-

Welcome

Your banking partner for ASEAN

Market Perspectives

Stay ahead with the latest news and trends shaping ASEAN, showcasing key developments and opportunities.

Insights and Views

Gain valuable insights through engaging videos and panel discussions, exploring growth strategies.

ASEAN Showcase

Explore reports highlighting ASEAN’s economic potential and the impact of strategic initiatives on markets.

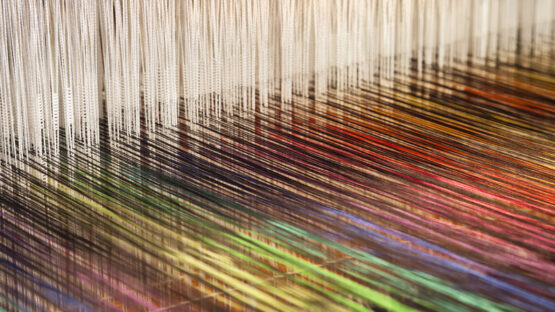

The bank connecting you to all of ASEAN and beyond

With a presence in 52 of the world’s most dynamic markets, we have been supporting clients in ASEAN for over 160 years. With our extensive global network, in-depth local market knowledge and wide-ranging suite of products, we are well-positioned to support your business growth and cross-border financing needs.

ASEAN Network Passporting

As you expand across ASEAN, our global footprint and banking services are ready to assist you every step of way. We can help you navigate through multiple documentation processes, stakeholder approvals and local market requirements across ASEAN, making it easier and more cost effective to implement.

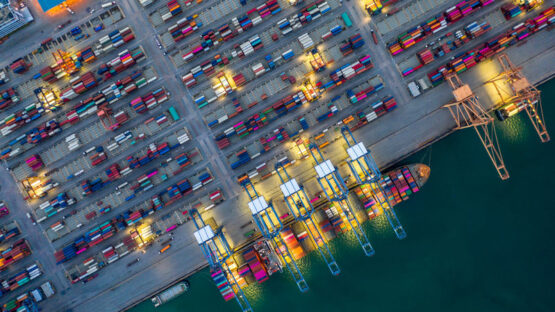

Cash management and trade digitisation

As one of the world’s leading trade banks, optimising digitisation, cash and trade distribution is at the heart of what we do. We offer a comprehensive range of solutions across ASEAN, including a wide range of APIs to support your trade transactions and reporting needs.

Connect your business to the world

Stay connected with the latest insights, ideas and events from the world of Corporate & Investment Banking

Trade financing

Our leading ASEAN Capital Markets platform offers currency agnostic financing options in all major ASEAN countries. As the top foreign bookrunner across all ASEAN Local Currency bonds, we can provide seamless financing from trade to loans and bonds for your entire supply chain across ASEAN.

FM franchise

With our presence in major hubs across Asia and globally, we can support your trade risk management, raise capital or diversify your investments. Our strengths include trading foreign exchange, rates, credit, commodities products and arranging debt issuance by offering bespoke solutions tailored to your needs.

Sustainable finance

Sustainable investment in Asia is poised for rapid growth. As a leading financial institution, we are committed to supporting sustainable economic growth, expanding renewables financing and investing in sustainable infrastructure where it is needed most.

SC Ventures and business innovation

SC Ventures is our platform and catalyst that promotes innovation, invests in disruptive financial technology and explores alternative business models.

As the bank’s innovation, fintech investment and ventures unit, it is focused on developing an innovation culture and mindset, deepening capabilities and experimenting with new business models through an open platform and network of people and partnerships.