Elevated expectations: the next step for the Greater Bay Area

The Pearl River Delta (PRD) region has long been China’s manufacturing powerhouse, spearheading its economic and financial opening. It is, however, now undergoing a major upgrade and integration to form the world’s largest city cluster called the Greater Bay Area (GBA) linking Guangdong, Hong Kong and Macau.

With the announcement of the GBA Outline Development Plan in February, aligning one of China’s most robust and dynamic regions with the country’s long-term economic priorities, the GBA is expected to drive China’s economic transformation and reshape how companies operate in the region for decades to come. In our 10th annual survey of PRD manufacturers, we spoke to over 250 manufacturers to find out about their growth expectations, relocation and industrial upgrading plans and opportunities and challenges arising from the GBA.

The dual headwinds of rising US-China trade friction and slowing global growth have impacted clients’ growth expectations for 2019. Almost 80 per cent of respondents see the US-China trade dispute having either some or a substantial impact on their sales and orders in 2019 up from 74 per cent in 2018. It is therefore no surprise that the trade war topped the list of concerns for 2019 followed by Renminbi volatility and China’s slowdown making the top three.

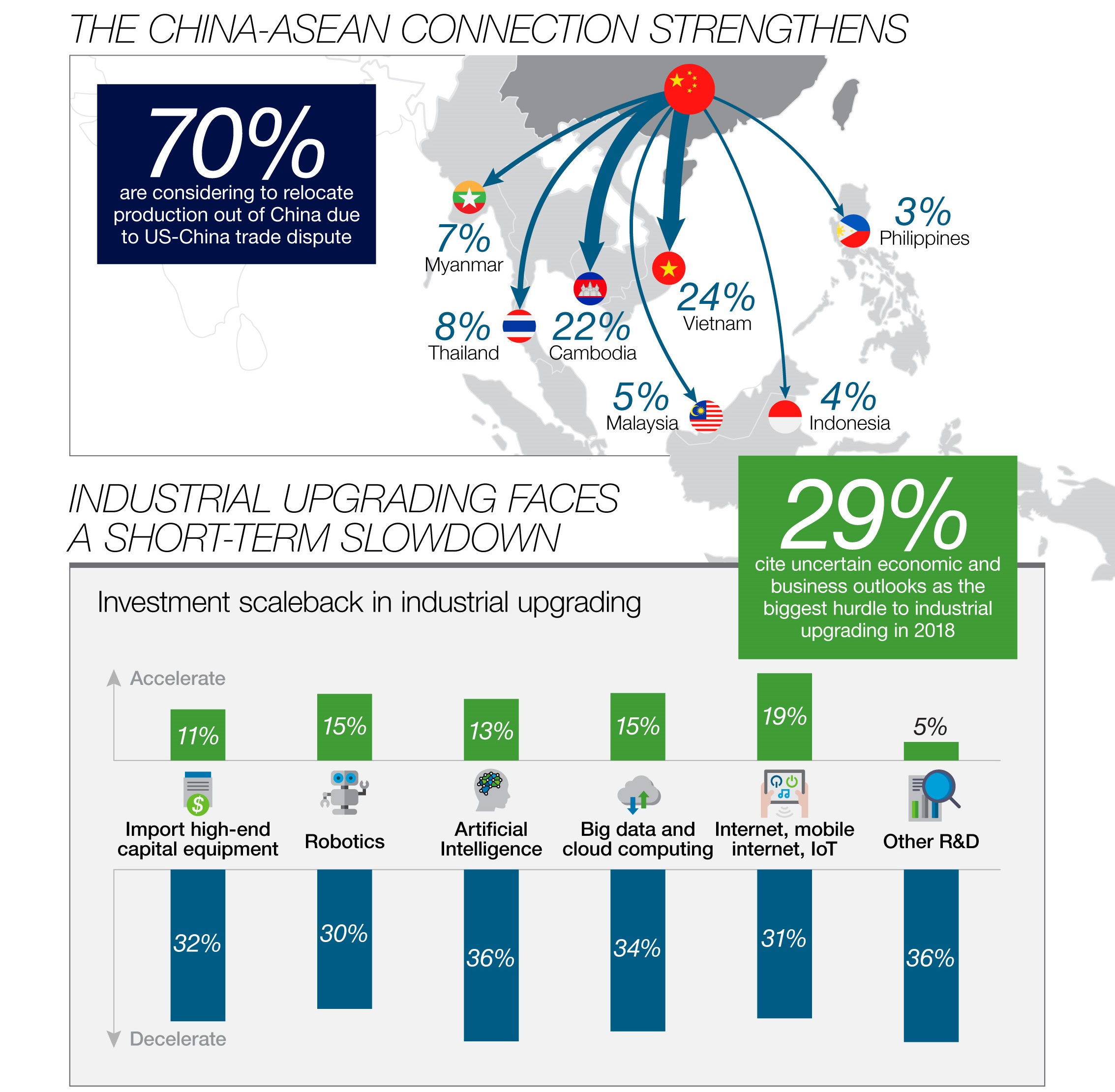

As trade uncertainty looms, moving overseas remains an attractive proposition from a cost-saving perceptive with the added benefit of diversification. Almost two-thirds of respondents are actively considering (or would be willing to consider) moving capacity outside China with about 70 per cent of them saying that the US-China trade dispute has made them more actively consider such a move.

Vietnam and Cambodia are the top destinations for survey respondents looking to move out of China, followed by Bangladesh, Thailand and Myanmar. Labour availability (both quantity and quality) remains the top-cited reason for moving out. This matches our findings that ASEAN economies are likely to be winners (relative to other regions) from lingering US-China trade tensions if production to meet US demand moves from China.

When asked about their industrial upgrading plans in 2019, more respondents see a ‘deceleration’ than ‘acceleration’ across all key forms, including artificial intelligence, robotics, big data and internet-related investment, citing uncertain economic and business outlooks as the biggest hurdles to industrial upgrading (29 per cent of respondents). This is evidence of the long shadow cast by the US-China trade war.

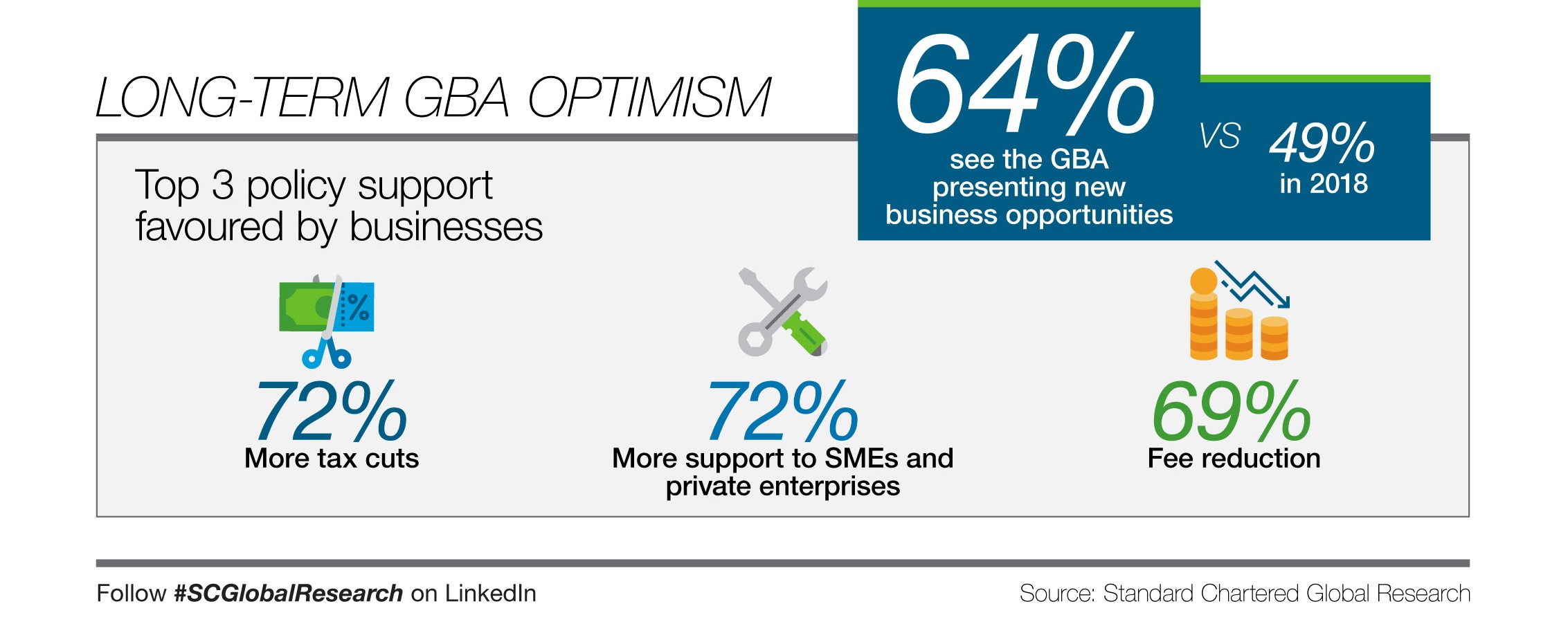

The good news is that despite the headwinds, a strong 64 per cent respondents see the GBA presenting new business opportunities some years down the road. This is up from a mere 49 per cent a year prior, suggesting that all the market talk running up to and following the announcement of the GBA Outline Development Plan has clearly boosted awareness and lifted expectations.

We believe this optimism is based on the GBA’s size and uniqueness, and on GBA-related policies. A decent 63 per cent respondents said that an accelerated launch of GBA policies would have positive impact on their business in 2019. Clients favour more direct and immediate policy reliefs, like ‘more tax cuts’ (72 per cent), ‘more support to SMEs and private enterprises’ (72 per cent) and ‘fee reduction’ (69 per cent), possibly in hopes of geographical- or industry-specific benefits boosting market access.

The Greater Bay Area has a comprehensive plan and strong policy backing but to achieve its full potential, the GBA would require freer flow of capital, goods, people and information, better integration of different legal systems, and functional specialisation via well-defined roles and priorities, among many other things. We believe the need to integrate multiple legal and social systems is a unique challenge and opportunity for the GBA; the key is to uphold the ‘one country, two systems’ principle.