FCF is the money a company has left after deducting all its cash payments towards capital expenditure (for example, property and equipment), inventory, debt and other operating expenses. The free cash flow to the firm (FCFF) is the sum of the cash flow to all claim holders in the firm, including stockholders and preferred stockholders. It measures how efficient a company is at generating cash.

FCF is the basic component of discounted cash flow (DCF) analysis that shows free cash flow available for shareholders. This attribute also makes it one of the most popular and easy metrics for determining whether an investment is good or bad. There are several methods for how to calculate free cash flow, but the easiest free cash flow formula is as follows:

Step 1 – Find the Cash Flows from Operations figure on a company’s cash flow statement.

Step 2 – Find the company’s total capital expenditure in the Cash Flows from Investing section.

Step 3 – Subtract the second figure from the first to derive the company’s FCF.

Cash flow from operations is derived from the income statement. Because capital expenditure counts as an investment, it’s not part of the income statement. This is the easiest way to calculate FCF, but if you still find it daunting, online free cash flow calculators can help.

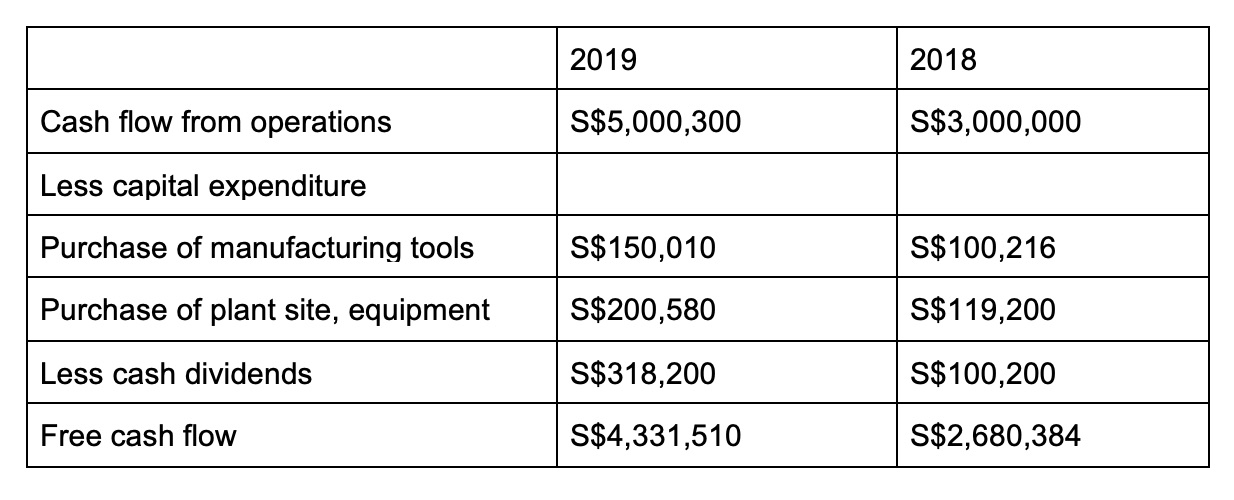

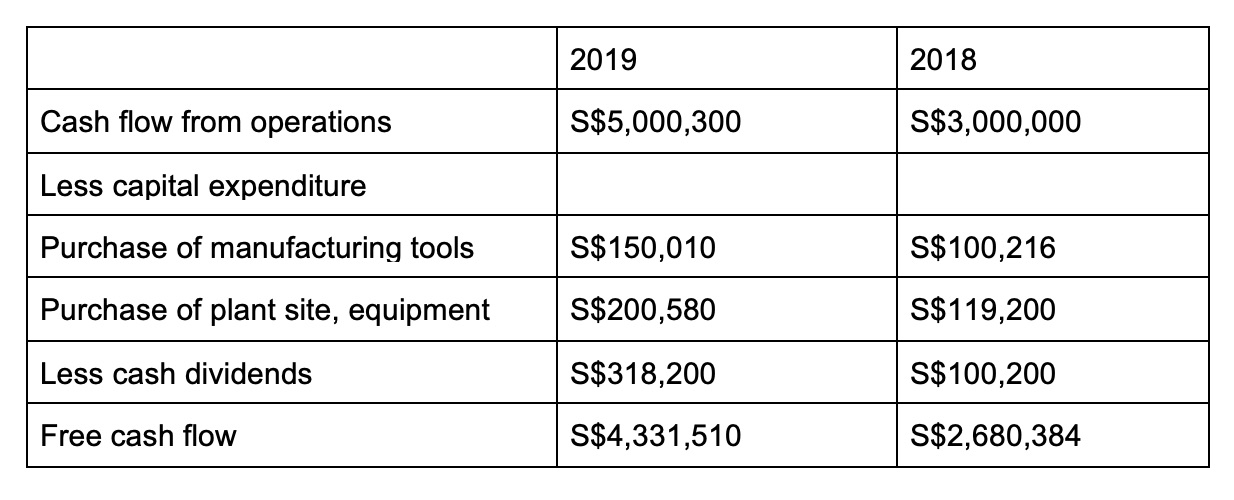

The following example illustrates FCF calculation for fictional Company ABC for 2019 and 2018.

Clearly, Company ABC’s good cash flow record would be attractive to investors who would like to invest in a company with increasing returns on investment. Company ABC’s cash flow has increased significantly over the one-year period from 2018 to 2019.

However, rising cash flow is not the only factor when considering an investment opportunity. Investors need to be mindful that dwindling cash flow may, for example, be a result of the company investing more heavily in product innovation or deciding to hold less cash. It’s worthwhile to note that some companies may show a good net cash from operations, but the nature of their business may require more liquidity and thereby higher capital expenditure to run the operations. The airline, hospitality and telecom industries are among those that fall into this category, resulting in a significantly high amount being spent on daily operations.

When you examine a historical cash flow statement, the figure that you come across is the actual cash on hand at the beginning of month versus the cash at the end of the month. It’s best practice to observe cash flow over a period of time to monitor and understand changes in the business.

There are a number of instances in which a company can report positive FCF that are due to circumstances not necessarily related to a good long-term scenario. For example, positive FCF can result if an organisation takes any of the following actions:

- Sale of fixed assets

- Delay in payments for accounts payable

- Reduced capital expenditure

- Receipt of advance on accounts receivable

- Reduction in manpower/employee costs

- Curtailed expenses of other divisions

In the above example, the organisation has taken measures to cut most of its long-term investments to boost short-term FCF. Other measures, such as receipt of advance on accounts receivable and delay in payments for accounts payable, can be beneficial in the short term but will have long-term repercussions.

A company’s growth can also impact its FCF. An early-stage business, for instance, is likely to display lower cash flow. If a business is growing rapidly, on the other hand, it often requires a large investment in accounts receivable and inventory management. This can lead to a rise in its working capital investment and a consequent decrease in the amount of FCF.

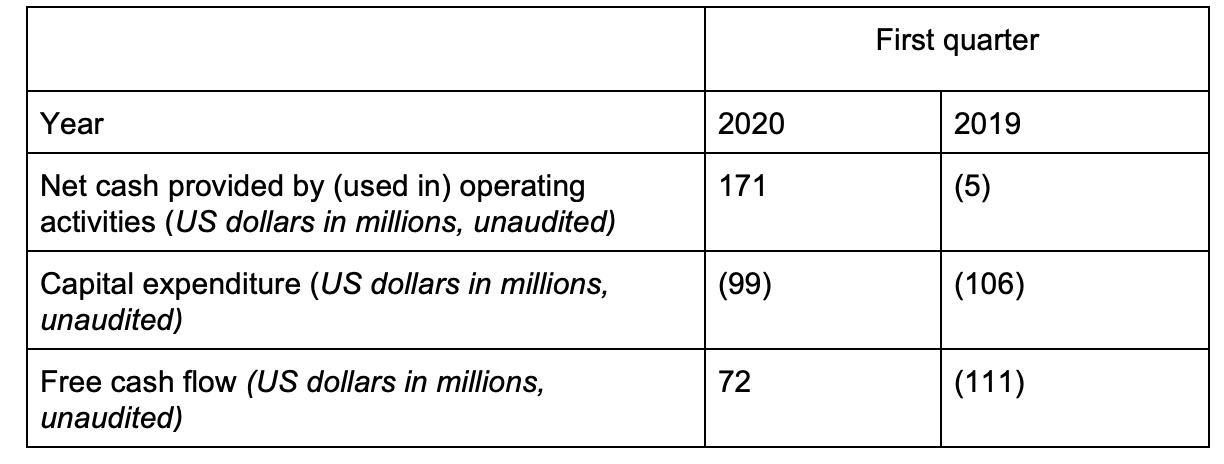

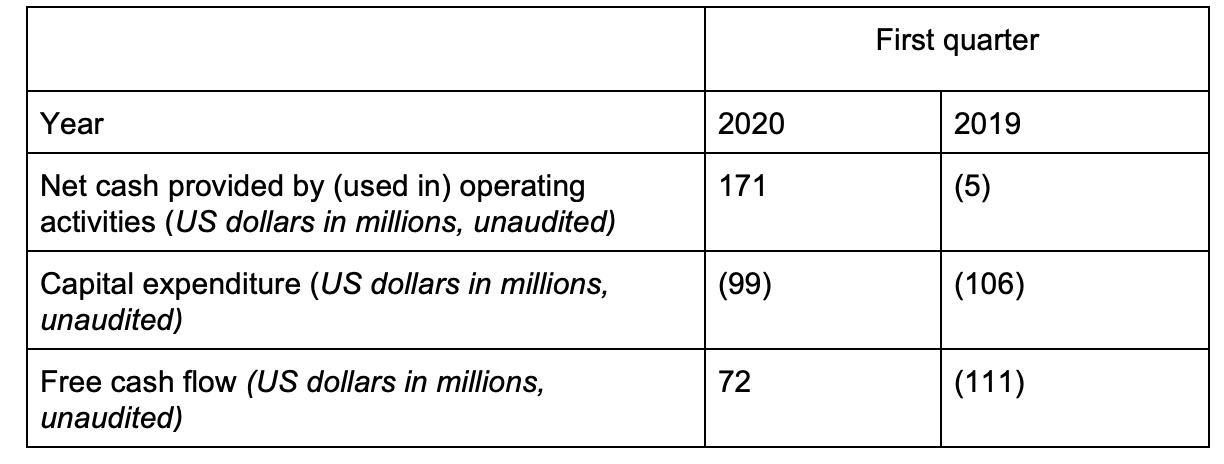

In an economic downturn, companies with free cash money can be more resilient and are in a better position to ride out the economic slump. Take, for example, the recent announcement by Eastman Chemical Company¹, a New York Stock Exchange-listed organisation claiming that strong FCF bolstered its solid performance. “We delivered strong year-over-year earnings growth and impressive free cash flow, demonstrating the power of our innovation and the discipline of our operational execution,” the announcement read.

Have a look at the free cash calculation of the company over the first quarters of 2019 and 2020:

In general, if a company has shown positive cash flow for more than three consecutive periods, then it will have the resilience to ride out rough patches in the business cycle or an economic downturn.

Three things FCF can tell you

- Ability to repay debt and take on future borrowings: Subtracting a company’s debt payments from its FCF figure indicates its ability to repay its current debt and its capacity for borrowing in the future.

- Ability to pay out dividends: The figure after deducting debt and interest payments from FCF indicates the company’s capacity to pay out current and future dividends.

- Change in fundamental business trends: When analysing a company’s FCF, pay attention to both the static figure and the trend (how it changes from year to year). The FCF trend tends to be jagged rather than smooth. The changes from year to year can tell you a lot about a company’s fundamental business operations and give you a micro-level view.

Some companies may convert profits into FCF, thereby showing higher figures. A diligent investor knows that a good organisation can grow without spending large amounts of money and still consistently generate FCF. All investors should learn to analyse a company’s financial health so they can make smarter, more informed investment decisions. FCF is one metric that can help equip you for this.

How is FCF different from net income?

Many items in a company’s total net income may not actually generate any cash for the company. For instance, items sold on credit can be booked as income at the time of sale, even if they have not yet been paid for. Non-cash items, such as depreciation and amortisation expenses, may also distort a company’s true financial standing.

Finally, because the market focuses so much on net income figures, companies may be motivated to paint a rosier picture. For instance, a company may extend overly generous payment terms to its customers to boost its net income for a particular period.

The main difference between these two terms is that FCF takes into account capital expenditure. A positive cash flow does not necessarily mean a company is in good financial health, as a company can generate this positivity by taking on additional debt or selling off long-term assets at the expense of future growth. So, FCF provides a truer picture of a company’s actual cash flow position.

Want to know more? Standard Chartered Bank is committed to helping you succeed in your investment journey. Speak to one of our financial advisers today to learn more about how we can help you.

Do you know how to calculate free cash flow and, more importantly, how to use it to analyse a company’s financial health? Read the article below to become a better, more knowledgeable investor.

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.

Sources:

- Eastman Chemical Company – 1st Quarter 2020 Release with Tables https://eastman.gcs-web.com/static-files/17d3c046-0e01-4d51-a56a-1231ccad2925