Three megatrends will define Real Assets in 2024

Critical infrastructure gaps coupled with the pursuit of net zero and adoption of AI will unlock ample opportunity across Real Assets.

Large capital deployments across renewable energy, data centres, and the monetisation of non-core infrastructure have tremendous implications for Real Assets over the short- and long-term.

Standard Chartered expects all three megatrends to provide compelling investment opportunities in the Real Assets space. Stable, recurring returns makes these assets attractive, especially amid continued uncertainty over interest rates and the lingering possibility of a recession in some of the world’s major economies.

Global sponsors and Real Asset funds are likely to continue to invest into infrastructure and alternatives. Record-high government deficits coupled with a growing need for new and upgraded infrastructure means private capital will play a greater role.

In the long-term, the challenges inherent in closing the real estate and infrastructure gap, decarbonising the global economy, and putting infrastructure in place to support the growth of AI will surface a host of investment opportunities that become staples of well-balanced, future-facing portfolios.

Here’s how.

The continued shift to cloud and rapid adoption of generative AI are fueling demand for computing power and storage capacity, making data centres an alluring opportunity in the Real Assets space.

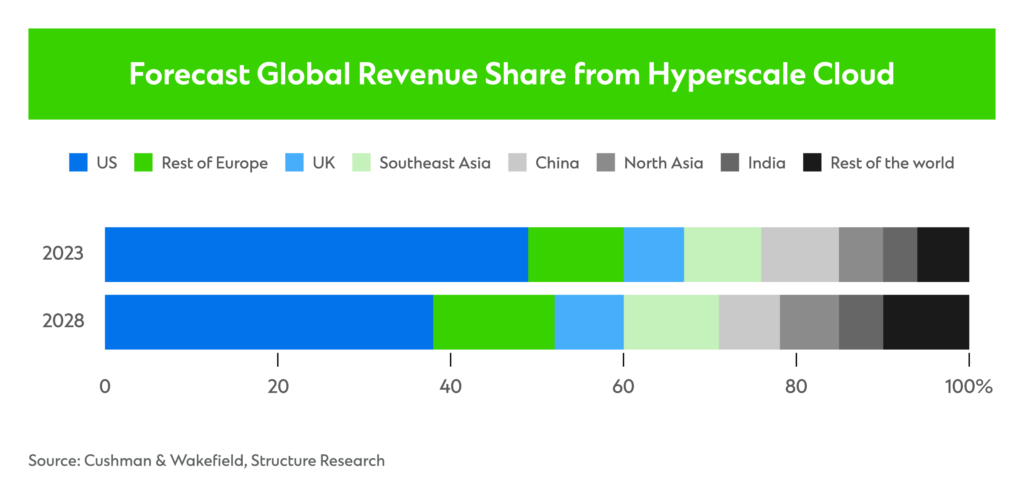

Asia Pacific stands out as a high-growth region. Data centres under construction in the region’s top five locations —Beijing, Shanghai, Singapore, Sydney, and Tokyo— are 32% larger than those currently in operation. And forecasts suggest demand in Southeast Asia and North Asia will expand about 25% a year through 2028.

Initiatives like the Data Centre Facilitation Unit in Hong Kong underscore the growth potential. The unit aims to attract significant investment, enhance infrastructure, and facilitate industry collaboration. And in Thailand, the Board of Investment’s promotion scheme offers a range of tax incentives and other benefits to companies that invest in data centers.

Rapid growth comes with sustainability challenges. Data centres, cryptocurrencies and AI consume nearly 2% of electricity globally for computing and to cool their servers. Their electricity needs could more than double over the next three years.

To decarbonise, hyperscalers must embrace carbon-free power and explore innovations including high-efficiency cooling systems and software that enables time and location shifting for electricity demand. All of that creates investment opportunities at the intersection of clean energy and innovation.

Global Heads of States and Governments have jointly committed to tripling renewable energy capacity globally by 2030 as part of the negotiations at COP28. To be on track, the world must install seven terawatts of renewables over the next seven years.

Proven, cost-effective solutions such as wind and solar will garner the lion’s share of investment, while the use of low-emissions fuels such as hydrogen and biofuels, which provide a low-carbon solution for hard-to-abate sectors, will also continue to increase as the world looks to get on track with the Net Zero Emissions by 2050 scenario.

One area that investors often overlook is the power grid. With the world’s electricity needs set to grow 20% faster in the next decade than they did in the last in order to meet countries’ national energy and climate goals, we need bigger, smarter, more connected power networks. The IEA estimates that a total of over 80 million kilometres of grids will need to be refurbished by 2040 – equivalent to the entirety of the existing global grid. New transmission corridors also need to be deployed at scale to connect remote renewable energy sources, such as offshore wind, that are far from demand centres. Otherwise, its report warns, ‘grids risk becoming the weak link of clean energy transitions’ .

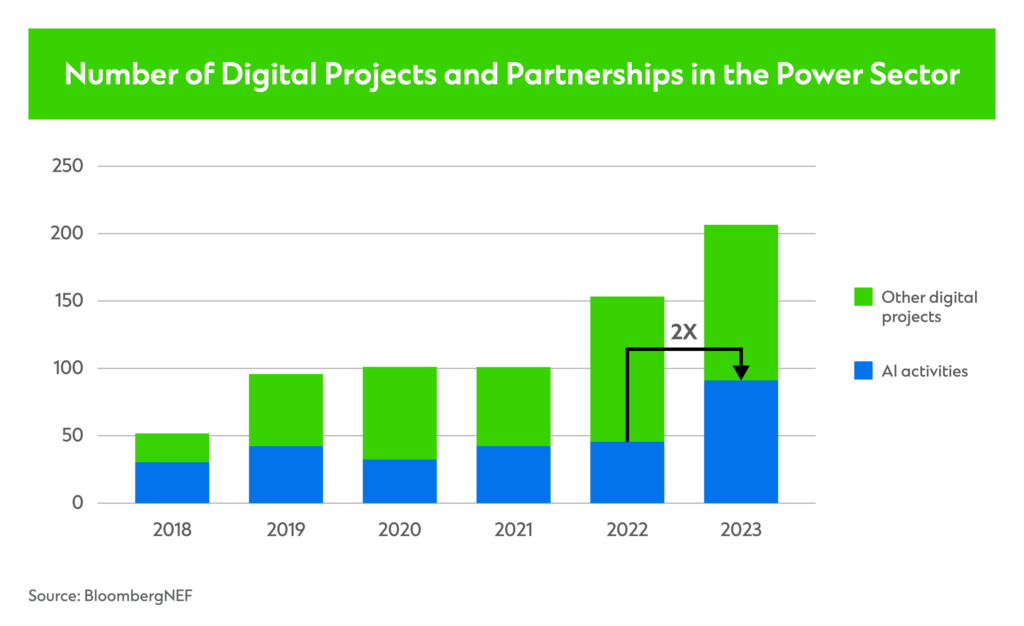

Digitalising the grid will be equally important. Wind turbines, electric vehicles, smart meters, and other technologies have made power system operations more complex. As the grid becomes increasingly interconnected, data processing and analytics will play an important role in the energy transition.

AI can analyse and generate value from these datasets. Data from BloombergNEF show the number of AI projects and partnerships in the power sector doubled between 2022 and 2023. Utilities are applying AI throughout the power value chain, from electricity generation to grids to retail.

Private sector investment will play a vital role in these efforts to modernise power infrastructure, accelerating innovation, and addressing capital constraints, especially in emerging markets where local funding and expertise may not suffice.

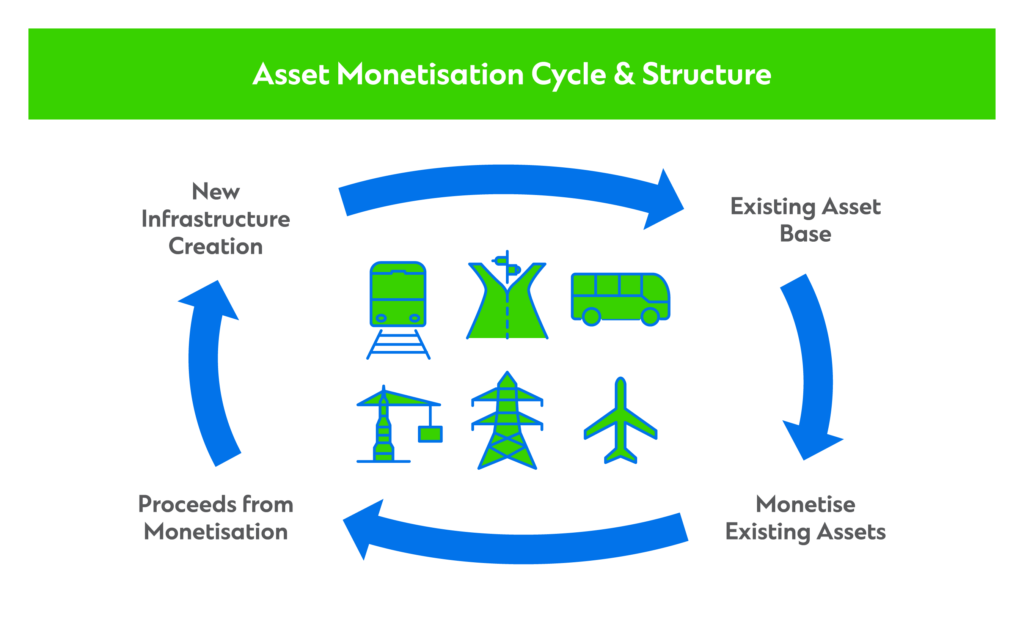

Asset owners will unlock new sources of capital by monetising infrastructure, especially in the Middle East, which has recorded significant activity of late.

Oil and gas companies, for instance, can monetise mid-stream infrastructure assets like pipelines and fuel terminals through carve-outs, with contracts that appeal to passive and yield-based investors. These deals enable the companies to channel newly generated revenue into capital spending for new projects.

In 2022, Saudi Aramco closed a $15.5 billion deal to sell a stake in its natural gas pipelines to a BlackRock-led consortium. The deal is part of Saudi Arabia’s drive to recycle capital. To the same end, Saudi Aramco signed a $12.4 billion deal in 2021 to sell a stake in their oil pipelines to an EIG led consortium.

In 2023, Standard Chartered advised Dubai Airports on the sale of its non-core district cooling utility package to UAE based strategic investor Empower. The deal makes Empower the sole district cooling services provider for one of the world’s busiest international airports in terms of passenger traffic .

Infrastructure monetization is also a priority for other state owned entities e.g. the Indian government plans to monetise around $24.1 billion worth of highways over the next five years. Similarly, the Indian government is also looking to spend $12 billion over the next two years on airports through Public-Private-Partnership (PPP) models wherein bulk of the capital employment will be done by private sector. Transferring revenue rights but not the ownership of infrastructure projects to the private sector, or engaging private sector through a fixed tenor PPP model, allows the government to generate funds for brownfield projects and reduce its debt burden.

Beyond these three megatrends shaping Real Assets this year, Standard Chartered expects that further pockets of opportunity exist in Commercial Real Estate including sectoris such as hospitality and Grade A logistics.

On the logistics front, the rapid growth of e-commerce requires continued investment in warehouses, distribution centres, and other industrial buildings. With the global e-commerce sector on course to more than double by 2030, e-commerce businesses must operate with greater agility. Among other things, that entails industrial warehouses located near urban centres to shorten delivery times.

Elsewhere, hospitality performed well last year compared with office buildings as many people continue to adopt flexible working. In the near future, the resurgence of tourism coupled with an increase in business travel will further catalyse the sector. Sensible deal making in the hospitality sector requires manageable bid-ask spreads, with transaction activity likely to increase. Whilst caution remains around the outlook of the office sector globally, brown to green retrofit strategies are an area of interest, given tenant-led demand for best-in-class ESG assets in prime locations.

— Shikhar Jain is the Global Head of Real Assets Group at Standard Chartered