Click

here for the full Twist & Win 2021 Promotion Terms and Conditions that apply. The Twist & Win 2021 Promotion (“

Promotion”) is available from 3 June 2021 to 15 August 2021 (both dates inclusive) (the “Promotion Period”). The Promotion is open to all principal cardholders of credit cards issued by Standard Chartered Bank (Singapore) Limited (“

Bank”) (each a “

Card”). Each principal cardholder of a Card shall be referred to as an “

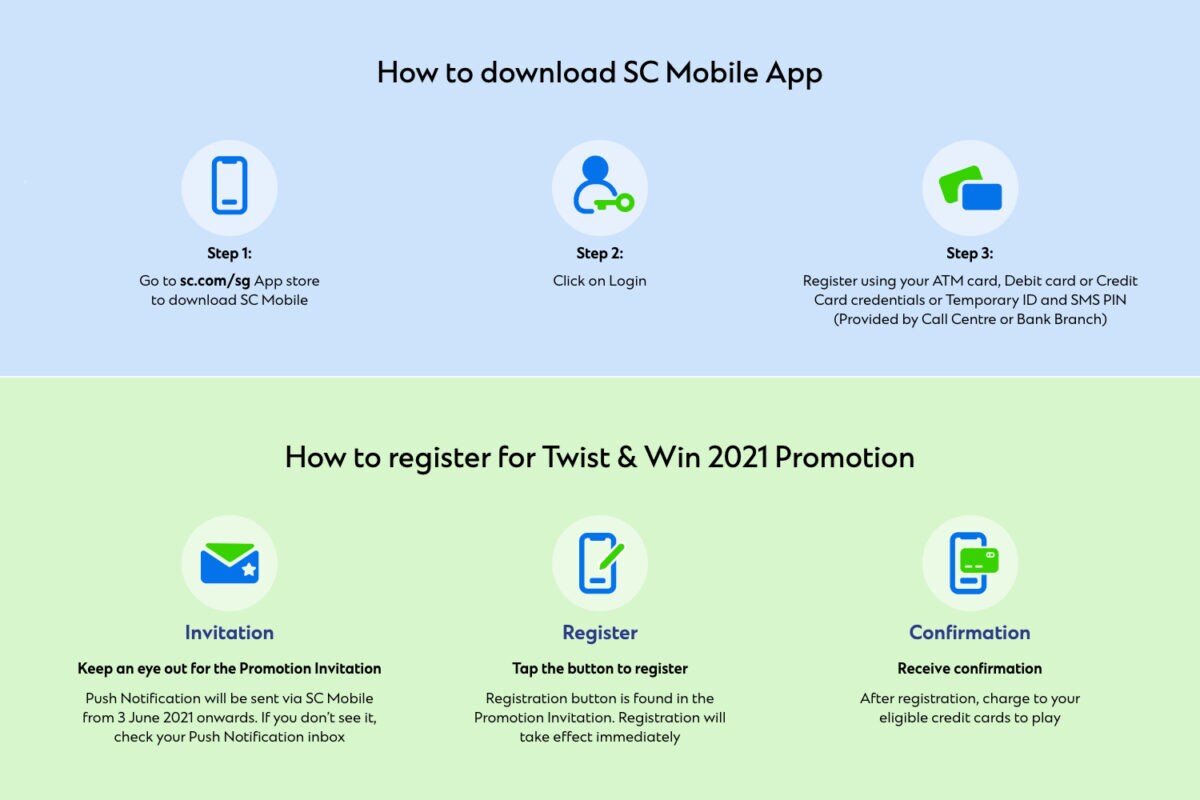

Eligible Cardholder”. To participate in the Promotion, an Eligible Cardholder must be a registered and valid user of the Standard Chartered Mobile Banking App (“

SC Mobile”) and have enabled the option to receive Push Notification (as defined below) on his/her mobile phone and SC Mobile. To successfully register for the Promotion, an Eligible Cardholder must register for the Promotion during the Promotion Period, by clicking on the ‘Register Here’ button found in a push notification (which is a service provided by Apple and Google for their respective mobile operating systems i.e. iOS and Android respectively, through which an iOS or Android mobile app can send a user (who has installed such mobile app) a notification) (“

Push Notification”), with the Push Notification summarising the details of the Promotion (“

Promotion Invitation”). For the avoidance of doubt, the Promotion Invitation will only be broadcasted from 3 June 2021 onwards, and the frequency of such broadcast will be at the Bank’s determination. Upon clicking on the ‘Register Here’ button in the Promotion Invitation, all of the Eligible Cardholder’s validly existing Card(s) (i.e. not suspended, cancelled and/or terminated) which are in good standing, and conducted in a proper and satisfactory manner, as determined by the Bank, will be registered for the Promotion (such successfully registered card(s) hereinafter referred to as a “

Registered Card” and the cardholder of such Registered Card, a “

Registered Cardholder”) immediately. To qualify, Registered Cardholders must charge a single retail transaction to a Registered Card that: a) is of an amount of S$150 or more; b) has a transaction date falling within the Promotion Period; c) has been successfully posted to a Registered Card account during the Promotion Period; and d) is not an excluded transaction (as set out at Clause 25 of the Twist & Win 2021 Promotion Terms and Conditions) (each such transaction fulfilling all limbs of this clause hereinafter referred to as a “

Twist & Win Qualifying Transaction”). The first 80,000 Twist & Win Qualifying Transactions (each a “

Winning Transaction”) made during the Promotion Period will each be randomly assigned a unique URL by an automated computerised system. A Push Notification containing a unique URL (“

Twist & Win Push Notification”) will be sent to the Registered Cardholder’s SC Mobile notification inbox when a Twist & Win Qualifying Transaction is a Winning Transaction. Twist & Win Push Notification will only be sent to the Registered Cardholders for the first 80,000 Twist & Win Qualifying Transactions to reveal a cashback prize of up to S$1,000. Each Registered Cardholder is eligible for 1 Twist & Win Push Notification for every Winning Transaction made, subject to a Registered Cardholder receiving a maximum of 3 Twist & Win Push Notifications per day. If the Registered Cardholder makes more than 3 Winning Transactions in a day, the Registered Cardholder will only receive the Twist & Win Push Notifications for the first 3 of the Winning Transactions which occurred on the same day. “Winning Cardholder” refers to the Registered Cardholder of each Winning Transaction. All cashback will be credited to the relevant Winning Cardholders’ Registered Card account used to charge the corresponding Twist & Win Qualifying Transaction by 30 September 2021.