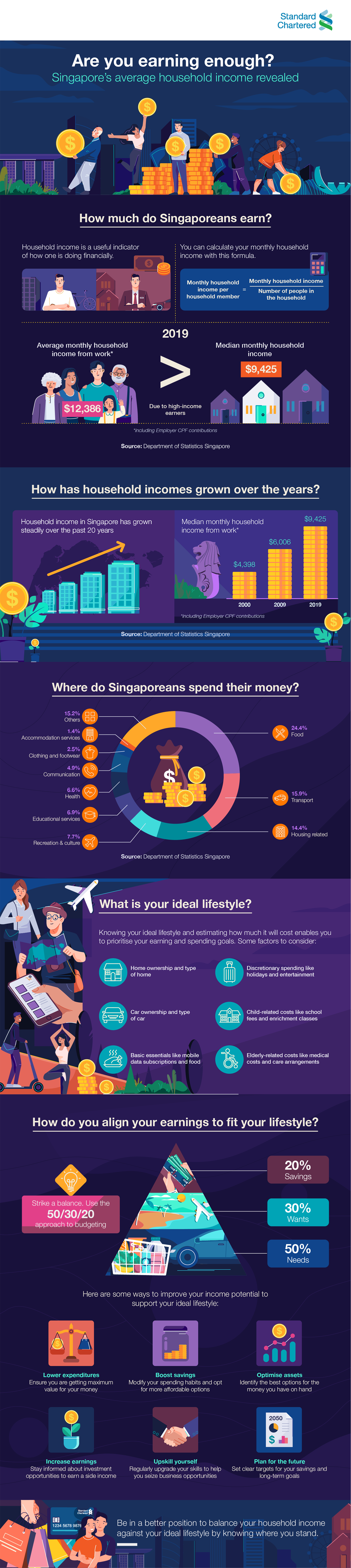

It is important to know where you stand in terms of income to others in Singapore so that you will be able to better determine your goalposts. Household income is a useful indicator of how one is doing financially. To obtain your monthly household income, add up the salaries, employer’s CPF contributions and business earnings of all the members in your household.

| Monthly Household Income Per Household Member |

= |

Monthly Household Income /

Number of People in the Household |

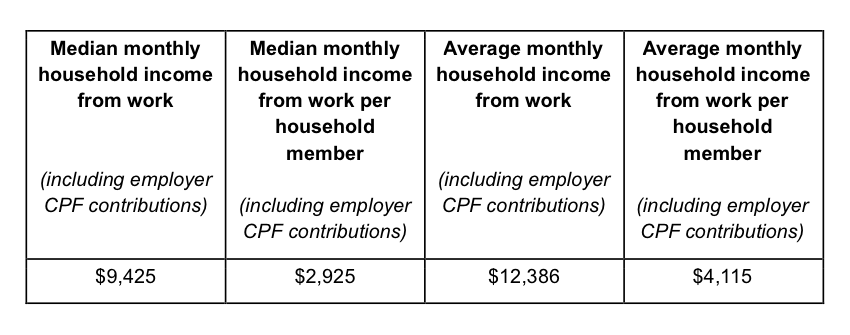

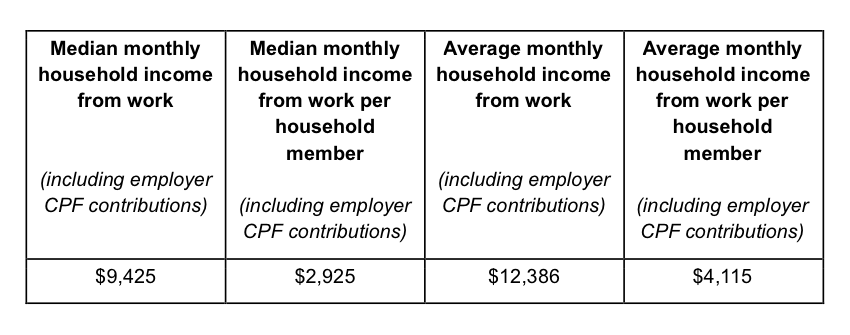

In 2019, Singapore’s median monthly household income from work (including employer CPF contributions)[1] was $9,425.

To understand how median household income is derived, imagine that all the households in Singapore are ranked from lowest-earning to highest-earning. The median is the income level at which half of the households would be earning less, and half would be earning more.

Therefore, if your household is earning $9,425, your income is higher than that of half the households in Singapore.

It can also be useful to compare your monthly income per household member with the national median income. To arrive at this figure, divide your monthly household income by the number of people in your household, including children.

In 2019, the median monthly household income from work per household member (including employer CPF contributions)[1] was $2,925.

Another useful figure is the average monthly household income. This number is derived by adding up the total of all incomes being earned in Singapore and dividing it by the number of households nationwide.

Singapore’s average monthly household income from work (including employer CPF contributions)[2] was $12,386 in 2019.

Did you notice that the average income in Singapore is higher than the nation’s median income? This is because high earners skew the figure upwards.

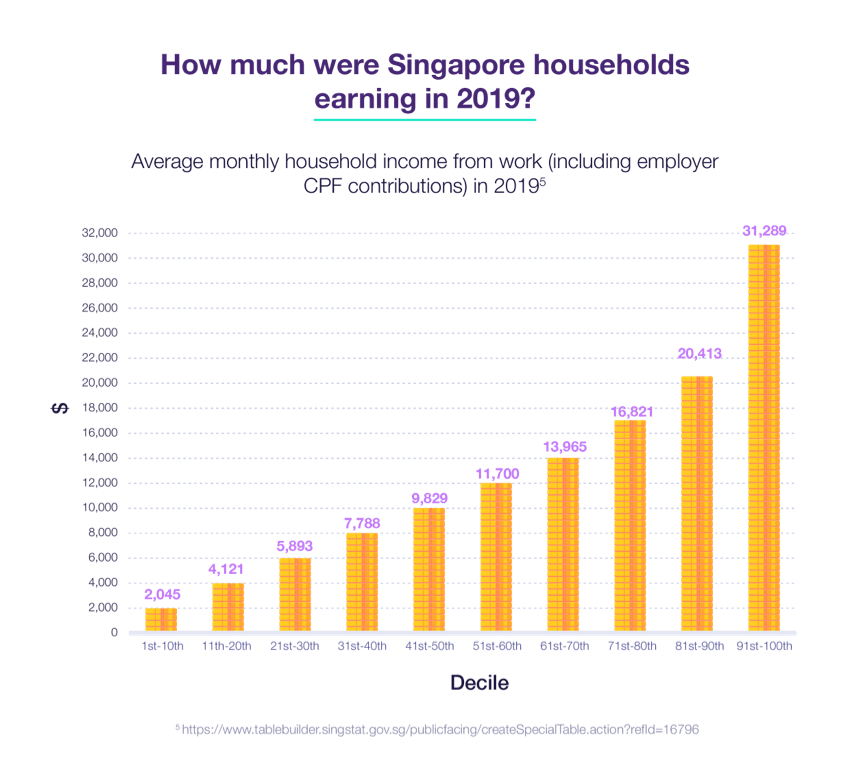

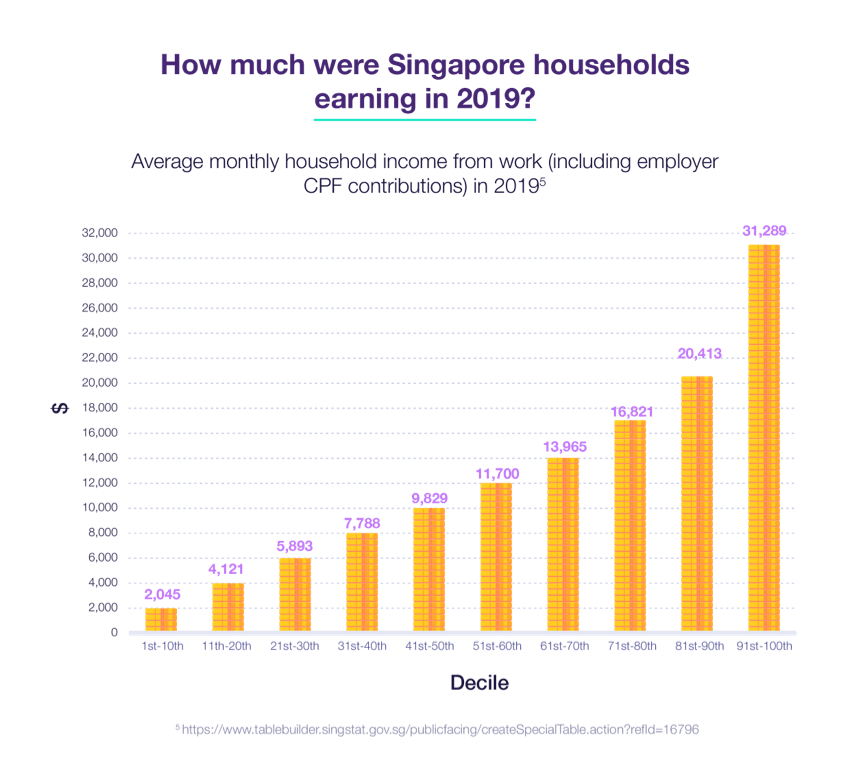

Measurements of average income enables us to split the population into deciles and see how much individual households are earning in each one. For instance, the 9th to 10th decile would make up the top 10% of earners in Singapore.

Measurements of average income enables us to split the population into deciles and see how much individual households are earning in each one. For instance, the 9th to 10th decile would make up the top 10% of earners in Singapore.

Examining the average income at each decile[1] allows us to get an idea of what households are earning at various income levels.

The graph below shows average household incomes in 2019 at each decile. Using this graph, you should be able to see which decile your own household falls into.

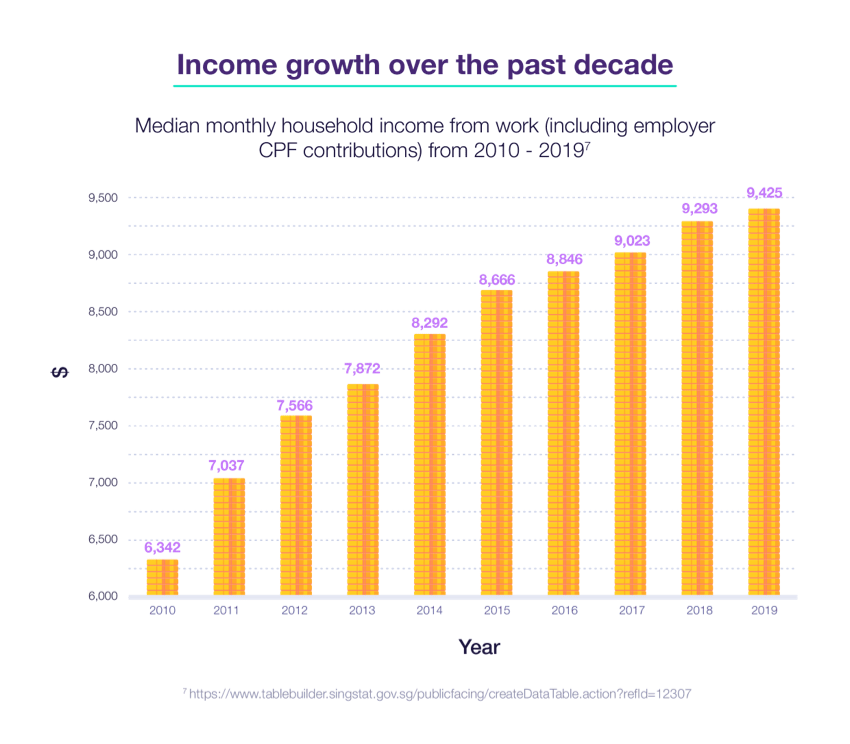

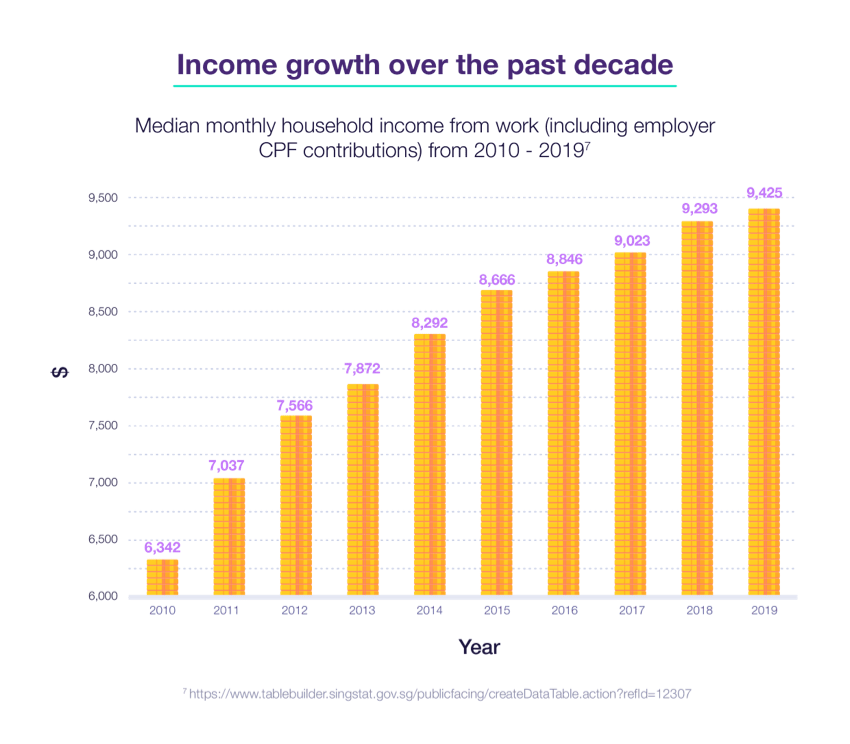

Income growth is a key concern in Singapore. Rapid income growth indicates strong purchasing power, while slow income growth can signal an inability to cope with the rising cost of living.

Statistics have shown that the median household income in Singapore has grown steadily over the past 20 years, whereby in the year 2000, Singapore’s median monthly household income from work (including employer CPF contributions) was just $4,398, less than half of what it was in 2019. This figure rose to $6,006 in 2009, before further increasing by about 57% to $9,425 in 2019.

The following graph shows how median household incomes in Singapore have grown over the past 10 years[1].

Growth in median household income reflects the country’s economic progress and mirrors the upward trend in Singapore’s Gross Domestic Product over the past decade.

It can be useful to benchmark the progression of your own income to see if it has kept pace with national median income growth.

With the growth in median household income, lifestyles have also changed for many households in Singapore. Perhaps your next question would then be “where do Singaporeans spend their money, and if these pockets of expenditure will lead you towards your dream lifestyle”?

The average monthly household expenditure in 2017/2018 was $4,906. Typically, households spent an average of $1,199 on food, including $810 on food purchased at establishments like restaurants, hawker centres and food courts, an average of $123 on clothing and footwear, $379 on recreation and culture, and $339 on educational services like tuition for children.

Living an ideal lifestyle may include gastronomic experiences at restaurants, island vacations, luxury fashion, among others. Discretionary spending varies greatly according to lifestyle, with higher income households more inclined to spend on things they love.

What about housing? It is no secret that the type of housing is a major gauge of lifestyle in Singapore. In 2019, Singapore’s home ownership rate was 90.4%[1].

Here is a breakdown of the types of housing residence which households were living in 2019[2]. Car ownership is another major lifestyle marker in Singapore.

Car ownership is another major lifestyle marker in Singapore.

In 2017/2018, 35.3% of households owned at least one car[1]. However, this number was lower compared to 42.1% in 2012/2013 – this is likely due to the expansion of Singapore’s public transportation network and the introduction of private hire car services in the last few years.

Fleshing out your ideal lifestyle and estimating how much it will cost enables you to prioritise your earning and spending goals.

Here are some factors to consider when estimating the costs of your preferred lifestyle:

- Home ownership and type of home

- Car ownership and type of car

- Basic essentials including utilities, mobile data subscriptions and food

- Discretionary spending such as holidays and entertainment

- Child-related costs, including school fees and enrichment classes

- Costs related to elderly parents, including allowance, medical costs and care arrangements

When you add up the costs of the above, you will have a better idea of the income you would need to earn to live your ideal lifestyle.

It is essential to strike a balance between spending in pursuit of your lifestyle ideals and putting money aside for the future. To ensure your spending habits are suited to your current income, you might want to use the 50/30/20 approach to budgeting [link to 50/30/20 article].

It is essential to strike a balance between spending in pursuit of your lifestyle ideals and putting money aside for the future. To ensure your spending habits are suited to your current income, you might want to use the 50/30/20 approach to budgeting [link to 50/30/20 article].

If you find that your current income is insufficient in supporting your ideal lifestyle or retirement, here are some ways to improve your income potential:

- Lower expenditures – Review your discretionary spending to ensure you are getting maximum value for your money. For instance, switch to service providers that offer better value for money than your existing ones.

- Boost savings – Look out for ways to cut unnecessary spending, such as by cancelling unused subscriptions and memberships. You might also wish to modify your spending habits, such as by dining out less or opting for more affordable eateries.

- Optimise assets – Ensure that your wealth is poised for optimal growth. Review your risk profile and update it if necessary, and identify the best options for the money you have on hand.

- Increase earnings – Keep your eyes open for investment opportunities to earn a side income. Be strategic in your career so as to maximise your earning potential, such as by negotiating your salary, looking for areas in which you can grow and being on the lookout for new career opportunities.

- Upskill yourself – Stay up-to-date on developments in your industry and regularly upgrade your skills. This will put you in a better position to seize career and business opportunities.

- Plan for the future – Set clear targets for your savings and long-term goals such as retirement. Next, identify concrete steps to achieve them.

Knowing where you stand in terms of household income, you are now in a better position to balance this against your ideal lifestyle and saving for your retirement. Quoting the late Mr Lee Kuan Yew: “To the young and the not-so-old, I say, look at the horizon, follow the rainbow, go ride it.”

Measurements of average income enables us to split the population into deciles and see how much individual households are earning in each one. For instance, the 9th to 10th decile would make up the top 10% of earners in Singapore.

Measurements of average income enables us to split the population into deciles and see how much individual households are earning in each one. For instance, the 9th to 10th decile would make up the top 10% of earners in Singapore.

Car ownership is another major lifestyle marker in Singapore.

Car ownership is another major lifestyle marker in Singapore. It is essential to strike a balance between spending in pursuit of your lifestyle ideals and putting money aside for the future. To ensure your spending habits are suited to your current income, you might want to use the 50/30/20 approach to budgeting [link to 50/30/20 article].

It is essential to strike a balance between spending in pursuit of your lifestyle ideals and putting money aside for the future. To ensure your spending habits are suited to your current income, you might want to use the 50/30/20 approach to budgeting [link to 50/30/20 article].