View your outstanding bill amount and make instant or automatic bill payments using either your bank account or credit card to the following billers:

- Etisalat (All services)

- du (All services)

- Dubai Electricity and Water

- Authority (DEWA)

- RTA Salik

- Sharjah Electricity and Water Authority (SEWA)

- Abu Dhabi Distribution Company (ADDC)

- Al Ain Distribution Company (AADC)

- Direct Debit

Access up to date information on the following types of accounts using this service.

- Savings Accounts

- Current Accounts

- Term Deposits

- Loan Accounts

- Credit Cards

Enjoy the convenience of transferring money to other accounts locally and internationally through Online Banking anywhere, anytime.

- Transfer money between your own accounts or other accounts with Standard Chartered Bank UAE.

- Transfer money to other accounts locally or internationally with other banks

All your Credit Card needs are now taken care of at the click of a mouse.

- Pay your Credit Card online

- View your Credit Card transactions

- Online Reward Redemption

- Credit Card PIN Generation and Change

You can now update the following details wherever you are, with our convenient new feature in Online and Mobile Banking service.

- Personal Details

- Contact Details

- Personal Identity Documents

- Other Details

View balances across selected Standard Chartered accounts worldwide. You can link accounts in up to 5 countries to your Online banking and Mobile banking account and access using the Online Banking Username and Password of the selected country.

- Balance enquiry

- Loan details enquiry

Pay your credit card bills of any bank in the UAE via Online banking or Mobile banking .

Pay your Visa or MasterCard credit card bills of any bank in the UAE via Online Banking or mobile banking .

- Bonus Saver - Classic

- Bonus Saver - Executive

- Bonus Saver - Premium

- Call Deposit

- Individual MMDA

- Fixed Deposit/Saadiq

- Term Account

- XtraSaver

View your portfolio or analyse your risk tolerance with our online tool and plan your investments.

Your Online Banking mail box can be used to send and receive emails from the bank.

- Subscribe to eStatements

- Subscribe to SMS alerts

- View FX rates

- SMS PIN Registration

- Separate Tabs for Conventional and Islamic Banking products

- Contact Details and Address Change

- Debit Card PIN Change

- Create nicknames for accounts, cards and loans

- Change Funds Transfer Limit

- Customise your alert settings to select your preferred notification mode.

If you are an existing online banking user, simply login now and start enjoying the benefits of digital banking.

Login Now

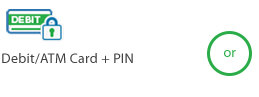

You will need one of the following to instantly register:

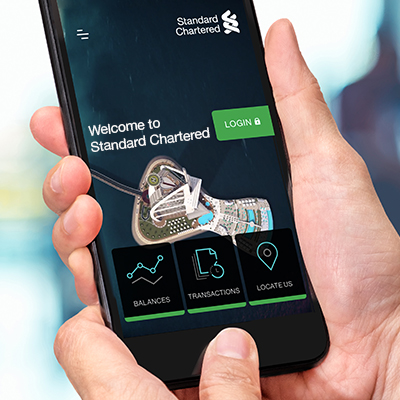

With Standard Chartered Mobile Banking, view transactions and balances pre-login. With an easy to navigate menu, we have made banking with us simpler, faster and better.

Know More

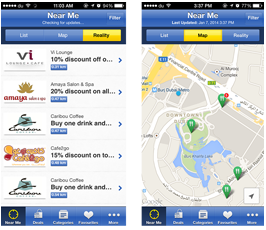

Wouldn't it be great if you could find attractive offers that are not only relevant to what you actually enjoy, but are also nearby? Whether you are en route to work and want to grab a coffee, planning for a nice dinner or simply want to indulge in a spa session - Standard Chartered Mobile Banking "The Good Life" is all you need.

Download Now

Pay your credit card bills of any bank in UAE from Online Banking.

Pay your Visa or MasterCard credit card bills of any bank in UAE from Online Banking.

1. What is Pay-Any-Card service about?

Pay all your other bank (local UAE bank) credit card bills within Standard Chartered Online banking. Any Credit card with any local banks are acceptable. Card payments can also be performed through Standard Chartered Mobile Banking anytime, anywhere

2. Who is Pay-Any-Card for? Who is eligible for it?

Pay-Any-Card service is only available to Standard Chartered Online Banking customers who hold a Current or Savings account with us. If you're an existing Standard Chartered customer without an Online Banking ID, simply register and be on your way to use Pay-Any-Card service.

3. Do you need to register for Pay-Any-Card service?

You will need to register the payee credit card through Online Banking and you will be able to pay your Non Standard Chartered Bank credit cards (within UAE)

4. Do I have to pay to use this Pay Other Bank's Credit Card service?

Local transfer fees will apply.

5. How do I access Pay-Any-Card service?

You can access this service by:

1.Log in to Online Banking with your username and password

2.Click "Transfers" on the left menu panel

3.Select "Local Transfers" and click on "Add Beneficiary"

4.Select "Local Bank Credit Card" from the beneficiary Type drop down list

5.Fill in the relevant Payee Details, navigate through the setup screens and you are done, your credit card beneficiary has been added.

6. What are the types of Standard Chartered accounts I can pay from?

You can pay from a Standard Chartered Current or Savings account

7. What are the types of Credit Cards I can pay to?

You can pay to any Credit Card issued in the UAE only.

8. Is there a limit on the amount I can pay other Bank's Credit Cards?

Yes. The maximum payment daily and per Pay-Any-Card instruction limit is AED 100,000.

9. How do I know if the payment request has been submitted successfully?

You can check the status of your payment request by:

1.Logging into online banking

2.Under Payments & Transfers > Payments / Transfers History

3.Check if the status is "Successful" or "Rejected"

10. What if the Visa or MasterCard is issued in a foreign currency?

For credit cards issued in a foreign currency, the transferred amounts will be in AED and will be converted into the applicable foreign currency by the Beneficiary Bank at its prevailing exchange rate.

11. What if I provide an inaccurate account number or submit a wrong payment amount?

You have to ensure to provide the accurate number of the Beneficiary Card and the accurate transfer amount. Standard Chartered Bank (UAE) is not responsible for an erroneous credit if an erroneous Beneficiary Card number and/or transfer amount is provided by the user, and the Bank shall not be liable to reverse such erroneous credit to the Beneficiary Card.

12. How long will it take for the funds to be credited to my other Banks' Credit Card account?

Standard Chartered Bank (UAE) shall endeavor to send the transferred amount within 24 hours of the Pay-Any-Card instruction, however the Bank is not responsible for the period within which the proceeds are received by the Beneficiary Bank and credited to the Beneficiary Card. Pay-Any-Card instruction initiated on public holiday will processed on the next working day.

- Subscribe to eStatements

- Subscribe to SMS alerts

- View FX rates

SMS PIN Registration

Customers that need to register by giving a written request at the branch (SME Customers and Joint Account Holders) will be sent a temporary ID via email and a temporary password via SMS. These credentials should be used when logging in for the first time. Customers will then be able to choose their permanent username and password.

Separate Tabs for Conventional and Islamic Banking Products

Your accounts, credit cards and loans will be viewable in separate tabs based on whether they are Islamic or conventional products. This will make it convenient for you to see consolidated view of the portfolios you hold in each product category.

Debit Card Activation/ PIN Set

Should you require to activate your debit card, you may do so easily through Online or Mobile Banking. This feature is available under "Help & Services”.

Debit Card PIN Change

Should you require to change your debit card PIN, you may do so easily through Online or Mobile Banking. This feature is available under "Help & Services".

Contact Details and Address Change

Contact details and address information can now be updated at a click of a button. Just login to Online Banking and update your details. This option is available under the "My Preferences" tab.

Please note that this option only allows you to update your current details - excluding mobile number change. In case you need to add any additional details to your profile, please contact our 24-hour Phone Banking team on (+971) 600 5222 88 for assistance.

All your Credit Card needs are now taken care of at the click of a mouse.

- Activate your Credit Card and Set up a PIN by logging in and selecting "Help & Services"

- Make payments towards your Credit Card

- View your Credit Card transactions

- Online Reward Redemption

Credit Card PIN Generation and Change

Whether you wish to generate or change your credit card PIN, you can do so easily through Online or Mobile Banking. Simply login and select "Help and Services".

You can now update the following details wherever you are, with our convenient new feature in Online and Mobile Banking service.

Personal Details*:

- Date of Birth

- Nationality

- Country of Birth

ID Document Details*:

- Passport

- Visa

- Emirates ID

Contact Details:

- Email address

- Phone numbers

- Addresses (Residential, Office and Permanent)

Other Details:

- Qualifications

- Marital status

- Employment Type

- Login to Online or Mobile Banking and click on Profile tab in Online or Mobile Banking

- Enter 1st OTP once received on your registered mobile phone

- View and amend your profile information

- Review changes made to your profile

- Enter 2nd OTP once received on your registered mobile phone

- A confirmation text and email will be sent to you within 2 working days to confirm changes

*Subject to successful submission of your ID documents as documentary proof. You may submit your valid document(s) in JPEG, PDF or PNG files in a clear and legible format. Updated details may take up to 2 working days to reflect on your account profile.

Access up to date information on the following types of accounts using this service.

- Savings Accounts

- Current Accounts

- Term Deposits

- Loan Accounts

Request for a cheque book for your existing Current Account(s)*

View and download your transaction history for your bank account(s) for up to the last 180 days.

Check the status for cheques issued on your account(s)

*Please ensure that your residency visa and mailing address are updated with us before placing a cheque book request through Online Banking. You may call our 24-hour Phone Banking team on 600 5222 88 from within the UAE or on +971 600 5222 88 from outside the UAE to check if you have your latest residency visa and mailing address registered with us. Your cheque book will be delivered to your mailing address within seven working days subject to clearance from the bank. Should your file be incomplete or outdated, we will contact you in the following two working days. For cheque book charges, please refer to the latest Service and Price Guide.

Enjoy the convenience of transferring money to other accounts locally and internationally through Online Banking anywhere, anytime.

Funds Transfers to Own Accounts

- Own Accounts Funds Transfer

- Transfer money instantly between your own accounts with Standard Chartered Bank UAE.

- No beneficiary addition required.

Funds Transfer to other Standard Chartered Bank UAE Accounts

- Internal Funds Transfer

- Transfer money instantly to anyone else who has an account with Standard Chartered Bank UAE.

- To do this you will first need to add the account as a beneficiary on Online Banking. This can be done instantly.

- Choose the e-mail alert option to send a confirmation alert to the beneficiary's e-mail address each time you send money to his/her account.

Local Funds Transfers to Other Accounts

- Local Funds Transfer

- Transfer money locally to accounts held with other banks in the UAE.

- To do this you will first need to add the account as a beneficiary on Online Banking. This can be done instantly.

- Your funds transfer requests are processed instantly (when submitted within the currency cut-off time)

- Enjoy a lower fee on funds transfers that you make through Online Banking.

* For more information on fees, please refer to the service and price guide available on the website www.sc.com/ae

International Funds Transfers

- International Funds Transfer

- Transfer money internationally to accounts held with banks outside the UAE

- Extensive network of banks that you can make transfers to: 23,000 banks across 200 countries in over 25 different currencies!

- Enjoy a lower fee* on funds transfers that you make through online

- To make a funds transfer, you will first need to add the account as a beneficiary on Online Banking. This can be done instantly.

- Your funds transfers are processed on the same day (when submitted within the currency cut-off time)

- For transfers to India, UK and USA you may be required to enter the IFSC code/SORT code/Routing number respectively, of the beneficiary account. This is to be mentioned in the "Payment Reference" field while executing a funds transfer.

* For more information on fees, please refer to the service and price guide available on the website www.sc.com/ae

Click here for fund transfer currency cut-off times

View your outstanding bill amount and make instant bill payments using either your bank account or credit card to the following billers:

- Etisalat (Wasel Prepaid, GSM Postpaid, Fixed Landline, eLife*, eVision, Al Shamil and Dial-up Internet)

- du(all services)

- RTA Salik

- Al Ain Distribution Company (AADC)

- Abu Dhabi Distribution Company (ADDC)

- Dubai Electricity and Water Authority (DEWA)

- Sharjah Electricity and Water Authority (SEWA)

*Note: Etisalat Single Play eLife subscribers will not be able to process a payment through Online Banking. To ensure timely payment of your Single Play eLife bills please visit your nearest Etisalat branch or stand.

a one time payment of my utility bill?

- Login to Online Banking and click on "Payments"

- Select the required Biller Type and Biller Name, and click on "Pay bill"

Examples

- To recharge your Etisalat prepaid mobile:

Select "Etisalat" as the Biller Type and "Wasel Recharge" as the Biller Name.

- To pay your DEWA bill:

Select "Electricity & Water" as the Biller Type and "DEWA" as the Biller Name.

- To top up your Salik account:

Select "RTA" as the Biller Type and "Salik" as the Biller Name.

- Type in the Mobile number / Telephone number / Utility Account Number / Contract Account Number depending on the biller.

- Pay your bill

How do I register my bill payees?

To avoid typing in your biller and bill details every time you pay, register your biller as a bill payee:

- Login to Online Banking and click on "Pay Bills".

- Select the "Add Biller" tab

- Select the required Biller Type and Biller Name, and click on "Next" to add your biller as a bill payee.

- Within two working days your biller will be displayed under the "Pay Bills” option for easy access to make future payments.

The next time you want to make payment to a registered biller follow the following steps:

- Click on “Pay Bills”

- Scroll to your list of “Registered Billers” and select the bill you with to settle by clicking on “Pay”

- Enter your payment details and confirm the transaction.

- Done

How do I setup a regular payment of my bills through Auto Payments? (Please have a wording here that says “NEW”)

An auto payment of your bills is designed to save you time when settling your bills. You do not need to remember due dates as our smart system does this for you and initiates payment as required. To setup an Auto payment you will need to follow the following steps:

- On your “Registered Biller” page, after selecting the bill you wish to pay, click on the “ Do you want to setup a recurring payment” option

- Select the “Recurring Bill amount”, “Frequency”, “Recurring payment date” and click on next.

- Confirm your setup

On the set date/frequency your bill will be settled automatically in accordance with the instruction you have set. Details of your recurring bill payments are displayed under the “View Standing Order” option.

Automatic Bill Payments cover all Post Paid billers and include Etisalat, du, DEWA, SEWA, AADC and ADDC

Auto payments of Pre-Paid billers will include SALIK and is smart in nature as it allows you to set a lower threshold on your SALIK balance and then does the automatic top up for you. You do not need to log in to trigger payment to RTA SALIK.

Where can I find the utility account number/premise number on my bill?

Click on the links below and view sample bills of billers to help you locate the utility account number / premise number.

The UAE Direct Debit System (referred as Direct Debit System, DDS or UAEDDS), is an initiative launched by the UAE Central Bank to provide a wider range of services to clients. This set up will cater to non-finance services such as utility bills, school fees, merchant and bank/finance related payments.

This payment method has been developed keeping client convenience and security in mind and will now enable clients to make payments to a number of Originators (also referred to as Billers/Merchants). With this payment initiative you can say good bye to the conventional issuance of cheques and late payment fees as clients can now authorize their Billers/Merchants to pull the funds automatically from their accounts or credit cards on a pre-defined frequency/date.

Standard Chartered Bank has further simplified this method of payment by allowing our clients the ability to setup a request through Online Banking. All you need is your user name and password to log in

Ease of payments through Direct Debits:

Direct Debit allows clients to set fixed or variable amounts for their payment as per their requirements. The following gives you an example of how helpful setting up a Direct Debit request can be:

Electricity Bill Payment

Example 1: Fixed Payment

You can setup a request to pay property rent/maintenance charges on a predefined frequency (daily, weekly,monthly, quarterly or yearly ). Normally, you would select this option when you know exactly what your monthly bills will be. All you need to do is select your biller, the amount and the frequency of your payments. No need to write 1, 4 or 12 cheques each year, you can set the payment period and frequency based on your requirement.

Example 2: Variable Amount

In the case of a post-paid mobile or electricity bill, the amount charged every month depends on your monthly consumption. The Direct Debit service is tailored in such a way that you can choose and select the minimum and maximum amount of payment. . If the amount is within the range you defined, the funds will be transferred automatically to the service provider without you needing to remember to make a payment. No more late payment charges.

Tips: No idea of what your bill amounts will be?

Select variable amount and keep your Minimum and Maximum amounts as “0”. This will ensure that your billed amount will be paid each month.

It is easy and convenient to setup your Direct Debit request. All you have to do is log into Online Banking and setup your request using the “UAE Direct Debit setup” link which can be found in the service menu on the left side of the Online Banking portal post login. . No more trips to the biller/originator offices to make payments. Use Online Banking and rest assured that bills and payments will reflect on time each month or at a frequency selected by you.

We recommend choosing a start date close to your billing date in order to avoid late payment fees from your biller.

For more information on Direct Debit and its setup please click here

- Who can apply for this service?

If you hold any (or a combination) of the following products from Standard Chartered, you can register for the service for free:

- Savings Account

- Current Account

- Credit Card

The service is offered for individuals and sole proprietorships.

- Why should I use Online Banking?

- It's easy to apply for, easy to use and best of all, it's FREE!!

- It's your own bank - you have instant access to real time information on your banking, credit card and loan accounts. This apart, you can access information on our full range of products and services at the click of a mouse. Rest assured it is personalised to meet your requirements.

- It's safe and easy - using your unique login ID and Password, you can now bank with confidence, knowing that your transactions remain safe. With our simple and easy to use navigational toolbars, you will realise how easy it is to browse the site.

- It's convenient - you can perform secure electronic banking right from the comfort of your home or office through the internet.

- It's open 24 hours - with Online Banking, you can access your accounts day and night - no need to wait for your monthly account statements or limit your banking to branch timings. You can even access it on bank holidays in effect 365 days a year.

- No special software is required - You don't need to purchase any special software. As long as you have a PC with the minimum configuration for internet browsing / surfing, you are ready to start.

- Wide range of services - Our wide range of Online Banking services will help you better manage your finances. Moreover, we will progressively add more services for your convenience, so remember to let us know what else you would like.

- How can I register for Online Banking?

- If you have a deposit account (e.g. Current account or Savings account), you can register for Online Banking instantly using your registered mobile number and one of the following combinations:

1. Your Account number and Telephone Identification Number (TIN)*

2. Your ATM/Debit Card number and ATM PIN.

- If you ONLY have a Credit Card (and no other products), you can register for Online Banking instantly using:

3. Your Credit Card number / Expiry Date / Date of Birth

- If you have a Credit Card and a loan but do not have a deposit account (e.g. Current account or Savings account), you will not be able to register for Online Banking instantly. Please call us on (+971) 600 5222 88 for assistance.

* If you do not have a TIN Number, you may call our 24-hour Phone Banking team on 600 5222 88 from within the UAE or on +971 600 5222 88 from outside the UAE and request for a TIN.

Follow these steps to register for Online Banking:

- Click on "Instant Registration"

- Read carefully the Terms and Conditions and click "Accept" in agreement

- Select your preferred registration mode – Debit Card number / Account number / Credit Card number

- Click "Next" to verify your mobile number registered with bank and confirm

- Enter the temporary password which was sent to your mobile number

- Set your Username and Password and click "Confirm"

- You have successfully registered for Online Banking!

If you are an SME Customer or a Joint Account Holder you must register to Online Banking by giving a written request at the branch. You will then receive a temporary ID via email and a temporary password via SMS. These credentials should be used when logging in for the first time. You will then be able to choose your permanent username and password

- Do I have to pay for using this service / Are there extra charges for this service?

No, there is no extra charge for using this service, this service is absolutely FREE!

- How secure is it?

We have adopted comprehensive security measures to safeguard your use of Online Banking.

Customer Authentication with Login ID and Password - You must enter the unique Login ID and Password to access Online Banking. All information transmitted through the Internet, including your Login ID, Password, your account information and your transaction details, from the moment you log in to the time you log out, are protected by strong end-to-end 128 bit SSL encryption; i.e. from your PC browser to the Bank's system.

2-Factor Authentication for transactions – All financial transactions and personal updates on Online Banking require a 2-factor authentication process. This means that in addition to your usual login credentials, we will send a temporary one-time SMS passcode to your registered mobile number in order for you to complete the transaction. This process ensures that only you, as the account holder, will be authorised to carry out transactions on your account.

Automatic Logout - To prevent unauthorized access at your PC while it is unattended, we have implemented a time-out feature. Your login session of Online Banking will be terminated if the browser is left idle for a while.

Last Login Date and Time are indicated- Your last login date and time are provided in your first screen for your verification. The system does not allow simultaneous or multiple log in. The Bank always considers security to be of utmost importance. We have adopted very high standards and tight controls in managing our computer systems and networks.

- What should I do if I have forgotten my password?

If you forgot your password, you can reset it online using your ATM/Debit Card number and PIN or your Account number and TIN.

- Can I access the service from overseas?

Yes, the Standard Chartered products and services are available from overseas except from Cuba, North Korea, Iran, Sudan, and Syria.