Custody 2.0 – Driving success through a data-centric strategy

Client expectations around data are changing with client demands and related ambitions fundamentally higher than seen previously.

Increasingly, we are having conversations with clients about ways to provide them with greater transparency through a comprehensive data conversation, on a near real time basis to drive business value and deliver positive outcomes for their own clients.

Meeting client requirements successfully relies on the backbone of a strong data strategy that allows data to be easily discoverable and subject to robust data governance to ensure integrity. Our data strategy is intertwined with that of our clients to enable our joint success.

This information can help them make material improvements to their businesses, either by maximising returns, identifying operational synergies, solving complex internal and external challenges, better managing risk, or even training up artificial intelligence (AI) software.

So what exactly are clients asking for, and why?

Following the recent volatility (e.g. COVID-19, the war in Ukraine, the regional banking crisis in the US and Switzerland etc.), clients want us to supply them with more near-real-time and real-time data covering areas like market intelligence, risk exposures and cash forecasts.

Access to such information makes it easier for clients to review performance, monitor their operations and respond quickly to fast moving market events.

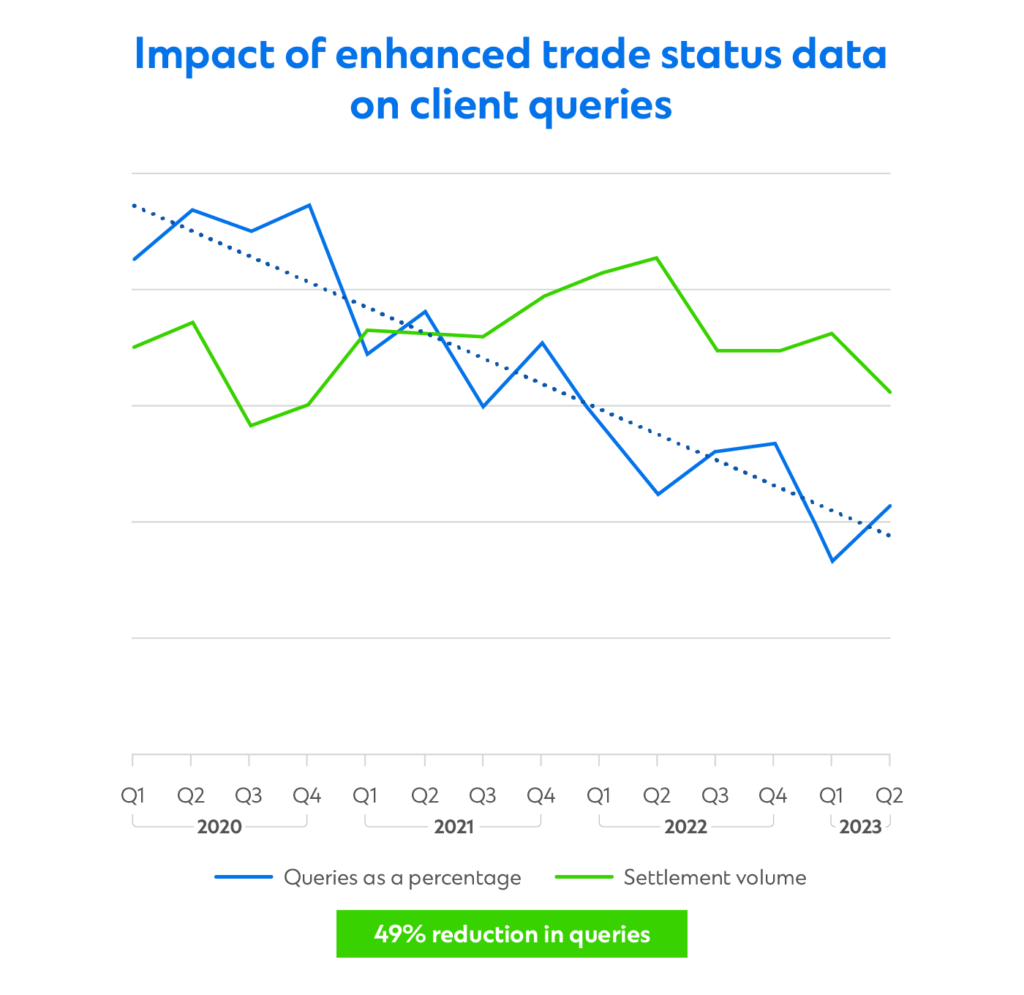

Trade status continues to be an area where clients are demanding additional information. In recent months we have supported two clients on separate initiatives to increase transparency, decrease client queries and improve settlement rates. Whilst both clients had similar ambitions, they had very different approaches with one client requesting enhanced operational led narratives and the other client requesting additional data points across the trade lifecycle. The two initiatives were equally successful, and we were able to pilot each in a single market before effortlessly scaling across all of their markets, utilising our single instance platform strategy.

In Q3 2023, we also launched our latest Application Programming Interface (API) to check the proof of underlyings in restricted currency markets. This two-way API has brought automation from a previously spreadsheet-based exchange of information, improving FX execution timelines from hours to minutes.

As market and operational risks intensify, corporate action processing has also become more important with clients reviewing opportunities to reduce risk and improve the client experience. Clients are focused on improving the corporate action data sets with an enhanced data exchange to improve the controls and reduce the risk of incorrect or non-performance related to voluntary events.

These types of initiatives will enable us to provide information to clients in a more timely fashion, while also allowing users to extract meaningful insights from the data we share. Not only will this lower costs for clients, but also help them to improve client experience and reduce their operational risks.

The re-imagination of the account opening process is another manual process which clients are looking to streamline, as institutions diversify into new markets in the search for alpha. Again, data will play a crucial role here.

Today, opening accounts in, say, 40 different markets, typically requires an investor to submit 40 different registration forms. Even opening accounts across several markets located within the same geographical region is not necessarily straightforward.

We can simplify this process by standardising the information required to open accounts. Our end goal is to get to the point where a client can send us a single data set containing all of the relevant account opening information, allowing faster access to all markets.

Client appetite for data is growing, but if custodians are to have a successful data strategy, they need to get some fundamentals right.

Firstly, our clients want data delivered to them in a seamless fashion, often via digital or automated channels and we strive for automatic ingestion and onward decision making in preference to manual review.

However, data delivery does need to be tailored according to the clients’ requirements. This is because certain clients will be more advanced than others in terms of their technology adoption and levels of automation. In some cases, clients want information conveyed to them through a specific communication channel, depending on the data’s particular use case, volume, payload or frequency.

Although standardisation and the delivery of consistent solutions across multiple markets is important, custodians need to be mindful that more clients want data-led, hyper-personalised services in their quest to drive service excellence and this is a key part of our innovation ethos. It is therefore critical that custodians adopt an omni-channel approach when sharing data with clients. In other words, custodians should be distributing data either through APIs, direct data streaming, online portals, Swift messaging or even email, depending on client preferences. In addition, extending the ecosystem via Fintech collaboration is a key part of the overall strategy.

Over time, the wider adoption of cloud-based solutions will eventually optimise data sharing and allow for integrated operating models to emerge. The implementation of this technology will be subject to regulatory hurdles existing in certain markets, but the benefits to our industry will make this a key intellectual peak to scale.

An effective omni-channel approach to communication and a willingness to embrace hyper-personalisation will enable custodians to differentiate themselves from their peers moving forward.

Talking about developing and driving value from a comprehensive data strategy is one thing. Executing it successfully is another. At the most rudimentary level, providers need to have an innovation culture where people are encouraged to try new things, and not afraid of failure.

On a practical level, data strategies will only be effective if they have proper funding, management buy-in and the right people involved driving the project forward. Similarly, data products cannot be developed in isolation. Engagement and collaboration – both internally and with clients or outside fin-techs – is vital if solutions are to gain traction.

Those custodians, which have clearly defined and thoughtful data strategies, will be the ones that ultimately win wallet share in the future, as clients increasingly prioritise data and digital.

The best is yet to come in emerging and frontier securities services markets. We’re ready to help.

Turning expertise into actionable insights. Explore our views on what to watch out for.