1. What is SORA (Singapore Overnight Rate Average)

SORA is a robust and transparent interest rate benchmark that is replacing SOR (Singapore Dollar Swap Offer Rate) and SIBOR (Singapore Interbank Offered Rate) for use in Singapore dollar interest rate products such as loans. SORA reflects the average rate at which banks in Singapore borrow funds overnight from one another. SORA has been calculated and published daily by the Monetary Authority of Singapore (MAS) since 2005.

MAS also publishes a series of Compounded SORA2 rates in 1-month, 3-month and 6-month tenors3, which are easily referenced in new SORA loan products offered by banks.

2. I currently have a property loan referencing SOR. How does the discontinuation of SOR affect my property loan? Do I have to take any action now?

If you have a property loan that references SOR, you will need to switch out to another loan package by 31 August 2022. This is to prevent you from being inconvenienced by any possible disruption to your loan when SOR ceases after 30 June 2023 (e.g. if the interest on the loan cannot be computed).

You are strongly encouraged to switch out of your SOR-based loan soon and contact us early to explore the available options. If you do not switch your SOR loan to an alternative package by 31 August 2022, we will automatically convert it to a SORA-based loan in October 2022, as set out in the letter accompanying this FAQ document.

3. Would all SOR-based retail loans (i.e. other than property loans) be affected by this transition?

If you have other retail loans referencing SOR, the loans will similarly be affected by this transition. We will contact you regarding a switch to other loan packages, including ones based on SORA.

Switching Out of Your SOR Loan By 31 August 2022

4. How do I make the switch now to a SORA Conversion Package or another loan package?

You can contact through email at SG.MRU@sc.com to find out more about the SORA Conversion Package or any prevailing loan package (e.g. a fixed rate loan) that we offer, subject to the prevailing terms and conditions (i.e. lock-in period could apply).

You are strongly encouraged to contact us soon, and by end July 2022 at the latest, so that we can effect the conversion by end of August 2022.

5. Will I be subject to re-computation of the Total Debt Servicing Ratio (TDSR) when I switch from my SOR loan to an alternate package?

As the need to replace the SOR-based property loan with an alternative loan package is driven by the discontinuation of SOR, MAS will not require financial institutions to re-compute the TDSR for affected customers making the switch within the same financial institution. This is a one-time exception as part of the industry-wide exercise to facilitate customers’ switch to replacement loan packages offered by their financial institutions.

6. What is a SORA Conversion Package?

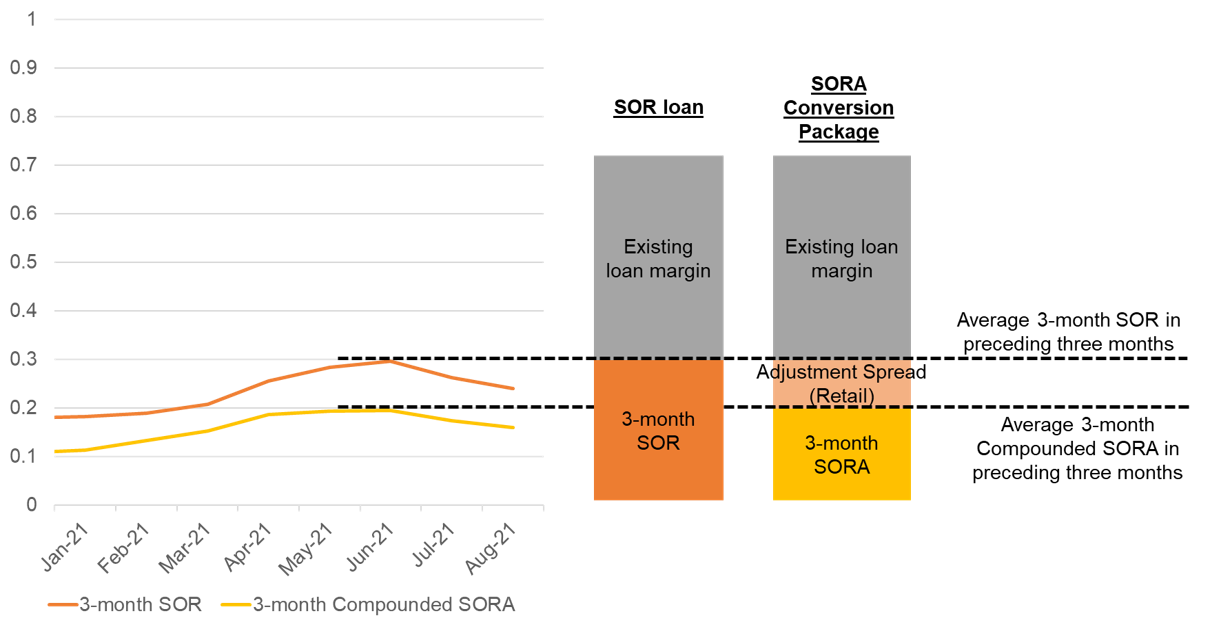

Banks are offering customers with existing SOR loans a switch to the SORA Conversion Package at no additional fee and lock-in period. The SORA Conversion Package is designed to minimise differences in interest payments at the point of conversion from SOR to SORA. This is achieved through the application of a standardised adjustment spread – Adjustment Spread (Retail).

|

|

|

After

(SORA Conversion Package)

|

| Reference Rate |

1-month SOR,

3-month SOR; or

6-month SOR

|

3-month Compounded SORA |

| Customer Margin |

Your existing SOR loan margin |

Your existing SOR loan margin

+ relevant Adjustment Spread (Retail)

See questions 7 to 9 for details on Adjustment Spread (Retail).

|

7. What is the Adjustment Spread (Retail) for and how does this affect my loan?

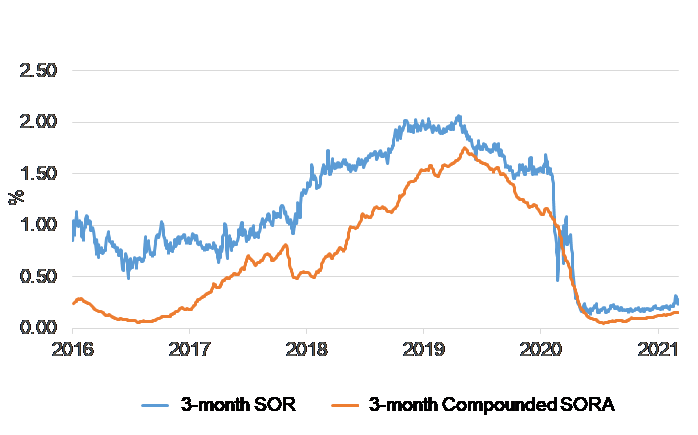

An adjustment spread is necessary when converting a SOR loan to a SORA reference to account for differences in interest rate levels between SOR and SORA. In particular, as seen in Chart 1, SORA is typically lower than SOR.

Chart 1: Historical comparison of 3-month SOR and 3-month Compounded SORA

8. Will the Adjustment Spread (Retail) change throughout the tenor of my loan?

No, the Adjustment Spread (Retail) that is applied to your loan will be fixed for the remaining tenure of your loan. There will not be any subsequent changes.

9. Why is the Adjustment Spread (Retail) fixed for the remaining tenure of the loan, even as the difference between SOR and SORA may continue to change after conversion?

The Adjustment Spread (Retail) is designed to account for the prevailing difference between SOR and SORA at the point of conversion, when a customer takes up the SORA Conversion Package. The Adjustment Spread (Retail) for the SORA Conversion Packages taken up in a given month will be fixed for the remaining tenure of the loan, so as to provide more certainty to customers.

However, please note that the SORA Conversion Package is still a floating rate package, as the reference rate (i.e the 3-month Compounded SORA) varies with changes in market conditions. You may consider switching to a fixed rate loan package if you would prefer more certainty over the interest payments that you will be making.

10. Why is the 3-month Compounded SORA the only tenure being used in the SORA Conversion Package?

The 3-month Compounded SORA has been assessed to be more stable than the 1-month Compounded SORA and less lagged than the 6-month Compounded SORA. It is also the most common tenure setting in SORA loan packages offered by banks in Singapore.

11. Why should I consider switching out of my SOR-based loan soon?

Since October 2021, the Adjustment Spread (Retail) has been on a rising trend driven by the rising global interest rate environment. All else being equal, a lower Adjustment Spread (Retail) will benefit customers, as this spread is fixed for the remaining tenure of your loan once applied at the point of conversion. The Adjustment Spread (Retail) to-date for converting a 3M SOR package to the SORA Conversion Package is provided below.

We strongly encourage customers to switch out of their SOR-based loans early and contact us to discuss the different available options. When you switch out of your SOR loan on or before 31 August 2022, you also have the flexibility to select a home loan package of your choice, whether it is a fixed-rate or floating rate package.

12. After my SOR loan is converted to the SORA Conversion Package, can I choose to change to another loan package?

Yes. Customers who converted to the SORA Conversion Package can choose to switch to another loan package without any penalty, without being subject to TDSR re-computation, at any time until 30 June 2023.

Automatic Conversion of SOR Loan to SORA after 31 August 2022

13. What will happen if I do not convert my SOR loan by 31 August 2022?

If you continue to service your loan via your existing or other payment arrangements with us, and do not voluntarily switch out of your SOR-based loan by 31 August 2022, we will treat your conduct as showing your clear intention to continue your loan arrangements with us. Your SOR-based loan will be automatically switched to a SORA-based loan with no lock-in period (“Automatic Conversion”) in October 2022 or such other date in October as we may decide, as set out in the letter accompanying this FAQ document. This SORA-based loan package under Automatic Conversion resembles the SORA Conversion Package with the difference being the date of the Adjustment Spread (Retail) applied (see question 16).

14. Why is Automatic Conversion being applied so far in advance of the discontinuation of SOR?

Automatic Conversion is being applied in October 2022, ahead of SOR discontinuation after 30 June 2023. This is to provide sufficient time for banks to prevent customers from being inconvenienced by any possible loan disruption (e.g. inability to compute loan interest rates).

15. How can I avoid the Automatic Conversion?

To avoid Automatic Conversion, you should contact us by end July 2022 at the latest, to effect a switch to the loan package of your choice by 31 August 2022. If your SOR loan has not been switched to an alternative package by 31 August 2022, Automatic Conversion will be applied.

16. What is the difference between the SORA-based loan that will be effected upon Automatic Conversion and the SORA Conversion Package that is offered to customers with SOR-based loans up to 31 August 2022? How will Automatic Conversion be done?

The key difference between the SORA-based package that you would be switched to via Automatic Conversion and the SORA Conversion Package that is offered to customers with SOR-based loans up to 31 August 2022 is that under Automatic Conversion, the SORA-based loan will reference the Adjustment Spread (Retail) published as of 1 September 2022. This is to allow the adjustment spread to be included in banks’ communication to customers in September 2022, 30 days before the conversion in October 2022.

|

|

SORA CONVERSION PACKAGE

|

AUTOMATIC CONVERSION

|

| Reference Rate |

3-month Compounded SORA at conversion date |

3-month Compounded SORA at conversion date in October |

| Customer Margin |

Your existing SOR loan margin + Adjustment Spread (Retail) in the given month of the conversion |

Your existing SOR loan margin + Adjustment Spread (Retail) as at 1 September 2022 |

17. What do the terms “existing SOR loan margin” and “Adjustment Spread (Retail) as at 1 September 2022” refer to?

“Existing SOR loan margin” refers to the spread on top of SOR that is used to compute your total loan interest rate. This would be stated in your Letter of Offer from us. For example, if your current SOR-based property loan is priced at SOR + 0.8%, then the SOR loan margin would be 0.8%.

“Adjustment Spread (Retail) as at 1 September 2022” refers to the adjustment spread that will be published by The Association of Banks in Singapore (ABS) on 1 September 2022. This adjustment spread would reflect the difference between the applicable SOR and 3-month Compounded SORA from June to August 2022, and will be used in the Automatic Conversion of your SOR loan.