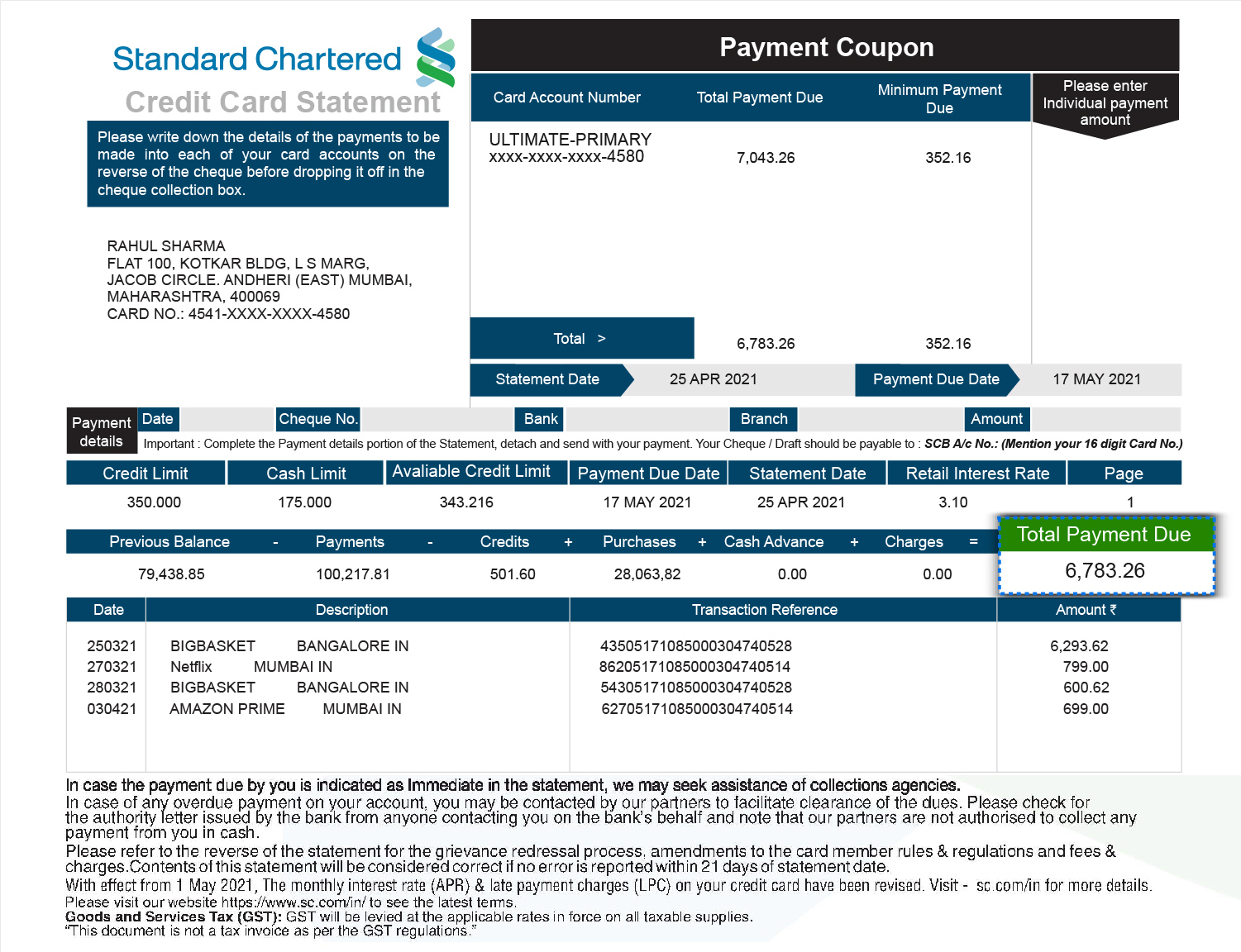

In the case of most credit card statements, the period of the report is mentioned at the top right-hand corner. Here, you can also find out the exact number and period of your credit card’s interest-free days. Interest-free days mean the allocated period of time in the billing cycle of your credit card, during which no interest is charged on the purchases. With its knowledge, it is possible to buy products using a credit card without having to pay any interest on it.

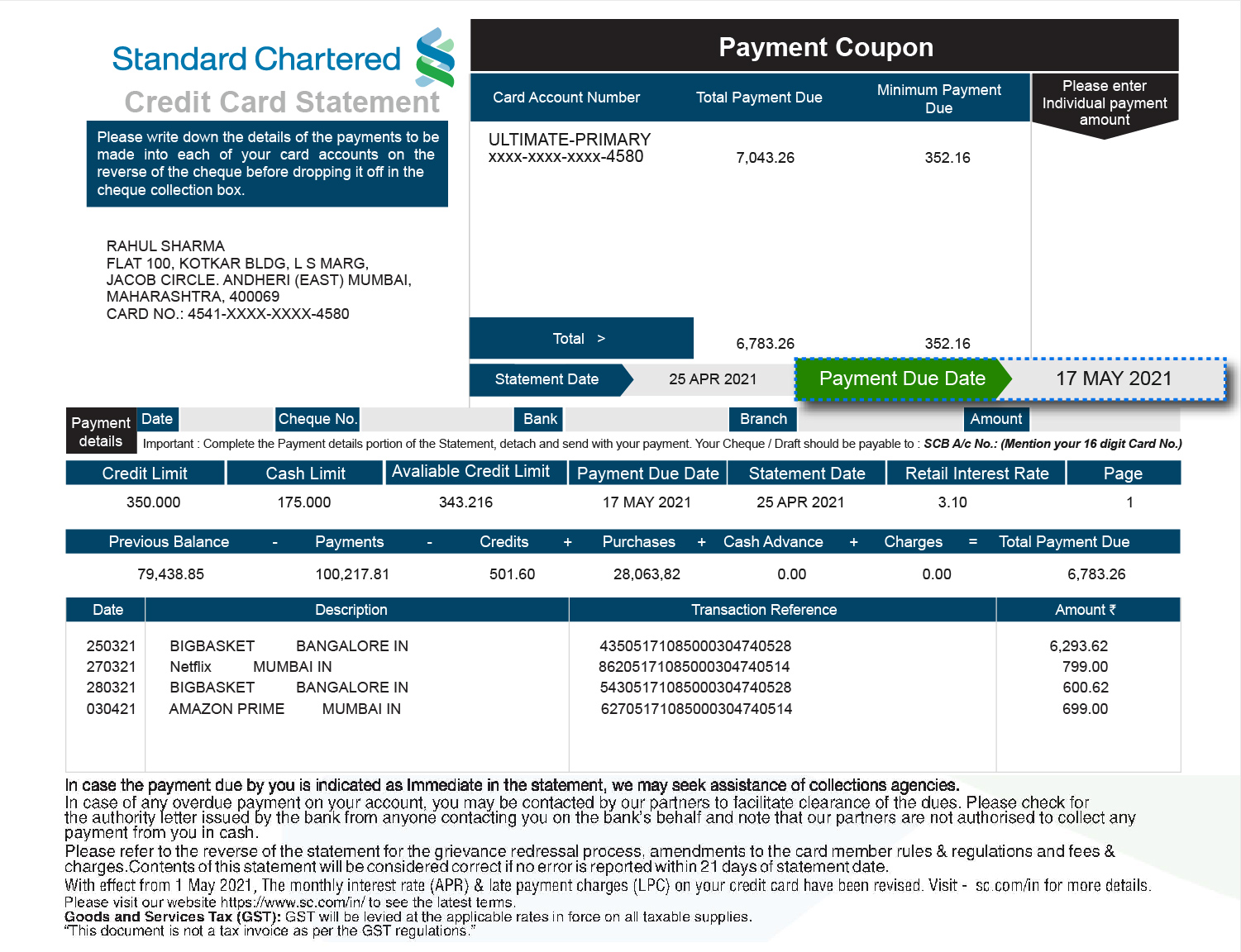

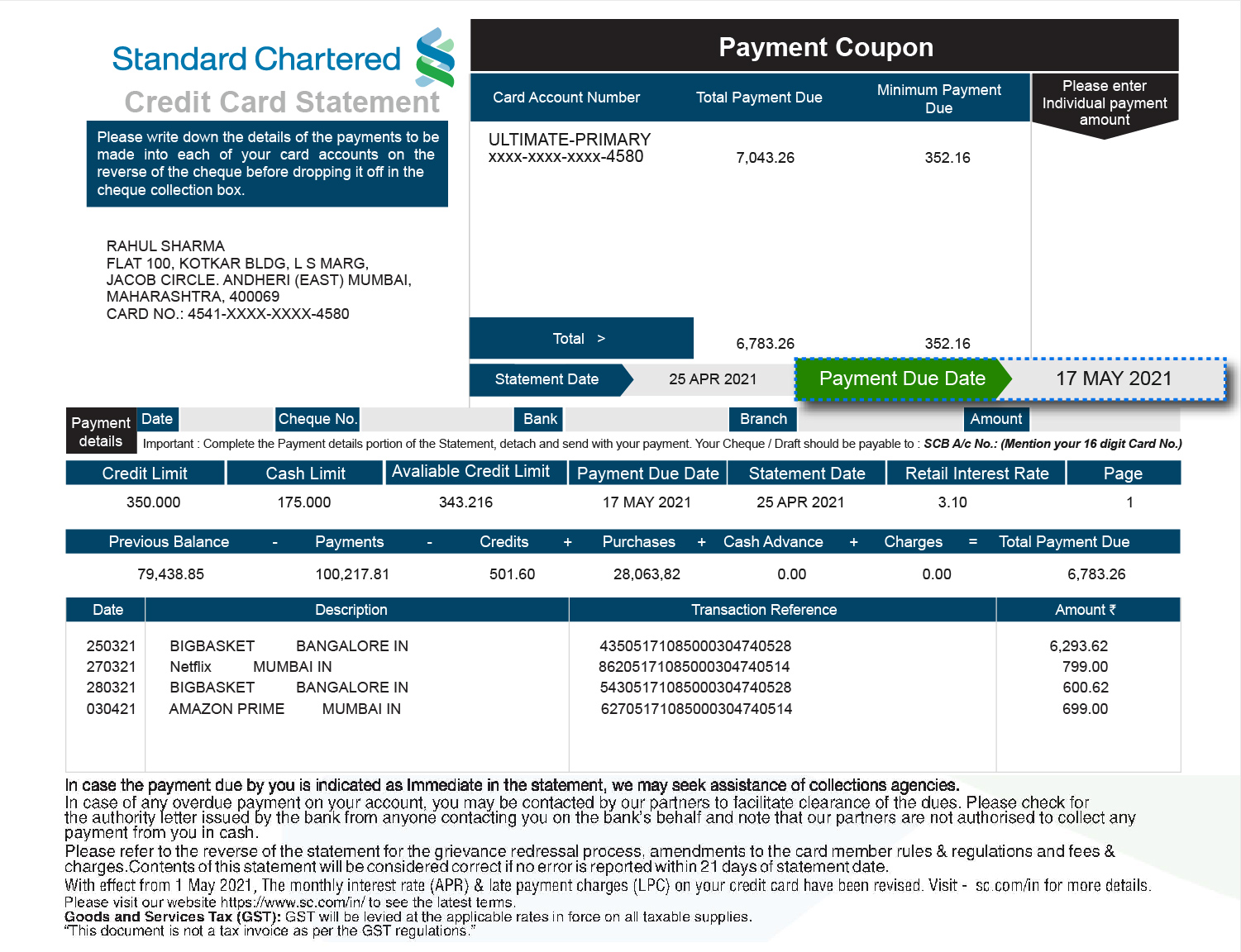

The due date by which you need to make at least the minimum payment is also usually mentioned at the top right-hand corner of the statement. While you are free to make the payment before the due date, failure of payment post the due date attracts a late-payment fine and interest on the outstanding amount.

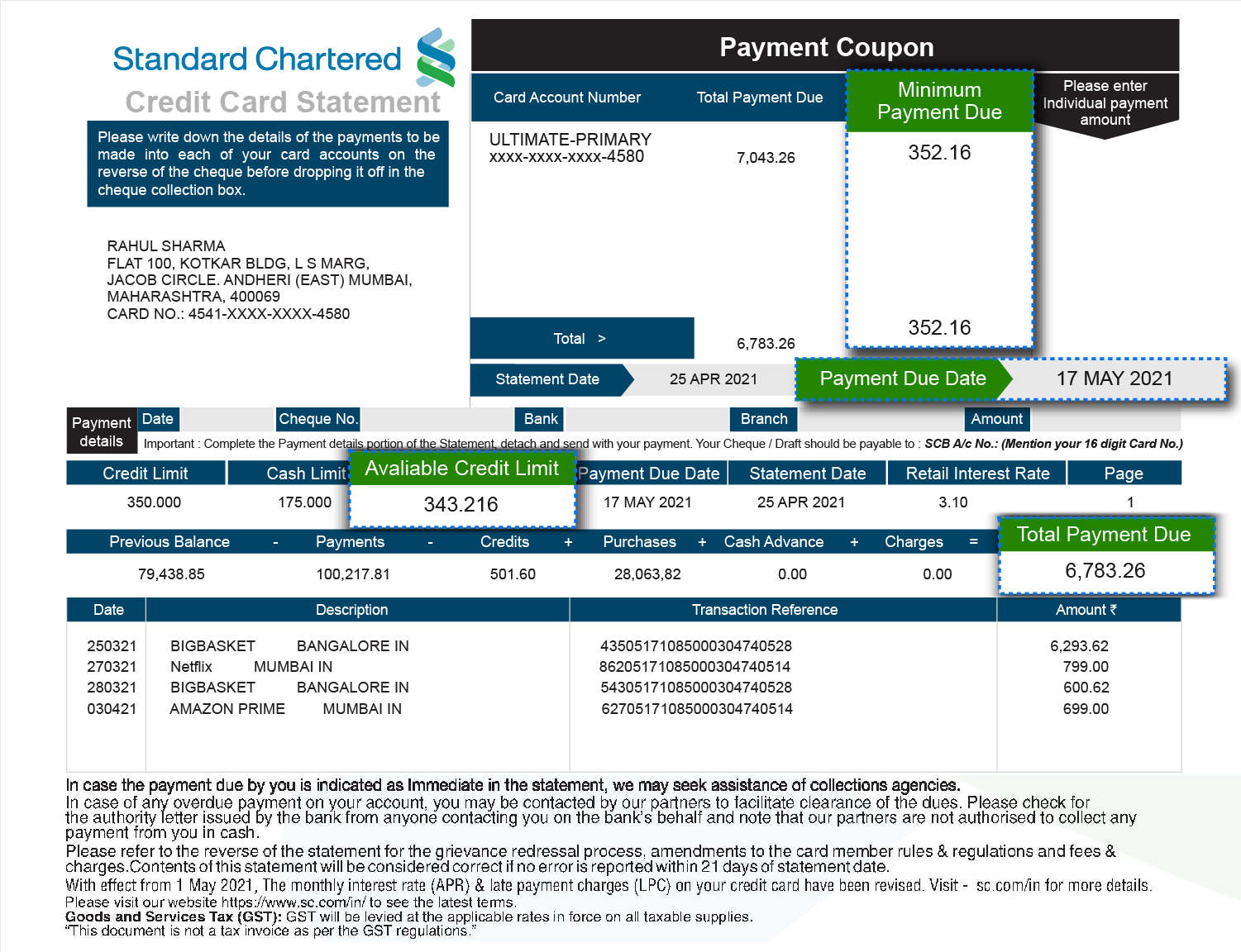

This is the minimum amount you need to pay in the month to avoid going delinquent. Going delinquent or being late in payment can create a negative impact on your credit history, besides, depending on the duration, type and cause of delinquency, your bank may penalise you with interest on the outstanding amount as well as late payment fines

The minimum amount payable could vary every month depending on your credit card purchases. It is approximately 5% of the total outstanding balance. However, this amount may vary from one bank to the other. Paying less than the minimum amount could result in fines. However, it is advised that you make payments above the minimum balance whenever possible.

If you have not paid the minimum due amount for a month or more than that, then the total amount that you are liable to pay will be reflected in the ‘overdue’ section of your credit card statement. The longer the duration of the overdue account, higher will be the late fee levied. It also impacts your credit score negatively, which may affect your future credit card or loan requests.

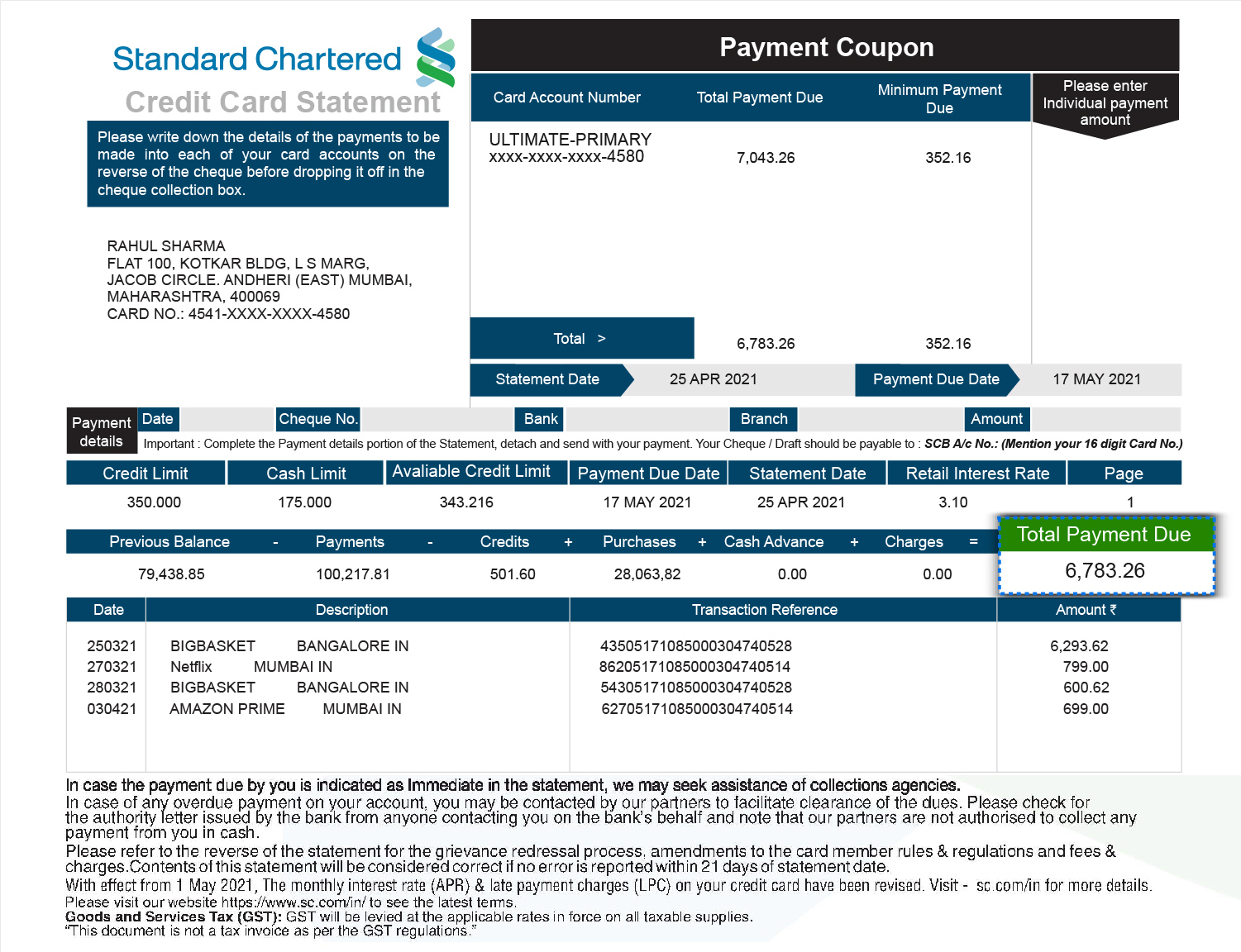

This is the total amount that you owe to the credit card account. If you happen to pay more than the amount that you owe, then the figure should be in negative, which means that this amount will be adjusted on your next credit card purchase. There are many advantages of paying the full amount every month which includes benefits like avoiding interest payment on the balance amount (total – minimum amount) and enjoying increased number of interest-free days for future purchases, among others.

Apart from these, there are also other important sections that you should closely track. These include sections like payments/refunds, new charges, transactions, daily rates, reward points, etc. This will give you a clear idea of your overall credit card record. Standard Chartered gives you the freedom to access credit card statements dating back up to 2 years. Additionally, it also allows easy and secure online credit card payment. Click here to make your credit card payments now! To opt for a Standard Chartered credit card, click here.

This image of the Credit Card Statement shown on this page is for representation purposes only and may differ from the actual Credit Card Statement

The views expressed in the article are those of Standard Chartered Bank (“SCB”) and do not constitute financial, professional or other advice. SCB, including its Directors, Officers or Employees shall not in any event be liable for any damages or injury arising merely from your reliance on any information provided here. Each bank / financial institution will have its own processes/ fees/ charges and any information contained in this Article is only indicative. Before placing any reliance on any information contained or views expressed in this Article, we would request you take all steps necessary to verify the correctness thereof. The information contained in this Article is only indicative. Each Standard Chartered Bank Product has its own terms & conditions and should be referred to in entirety. We request you to kindly visit “sc.com/in” or visit your nearest Standard Chartered Bank Branch or call on our Customer Care numbers for more details.