Get Silver & Gold ETFs worth US$460* in Welcome Rewards

Unlock 1 share of iShares Silver Trust (SLV) and 1 share of SPDR Gold Shares (GLD), limited to the first 500 qualifying customers. Offer ends on 31 March 2026. *T&Cs apply.

Unlock greater potential with global trading opportunities on SC Online Trading

Trade ETFs, REITs, and shares with brokerage rates from as low as 0.18% and $0 custody fees.

Why SC Online Trading?

Access 14 stock exchanges with low brokerage fees

Trade US equities and more across 14 global stock exchanges with brokerage fees from as low as 0.18% and $0 custody fees.

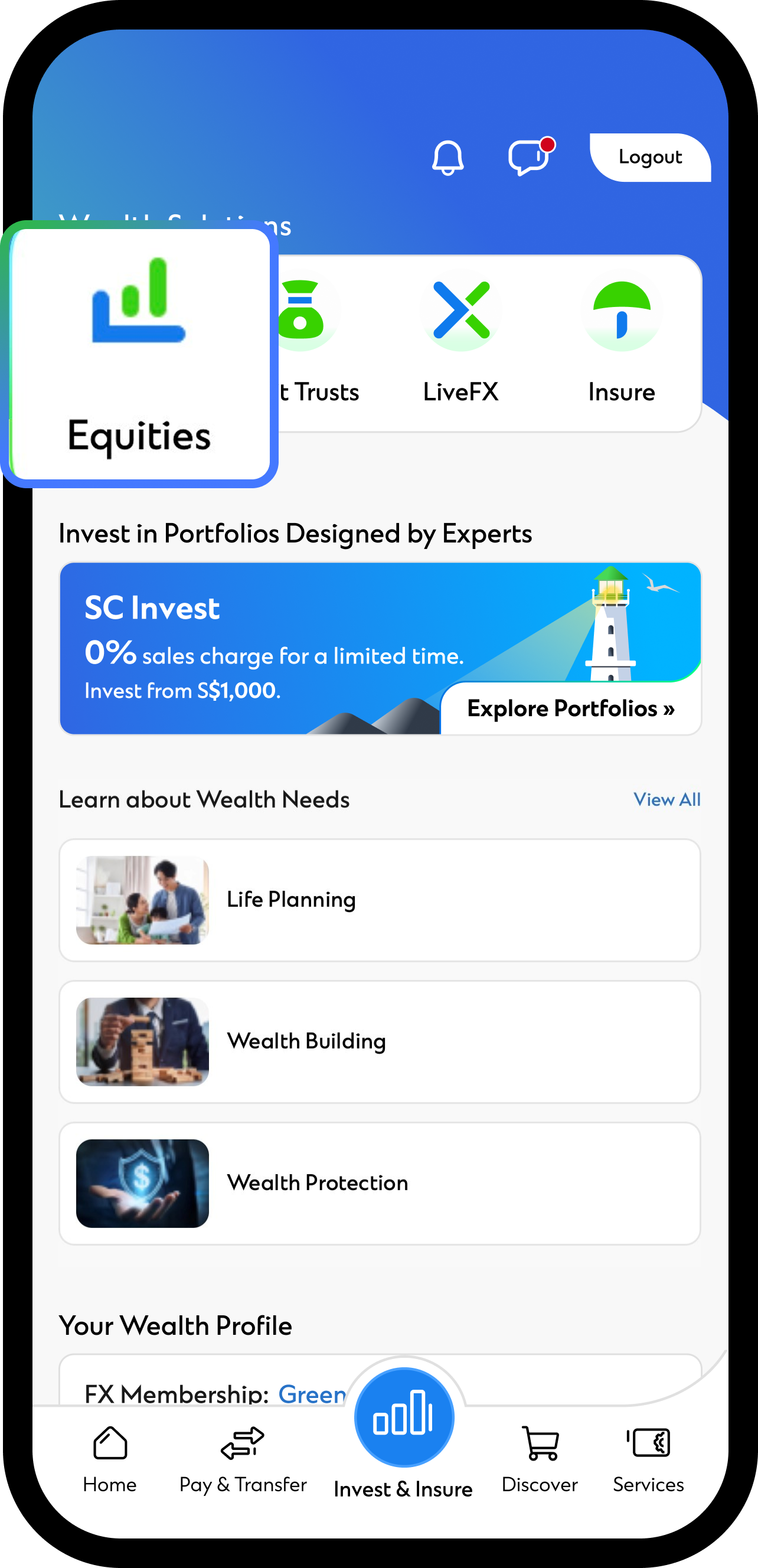

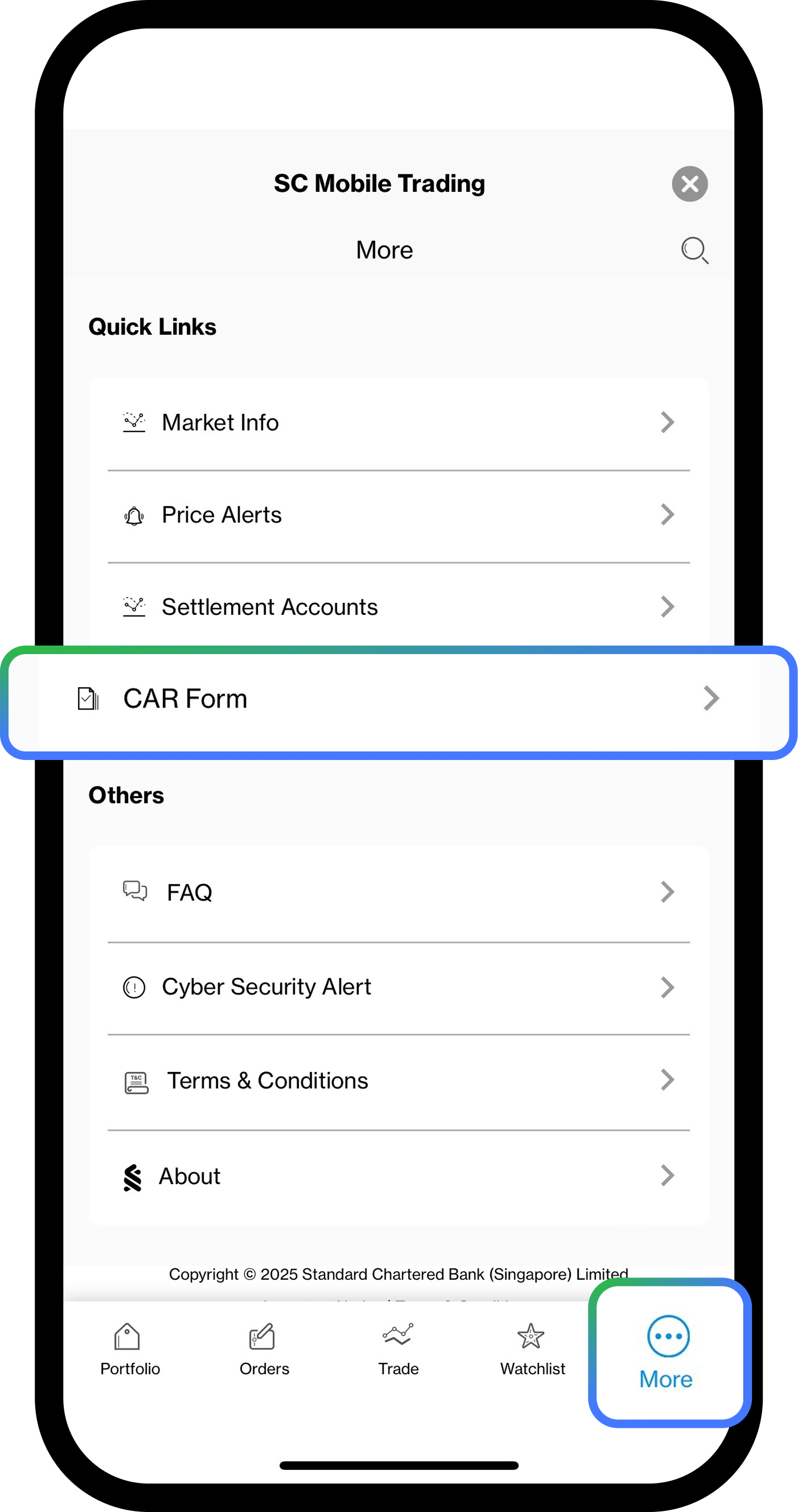

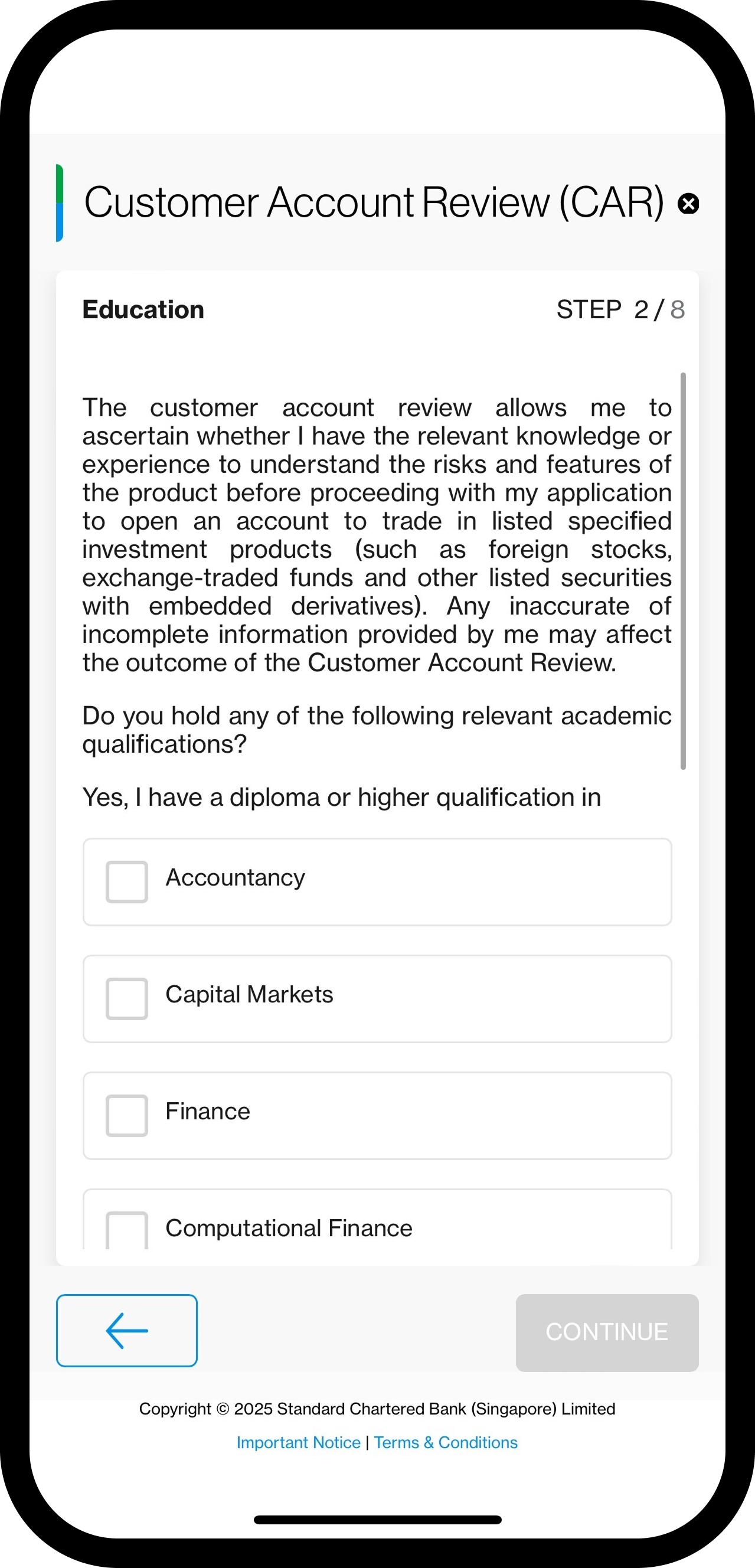

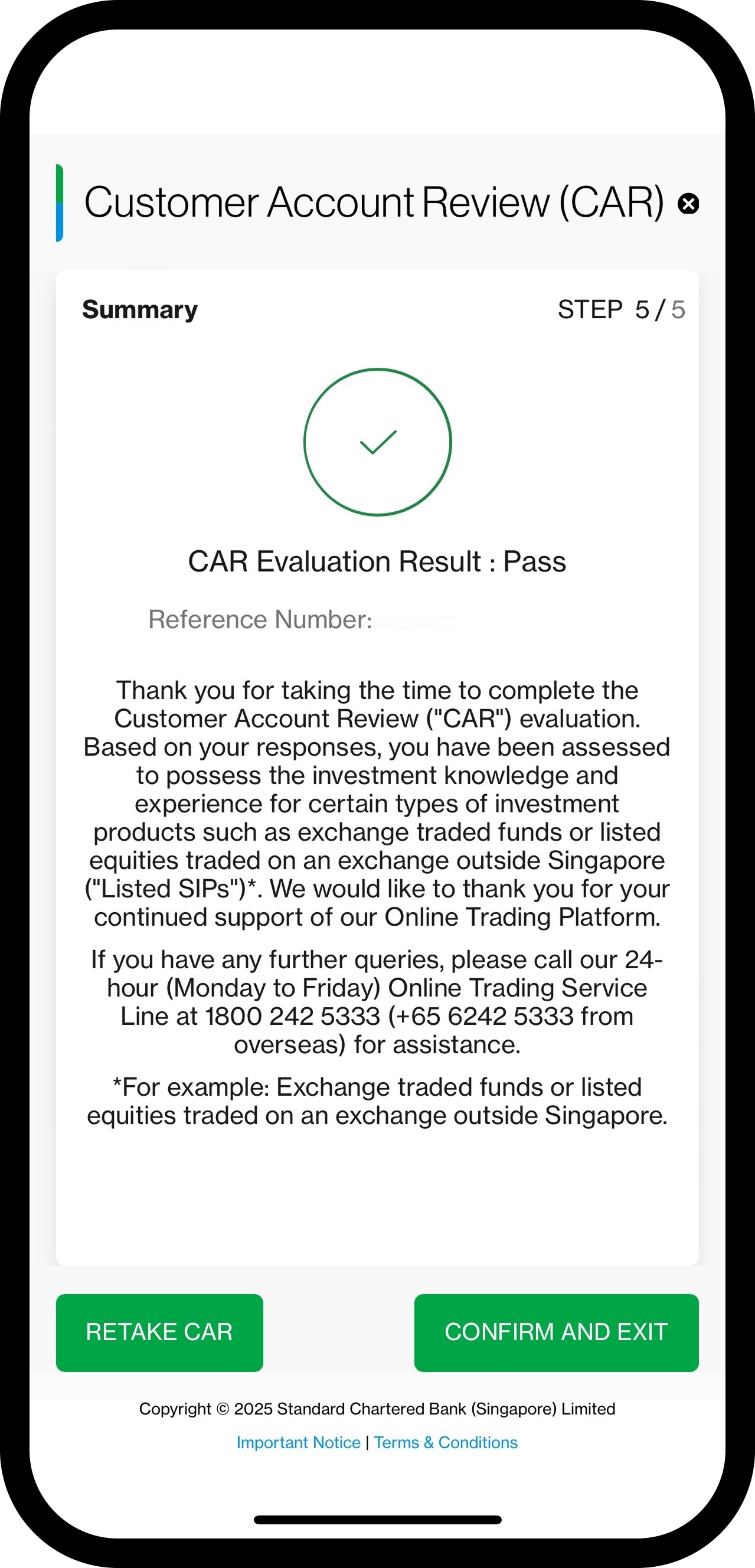

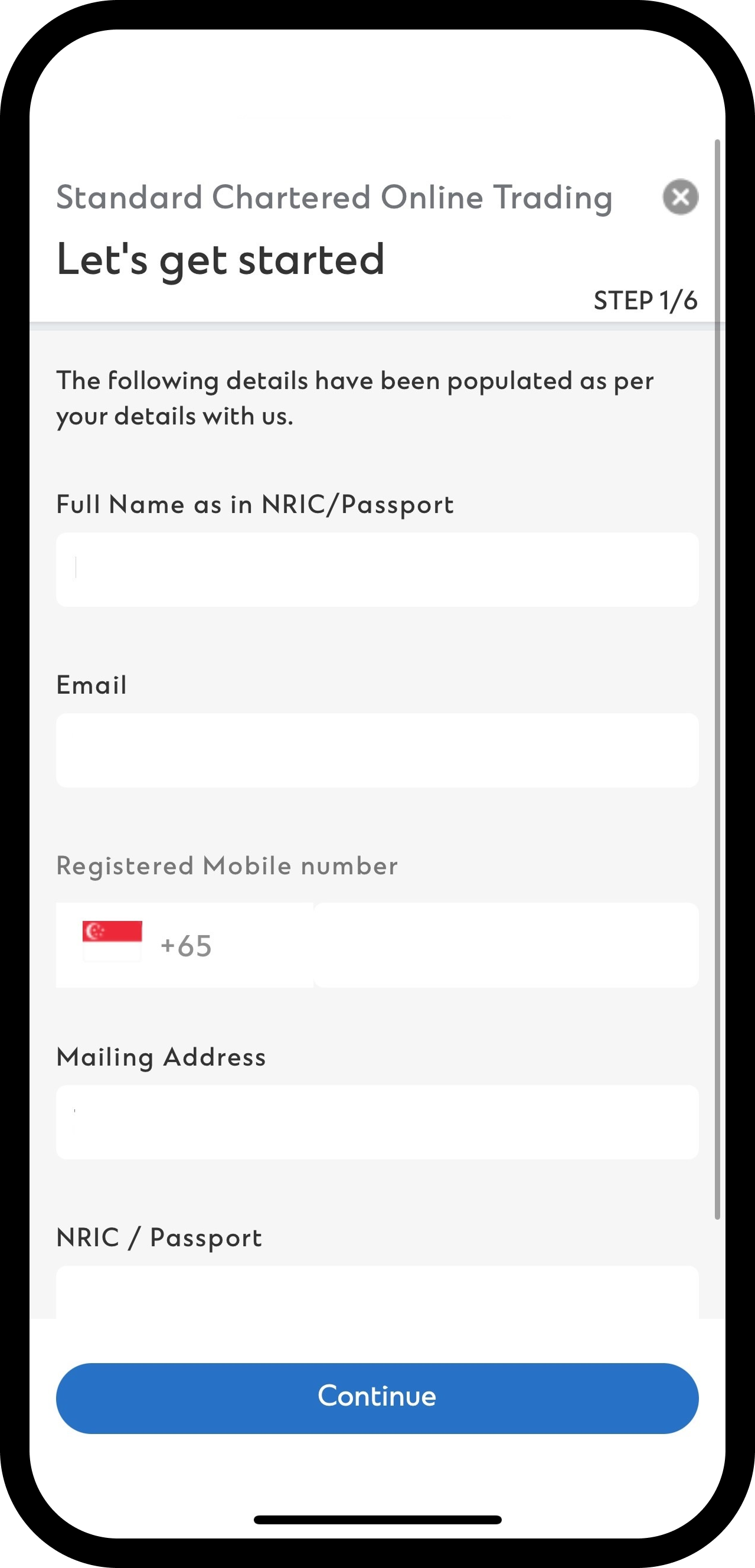

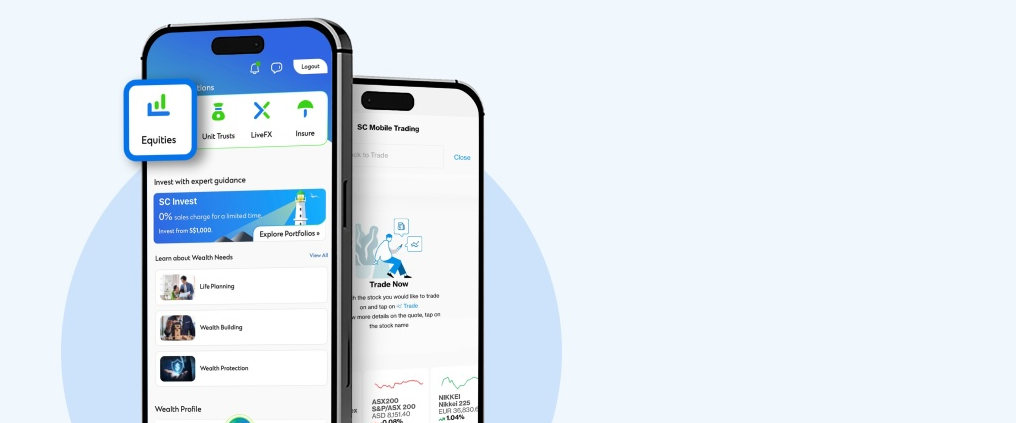

Bank and trade conveniently all on one app

Access your banking needs, fund your trading account, convert currencies and trade on-the-go via SC Mobile.

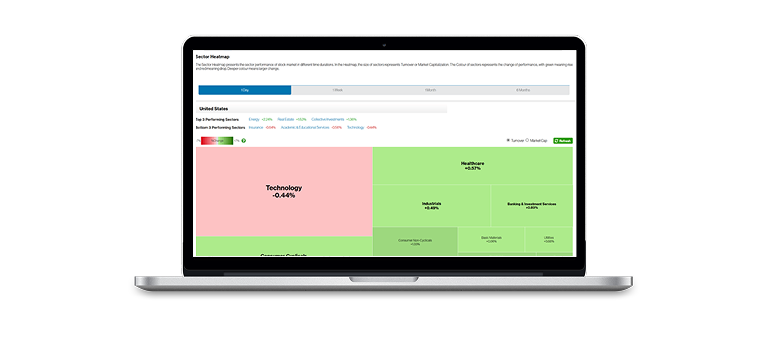

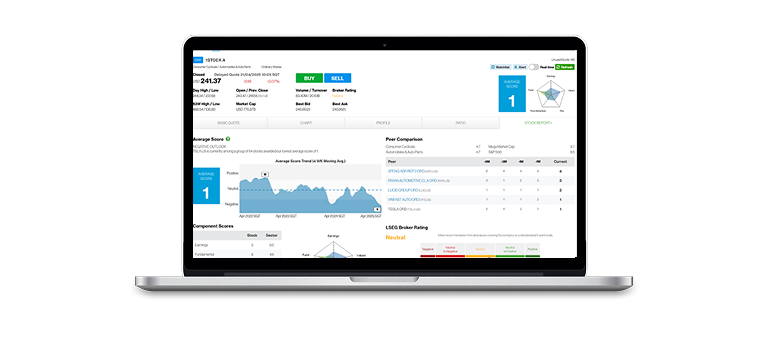

Invest smarter with market tools and insights

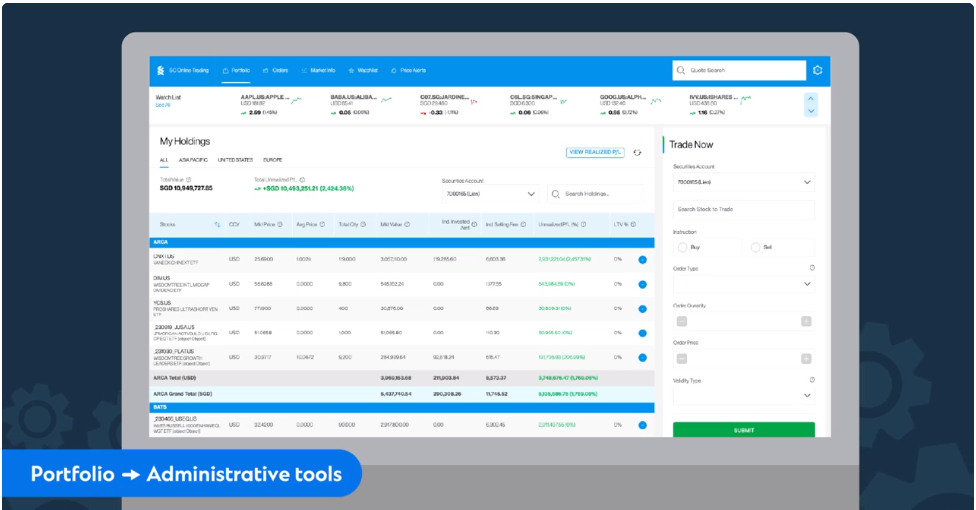

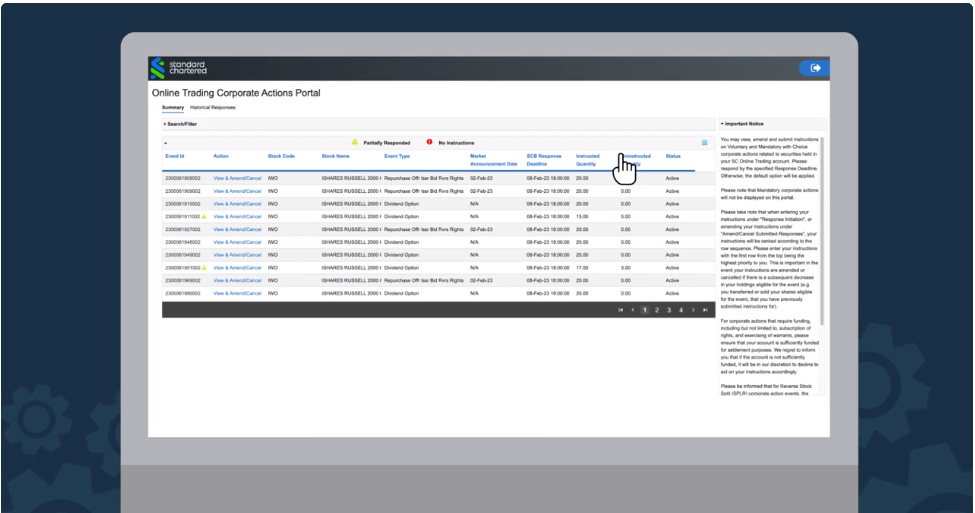

Seize investment opportunities with our real-time trading tools and data-driven market insights.

Why SC Online Trading?

Access 14 stock exchanges with low brokerage fees

Trade US equities and more across 14 global stock exchanges with brokerage fees from as low as 0.18% and $0 custody fees.

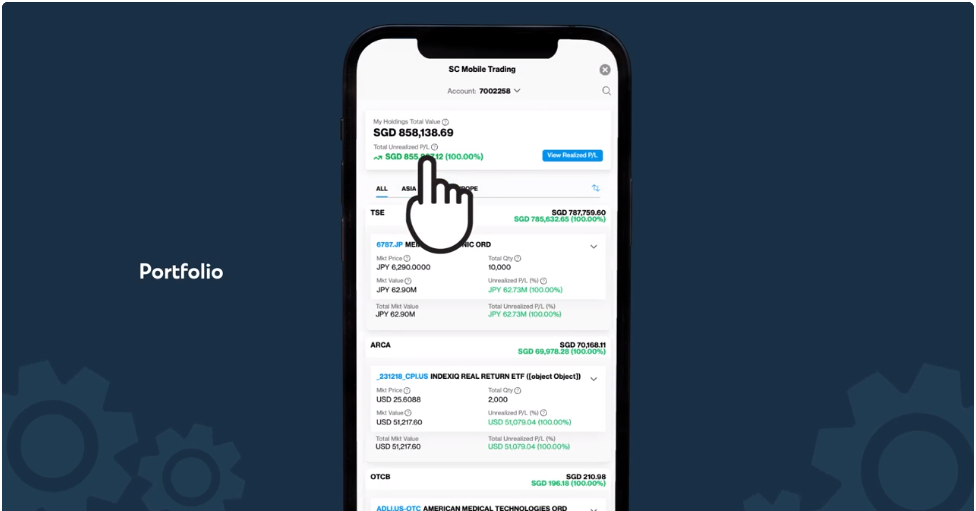

Bank and trade conveniently all on one app

Access your banking needs, fund your trading account, convert currencies and trade on-the-go via SC Mobile.

Invest smarter with market tools and insights

Seize investment opportunities with our real-time trading tools and data-driven market insights.