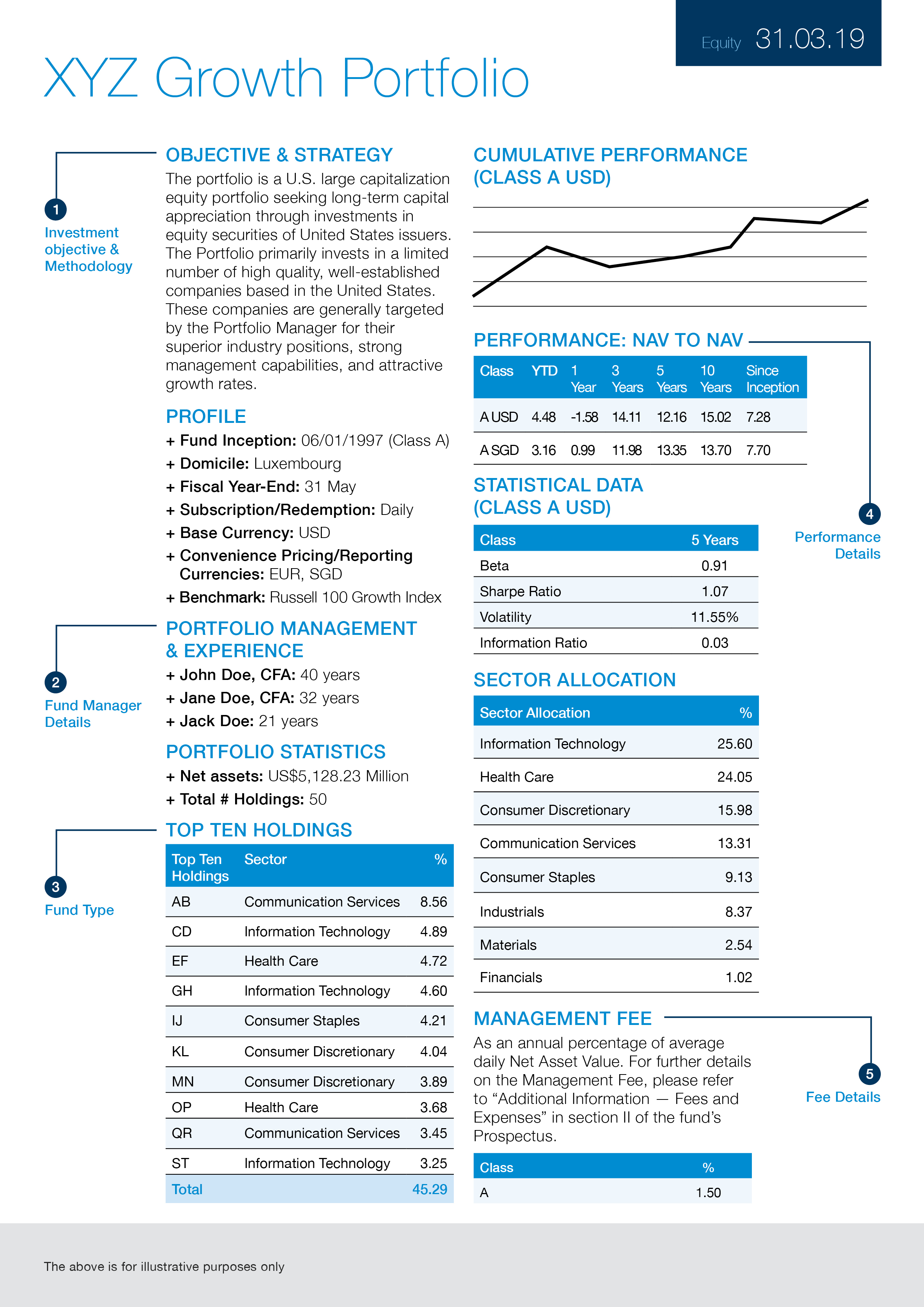

Get a better understanding of the UT’s characteristics, what it strives to achieve and the investment strategy it plans to adopt to meet its goals. Make sure the fund’s investment objective and methodology align with your risk appetite and desired return to avoid investing in a product that does not suit you.

When you invest in a UT, you are essentially handing over your money to fund managers. Therefore, be sure to gather information about the credibility of the people who will be managing your hard-earned money, by studying the performance of past investments that the fund manager has run.

Funds differ in the way they are invested into and the way they generate income.

Asset allocation: Certain UT invest exclusively in equity or only in debt while others may adopt a more balanced approach by having a mix of both equity and debt. Along with this information, the UT factsheet will also highlight the industry-wise breakdown of where your money is being invested and the fund’s top 10 holdings.

Income feature: The factsheet can also tell you whether the UT has an accumulation feature where the dividend/interest generated is reinvested, or a payout feature where this income is distributed to the investor.

While past performance of a UT is no guarantee of its future performance, it is still useful to compare a fund’s performance with its peers’. Returns are typically shown over one-year, three-year, five-year and 10-year terms.

You can also look out for statistics such as Sharpe ratio and standard deviation. Sharpe ratio depicts risk-adjusted returns — the higher the ratio, the better. Standard deviation reflects the volatility of the fund over time — the lower the number, the better.

When you purchase a UT, you accrue an annual fee that covers management charges, administrative charges and operating costs. This is commonly referred to as the Total Expense Ratio (TER). Funds with higher assets under management (AUM) tend to have a lower TER.

Other than the TER, you might also be subject to fees such as entry load when you purchase a UT and exit load when you sell it. These costs can eat into your investment returns so be fully aware of them.

Any retail investor who’s interested in UT as an investment avenue should familiarise themselves with the factsheets so as to make better informed investment decisions.

Want some advice on building your wealth portfolio?

We can help to arrange a session with our financial advisor, who will help you with the information you need. Chat with us now.

This article is brought to you by Standard Chartered Bank (Singapore) Limited. All information provided is for informational purposes only.