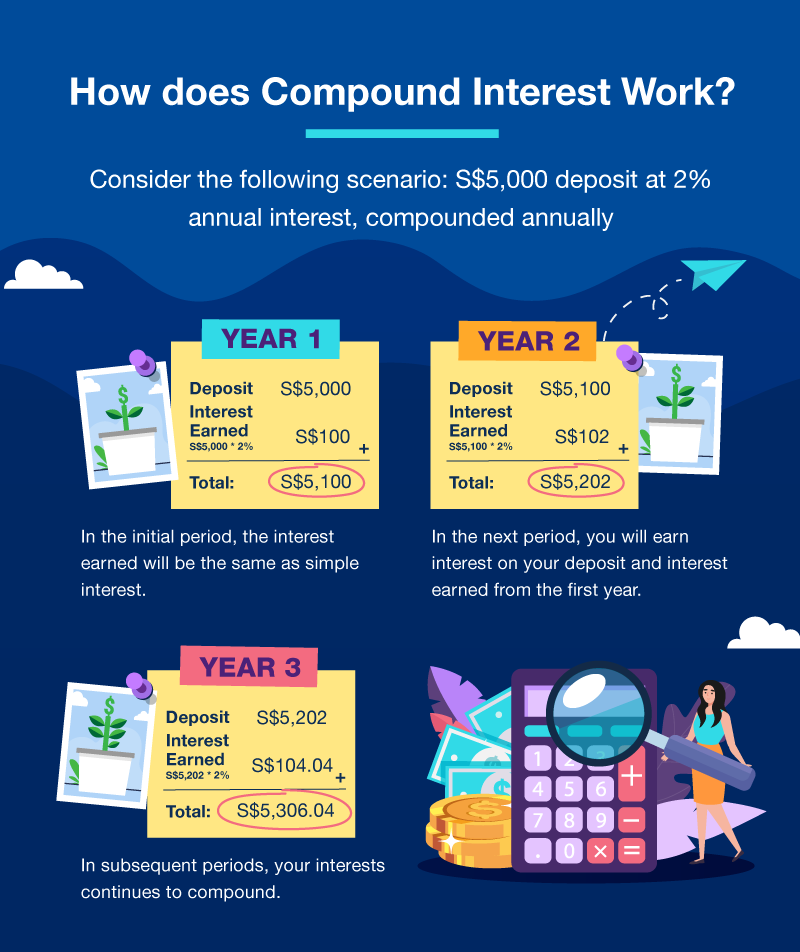

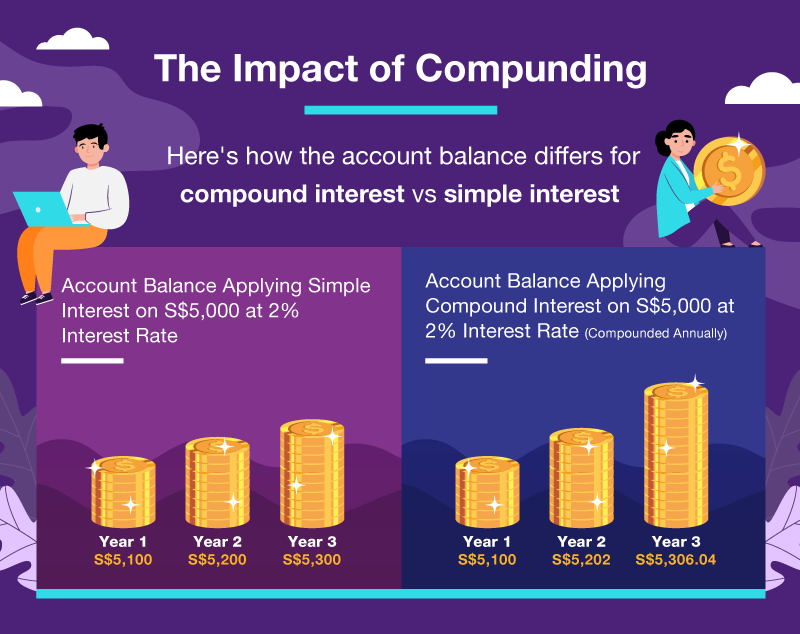

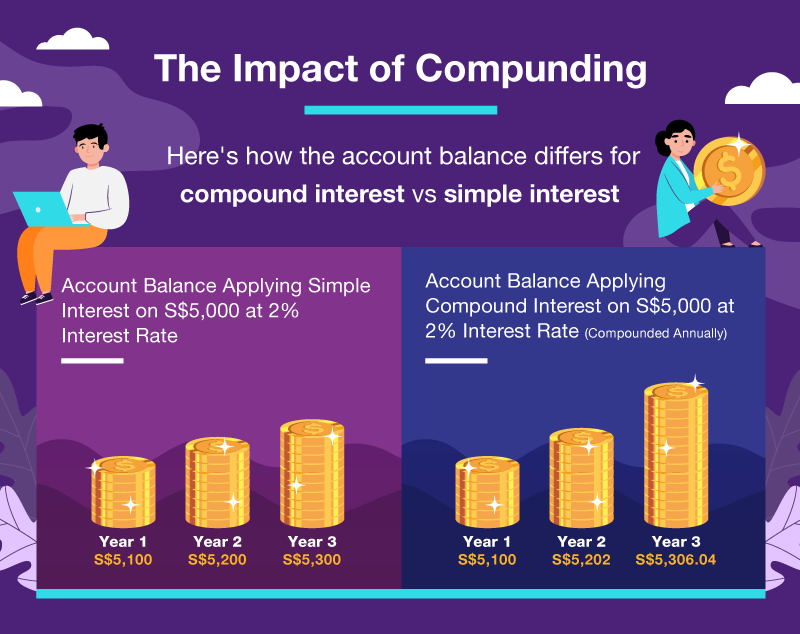

Before we get into compound interest, let’s begin by understanding how simple interest works. Simple interest is the interest calculated on the original contribution or deposit. Suppose you deposit S$5,000 that offers you 2% annual interest. At the end of the year, you would have a total balance of S$5,100, including the S$100 interest paid on your initial deposit of S$5,000. And in the second year, you’d have S$5,100 + S$100 = S$5,200, S$5,300 in the third year, and so on.

In the case of compound interest, however, the money you accumulate begins to accelerate after the first year. This is because you begin to earn interest on the interest you have accumulated in the previous years or compounding periods.

Compounding refers to a process of growth. Compound interest is interest earned on the interest that was previously accumulated. This leads to the accrual of wealth at a rate that is faster than when simple interest is applied, thus yielding significant returns over the long term. This is why particular attention is placed on compound interest for retirement planning.

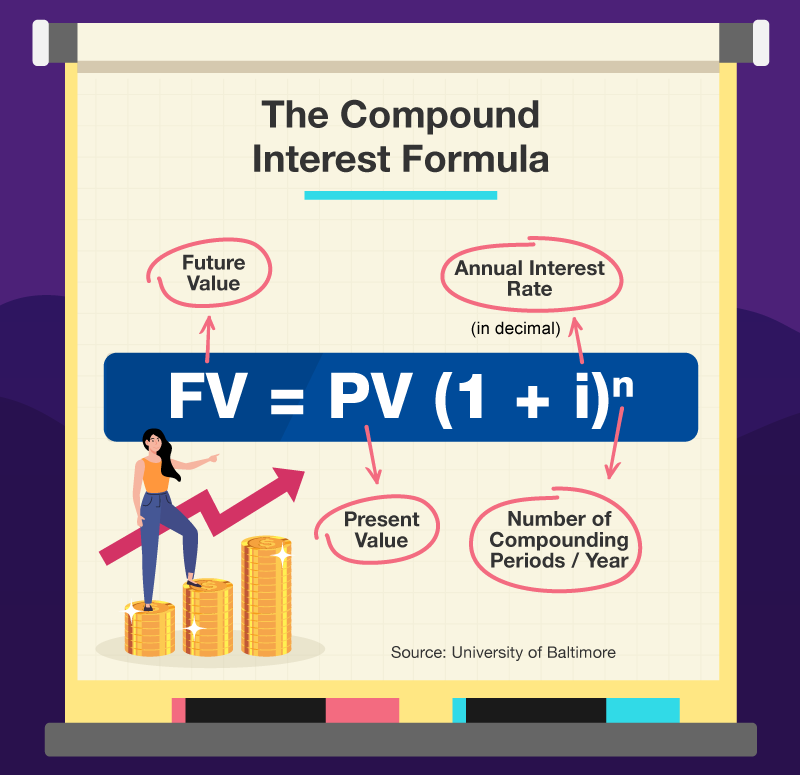

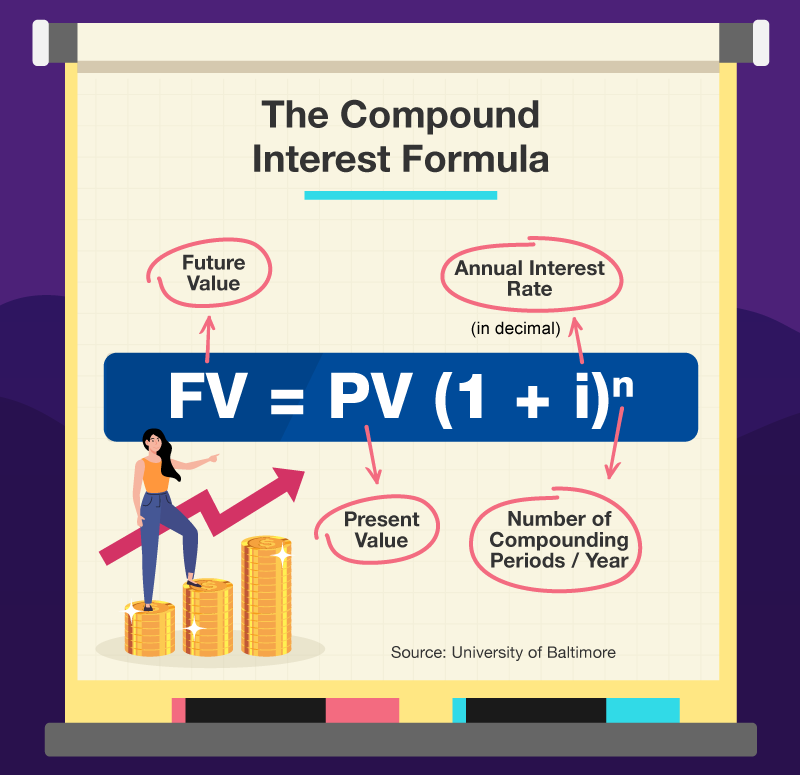

The Compound Interest Formula

The easiest way to calculate compound interest is by applying the following formula*:

The Future Value of your asset is essentially the total value of your money or total account balance, including interest, after the compounding period. The Present Value, on the other hand, refers to your initial deposit or contributions made by you. It is commonly called the principal amount or principal value. Here, it is also useful to note that the higher the Annual Interest Rate or the Number of Compounding Periods Per Year, the larger the Future Value of your asset.

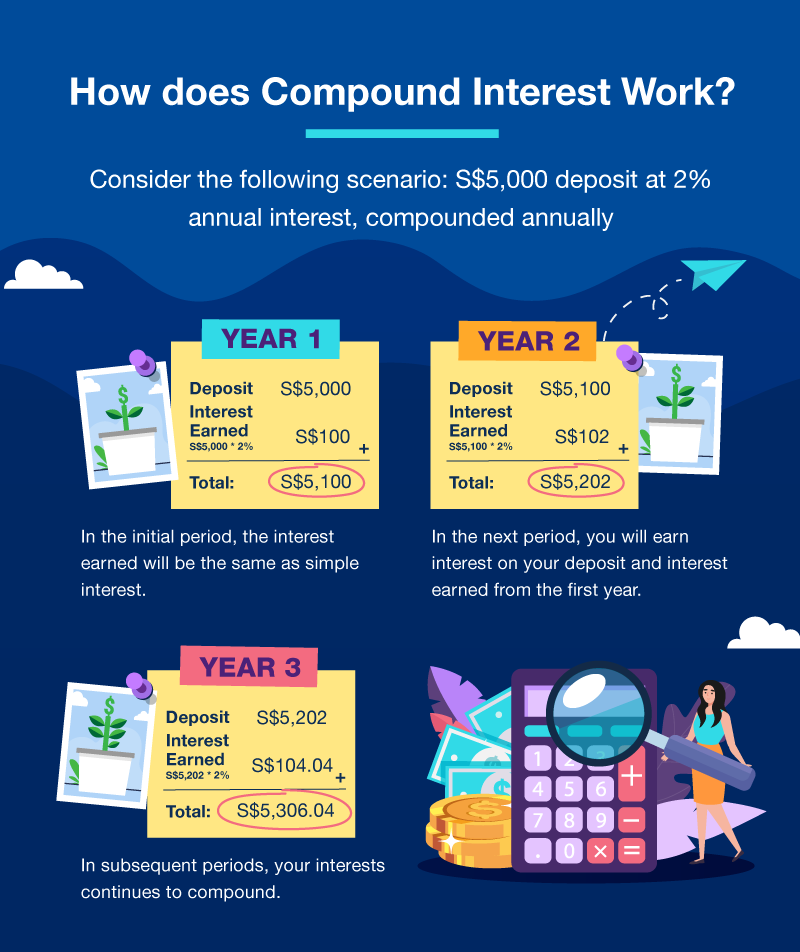

Here’s how compound interest works:

Allowing Compound Interest to Work for You

At this point, you might be wondering about how small the difference seems. This is because we have taken a simple case of annual compounding and a small deposit for a simple explanation of the concept. However, in real-life scenarios:

- You are often offered quarterly, monthly, or even daily compounding, and

- Regular deposits may be made, which then makes the difference between applying simple interest and compound interest significant.

- Also, the first few cycles of compounding typically tend to not look too impressive, but things quickly pick up after that.

With compound interest working for you, you can use your money to achieve your wealth targets. Here, the financial goal we’re looking at is retirement planning. If you start early, a key asset you will have is time. And given time, the role that compound interest can play in this process of building your retirement nest egg is huge, especially if you make regular contributions to this fund.

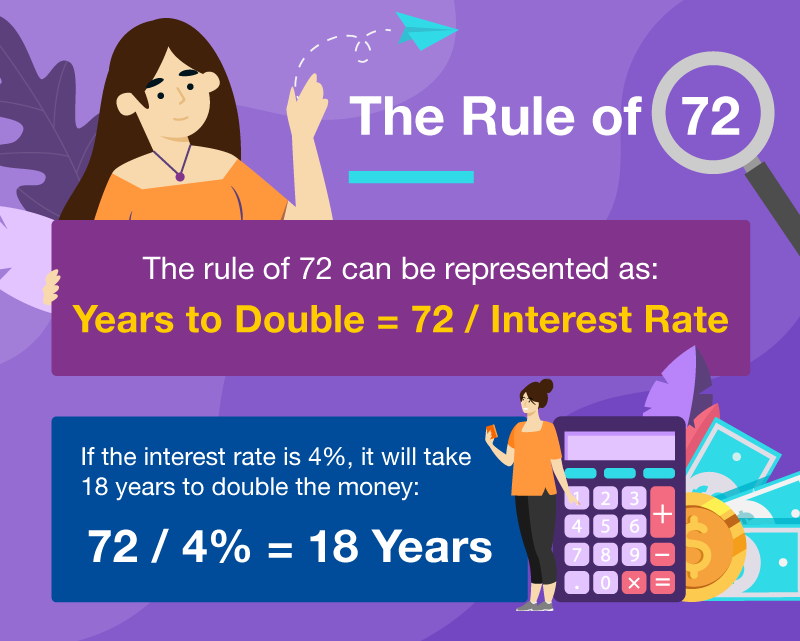

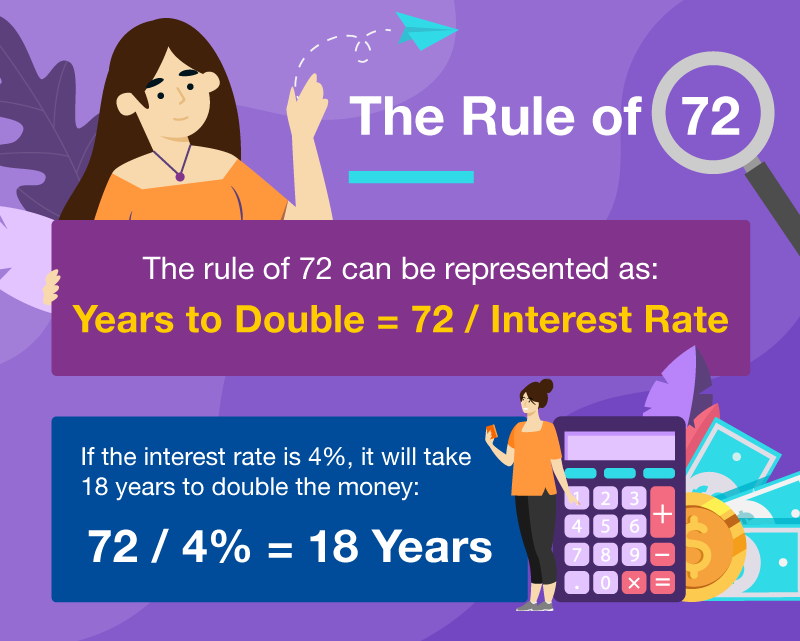

A Useful Method to Evaluate Compound Interest: The Rule of 72

As you go about comparing instruments to reach your retirement goals, you will find that not all compound interest instruments are created equal and you will need to make quick estimates about them. Here, the rule of 72 will prove to be handy. In vogue since the Renaissance, it is a useful tool to make quick estimates for compound interest. Highlighted as a key personal finance topic to understand in a book by Tom Mathews and Steve Siebold on “How Money Works,” the rule of 72 takes into account the rate at which you earn and the period of time for which you will earn at that rate to calculate the number of years it will take to double your money.

Ways to Maximise Compound Interest

1. Start as early as possible

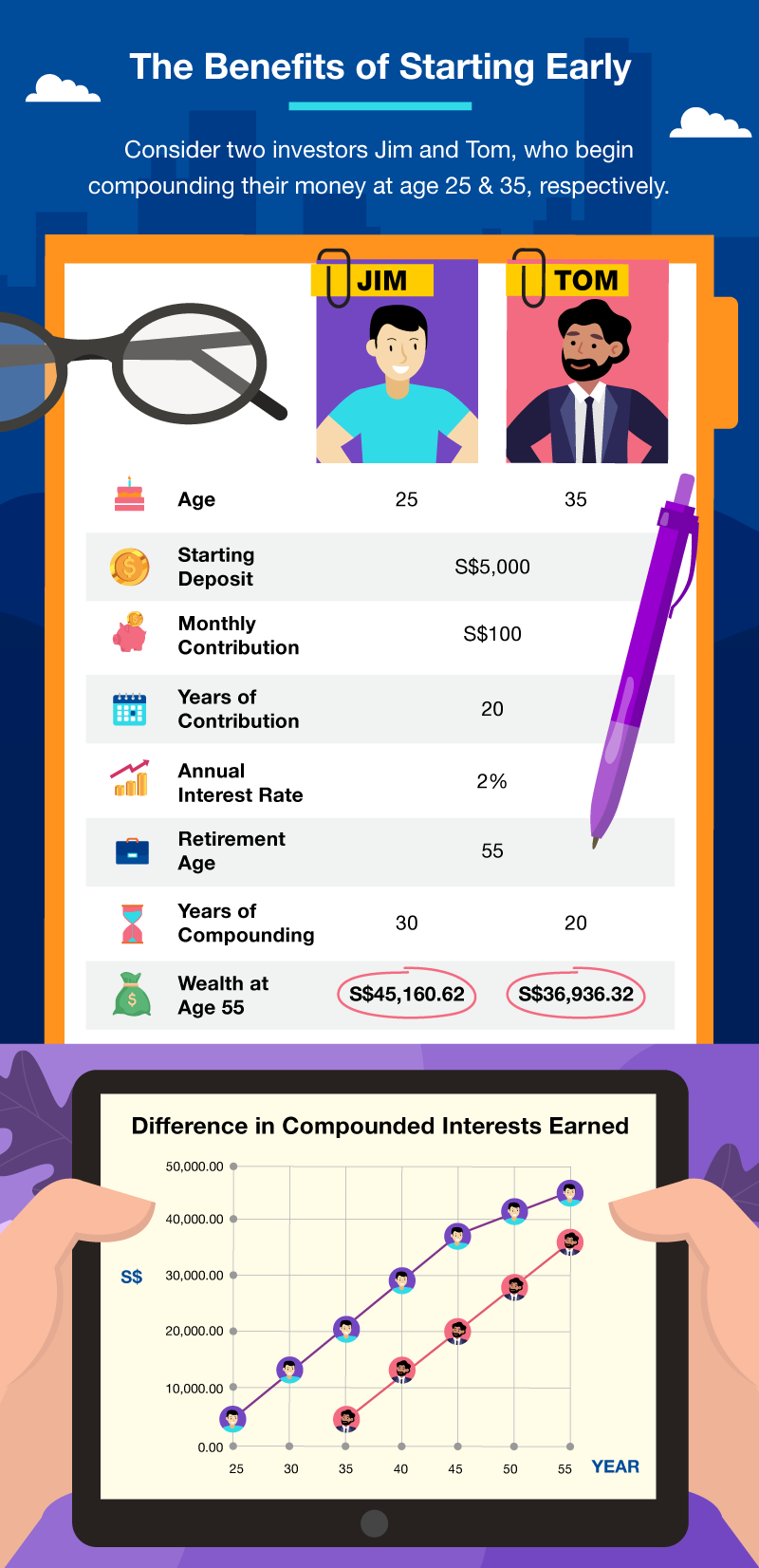

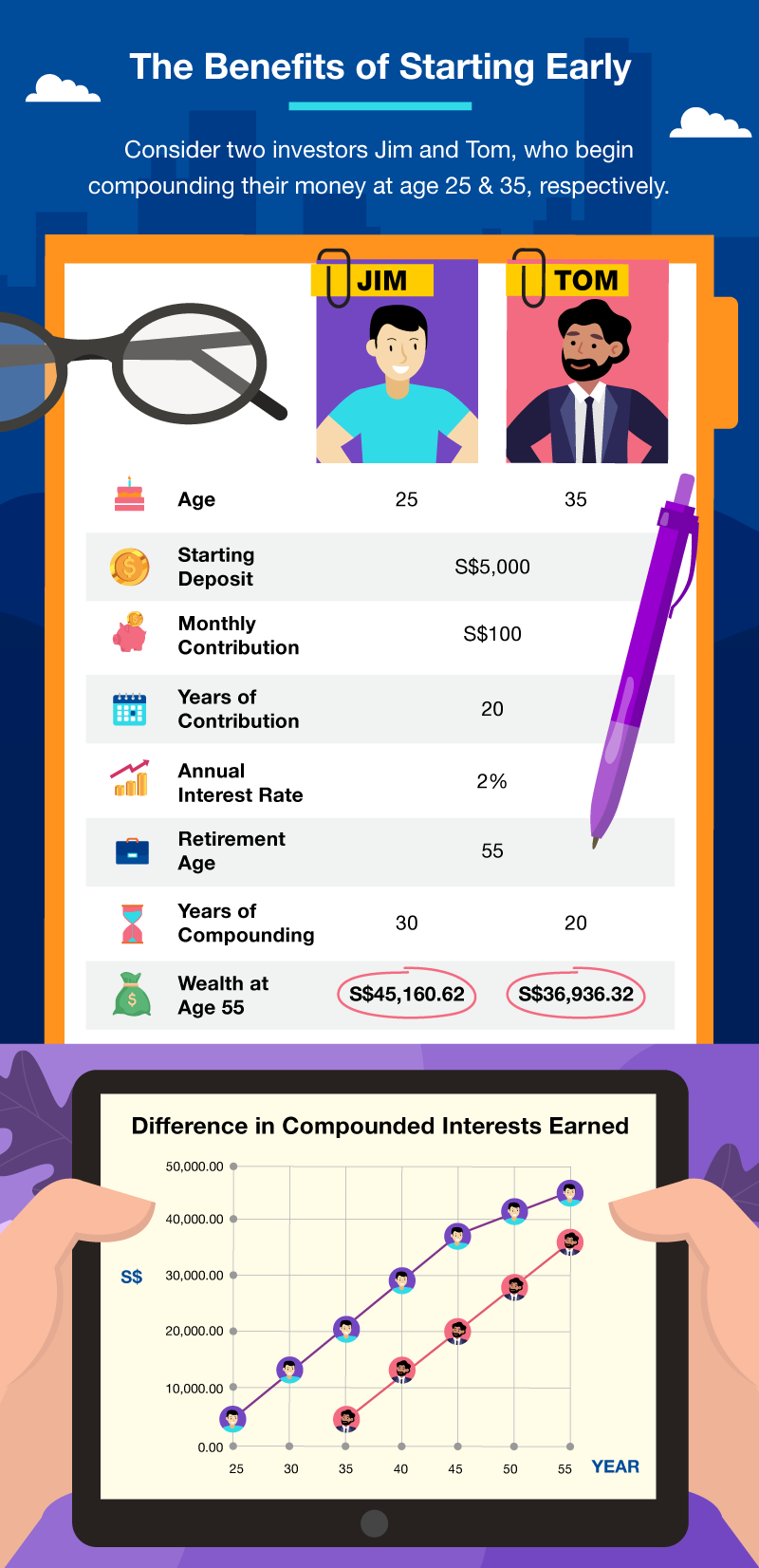

When it comes to compound interest, time truly is money. And when you start your retirement planning journey early, this kind of time is actually available to you. To understand the difference between wealth accumulated when you start early vs. later in life, consider two investors Jim and Tom, who begin compounding their money at 25 and 35 years of age respectively. They both have S$5,000 savings initially and contribute S$100 to it at the end of each month.

They are both offered an annual interest rate of 2%. Let us assume they both make contributions for 20 years and retire at 55. Here’s how their total balances will differ at age 55, having compounded their wealth for 30 years and 20 years respectively. Jim’s money is now worth S$45,106.62 whereas Tom has S$36,936.32. The additional 10 years of compound interest has created a difference in value of S$8,170.30.

2. Leverage the interest you earn

Even if you cannot make regular contributions beyond a few years, if your money is left untouched for a long period, then it can compound over that time and show significant exponential growth.

Compound interest can help immensely with building your retirement fund, if you are in a position to allow your money to accumulate over time.

3. Increase the amount you save

Yes, it’s as simple as that! Increase the amount you deposit as savings and you’ll see that your interest grows much faster. In other words, increase the principal amount or principal value. This requires no additional know-how when it comes to investment types and the like. It also does not call for any additional investment of time to follow market trends. In order to save more for your retirement fund:

4. Choose a high-interest savings account

An account that offers a high interest rate can make all the difference when it comes to saving for your retirement using compound interest to your advantage. In Singapore, a deposit account that offers you a good interest rate is the Standard Chartered Bonus$aver Account. Earn Standard Chartered’s highest interest rate of up to 2.38% per annum on the eligible balance using the Standard Chartered Bonus$aver Account. That works out to up to S$1,904 in bonus interest per year!

—

Compound interest is among the most important concepts to understand if you’re looking to save or invest your money, especially for retirement planning. It ensures that your money is, in fact, making money for you and that you’re not losing out on this additional wealth that you could be accumulating over time.

Whether you’re 30, 40, or 50, there is still time for you to take advantage of compound interest and the returns it has to offer you. The earlier you start planning for your retirement fund, the more you will benefit from compound interests. Reach out to us at Standard Chartered to begin your journey to successful retirement planning today.