Click

here for the full Fros’ Journey 2021 Promotion Terms and Conditions that apply. The Fros’ Journey 2021 Promotion (“

Promotion”) is available from 1 November 2021 to 31 December 2021 (both dates inclusive) (the “Promotion Period”). The Promotion is open to all principal cardholders of credit cards issued by Standard Chartered Bank (Singapore) Limited (“

Bank”) (each a “

Card”). Each principal cardholder of a Card shall be referred to as an “

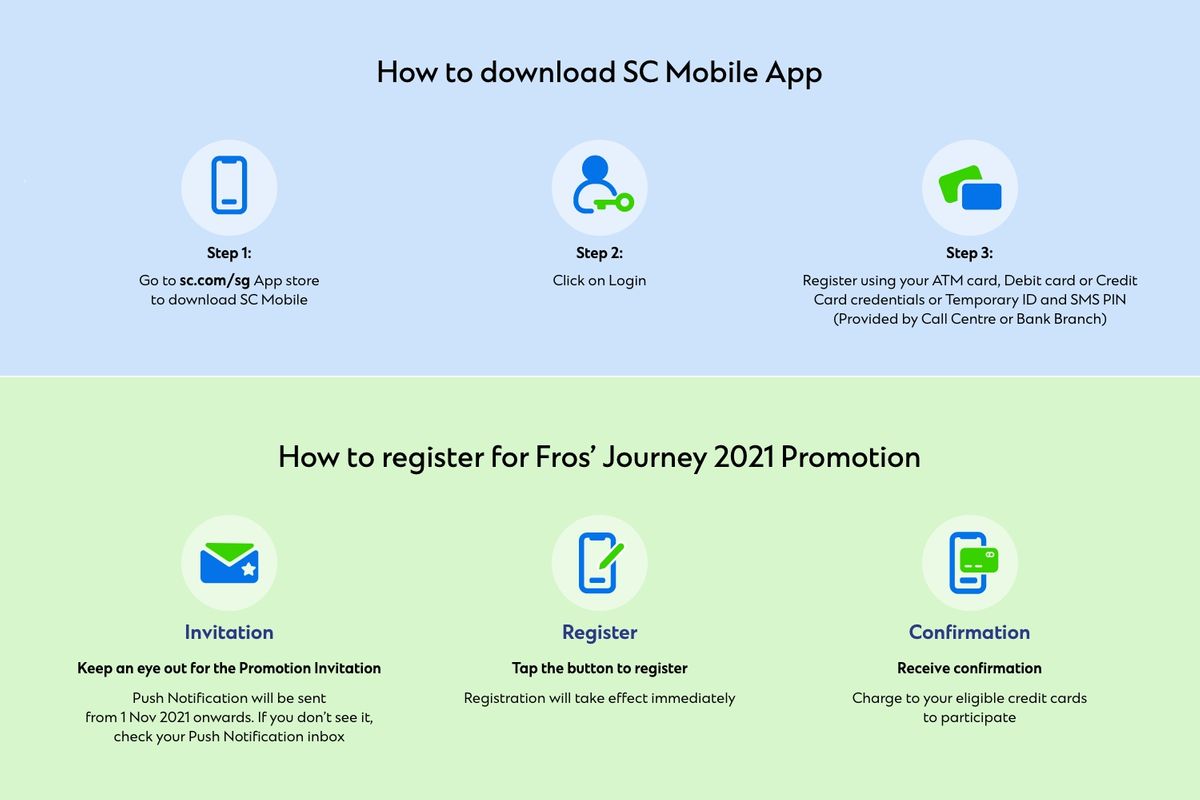

Eligible Cardholder”. To participate in the Promotion, an Eligible Cardholder must be a registered and valid user of the Standard Chartered Mobile Banking App (“

SC Mobile”) and have enabled the option to receive Push Notification (as defined below) on his/her mobile phone and SC Mobile. To successfully register for the Promotion, an Eligible Cardholder must register for the Promotion during the Promotion Period, by clicking on the ‘Register Here’ button found in a push notification (which is a service provided by Apple and Google for their respective mobile operating systems i.e. iOS and Android respectively, through which an iOS or Android mobile app can send a user (who has installed such mobile app) a notification) (“

Push Notification”), with the Push Notification summarising the details of the Promotion (“

Promotion Invitation”). For the avoidance of doubt, the Promotion Invitation will only be broadcasted from 1 November 2021 onwards, and the frequency of such broadcast will be at the Bank’s determination. Upon clicking on the ‘Register Here’ button in the Promotion Invitation, all of the Eligible Cardholder’s validly existing Card(s) (i.e. not suspended, cancelled and/or terminated) which are in good standing, and conducted in a proper and satisfactory manner, as determined by the Bank, will be registered for the Promotion (such successfully registered card(s) hereinafter referred to as a “

Registered Card” and the cardholder of such Registered Card, a “

Registered Cardholder”) immediately. “

Qualifying Transactions” are retail transactions that: a) have a transaction date falling within the Promotion Period; b) have been successfully posted to the Registered Card account during the Promotion Period; and c) are not excluded transactions (as set out at Clause 22 of the Fros’ Journey 2021 Promotion Terms and Conditions). To qualify for the cashback (“

Cashback”) under the Promotion, the Registered Cardholder must, during the Promotion Period, meet at least one of the respective spend amount(s) in Qualifying Transactions (“

Spend Amounts”), aggregated across his/her Registered Card(s). There are a total of three (3) Tiers, each with a corresponding Cashback Amount to be awarded: Tier 1- Get S$30 cashback with Spend Amounts of S$2,500-S$6,999.99, limited to the first 8,000 Registered Cardholders; Tier 2- Get S$120 cashback with Spend Amounts of S$7,000-S$14,999.99, limited to the first 4,000 Registered Cardholders; and Tier 3- Get S$250 cashback with Spend Amounts of S$15,000 and above, limited to the first 1,000 Registered Cardholders. If the Registered Cardholder is within the allocated number of qualifiers for any Tier (as determined by the transaction date and time of the Qualifying Transaction which causes the Registered Cardholder to cross into that Tier), then he/she will be entitled to the corresponding Cashback Amount. A Registered Cardholder may only receive one (1) of the 3 Cashback amounts. The maximum amount of Cashback that can be awarded to each Registered Cardholder is capped at S$250. Registered Cardholders who are entitled to receive any of the Cashbacks will be notified by Push Notification by no later than 28 February 2022. Cashback will be credited by 28 February 2022 to the Registered Cardholder’s Registered Card account with the highest cumulative spend in Qualifying Transactions during the Promotion Period.