allocation into Equities and Fixed Income, with a slight tilt to Equities. Plus, Commodities and Alternatives

- Balanced Equities and Fixed Income allocation to provide upside returns while mitigating drawdowns

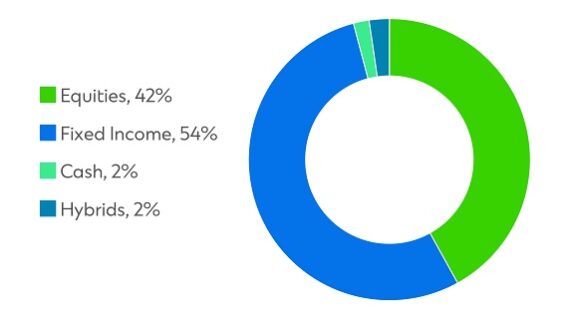

Signature CIO Income Fund

- For income seekers

- Aims to generate regular income by investing in a diversified portfolio with indicative 6% p.a. income generating securities globally

- Portfolio that invests over 50% in Fixed Income instruments

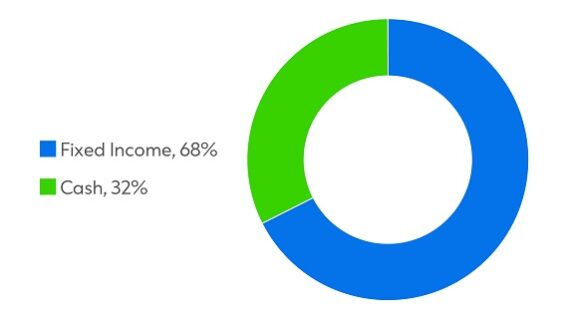

Signature CIO Conservative Fund

- For low volatility

- Grow your investment with a conservative profile

- Aims to generate income over a mid to long-term period

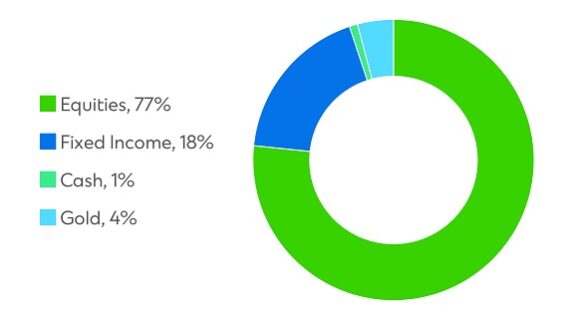

Signature CIO Growth Fund

- For aggressive capital growth

- Equities and Fixed Income allocation, with higher proportion in Equities. It also invests in Commodities and Alternatives

- Higher allocation to Equities which are sensitive to market fluctuations

Why a portfolio approach matters?

Strategic Asset Allocation

We use a 7-year capital market assumptions incorporating expected returns, risk and correlation estimates and overlay it with market capitalisation and volatility considerations to determine the optimal “through-the-cycle” allocations.

Tactical Asset Allocation

Our Tactical Asset Allocation enhances the Strategic Asset Allocation models with tactical over or underweight tilts for each asset class, expressing our 6–12-month views, to capitalise on near term market or economic conditions.

3 D investment philosophy

Diversity – we use third party views from leading banks, research and asset management firms.

Debiasing – questions, insights and analysis are debated to mitigate biases.

Decision-making – is collective and based on anonymous voting.

Our partnership

Standard Chartered – an expert in wealth advice

- Global reach in 59 markets

- A team of 30+ investment professionals with in-depth expertise

- Over 20 years multi-asset portfolio experience

- Tried and tested framework to navigate complex and dynamic markets

Amundi – global top 10 player with USD 2 trillion AUM

- Provides active and passive management, in both traditional and real assets

- Efficient industrial model with one of the lowest cost income ratio (53%)

- USD 410 billion AUM in Asia