-

Private Banking

International. Interconnected. Inter-generational.

Exploration for entrepreneurs and their future generations

Here to help you grow and protect your wealth. As your wealth needs extend beyond wealth management, our 170-year history and presence in 53 markets connects you to a global network of opportunities to help you make the most of your successes and leave a lasting legacy

International connections

Unlocking new opportunities in dynamic markets

Interconnected bank

Serving your personal and business needs

Inter-generational services

Helping you look after your future generations

Wealth insights

Latest insights from the Chief Investment Office team

Tailored solutions

Supporting your wealth aspirations your way

Spot investment opportunities

See our latest Global Market Outlook

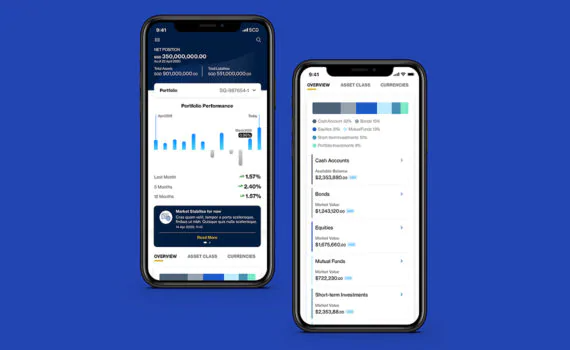

Manage your private banking

Access your account conveniently when it matters

Future-proofing your portfolio

Providing you with opportunities in sustainable investing

Follow us on Facebook

See our daily Wealth insights on social media

We are delighted to be conferred

Latest CIO view across asset classes

Equity

Δ Overweight ∇ Underweight — Neutral

Equity – at a glance —

21 JUNE 2024

- We are Overweight equities over bonds and cash, with US equities our most preferred region. We are positive on US earnings growth, particularly in the growth sectors. We downgrade Japan equities to core holding (Neutral). Improving corporate governance is still a plus but deteriorating earnings revision is likely to limit the upside. We upgrade Europe ex-UK equities to core holding (Neutral) amid an earnings recovery, even though the French snap elections may lead to volatility in the near term.

- We have a core holding (Neutral) view on Asia ex-Japan equities, but we are Overweight Indian equities. Expensive valuations are justified by high return on equity and rapid economic growth. We trim Taiwan equities to core holding (Neutral); tailwinds from the AI themes and strong GDP revision are offset by the expensive valuations and high geopolitical uncertainties. We also downgrade Korea to core holding (Neutral) – we see fading effect from the government’s ‘Value-up’ programme and quietening foreign interests. We are core holding (Neutral) China equities. Challenges of long-term economic growth and the property sector remain the key risks, supported by the piece-meal government policies. We remain Underweight on ASEAN, which is overly defensive in a global environment favouring high-beta stocks. Lastly, we downgrade UK equities to Underweight. Despite cheap valuations, the region is similar to ASEAN – overly defensive.

North America equities – Preferred holding Δ

21 JUNE 2024

The bullish case:

- Strong earnings growth and momentum

- Technology sector propelling performance

- Delayed economic slowdown

The bearish case:

- Overconcentration on Magnificent 7

- Macro uncertainties: e.g., US election

- Expensive valuations. Elevated positioning

Europe ex-UK equities – Less Preferred holding ∇

21 JUNE 2024

The bullish case:

- Improving earnings growth

- Rebound in economic data

- Loosening policies from the ECB

The bearish case:

- Macro uncertainties from elections

- Less compelling in valuations

- Economic rebound unable to sustain

UK equities – Core holding —

21 JUNE 2024

The bullish case:

- High dividend yield

- Cheap valuations

- Relatively defensive sectors

The bearish case:

- Weak earnings growth expected in 2024

- Light in growth sectors

- Lack of upside catalysts

Japan Equities – Preferred holding Δ

21 JUNE 2024

The bullish case:

- Strong corporate balance sheets

- Rising ROE from corporates reform

- Further improvement in earnings outlook

The bearish case:

- Foreign net inflows decelerating

- Rebound in JPY to hurt company earnings

- Forward guidance deteriorating

Asia ex-Japan equities – Core holding —

21 JUNE 2024

The bullish case:

- Higher EPS growth projected in 2024

- Rising demand for semiconductors

- China’s fiscal and monetary stimulus

The bearish case:

- Soft survey data and economic activities

- Lack of confidence from investors

- Intensification of geopolitical tensions

Bonds

Δ Overweight ∇ Underweight — Neutral

Bonds – at a glance —

21 JUNE 2024

- Developed Markets (DM) Investment Grade (IG) government bonds remain a core holding. The risk-reward of US government bonds appears fair, with market rate cut expectations being in line with our own expectations for one 25bps Fed rate cut this year. Absent significant catalysts, we anticipate the US 10-year government bond yields to stay within recent ranges in the near term. Our expectations over 3-month and 12-month are unchanged at 4.25-4.50% and 4.00-4.25%, respectively.

- We are Overweight Emerging Market (EM) USD government bonds. Valuations, in our view, remain attractive given a yield premium that continues to exceed historical averages. Despite heightened geopolitical concerns, the fundamental strength of emerging economies remains bolstered by strong foreign exchange reserve, increasingly healthy fiscal balances and greater access to external debt than in recent years. We are Neutral DM IG and High Yield (HY) corporate bonds. Their narrow yield premiums are expected to be sustained by strong fundamentals and healthy supply-demand dynamics. We are Neutral Asia USD bonds as weak China growth outlook and geopolitical concerns are fairly compensated by the yield premium. We are Underweight EM Local Currency (LCY) government bonds on worries of EM FX volatility.

Developed Market Investment Grade government bonds – Core holding —

21 JUNE 2024

The bullish case:

- Attractive yield

- DM central banks’ pivot

The bearish case:

- ‘Higher for longer’ monetary policy amid a strong economic growth backdrop

- Unfavourable supply-demand balance

Developed Market Investment Grade corporate bonds – Core holding —

21 JUNE 2024

The bullish case:

- High rate sensitivity (long duration) a positive from a peak in interest rates

- Attractive absolute yield on offer

The bearish case:

- Relatively tight yield premium

- Weakening credit fundamentals

Developed Market High Yield corporate bonds – Core holding —

21 JUNE 2024

The bullish case:

- Corporate credit fundamentals are still looking solid

- Attractive yield on offer

The bearish case:

- Rating downgrade risk

- Surge of default risks

Emerging Market USD government bonds – Preferred holding Δ

21 JUNE 2024

The bullish case:

- High rate sensitivity (long duration) a positive from a peak in interest rates

- Commodity prices

The bearish case:

- Commodity price disinflation

- Geopolitical risk amid elections in the US and key EM countries

Emerging Market Local currency government bonds – Less Preferred holding ∇

21 JUNE 2024

The bullish case:

- Supportive EM currency outlook

The bearish case:

- Unfavourable yield differentials with DM

- Rate cut expectation is in the price

Asia USD bonds – Core holding —

21 JUNE 2024

The bullish case:

- Regional growth continues to impress

- Attractive yield

The bearish case:

- Soft China economic growth outlook

- Defaults or bond restructuring risk

Commodities

Δ Overweight ∇ Underweight — Neutral

Commodities – at a glance

21 JUNE 2024

- We upgrade our 12-month gold price forecast to USD 2,450/oz. Gold remains a Core Holding within our portfolio for its portfolio diversification benefits. We expect official sector demand to remain robust as central banks diversify their reserves. The start of the G7 rate cutting cycle, which we expect will broaden out to the Fed, is also supportive of the gold appetite. Both investor positioning and ETF flows are likely to improve as Fed rate cuts emerge. Physical consumption, especially in China and India, would continue to be supported by jewellery and alternate-fiat demand. In the next 3 months, the volatile Fed rate expectations and the slowdown in PBoC buying are likely to shift the market sentiment from being outrightly bullish to more balanced, suggesting that gold prices are likely to trade rangebound at around USD 2,300/oz.

- We revise our 12-month WTI oil forecast lower to USD 75/bbl on higher supply expectations. OPEC+’s surprise move to gradually taper down the third round of cuts (2.2mb/d) after Q3 is likely to ease the supply tightness. Though, we believe the bloc could reverse the decision should market conditions deteriorate, putting a floor to crude oil prices. On the demand side, while the recent data are largely bearish, it is unlikely to collapse outside of a recession – not our base case. In the near term, we maintain the view that the oil markets are likely to be in a deficit with the extension of all three rounds of OPEC+ rate cuts. Coupled with the stretched short positioning, this suggests a higher WTI oil price at around USD 80/bbl in the next 3 months.

Gold —

21 JUNE 2024

The bullish case:

- A normalisation in Fed rates

- Escalation of geopolitical tensions

- Safe-haven bids

- Reserve diversification for central banks

- Strong central bank and physical demand

- USD weakness

The bearish case:

- Rising real yields increase opportunity costs of holding gold

- Geopolitical risk premium tends to be short-lived

- USD strength

- Risk-on sentiment

- Demanding valuations

- ETF outflows

Crude Oil

21 JUNE 2024

The bullish case:

- Resilient global economies

- Supply reduction from geopolitical conflicts

- OPEC+ supply cuts

- Low inventories

- US shale underinvestment

- US SPR refill

The bearish case:

- Tight monetary policies; growth slowdown

- Redirection of Russian oil flows

- Easing of sanctions against Venezuela

- Significant global spare capacity

- OPEC+ supply discipline

- Lower demand from energy transition

Alternatives

Δ Overweight ∇ Underweight — Neutral

Alternatives at a glance —

21 JUNE 2024

The bullish case:

- Diversifier characteristics

The bearish case:

- Equity, corporate bond volatility

Multi-Asset

Δ Overweight ∇ Underweight — Neutral

Multi-Asset – at a glance

21 JUNE 2024

- Our Multi-Asset Income (MAI) model allocation has delivered 4.4% YTD return. The model benefitted from optimism surrounding risk assets, and dividend equities also benefitted from a broadening of the rally in traditional equities. Developed Market High Yield (DM HY) and leveraged loans gained from a strong corporate earnings season, while EM USD government bonds benefitted from a decline in US government bond yields.

- Our MAI model now yields c.5.8%, dipping below the 6% mark for the first time this year. In recent weeks, major central banks, including the Swiss National Bank (SNB) and the European Central Bank (ECB), have initiated their rate cutting cycle, while the Fed has guided for one rate cut this year. We expect the ECB to deliver more rate cuts this year (see the macro section for more details), and the Fed to be more cautious in order not to loosen financial conditions prematurely while economic data remains resilient. We believe yield levels are attractive for income-focused investors to lock in the current high yield on offer.

- Over the next 6-to-12 months, the 2024 US elections will be closely watched by markets. History suggests income assets tend to deliver positive returns during US election years, regardless of whether the Fed is cutting or hiking rates. The only exceptions were REITs and Europe high dividend equities, which delivered negative returns in the 2020 pandemic election year.

We are here for you

Get in touch now or explore our private banking resources