Don’t have time to read the whole article? You can check out our summary below.

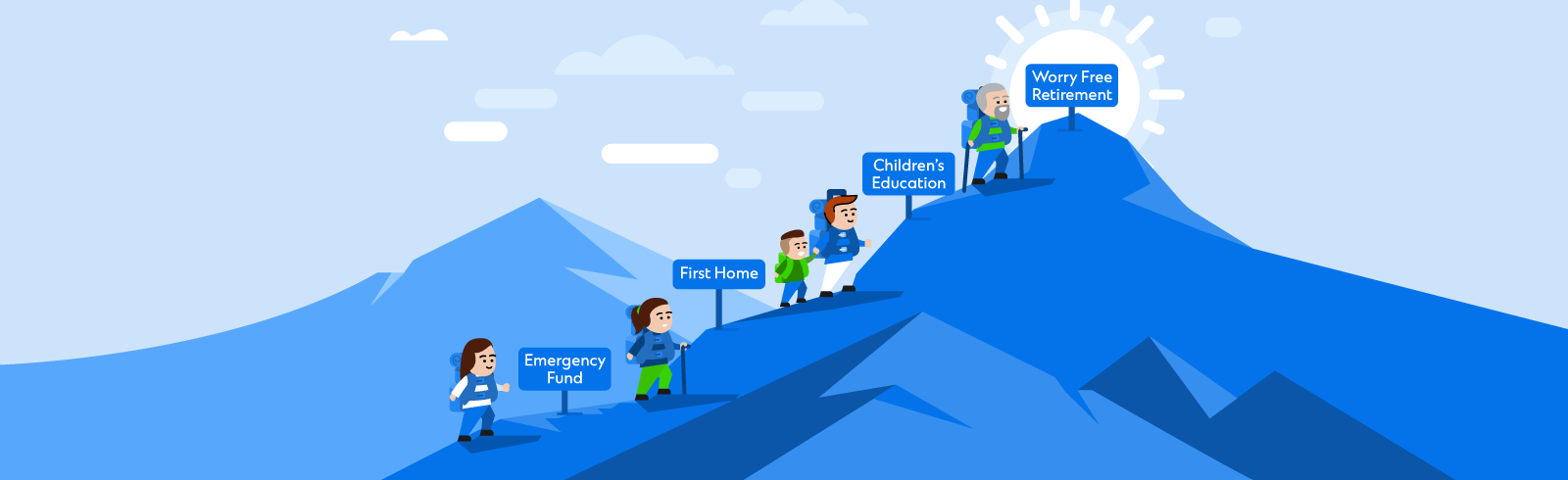

- Financial goals are always changing at different life stages, so make your financial planning an ongoing process

- While we can’t foresee everything in life, we can predict some major milestones such as home ownership, starting a family, or retirement

- The sooner you start, the longer runway you have, the less you need to commit each month to meet your goals

- Use a mix of tools and investment options to meet your goals; qualified financial advisor can help you pick the right mix of assets

Life can be unpredictable, and our goals and needs will change as we grow older. While we cannot foresee every small twist in the road, we can predict some of the biggest life needs. Home ownership, raising a family, and eventual retirement are all foreseeable needs, and we can plan for these early. The key is to ensure our financial planning is an ongoing process.

Start adulting in your 20’s

In your 20’s, your most significant advantage is time. You just stepped into the world of adulting and have a long way to retirement, and more time for your money to compound.

You may not have reached your full earning potential yet; and this may limit how much you can save; however, you can always start small and adjust as your income increases. As you step into adulting, you should focus on:

1. Building an emergency fund

An accessible emergency fund is used to cover unexpected costs, from job losses to medical bills. Try to set aside a small amount of your salary – such as around 20% – to build up this fund. A good amount to aim for is six months’ worth of expenses. This will minimise your need to borrow money, should an emergency occur.

When you don’t need to rely on personal loans or credit cards, you will save money on interest repayments.

2. Securing financial protection early

Protect your savings through insurance policies, such as life insurance, health insurance, disability insurance, and critical illness policies.

It is almost always cheaper to buy insurance when you are young and healthy so try to lock in the best insurance options while you can.

Insuring yourself also provides protection for your dependents. Reason being, in the unfortunate event that you cannot work/get disabled/die, there will be a pay-out and you will not be a financial burden to your loved ones.

3. Tackling high-interest debts

Most likely it is your first time to have access to credit cards and personal loans. Whilst many credit cards offer merchant discounts and rewards to encourage usage of the card, build a good habit to always pay off on time and in full. Notwithstanding that many retail stores are extending credit nowadays, allowing you to purchase clothes, phones, and other items but paying later (some even interest-free).

It is best to stay disciplined and avoid borrowing; but if you must borrow, make sure you identify the right credit facilities for yourself. You should:

- Compare the interest rates being charged, as some credit facilities are cheaper than others. Personal loans often offer lower interest rates than credit cards.

- Some lenders charge much higher interest rates than others. For example, “payday lenders” for short-term loans often charge much higher interest than most banks.

- Loans for specific purposes tend to be cheaper than generic lines of credit, or personal loans. It is often cheaper to get a car loan for the specific intent of buying a car, than to buy a car with generic personal loans.

Never take a loan where you don’t understand the repayment terms.

In the event you have incurred debts, always focus on paying off the higher-interest loans first. For example, if you have a credit card loan that is at 26% interest, and a personal loan at 6% interest, you should aim to pay off the credit card before the personal loan. You can also consider refinancing high-interest loans, to save money on interest repayments. Securing a lower refinancing rate reduces your cost of borrowing so you’ll pay less interest on your loan.

4. Start a long-term investment plan

The sooner you start investing, the less you need to set aside monthly to reach your financial goals. This is because you will earn interest-on-the-interest, via the magic power of compounding.

Consider what happens if you set aside $500 a month for 20 years. We will assume returns of around 4% per annum. The eventual amount comes to $225,818.

But what if you were to save only for 10 years? For simplicity’s sake, we assume the same 4% per annum. This results in roughly $102,086.

If you want to accumulate the same amount in 10 years as in 20 years, you still can catch up; but then you would need to set aside more than double the amount, at around $1,106 per month. This could be a challenge, as with other obligations at a later age, like covering your children’s education, paying for your property mortgage, and looking after your elderly parents. So, the sooner you start investing and saving, the less you will feel the pinch.

Dealing with major life changes in your 30’s

Most people see their major financial decisions occur in their 30’s. This is commonly the age where people get married, obtain their new home, see the birth of their first child, etc. You should aim to:

1. Prepare for your property down payment

Lenders usually don’t loan you the entire amount needed to purchase a property. In most cases, lenders will finance only a percentage of the property price; this is commonly known as the loan quantum, or the Loan to Value (LTV) ratio).

For example, an LTV ratio of 75% means the lender can loan up to 75% of the home price (in some markets, this could be the purchase price or current market value whichever is lower); so, you could borrow up to $487,500 for a property that costs $650,000. This would make the required down payment $162,500.

Do check out this article (Read: 5 key tips for buying property as an investment or a home) for more details on purchasing your home.

Based on the expected purchase price of your dream home, formulate a plan to meet the estimated down payment. You could set aside money in an endowment plan with a targeted return, enough to meet the down payment in 10 years.

2. Plan the cost of your children’s education

Education costs can differ significantly, depending on where your child will be studying at. Studying abroad in the United States, for instance, can cost around US$14,000 to US $31,000 per year, so a typical three-year degree can come to as much as US$93,000. This is before adding other essential costs, such as lodging, food, entertainment, etc.

Besides this, do check if there is a higher cost for specialised courses your child is interested in; these may require an additional year of study, or may have higher tuition fees (these vary between institutions, so it’s best to check with the specific school).

Local education tends to be lower in costs, as citizens usually have subsidised fees when studying in their home country. Nonetheless, when planning for your children’s education, it is best to assume the higher end of the fees. That is, plan in case your child does not receive grants or policy changes with time.

There are several ways to plan for these costs. One method is to use targeted savings plans, such as endowment plans, to try and cover one aspect of the costs, for example, all the tuition fees.

3. Identify high-cost, short-term goals

In your 30’s, you may face some one-off necessities that bring about high costs. Some typical examples include:

- Paying for your wedding

- Purchasing a car

- Further education for career advancement

As far as possible, try to save up aggressively for short periods to cover most or all the costs.

As a rule of thumb, try to keep to the 50-20-30 budget rule when preparing for these goals. This rule suggests that 50% of your monthly income can go into needs, while 20% goes into savings; you can do as you please with the last 30%.

If you are going to take on debt for your wedding, car, or other costs, try to borrow such that your monthly expenses would not exceed the allotted 50% of your monthly income.

4. Review insurance policies to match new situations

Most people will find their insurance needs have changed significantly from their 20’s. In your 30’s, consider buying insurance protection for your children, while they are young. As explained above, insurance policies are almost always cheaper for younger persons.

This aside, you should check that your ageing parents are well-insured. Otherwise, you may need to plan top-ups to their insurance or savings funds to compensate.

You should also consider raising your life insurance and critical illness coverage if your family situation has changed, for instance, if you have new additions to the family or if your spouse has stopped working.

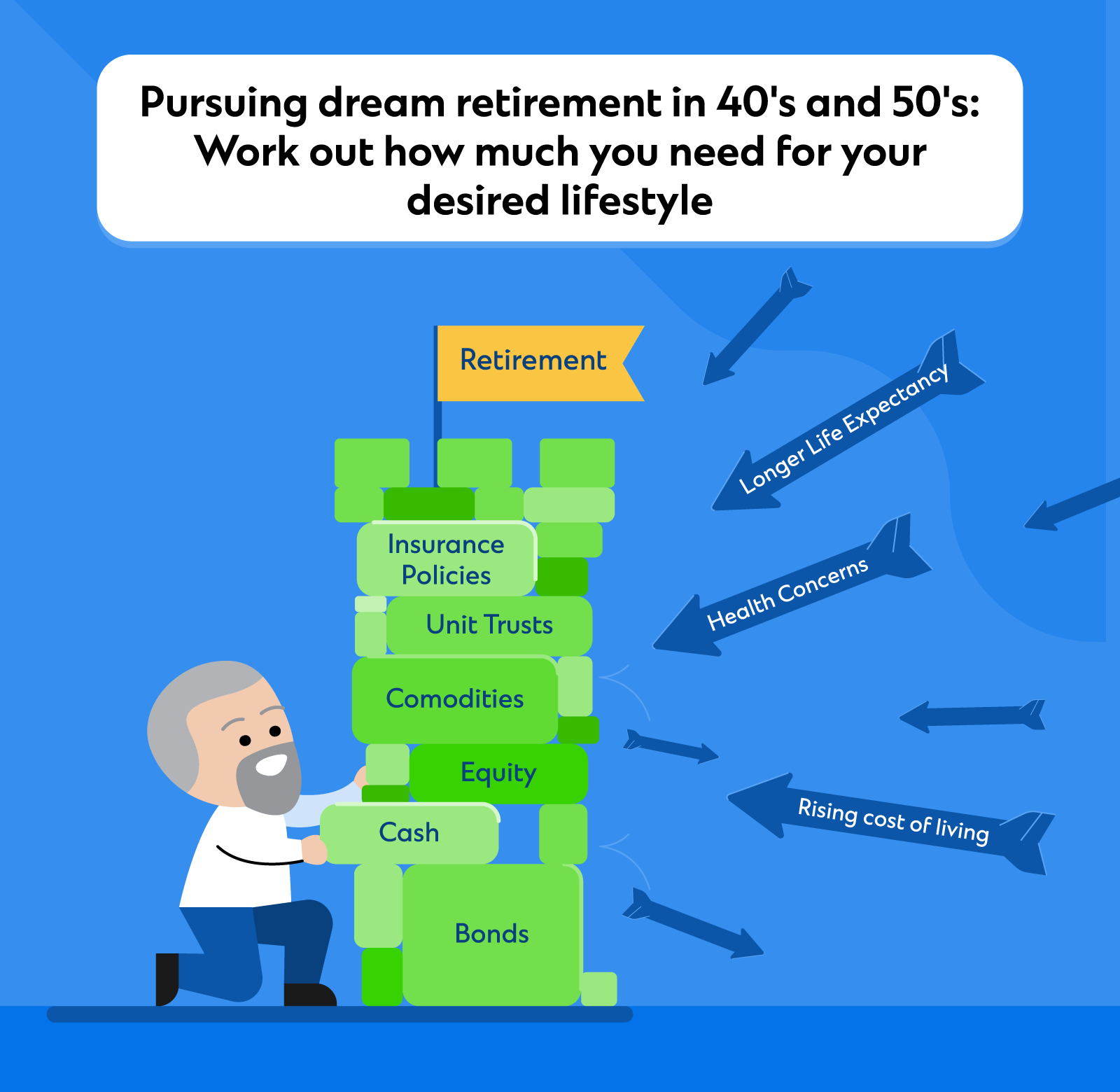

Pursuing dream retirement in your 40’s and 50’s

At this stage in your life, you should begin preparing for retirement, or semi-retirement; remember that even if you choose to keep working past your 60’s or 70’s, your income may be lower than before.

At this stage, you should revise or work out your desired Income Replacement Rate (IRR). IRR is the percentage of your income that you want to retain, should you stop working. For example, an IRR of 70%, if you currently earn $3,500 per month, would mean $2,450 a month after retirement (not considering inflation). Based on this amount, you can approximate the total amount needed for retirement. For example, if you want $2,450 per month, from the retirement age of 65 till you reach 90 years old, you will need $735,000 ($2,450 per month for 25 years).

Note, however, that this is just an approximate figure, not accounting for factors such as inflation, or added costs from lifelong dependents.

Look up this article for different suggestions to contribute to your retirement plan.

Have a long-term financial plan, but don’t be afraid to make changes

Don’t feel a need to conform too rigidly to the financial goals you have right now. It is normal for priorities to change at different life stages.

Financial plans must be adaptable to cope with these changes; some of which are more foreseeable than others. Seek out a qualified financial advisor who can personalise a financial plan according to your short and long term needs and suggest suitable solutions to meet those goals. Speak to Standard Chartered’s Relationship Managers or visit any of our branches to learn how to manage and grow your wealth today.

This article is for general information only and it does not constitute an offer, recommendation or solicitation of an offer to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This article has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice or an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any person or class of persons. You should seek advice from a licensed or an exempt financial adviser on the suitability of a product for you, taking into account these factors before making a commitment to purchase any product or invest in an investment. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether the product or service described herein is suitable for you.

You are fully responsible for your investment decision, including whether the investment is suitable for you. The products/services involved are not principal-protected and you may lose all or part of your original investment amount.

Standard Chartered Bank (Singapore) Limited will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of information in this article.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. For clarity, these investment products are not deposits and do not qualify as an insured deposit under the Singapore Deposit Insurance and Policy Owners’ Protection Schemes Act 2011. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

The information stated in this article is accurate as at the date of publication.