Wealth and Retail Banking

We support our clients throughout their wealth journey with a range of opportunities across our unique international network, backed by convenient online platforms. Our approach is unbiased and tailored, with open sourcing of solutions, to help our clients make better financial decisions.

Corporate and Investment Banking

We are a connector for corporates and financial institutions across the world’s most dynamic markets to unlock the most exciting growth opportunities. From transaction banking to financial markets and advisory services and solutions. From here, possibilities are everywhere.

Be fraud aware

Stay informed about the latest methods and find out how you can report suspicious activity to help us fight back against fraud.

Make a difference

Explore careers with Standard Chartered and find a role which expands your horizons.

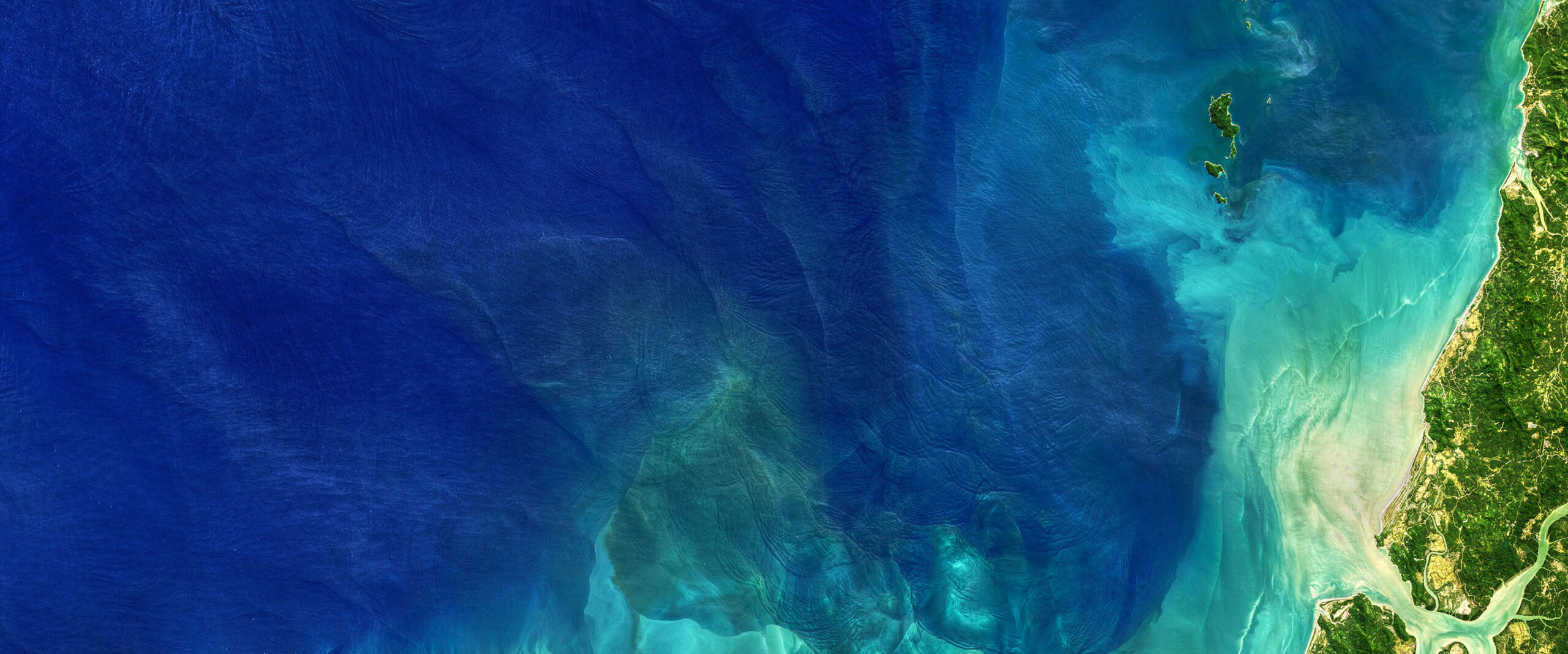

Our people and markets

As a leading international cross-border bank, our unique footprint and diverse capabilities set us apart.

129

nationalities

53

markets

85,000

employees worldwide