Banking Protection covers financial losses resulting from phishing and smishing attacks, unauthorized access to your financial accounts, or fraudulent transactions carried out without your consent.

Examples of scenarios which would be covered under the Banking Protection benefit are provided below for illustrative purposes only. The claim must still satisfy all other conditions as set out in the policy wordings.

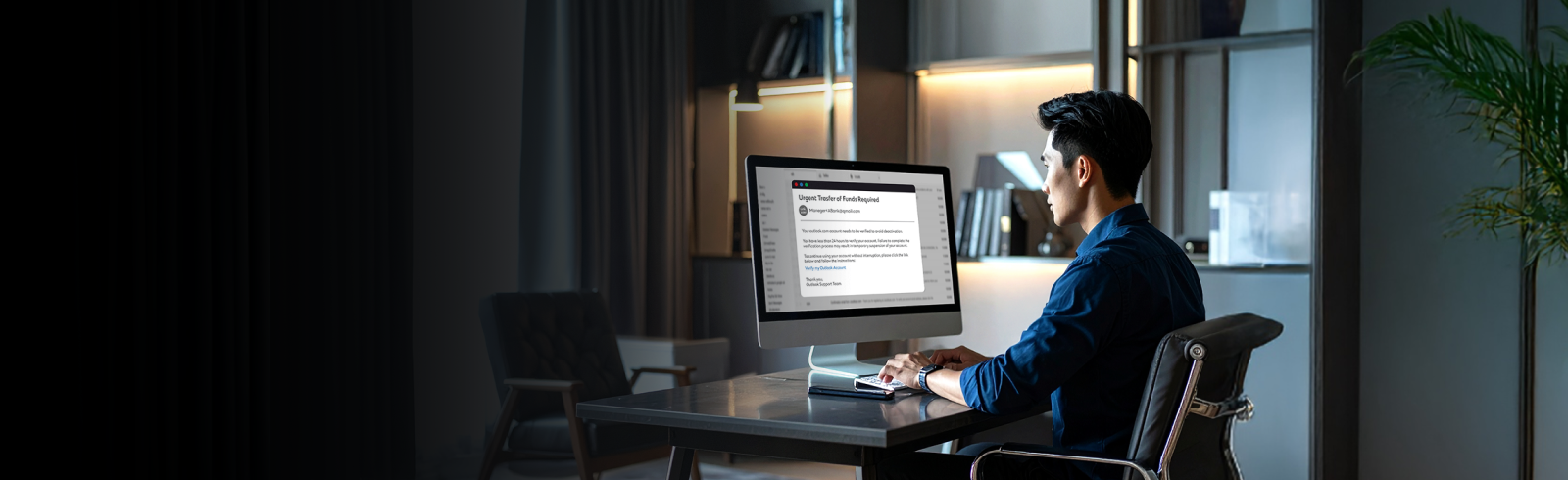

Scenario 1: Unauthorized Transaction resulting from Phishing

You receive an email claiming to be from your bank, prompting you to click a link to verify your bank account by entering your credentials. As a result, the scammers gain access to your bank account and an unauthorized transaction is made.

Scenario 2: Unauthorized Transaction resulting from Phishing

You receive a phishing email that mimicked a popular online shopping site. After clicking the link and entering your online banking credentials to make a purchase, you notice a sum of money was stolen from your bank account.

Scenario 3: Fraudulent Authorized Transaction due to Smishing

You receive an SMS claiming to be from a government agency requiring you to make payment of unpaid taxes by clicking on a link. After clicking the link, you entered your payment information and authorize a payment of $1,000. The payment went through and $1,000 was stolen from your bank account.

Scenario 4: Unauthorized Transaction resulting from Phishing (Malware)

You receive an email claiming to be from an e-commerce platform requiring you to download an application to receive attractive offers. You click on the link which results in malware being downloaded onto your phone. Through the malware, scammers are able to access your banking credentials or banking app to steal money from your bank account.

Scenario 5: Unauthorized Transaction resulting from Identity Theft

You drop your wallet on public transport and a passerby returns the wallet to you. However, before returning the wallet your credit or debit card information and personal details were copied by the passerby and used to make unauthorized payments.

Scenario 6: Unauthorized Transaction resulting from Identity Theft or Theft of payment means

You lose your wallet after walking in a busy shopping mall. Later, you are notified of transactions being made on your credit or debit card that were not enacted by you.