Sustainability through ESG financing

The objective of green financing is to ensure more capital is directed to serve the long-term needs of an inclusive, environmentally sustainable economy. And for the large-scale infrastructure gaps that have long persisted in developing markets, the opportunity to channel investments that are sustainable in nature is one that should be urgently addressed.

The narrative around green finance has accelerated in recent years. Indeed, this topic was front and centre at the World Economic Forum in Davos in January 20201. What the participants at the forum – and those watching the world over – were about to learn was that COVID-19 would soon threaten to derail the sustainability agenda.

The short-term reality indicates stinted momentum around green finance. Indeed, green bonds have seen a decline in issuance since COVID-19 set in, according to Mark Oliphant of The International Stock Exchange Group2. However, the issuance of sustainability and social bonds – an arguably under looked element of sustainable finance – has on the other hand increased. This is perhaps unsurprising, as corporates and governments shift short-term priorities to enable funds raised to address the immediate social implications of COVID-19.

Near-term reactions to the pandemic aside, broadening the sustainable finance dialogue to beyond just green financing is an important agenda – one that COVID-19 may catalyse. Indeed, flows into sustainable funds in Europe more than doubled to a record high of EUR54.6 billion in the second quarter of 2020 amid growing interest in ESG issues.

When it comes to bridging infrastructure gaps in developing markets, a sustainably funded future will be one that does so with the interests of all aspects of ESG investing at the heart. That drive is evident in the push to ESG assets among emerging markets investors, though a shortfall of investment options remains a barrier.

Financing attempts to plug the infrastructure gaps in developing markets across Asia, Africa and the Middle East have, to date, largely come from multilateral development banks (MDBs) and government-backed lenders. MDBs, for instance, commit around USD100-120 billion to development projects in low and middle-income countries every year. This in many cases was a critical first step – providing urgently-needed funding and mitigating some of the risks that can deter private capital investment.

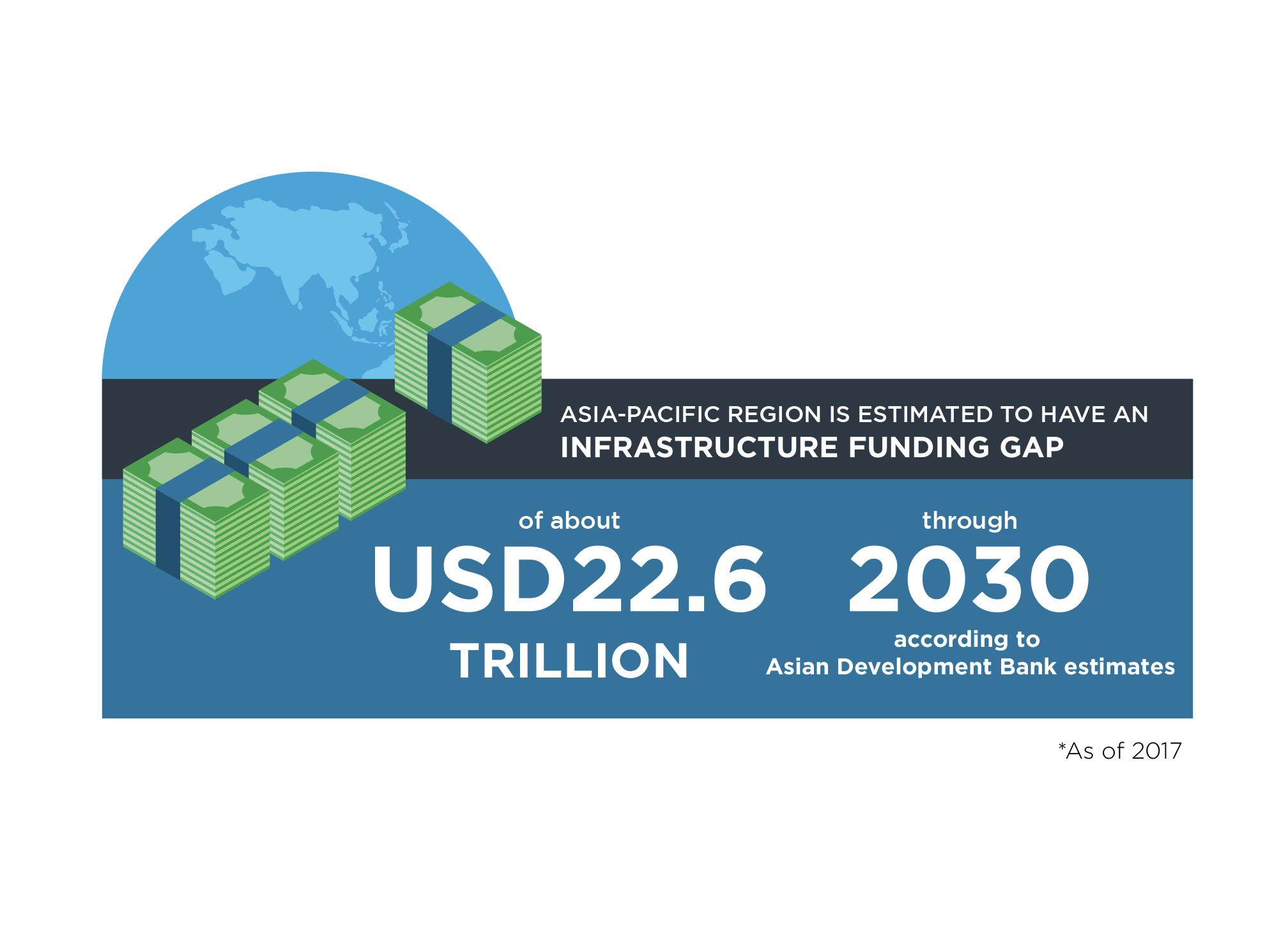

At the same time, it’s clear that public funding will not be enough. The Asia-Pacific region alone is estimated to have an infrastructure funding gap of about USD22.6 trillion through 2030, according to Asian Development Bank. Public sources alone will simply be unable to plug this.

When approaching large-scale, long-term projects, investors naturally plan for financial sustainability from start to finish. With the growing awareness of the effects of carbon-intensive development projects on an already-stressed global environment, it’s no longer enough to limit sustainability considerations to the structuring of financial obligations. Nor can the need to raise and channel funds to socially-minded projects be ignored. For the multilateral lenders, private-capital investors and even state-backed entities that invest in developing market infrastructure projects, sustainable finance principles are increasingly a core requirement.

“Financiers have an obligation to support developing-market projects that are being built with sustainable principles,” said Simon Cooper, CEO of Standard Chartered’s Corporate, Commercial and Institutional Banking division. “We’re committed to ensuring that such projects have a positive impact on communities and environments in our markets, as are investor clients and shareholders.”

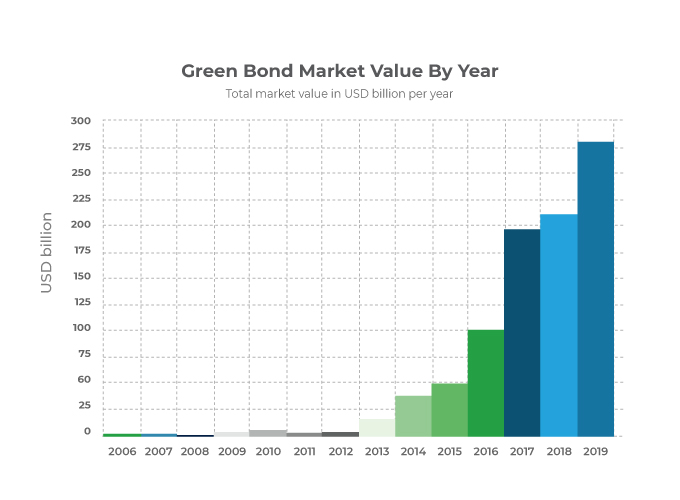

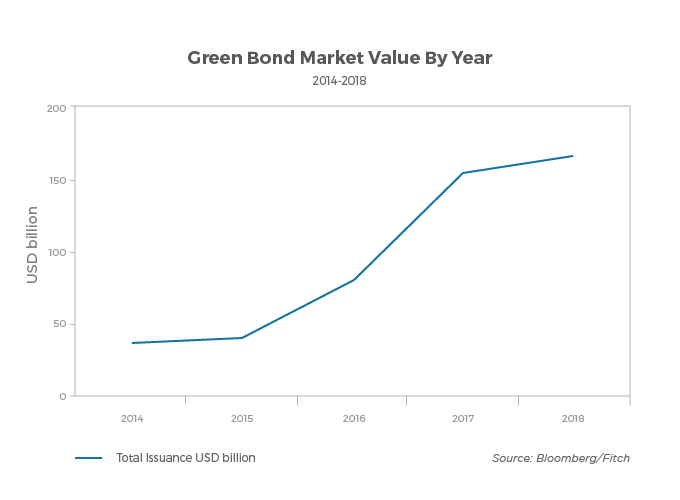

The movement towards green finance (pre-COVID-19) had already been gathering pace. The green bond market grew a staggering 51 per cent in 2019 from the year prior, to a new global issuance total of USD257.7 billion3. And while the issuances remain heavily concentrated among three countries (the United States, China and France), the market is increasingly diversifying. Last year saw a particularly welcome development – in that all new market entrants were from developing countries, according to the Climate Bonds Initiative4.

While social bonds have not seen nearly as much growth as green bonds, they arguably have the most potential. S&P expects social bonds to emerge as the fastest-growing segment of the sustainable debt market in 2020. This, it notes, is in sharp contrast to the broader global fixed-income market, for which it expects issuance volumes to decline this year5. And while perhaps initially driven as a reaction to COVID-19, S&P noted that the “appeal of social bonds as a sustainable finance instrument may endure after its effects have subsided.”

Regardless, more needs to be done to ensure sustainable capital-raising across the board – especially when it comes to developing markets.

This creates massive opportunities for the private financial sector to play a bigger role in funding developing-market infrastructure projects. For its part, Standard Chartered is seeking great involvement in this space – having in 2019 issued its first Sustainability Bond focused on emerging markets to fund projects including wind and solar power, railways and water treatment.

Financial products aside, the establishment of frameworks for sustainable investing are vital to drive the sustainable finance agenda in the long run. On an international scale, several sustainable-finance initiatives have been established – the majority since 20176. Reflective of the general pace of development, these initiatives have focused on the green side of sustainable investing thus far.

This is also the case at a regional level. Among developing markets, both China and the ASEAN region have led the charge, with various new initiatives launched in the past few years. Perhaps most notable are the ASEAN Social Bond Standards7 and ASEAN Sustainability Bond Standards8. Launched in 2018, these have already been embedded into country-based frameworks by Malaysia and the Philippines.

There are early signs of frameworks establishing elsewhere. For example, Kenya recently launched its new green bond framework9 – marking an important first step in the African continent.

For the broader sustainable finance bond market to grow however, more will need to be done across developing markets. This will help ensure both investors and issuers are supported and encouraged to move deeper into this underdeveloped space.

“Once the fundamental parameters of financing are in place, the expansion of the developing-market funding ecosystem will continue to accelerate, as more asset owners and managers realise the opportunities,” said Cooper. “And with this, comes the prospect of instruments that channel funds specifically to developing-market projects moving further along the ESG continuum.”

In the post-COVID-19 world, whatever the economic stimulus for developing-market infrastructure projects – whether from private or public sources – for a sustainable recovery of the initiative, there is an undeniable need to focus on supporting sustainable business practices.

1 https://www.refinitiv.com/perspectives/future-of-investing-trading/davos-was-a-good-start-now-the-hard-climb-on-climate-change-begins

2 https://www.ethicalcorp.com/will-covid-19-take-steam-out-green-finance

3 https://www.climatebonds.net/resources/reports/2019-green-bond-market-summary

4 https://www.climatebonds.net/files/reports/2019_annual_highlights-final.pdf

5 https://www.spglobal.com/ratings/en/research/articles/200622-a-pandemic-driven-surge-in-social-bond-issuance-shows-the-sustainable-debt-market-is-evolving-11539807

6 https://www.icmagroup.org/green-social-and-sustainability-bonds/sustainable-finance-initiatives

7 http://www.theacmf.org/ACMF/upload/SOCIALBONDACMF.pdf

8 http://www.theacmf.org/ACMF/upload/SUSTAINABILITYBONDACMF.pdf

9 https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Kenya-Policy-Guidance-Note-for-Green-Bonds-260219.pdf