Imagine saving up for something like a year of travelling across Europe once travel bans are lifted, and compare that to saving up for a child’s education. They may be comparable in amount, but where you stash your money could be entirely different. While it may seem intuitive, financial goals with different time horizons require investment strategies that make timing sense.

While investments can fall across a wide spectrum of time horizons, we can generally break down investments into the following: Short-term and long-term.

Short-term investments refer to those which are typically held for five years or less[i] but can be sold off within days or months from purchase, whereas long-term investments take more time before they mature. These two types of investments differ with regard to factors such as their risk profiles, liquidity, and ability to meet your needs.

What Makes Them Different?

Popular investment vehicles such as stocks can fluctuate in value greatly within the short term. This means that short-term investments can expose investors to market fluctuations. If you’re forced to take your money out during a stock market recession, you may have to stomach a financial loss.

On the flipside, however, keeping stocks as a long-term investment can grow your capital substantially. Historically, the stocks of top companies tend to grow after a period of time, as seen in the Straits Times Index’s (STI) monthly close graph from 2000 to 2020, below. STI tracks the performance of the top 30 companies listed on the Singapore Exchange (SGX).

- They cater to different life goals

Some investment products are designed around specific goals. Insurance products for legacy planning, for instance, are built around long-term goals. Some examples of long-term goals include:

On the other hand, short-term investments are preferable if you’re looking to meet requirements for liquidity in the near term. Such goals may include:

Long-Term Investments

- You have time to meet your goals

Suppose you’re 25 or 30 years of age and want to grow your money over a longer horizon for retirement, then long-term investments may be ideal for you. This is because, over such a period, you have the time to recover from factors like market downturns. For the same reason, it also allows you room to learn from experience and better manage your investments.

- You want to protect your wealth from inflationary forces

Long-term investments are also the best bet if you’re looking to protect your wealth from being eroded due to inflation. Due to their high-risk profile, investments such as stocks also offer you potentially high returns over time, thus giving you a better chance at being protected from inflationary forces.

Short-Term Investments

- You have needs that will arise soon

Short-term investments are well-suited for specific needs, such as funds for a vacation or a down payment for a car. Short-term investments allow better liquidity for use in the near future. Certain short-term bonds for instance, may offer you a guaranteed return while also allowing you to withdraw your money at any time.

- You require a regular income source

If you are in a financial situation that necessitates a regular income flow, short-term investments may offer you this. Fixed income or unit trusts with dividend payouts, for example, may help in such circumstances, although the return may not be as high as in the case of, say, stocks

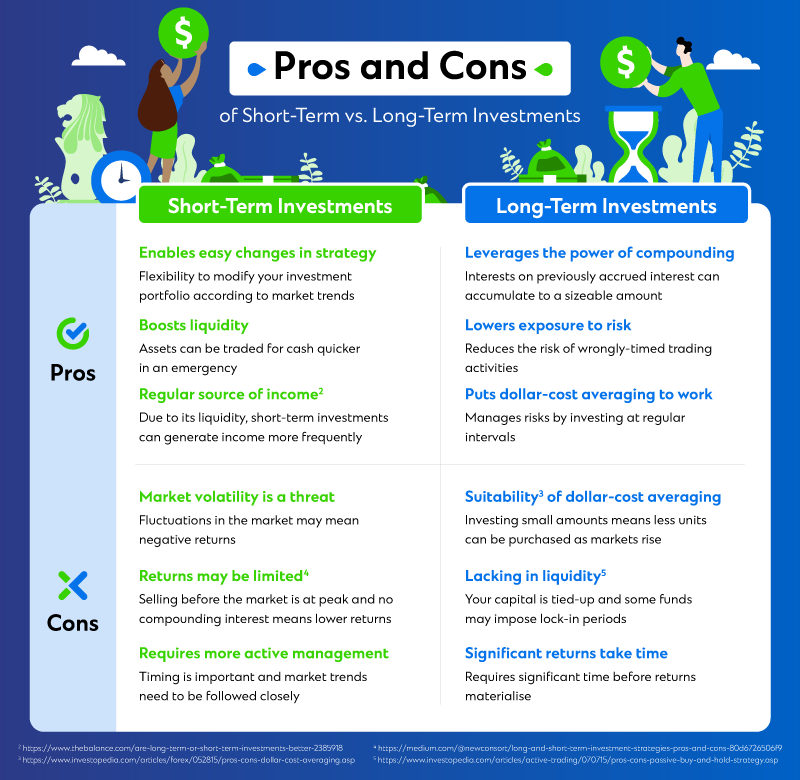

Advantages and Disadvantages

Let’s have a bird’s eye view of the advantages and disadvantages of long-term and short-term investments, which may be helpful in your investing decisions:

You may also want to consider diversifying your investment portfolio to include instruments for both long- and short-term investments. That way, you will be able to balance out your risks while tending to different needs that may arise periodically.

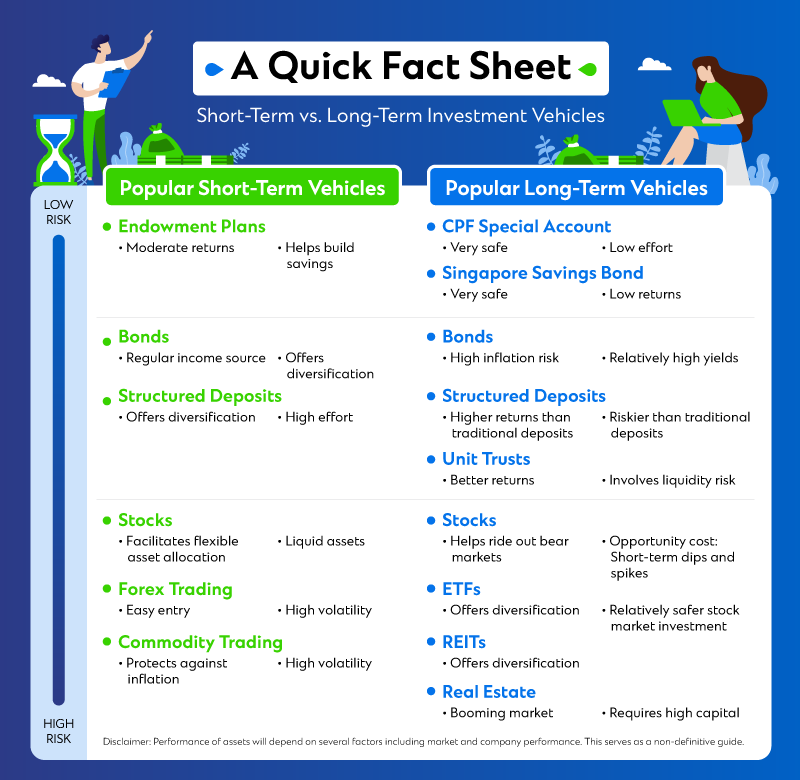

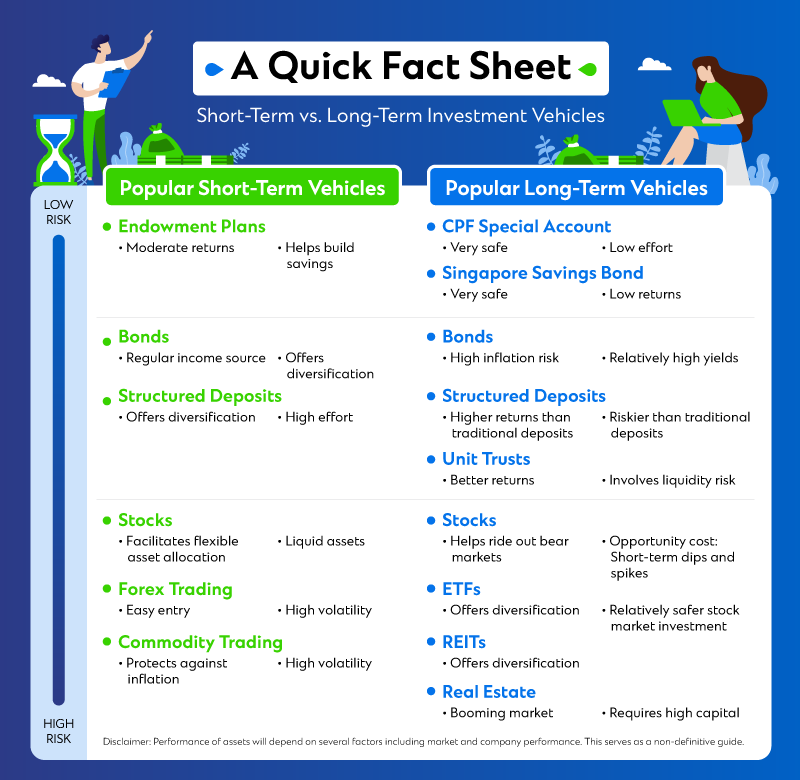

A diverse range of investment vehicles are available for all types of investors. Here are a few options to go with based on your timelines and risk appetite.

Note that some investment vehicles, such as:

- Bonds and Structured Deposits vary in the time to maturity and may be used for short-term or long-term investing.

- Stocks lend themselves to both long-term and short-term investing.

- Unit Trusts are diverse and can be designed to suit various investor risk profiles.

Further readings:

No matter what your life goals are, ensure you set a timeline to achieve each of them, then, choose an investment strategy that meets your unique requirements, such as expected returns and risk appetite. Such an approach will prove invaluable in your quest to balance out your investments to meet short-term and long-term life goals.

To find out more about investing your wealth, reach out to us at Standard Chartered Wealth Connect.